CPLIX’s Grant Called the Market Rally, and Continues Risk-on

Few investors had the conviction of Calamos Co-CIO Michael Grant in March and April. As anxiety over COVID-19 closed down the economy and stressed the markets, Grant turned bullish on U.S. equities.

“For the first time in years, the math for equity investors makes sense…Investors stand to be paid to engage equity risk once again,” Grant, Senior Co-Portfolio Manager of Calamos Phineus Long/Short Fund (CPLIX), said on a call on March 25, near the bottom of the drawdown (see post).

Long story short: He was right.

“When the virus permits a resumption of activity, markets will enjoy a sharp rebound,” Grant declared in his April commentary, and positioned the fund accordingly.

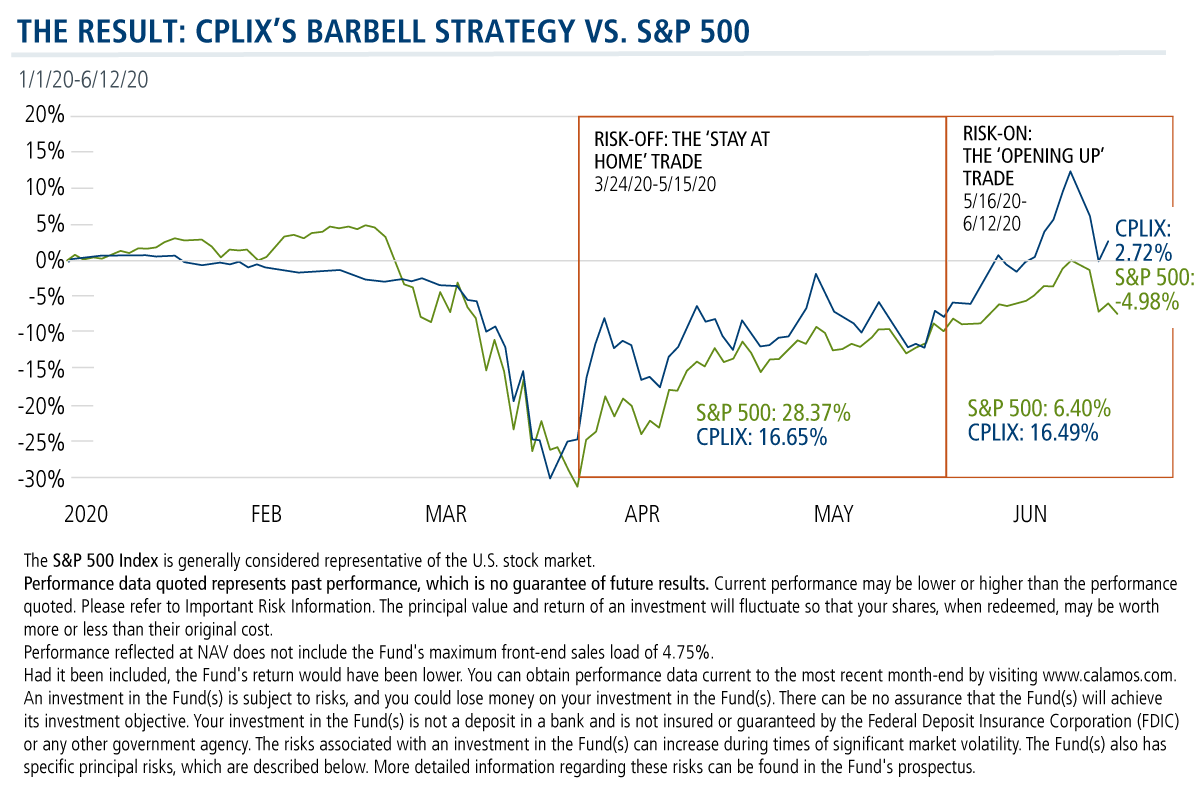

Through June 10, the S&P 500 was back in positive territory for 2020, after having fallen almost 34% during the drawdown. By the close of the market two days later, and after a near 6% loss on June 11, the broad market was down -4.98%.

