CTSIX Outperformance YTD Showcases the Skill of Active Management Backing Small Cap Winners

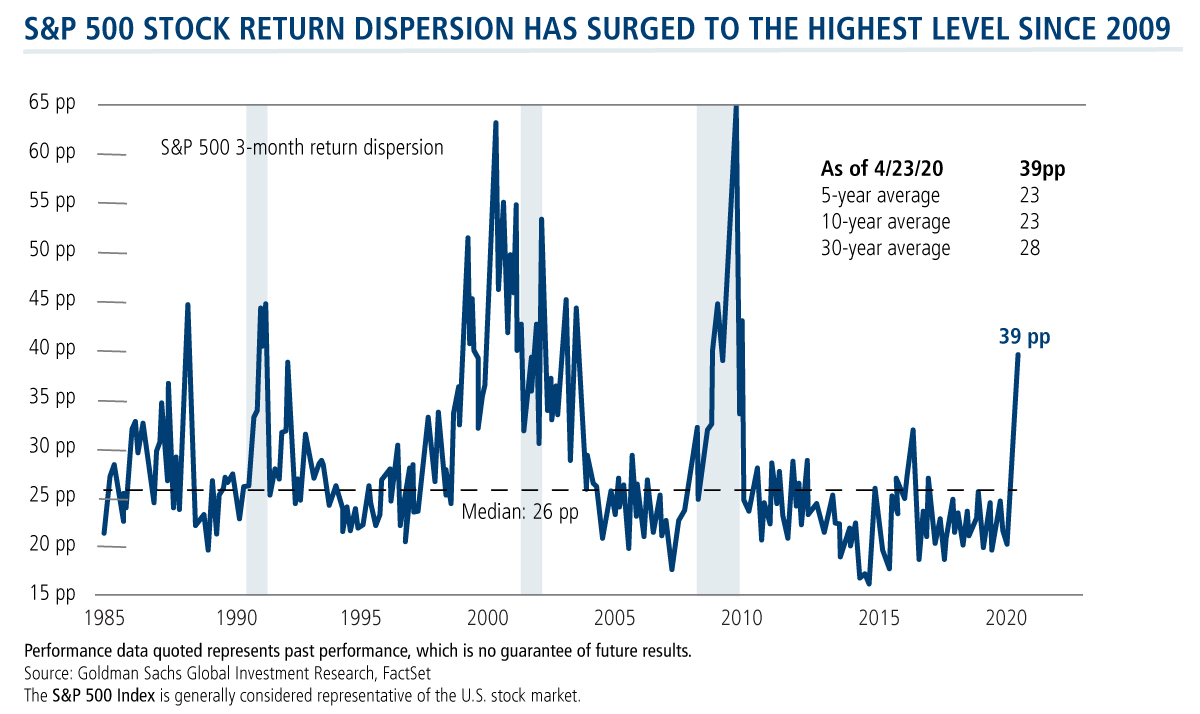

It’s been said that performance dispersion in stock returns presents opportunity to express investment skill. If that’s the case, this is the season for expressing skill.

The dispersion of S&P 500 returns has risen to its widest level since 2009, according to Goldman Sachs Global Investment Research and as shown below.

The same is true in small caps, says Brandon Nelson, Senior Portfolio Manager of Calamos Timpani Small Cap Growth Fund (CTSIX). “The year-to-date performance spread between dead weight and winners has been enormous,” according to Nelson. “In the past several weeks, the market has sorted through the rubble, quickly and clearly identifying which companies are well positioned and which are poorly positioned.”

