New Animation

Watch the animation to explore performance across a bull market, down market and flat market scenarios.

Why risk it? Discover the power of Calamos Structured Protection ETFs.

Latest Offerings

Listing August 1

Calamos S&P 500 Structured Alt Protection ETF – August

Listed July 1

Calamos Russell 2000 Structured Alt Protection ETF – July

Structured Protection ETFs

100% Capital Protection

Defined Upside Participation

Tax Alpha

Why Use Structured Protection ETFs

| Investors who seek: | Solves for: | Alternative to: |

|---|---|---|

|

Downside protection

|

|

|

|

To reallocate cash

|

|

|

|

Capital preservation near or during retirement

|

|

|

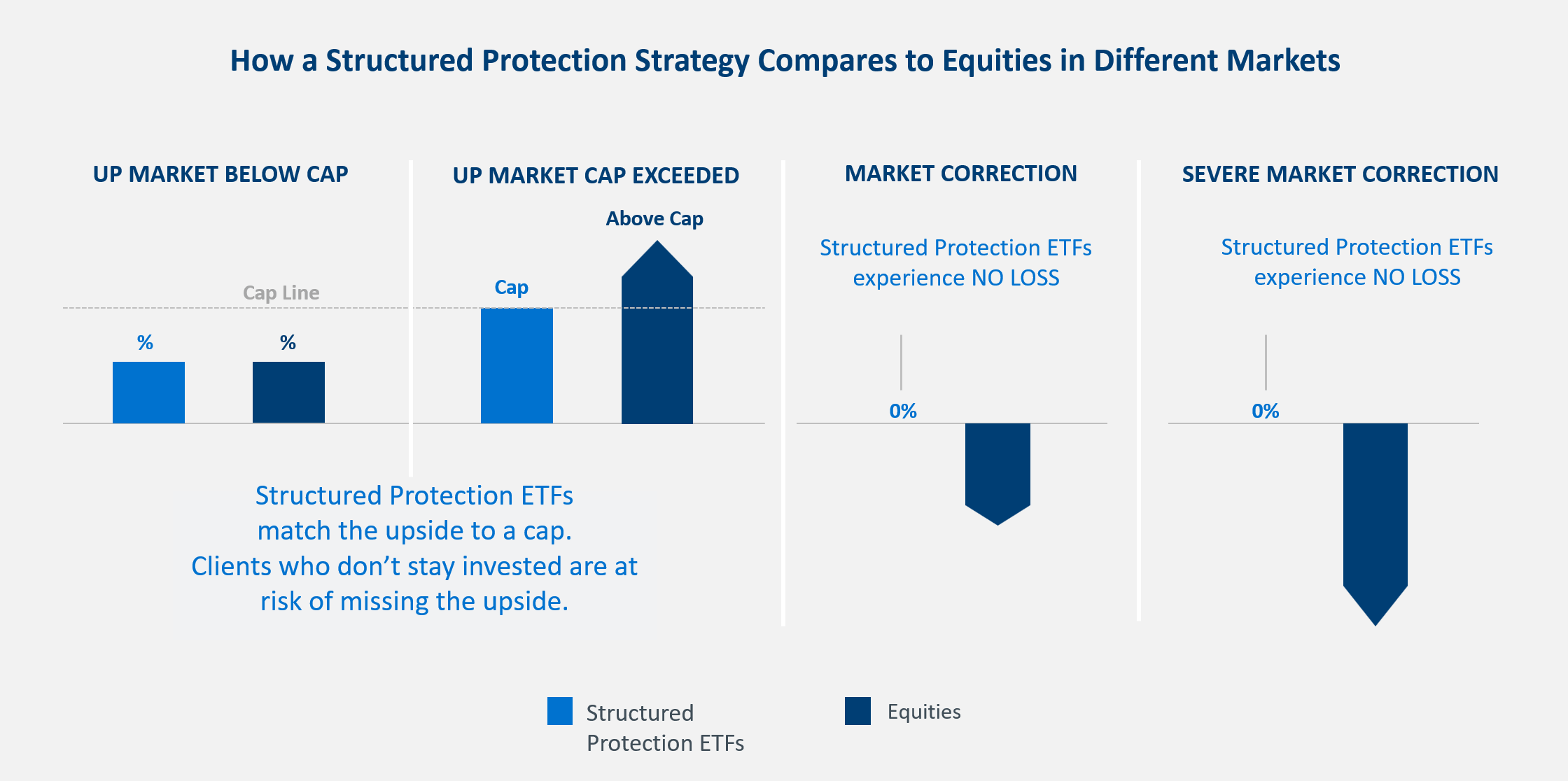

How Do Structured Protection ETFs Work?

Structured Protection ETFs are designed to avoid losses when the market goes down over the one-year outcome period.

When To Buy Structured Protection ETFs

Entry points into Structured Protection ETFs offer a range of opportunities if held over the course of the one-year period.

| Potential Entry Points: | Upside and Downside Participation: | Reason to Buy: |

|---|---|---|

|

Index at launch Day-1 ETF NAV

|

|

|

|

Index is near Day-1 ETF NAV

|

|

|

|

Index is below Day-1 ETF NAV

|

|

|

|

Index is above Day-1 ETF NAV

|

|

|

Why Calamos?

Alternatives and options-based investing is in our DNA

Calamos portfolio managers have been investing in options for nearly 50 years, creating new and innovative strategies to help investors manage risk.

Calamos is a leading US manager of alternatives investments, overseeing $16 billions in liquid alternatives with the majority of total fund assets in options-related strategies.