Volatility Is Our Specialty, 2020 Confirms

After living through this year in the markets, we’re likely to spend the rest of our lives talking about 2020. Where were you during that eight-day stretch in March when the smallest daily move was 4.89%? How about when the VIX closed at a record high of 82.69? And were you part of the records being set for options contracts in 2020, including on Nov. 9?

Key Dates in 2020

- February 19-March 23: Market sells off, with the S&P 500 declining 33.9% at its bottom.

- July 13: The S&P 500 turns positive.

- Aug. 18: The S&P hits the first of what would be 10 more all-time highs.

- Nov. 9: Pfizer announces its vaccine was more than 90% effective.

The Calamos Investment Team went on the record multiple times in 2020. In addition to their quarterly commentaries and conference calls, they participated in a series of CIO calls starting in March—two weeks prior to what would become the market bottom.

Most comments here are excerpted from blog posts based on the calls, but all calls are available to be listened to in their entirety.

Investors large and small have countless war stories to swap about a year that was unprecedented in many respects. With the S&P 500 falling 34% from an all-time high, recovering and then moving on to new all-time highs—there was a lot to react to.

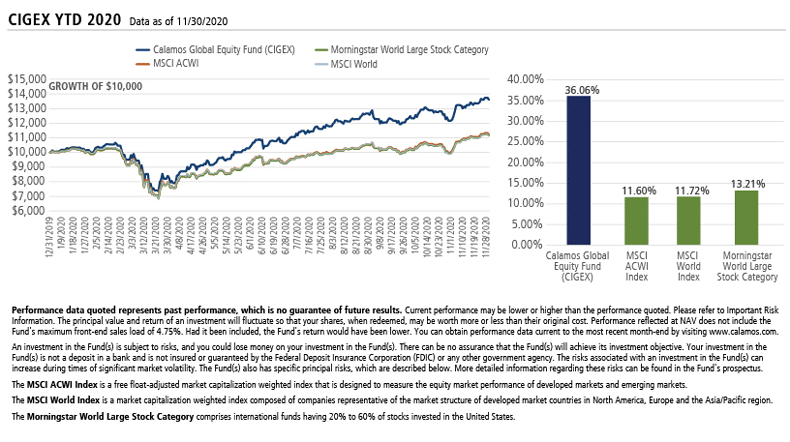

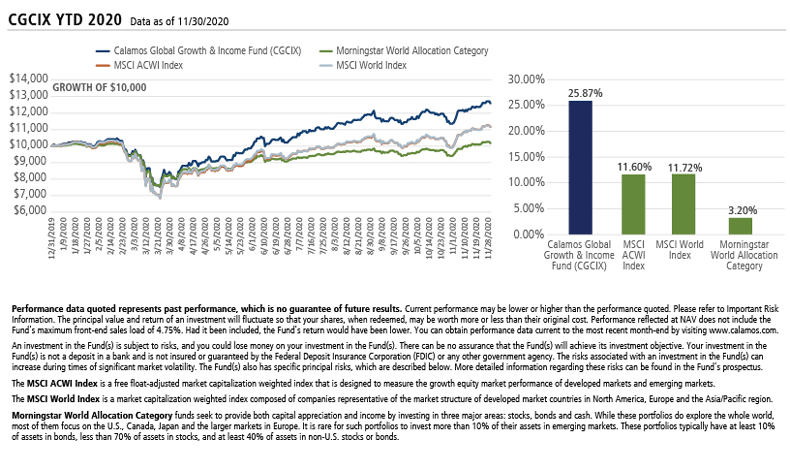

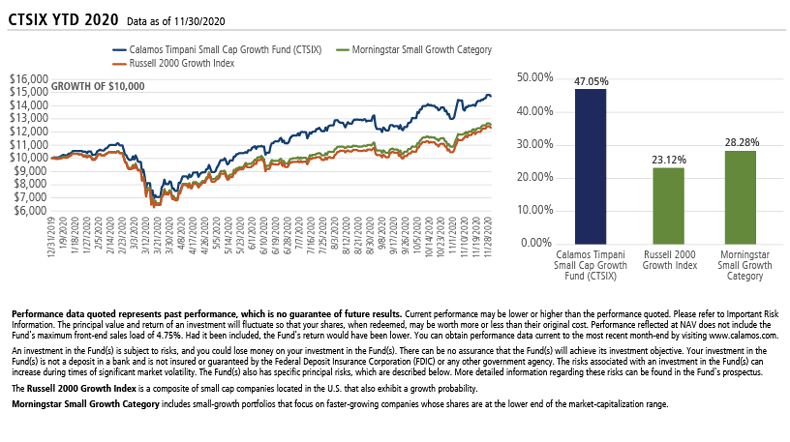

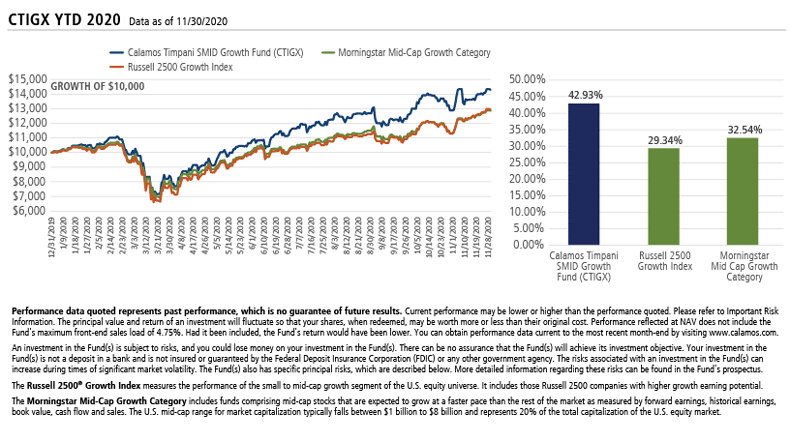

Too much happened too quickly this year to “buy the dip” or wait for a “double bottom.” Above all else, 2020 rewarded deliberate, continuous management of the risks and rewards posed. The performance results of our equity-related funds through Nov. 30 validated the Calamos risk management that has been part of our DNA since Calamos Founder, Chairman and Global Chief Investment Officer John P. Calamos, Sr. pioneered the use of convertible securities to provide potentially lower volatility equity exposure more than 40 years ago.