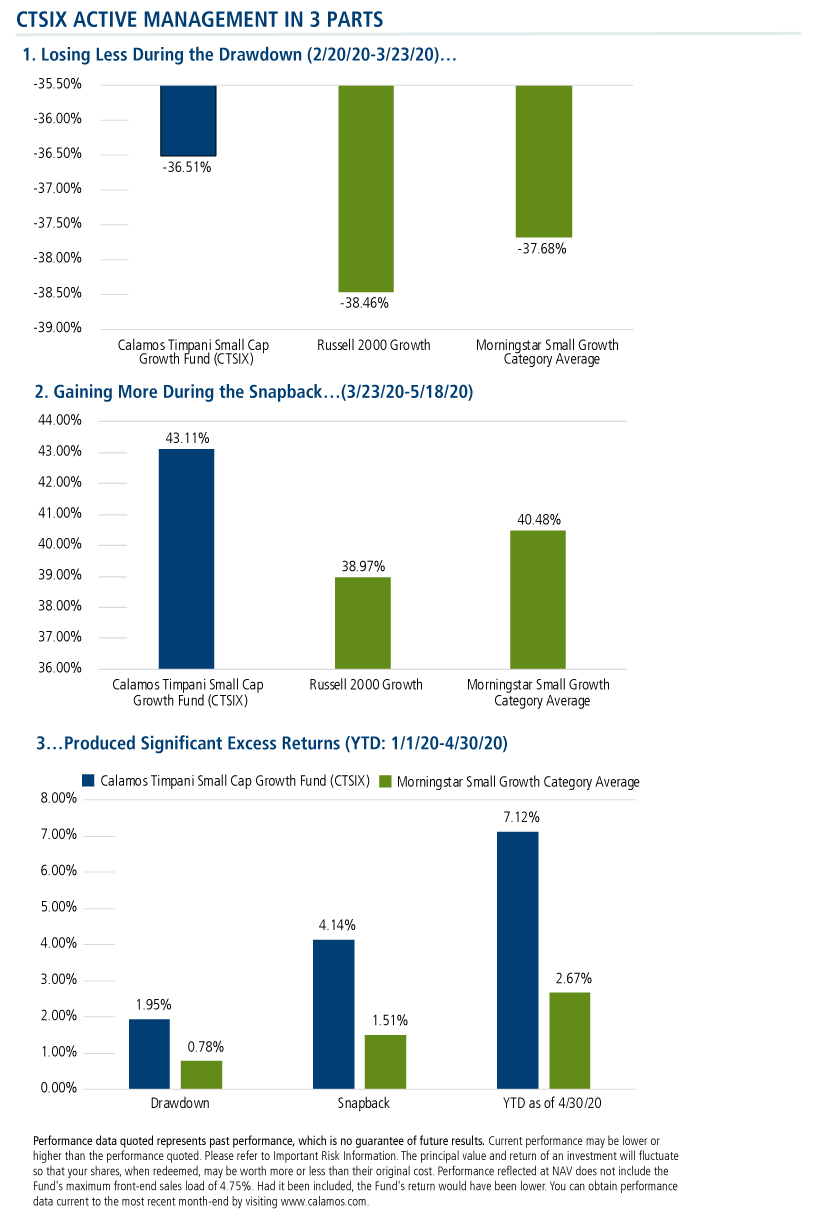

In this environment, the skills of Nelson and the CTSIX team are expressed in the fund’s performance results both during the drawdown and as the snapback has continued through May.

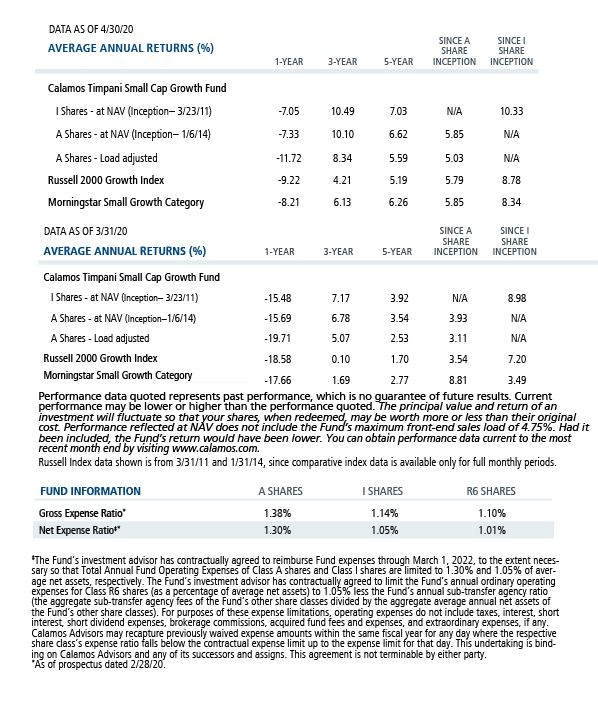

Demonstrated outperformance relative to the index is a function of the fund’s active management. Such a performance gap is inevitable, according to Nelson. “Passive index investing does a good job of getting investors exposure to an asset class, but inevitably gets investors disproportionately exposed to underperforming stocks of companies that have poor fundamentals.” Such dead weight can hurt overall returns.

Note, too, CTSIX’s outperformance versus its Morningstar Small Growth Category peers during the drawdown, snapback and year-to-date ending 4/30/20.

Here are three points Nelson uses to crystallize what he believes are the fund’s advantages:

- Process: The fund has a proven investment process that seeks to find big winners and quickly reduce exposure to losers. The process is time-tested, consistent and repeatable across multiple market cycles. (For more on this advantage in the first quarter, see this post.)

- Experience/alignment: The team has been consistently implementing the same growth philosophy for almost 25 years, with Nelson and all team members invested in the fund.

- Low asset base: The fund’s relatively low asset base, relative to its competitors, enables it to be more nimble with holdings and explore investing in names further down the market cap spectrum—where security pricing is less efficient.

The Recovery Is Underway

Whether via earnings calls or one-on-one conversations, the first quarter earnings season gave the team unprecedented access to management teams and heightened disclosure, including the progression of trends from late March to early May.

Overall, says Nelson, the theme is that “things are getting less bad.” While not close to 100% back to normal, of course, the recovery is in motion, he says.

Nelson has been optimistic about small cap prospects since March, when he commented on the factors making small caps especially compelling (see this post for more):

- Small caps’ historic significant outperformance (1400 basis points on average)—in the first 12 months of a new bull market following an economic downturn.

- Long-term, small caps have produced the highest rates of return versus large and mid-caps.

- Small caps are the cheapest they’ve been in more than 20 years.

Investment professionals, for more information about CTSIX, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

802035 0520

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 27, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.