Extreme Volatility Presented the Opportunities and Profit Streams—and CIHEX Shifted to Take Advantage

In a turbulent period for the markets, Calamos has been hosting a series of Calamos CIO Conference Calls for investment professionals. Below are notes from a call Wednesday, May 6, with Eli Pars, CFA, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager, and David O’Donohue, Senior Vice President, Co-Portfolio Manager. To listen to the call in its entirety, go to www.calamos.com/CIOhedgedequity-5-6

For highlights on the March calls with the team, see this post.

“What’s unique about today, and how can we use it?”—that’s how Calamos Hedged Equity Fund (CIHEX) PMs Pars and O’Donohue explain the advantage of managing a dynamic options-based fund at all times, but particularly in the recent market turbulence.

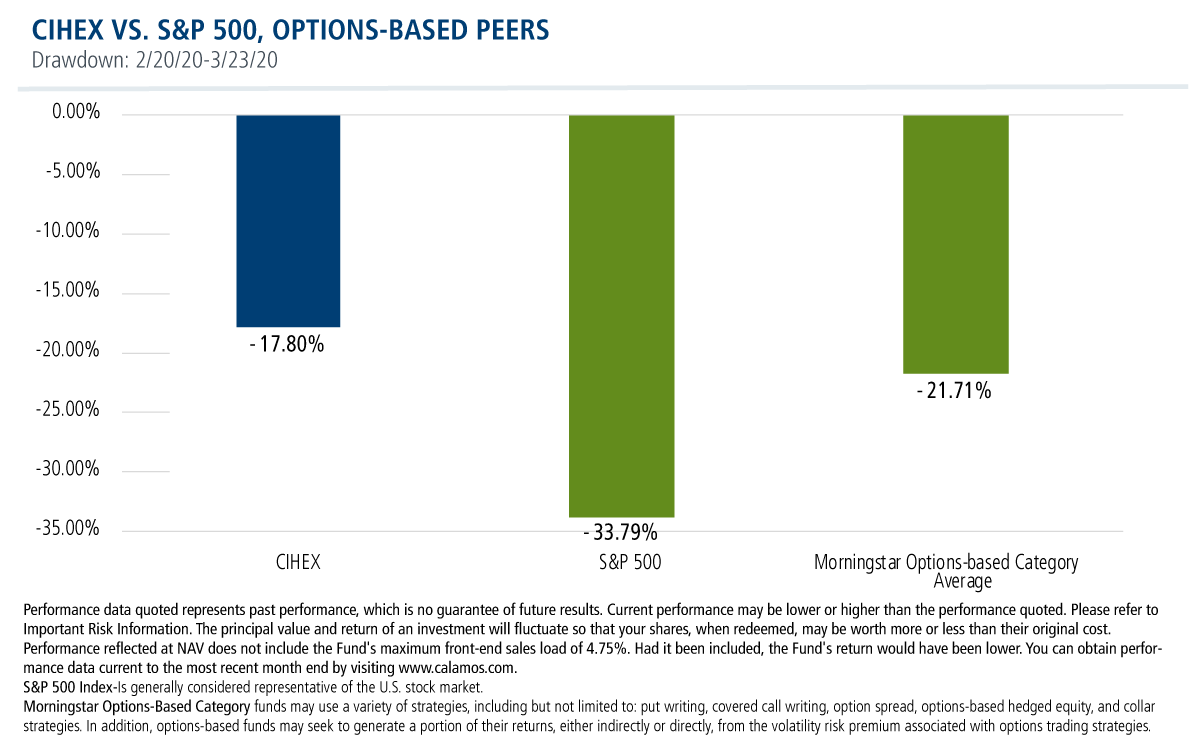

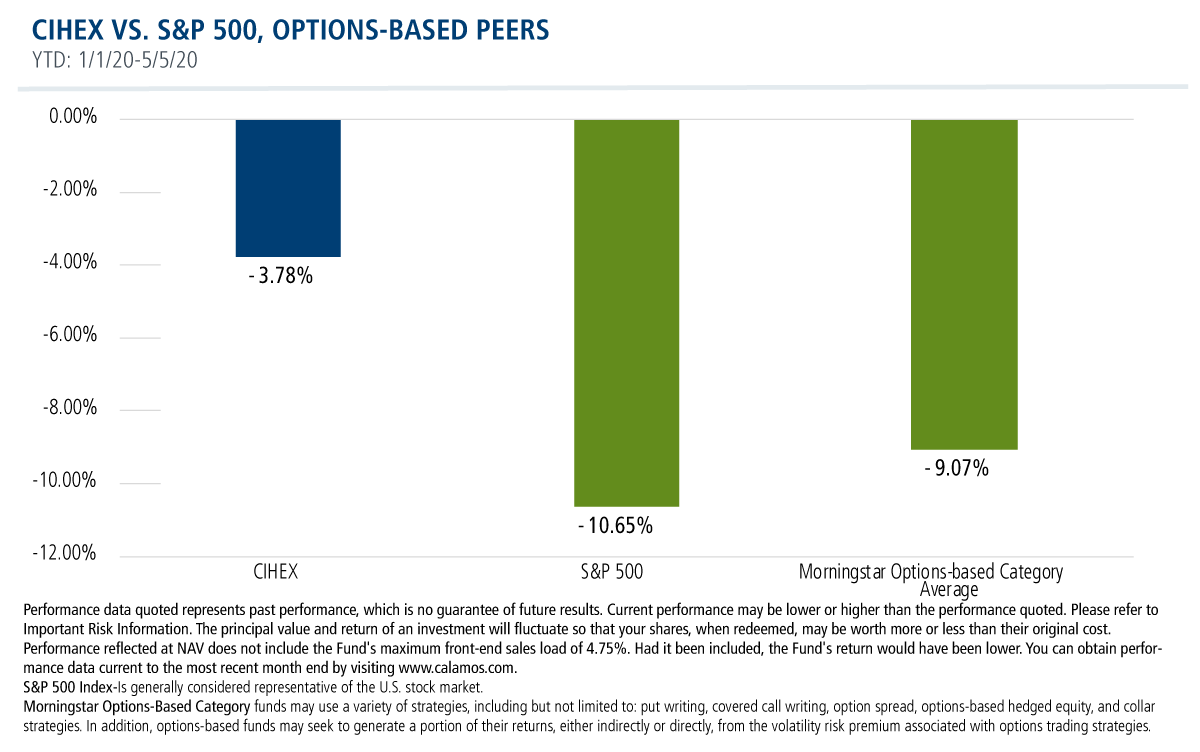

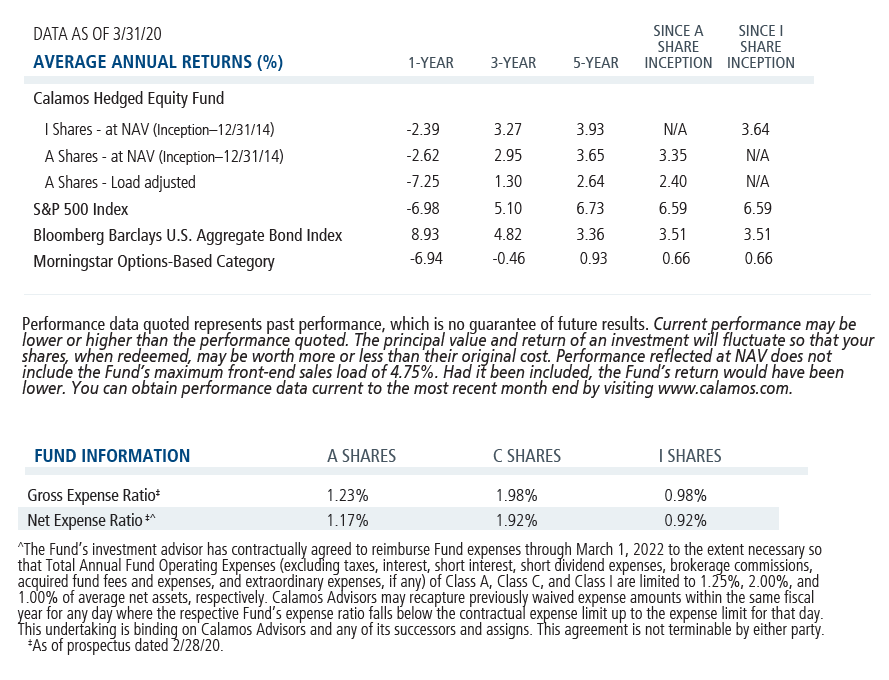

Managing a “living, breathing hedge” on a portfolio of equities enabled the fund to mitigate more than half of the recent equity downturn while capturing more than half of the subsequent bounce back. The result: Year to date as of May 5, the fund’s return is -3.78% versus the S&P’s -10.65%.