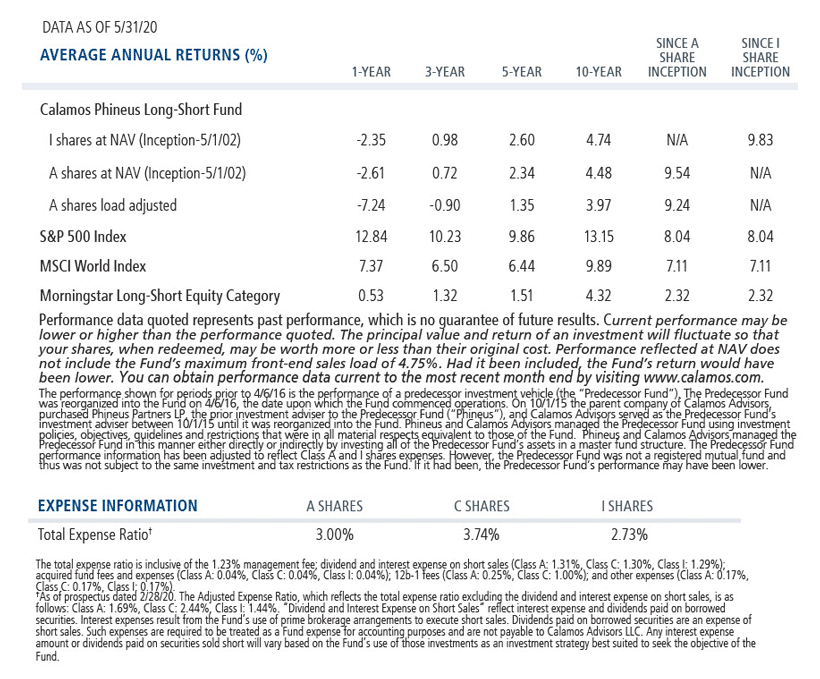

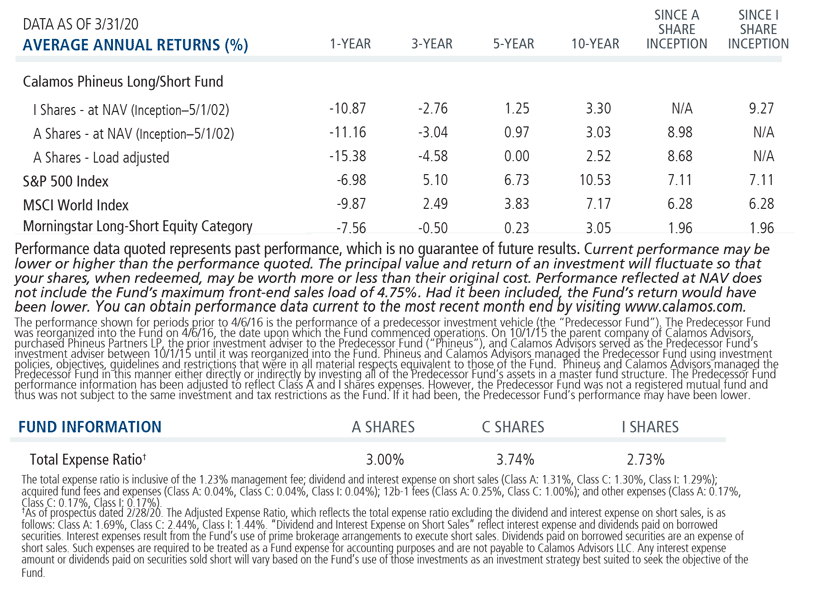

Meanwhile, CPLIX gained 36.04% from the trough of the bottom (March 24) through June 12. Its performance ranked it #1 among its peers in the Morningstar Long-Short Equity category as of June 12.

In a call with investment professionals last week, Grant continued to express optimism about an eventual global synchronized recovery.