You’ve heard a lot from us about volatility in recent years. Volatility is our specialty. Your rough spot is our sweet spot. The flipside of volatility is opportunity. In less turbulent times, in an extended bull market, we’ve asked investment professionals to trust us that there’s more to these sayings than marketing. This year’s performance proves it, as we hope you’ll agree.

Before we move ahead to the new challenges/opportunities of 2021, we’re taking a pause and looking back. Below we revisit some of what our portfolio management teams were saying (and doing) as markets began to reflect the uncertainty related to COVID-19 and its repercussions—and the impact of positioning decisions made, largely in the tumult of the first half of the year.

Most important, as John Calamos stresses year in and year out, is that your clients remain invested. Risk management enables that.

Macroeconomic

January 2020

“We expect volatility to rise due to the U.S. elections and geopolitical uncertainty. Market sentiment shifts quickly, and we would not be surprised to see leadership rotation, sideways markets and drawdowns. This environment may challenge investors.”

Read more from the Calamos Investment Committee

March 2

“We’ve seen a lot of panic selling going on right now, and many stocks with strong fundamentals have been oversold. In many cases, it’s an over-reaction, and we could see rebounds when markets recognize this.”

Read more from John P. Calamos, Sr.

John P. Calamos, Sr.

John P. Calamos, Sr.

Founder, Chairman and Global Chief Investment Officer“This recovery will be better than most people think. Technology is fast moving, whether it’s bio tech or whether it’s something else. It’s not going to take two years to figure this out." (March 24)

March 20

“We are focused on preserving capital, while also positioning our strategies to take advantage of the inflection point that we believe will come, even if we cannot predict exactly when it will occur. In many areas of the market, we are seeing compelling prospects emerge as prices decline beyond what we believe fundamentals warrant.”

Read more from John P. Calamos, Sr.