The ‘Rules’ Guiding CIHEX’s Option Hedging

The CIHEX team has the freedom to optimize implementation and generate diversifying alpha from option market dynamics.

Pars reviewed the guardrails that are in place:

- “We won’t overwrite to the upside, we won’t be short more than 100% notional calls. Our objective is never to get run over if the equity market has a powerful run to the upside.

- “We’re generally going to be at least 40% net long puts to have some ability to mitigate the downside.

- “And, we’re generally going to have at least a 40 downside delta protection coming from the calls and puts together.”

Pars recalled the actions taken during the drawdown and in subsequent weeks as the market recovered. As the market moved down, the team’s focus was on rolling out hedges and “clearing runway” for the market to come back.

(To explain “clearing runway,” he offered the example of buying calls that were short: “We might short something for $20, and their value drops to $2. They’re only going to $0 so at some point it makes sense to buy those back and clear some runway for when the market moves back up.”)

Throughout the period, the team continuously adjusted hedges, traded around and generally took advantage of what continues to be elevated volatility. Most recently, Pars said, call selling has become more attractive, and serves as a source of income for the fund. At the same time, puts as a means of mitigating downside risk continue to be in place, despite their expense.

O’Donohue elaborated on the cumulative effect of the series of decisions made by the team.

“When we talk about wanting to capture 60% of the market’s upside and 40% of the downside,” he said, “it isn’t about capturing 60% of every up day or every up period and 40% percent of every down day or every down period. It’s really about capturing a little more up and a little less down over multiple periods.”

What It Means to Be Dynamic

Here’s the analogy O’Donohue uses to explain the difference between following a dynamic versus passive strategy in a market.

“If you head to a store and you have to buy exactly what’s on your list, you are at the mercy of whatever prices are that day.

“If you have some flexibility, though—for example, ‘This is on sale today, I’ll grab that. But this item isn’t, I can wait.’

“Everything isn’t on sale every day, but all of them might be at some point. Think about how advantageous it is to buy most of what you need at their cheapest prices.

“That’s what we aim to do.

“When markets are quieter, those prices just don’t change as often. Now, with volatility this high and all of those back and forth 2%, 3%, 4% days, this is the equivalent of Black Friday. Prices are all over the place and changing rapidly—and it can be to our advantage.”

“As markets move,” he continued, “we want to use that to add in pieces. What piece can I add in today that I couldn’t yesterday or last week or last month? If we wake up tomorrow and the market is up 3%, how can I use that to add a piece? Can I sell a call higher, can I add a put or a put spread for 30% less than it cost yesterday?”

This flexibility, O’Donohue noted, isn’t available to other options-based funds, many of which preordain the amount of calls they’re going to sell and puts they’re going to buy in a period.

Making Subtle Shifts at Different Points

The start of 2020—the four months that Pars said felt more like five years—will be remembered for its large daily moves.

“There was an eight-day stretch in March where the smallest daily move was 4.89%,” said O’Donohue. “But equally important for us, there was an eight-day stretch starting on the Thursday before Easter when the market didn’t really move. It was in a pretty similar place at the end as it was in the beginning. But during that period there were four up days and four down days, and the average daily move was about 2%.

“That’s a lot of opportunity for us to add in pieces and also realize profits—we sold calls and covered them the next day, and resold them the day after that. That’s an opportunity and profit stream that didn’t exist in 2017,” O’Donohue said.

CIHEX has the advantage of not needing to make aggressive market calls, O’Donohue said. Rather, the team makes “subtle shifts” at different points.

He explained, “When markets are near highs and volatility is low and the cost of hedging is low, we are likely to be more defensive and more focused on how we’d do in a 10% or 20 % pullback. After a 34% pullback [such as was experienced in March], we’re going to be longer leaning and more focused on maximizing how we do in a recovery.

“Now after a 25% recovery and volatility falling, we are somewhere in the middle. But as the market rises, we’re trying to build up layers of hedge and add back some of those puts that we weren’t able to in March. The flexibility is what enables us to have more favorable participation rates.”

Investment professionals, for more information about CIHEX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Morningstar Ratings™ are based on risk-adjusted returns and are through [As Of_5/31/20] for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

802018 520

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 07, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.