“For now, all we need to know is how extraordinary the stimulus has been, and that no one is going to back away until the world looks a lot better,” he said.

What’s more, he predicted, “Politics will not allow another shutdown, the costs have been too severe. Even if there is a mild second wave, politicians will plow through it.”

Grant anticipated that CPLIX would retain its positioning through June, and then re-assess the possibility of consolidation or correction in July/August, as risks related to the national elections begin to heighten.

Investors Continue to Underestimate the Opportunity

Grant reflected on the market’s recovery, which he characterized as unusual by historical standards: The initial rally favored the same high-quality “safety” stocks that dominated before the drawdown. More recently, it has transitioned to a more classic recovery, led by cyclical issues.

To be in a position to benefit, the team has employed a barbell strategy.

“The objective is balance,” Grant explained on an April 30 call (see post). Noting the positioning by others in cyclicals at unprecedented lows at that time, he said, “Everyone is standing on one side of the boat. When I see everyone standing on one side of the boat, I at least want to have a leg on the other side.”

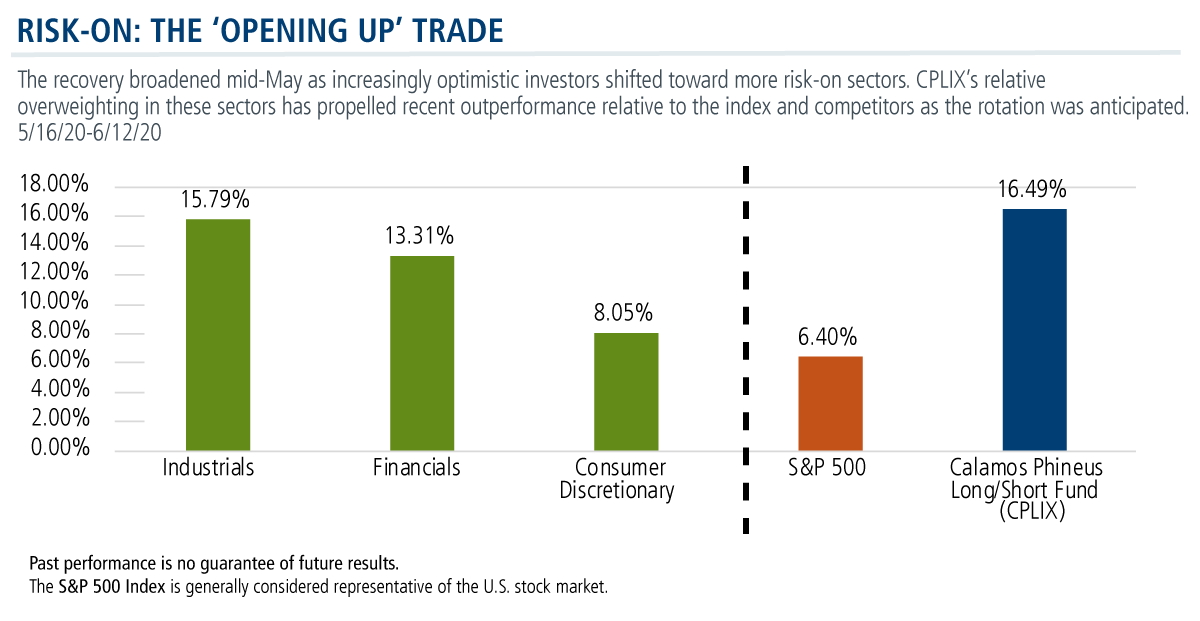

The team participated in the first leg of the recovery, then adjusted mid-May to capture the broader recovery.

Grant Called It

In conference calls and commentary published in March and April, Michael Grant went on the record with several high conviction statements. They included:

- That the recession started in February (see his April commentary). This was confirmed last week by the National Bureau of Economic Research.