March 24

“This recovery will be better than most people think. Technology is fast moving, whether it’s bio tech or whether it’s something else. It’s not going to take two years to figure this out.”

Read more from John P. Calamos, Sr.

March 26

“What we’re seeing now reminds me of the 1987 crash, and I believe conditions point to a V-shaped recovery, supported by monetary and fiscal policy. Many securities have been oversold, which creates opportunities for long-term investors.”

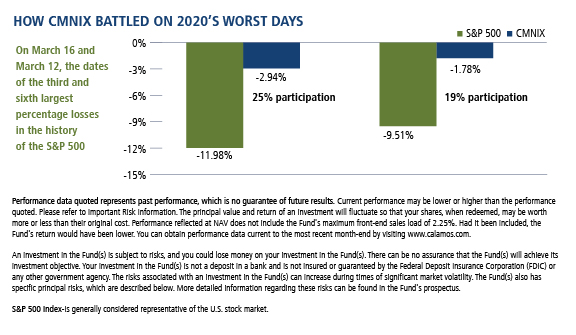

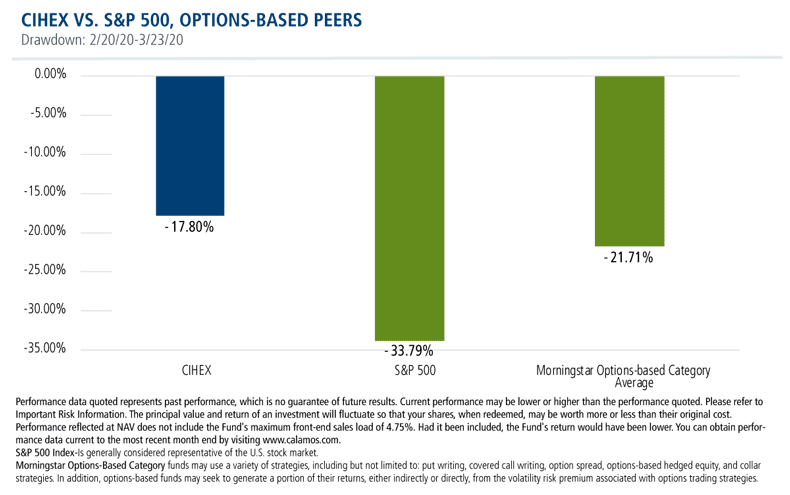

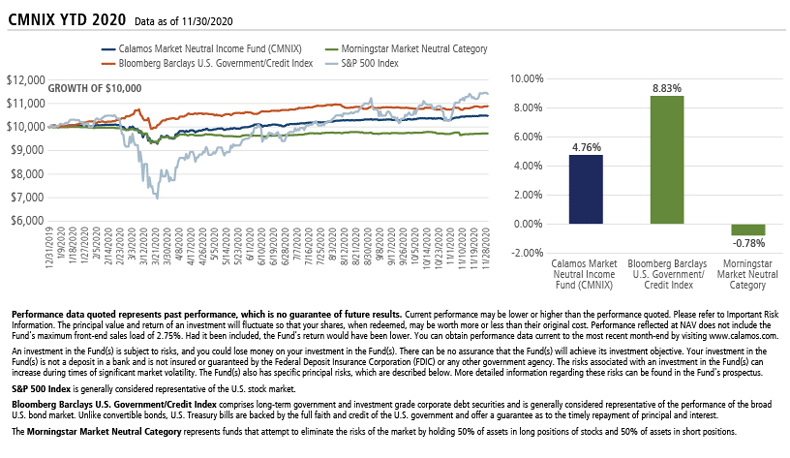

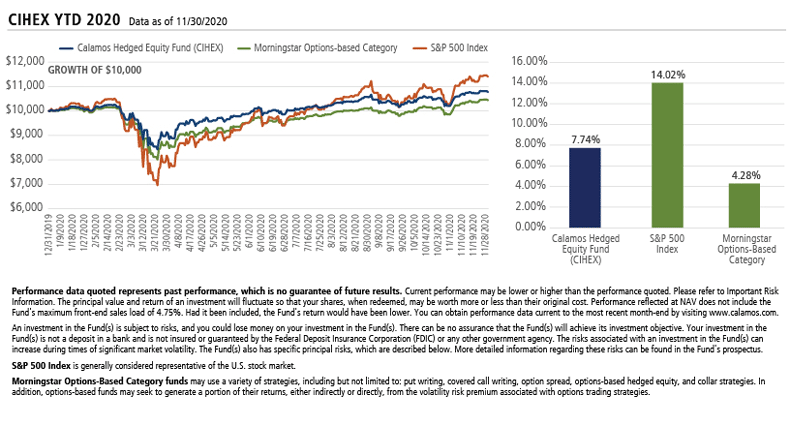

Calamos Market Neutral Income Fund (CMNIX) and Calamos Hedged Equity Fund (CIHEX)

March 23, updated March 30

“The environment is providing opportunity. The team has been selectively adding to the convertible arbitrage sleeve of CMNIX. While convert arb has held up fairly well, we have seen our book cheapen in recent weeks. This is not unusual in risk-off periods. We think there is significant value in the book and anticipate realizing this in coming months.

”The CIHEX team is actively trading the options book. The goal is to monetize the hedges, continuing to have downside protection in place but in pursuit of participating on the way up.”

Read more from Eli Pars, CFA, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, Jason Hill, Senior Vice President, Co-Portfolio Manager, and David O'Donohue, Senior Vice President, Co-Portfolio Manager

April 30

“With one-day moves of this magnitude, we’re just not going to have as many levers to change our potential returns in the short term. With convertible arbitrage, for example, a lot of that strategy is about accruing and capturing value over time, so you won’t see that flow through immediately.”

Convert arb was selling off as the market declined, and rallying as it climbed—what Hill called a short-term phenomenon that isn’t sustainable, which may result in reduced beta longer term.

“Over time you’re able to see this vet out in the returns, even by looking at a little bit longer time horizon—such as the year-to-date performance. We’re very happy with that amount of downside when being compared to the equity markets and how much risk we are taking/not taking.”

Read more from Eli Pars, CFA, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, Jason Hill, Senior Vice President, Co-Portfolio Manager, and David O'Donohue, Senior Vice President, Co-Portfolio Manager

May 7

“When markets are quieter, prices just don’t change as often. Now, with volatility this high and all of those back and forth 2%, 3%, 4% days, this is the equivalent of Black Friday. Prices are all over the place and changing rapidly—and it can be to our advantage.”

Read more from Eli Pars, CFA, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, Jason Hill, Senior Vice President, Co-Portfolio Manager, and David O'Donohue, Senior Vice President, Co-Portfolio Manager

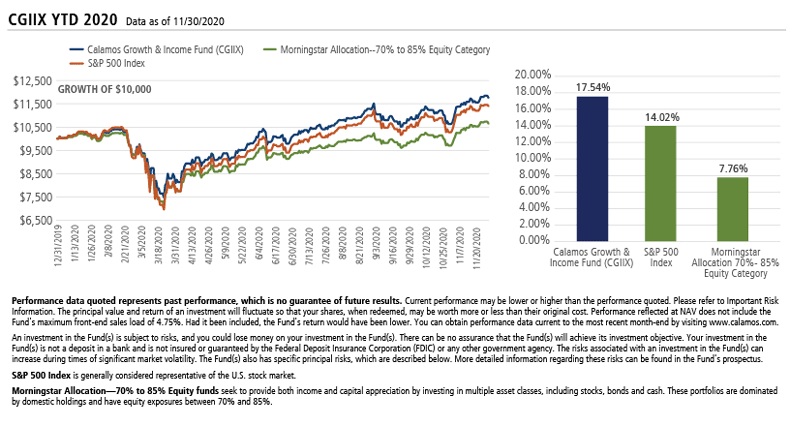

Calamos Growth and Income Fund (CGIIX)

March 26

“Positioning seeks to balance out short-term rebound winners (cyclical but oversold) along with longer-term business model winners with the goal of providing an asymmetrical risk/reward profile, with more upside equity market participation than downside. Our return on capital model points to very favorable risk/reward profiles in half of the large cap universe (modestly extreme result). We are going through those names for opportunities.”