- That the “extraordinary” policy response from the Federal Reserve would triumph over COVID-19’s economic implications (see this post). Having declined almost 34% by March 23, the S&P climbed all the way back, turning positive on June 7.

- In order for the equity recovery to continue, Grant said in this post, it would need to broaden to include value, high beta, and higher risk sectors and stocks. Leadership shifted toward risk-on sectors mid-May.

Many investors today continue to be “dazed and confused,” according to Grant. He noted high cash levels in investor portfolios and “remarkably bearish” sentiment and positioning. “Too many investors have capitulated, selling out of the market or selling the wrong sectors at levels we may never again see the rest of our careers.”

Grant believes that many are underestimating economic and corporate data through June. And he emphasizes the role being played by the Fed.

“In 2.5 months [the Fed] has thrown liquidity at the system that it took five years to throw in 2008…We simply have never seen this liquidity backdrop, which is why we need the risk-on move to unfold.” Grant gives the Fed an A+ for keeping corporate credit markets functioning during the darkest days of the crisis.

If S&P 500 earnings can reach an average of $180 per share, the index could rise to 3,500, he said. More broadly, if the U.S. does in fact achieve a V-shaped economic recovery, the S&P 500 could reach 3,800 by 2021.

Investment professionals, for more information about Grant’s outlook or CPLIX, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Past performance is no guarantee of future results. As with other investments, market price will fluctuate with the market and upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment. Returns at NAV reflect the deduction of the Fund’s management fee, debt leverage costs and other expenses. You can purchase or sell common shares daily. Like any other stock, market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment. Shares of closed-end funds frequently trade at a discount which is a market price that is below their net asset value. You can purchase or sell common shares daily. Like any other stock, market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment. Shares of closed-end funds frequently trade at a market price that is below their net asset value.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Equity Securities Risk. Equity investments are subject to greater fluctuations in market value than other asset classes as a result of such factors as the issuer's business performance, investor perceptions, stock market trends and general economic conditions. Equity securities are subordinated to bonds and other debt instruments in a company's capital structure in terms of priority to corporate income and liquidation payments. The Fund may invest in preferred stocks and convertible securities of any rating, including below investment grade.

Short Selling Risk. The Fund will engage in short sales for investment and risk management purposes, including when the Adviser believes an investment will underperform due to a greater sensitivity to earnings growth of the issuer, default risk or interest rates. In times of unusual or adverse market, economic, regulatory or political conditions, the Fund may not be able, fully or partially, to implement its short selling strategy. Periods of unusual or adverse market, economic, regulatory or political conditions may exist for extended periods of time. Short sales are transactions in which the Fund sells a security or other instrument that it does not own but can borrow in the market. Short selling allows the Fund to profit from a decline in market price to the extent such decline exceeds the transaction costs and the costs of borrowing the securities and to obtain a low cost means of financing long investments that the Adviser believes are attractive. If a security sold short increases in price, the Fund may have to cover its short position at a higher price than the short sale price, resulting in a loss. The Fund will have substantial short positions and must borrow those securities to make delivery to the buyer under the short sale transaction. The Fund may not be able to borrow a security that it needs to deliver or it may not be able to close out a short position at an acceptable price and may have to sell related long positions earlier than it had expected. Thus, the Fund may not be able to successfully implement its short sale strategy due to limited availability of desired securities or for other reasons.

Each fund has specific risks, which are outlined in the respective funds' prospectuses. The general risks involved in investing in a closed end fund include market volatility risk, dividend and income risk, and loss of investment risk. Please refer to each fund's prospectus, annual and semi-annual reports at www.calamos.com for complete information on the fund's performance, investments and risks.

Morningstar Long/Short Equity Category funds take a net long stock position, meaning the total market risk from the long positions is not completely offset by the market risk of the short positions. Total return, therefore, is a combination of the return from market exposure (beta) plus any value-added from stock-picking or market-timing (alpha).

The S&P 500 Index is generally considered representative of the U.S. stock market.

802050 620

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on June 15, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.