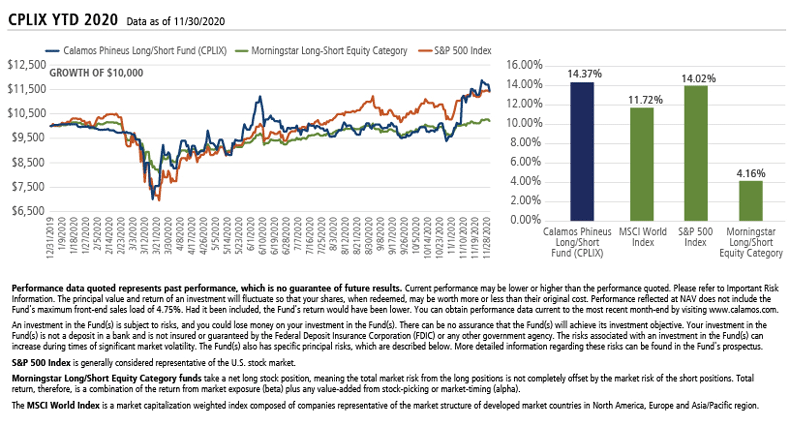

Calamos Phineus Long/Short Fund (CPLIX)

March 3

“While Calamos Co-CIO and Senior Co-Portfolio Manager Michael Grant couldn't have foreseen the coronavirus, he anticipated the fragility of the market, based on valuations that may not have been substantiated by global earnings expectations. Accordingly, CPLIX’s equity exposure was net neutral when the market began to fall on February 20.”

March 25

The S&P was at 2,409.50 and declining on March 19 when Michael Grant said, “The initial wave of forced selling and price discovery will likely run its course by late March around 2400 on the S&P 500…We believe equities are carving out an important bottom.

“The risk/reward for equities has turned positive…I think clients need to be just as concerned about not being invested should we experience a very sharp snapback in equities.”

Read more from Calamos Co-CIO and Senior Co-Portfolio Manager Michael Grant

April 30 commentary

“When the virus permits a resumption of activity, markets will enjoy a sharp rebound.”

Read more from Calamos Co-CIO and Senior Co-Portfolio Manager Michael Grant

September 30 commentary

As excerpted:

- Rotations into the more cyclical reflationary plays have been short and tactical, rarely lasting more than a few weeks. We think that is about to change.

- We will shortly see readouts from the Pfizer vaccine trials, with a high likelihood (>80%) of favorable efficacy.

- There is considerable pent-up demand for renewed spending shifts when normalization occurs. The combination of negative real interest rates and eventual normalization is a recipe for substantial style and sector rotation. Given how we got here, investors should consider an abrupt turning for the better.

Read more from Calamos Co-CIO and Senior Co-Portfolio Manager Michael Grant

Global Markets

March 13

“My current expectation…is that the sell-off/wash-out we are seeing in global equities will likely result in new leadership on the other side of correction. We are seeing certain overseas markets outperform the U.S., and the combination of lower rates, lower oil prices, accommodative monetary policies, and increased fiscal stimulus—coupled with very attractive valuations—likely supports a rotation toward cyclical growth and select overseas equity markets as the year unfolds. When this passes, I believe the recovery is going to be very strong and I remain optimistic that we could still see positive returns in global equity markets for 2020.”

March 31

“The Global Equity Team is beginning to re-risk the portfolios, adding names that can participate in the recovery. There may be a re-testing of lows in the bottoming process, but the team believes that names that lead the way in 2H 2020 have probably already reached their lows. The companies that reach their lows again will be a different subset of the market.”

April 23

Niziolek disagrees with those skeptical about today’s rally, saying they mistakenly believe that the economy and earnings need to get back to the levels seen in January and February in order to justify the valuations being paid at that time.

“You have a very significant new buyer—central banks around the world. By our estimates, balance sheets of the top 25 central banks increased by $10 trillion. And then couple that with the fiscal response, which we’ve seen is $3.5-$4 trillion. Those are very significant numbers…This in itself will increase equity multiples…But Niziolek cautions that “the next leg is likely to be more discerning.”

Small Caps

March 19

“Investors should be looking for entry points to add to the equity markets, especially in small caps, where stock performance tends to be strong coming out of economic downturns.

- A V-shaped recovery seems very believable, framed by a combination of low gasoline prices, cash savings from mortgage refinance activity, and pent-up demand for consumption.

- Many of the financial market signals we are seeing today are bullish indicators and often occur near stock market bottoms."

April 22

“Things are messy, but if you’re an asset allocator it’s hard not to be intrigued with the intermediate- to long-term outlook for small caps.”

May 27

“The year-to-date performance spread between dead weight and winners has been enormous…Passive index investing does a good job of getting investors exposure to an asset class, but inevitably gets investors disproportionately exposed to underperforming stocks of companies that have poor fundamentals. Such dead weight can hurt overall returns.”

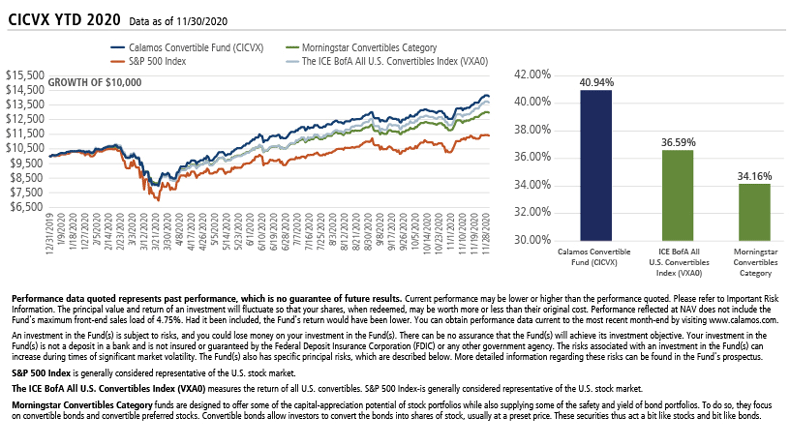

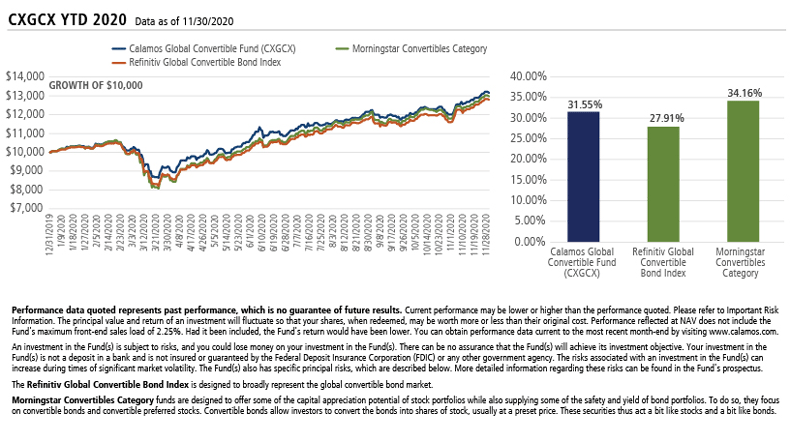

Convertibles: A Proven Hedge Against Unforeseen Negative Events

Convertibles are in a portfolio, according to a comment made by Calamos Convertible Fund (CICVX) Co-Portfolio Manager Jon Vacko in January, because “No one really knows what’s going to happen in the stock market.” In fact, equity investors were full steam ahead this year until the crash began on Feb. 19.

Here, too, our funds’ YTD performance reflects the teams’ active management—the balancing of equity upside participation with the mitigation against downside risk. When the market sold off, we added equity sensitivity. As the market ripped higher, we reduced equity sensitivity (for more, see this post).

In June, Co-Portfolio Manager Joe Wysocki commented on the fast-moving convertible market as it was among the first markets to open back up. He emphasized the unique characteristic of convertible portfolios: “Convertibles can change without you changing your portfolio at all. If you don’t monitor the risks, you could be left with a portfolio that’s full of busted bonds or yield alternatives. Or you could be left with a portfolio of equity alternatives, failing to provide downside protection.”

As 2020 draws to a close, it’s still true that no one knows what’s going to happen in the stock market. The markets have calmed down and there’s a strong case to be made for equities. With a loose monetary policy and increased fiscal stimulus along with the COVID recovery, what could go wrong? As seen this year, volatility may accompany an upward trend in equity prices. Any number of concerns—the timing of the recovery (time to distribute vaccines, etc.) along with issues that had been relegated to the sidelines during the run-up to the November election (e.g., U.S.-China Trade, Brexit, North Korea nuclear ambitions)—may surface.

An actively managed convertible portfolio can help investors stay the course and shield against unforeseen negative events. The convertible market itself, with a large percentage of convertibles displaying high amounts of equity sensitivity, may not provide this on its own.

Investment professionals, for more information about Calamos risk-managed funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Click here to view CMNIX's standardized performance.

Click here to view CIHEX's standardized performance.

Click here to view CPLIX's standardized performance.

Click here to view CICVX's standardized performance.

Click here to view CGIIX's standardized performance.

Click here to view CXGCX’s standardized performance.

Click here to view CTIGX's standardized performance.

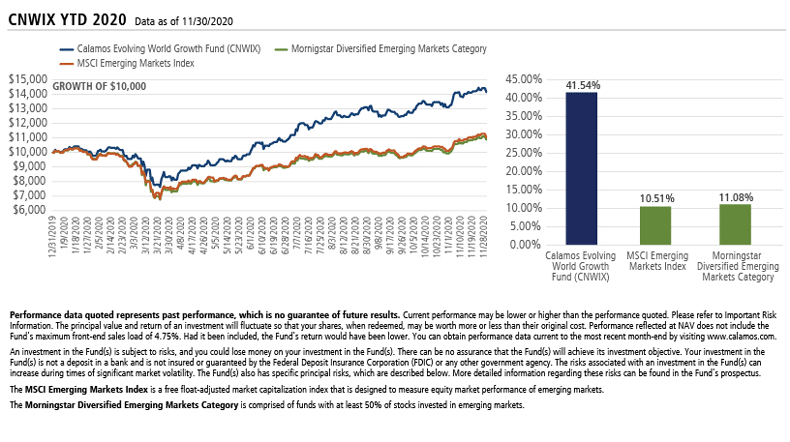

Click here to view CNWIX’s standardized performance.

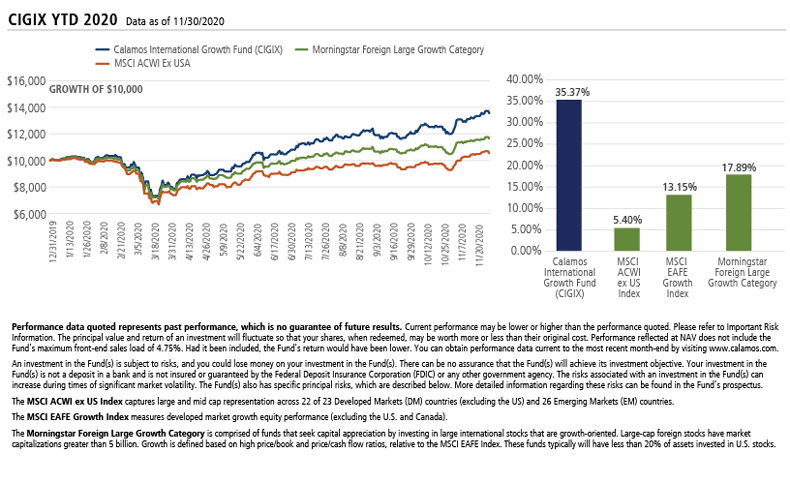

Click here to view CIGIX's standardized performance.

Click here to view CIGEX's standardized performance.

Click here to view CGCIX's standardized performance.

Click here to view CTSIX's standardized performance.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

802248 1220

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on December 14, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.