No, It’s Not ‘Too Late’ for Convertibles

First published: July 29, 2020

For the last half-century—since the early days when John P. Calamos, Sr. pioneered the use of convertible securities to participate in equity market upside with potentially less exposure to equity downside—we’ve been educating investment professionals and investors alike on the benefits of convertibles. Those who have gone through multiple volatile market periods understand that convertible strategies have often provided better returns than either the stock or bond markets.

But those of you who are looking at convertibles for the first time in 2020 naturally have some questions, and even perhaps some hesitation, particularly after converts’ strong first half. We get it, and we welcome your questions.

Below, Scott Becker, CFA, Calamos Senior Vice President and Head of Portfolio Specialists, addresses two of the most common questions we’ve been fielding.

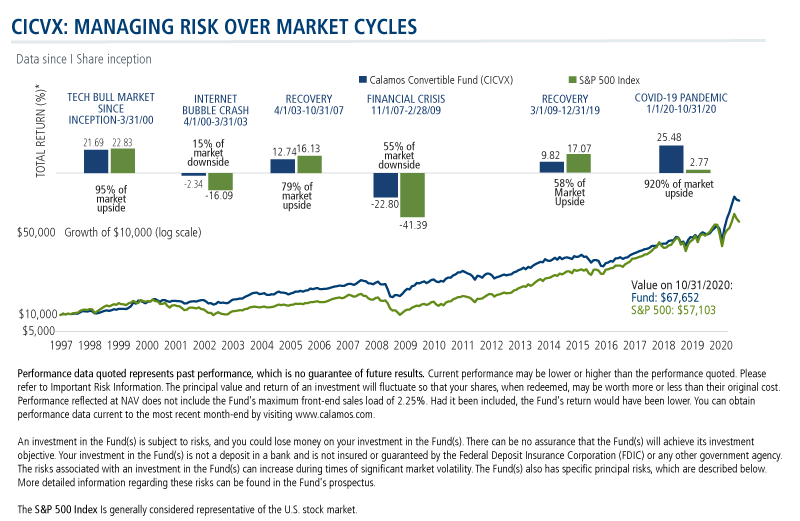

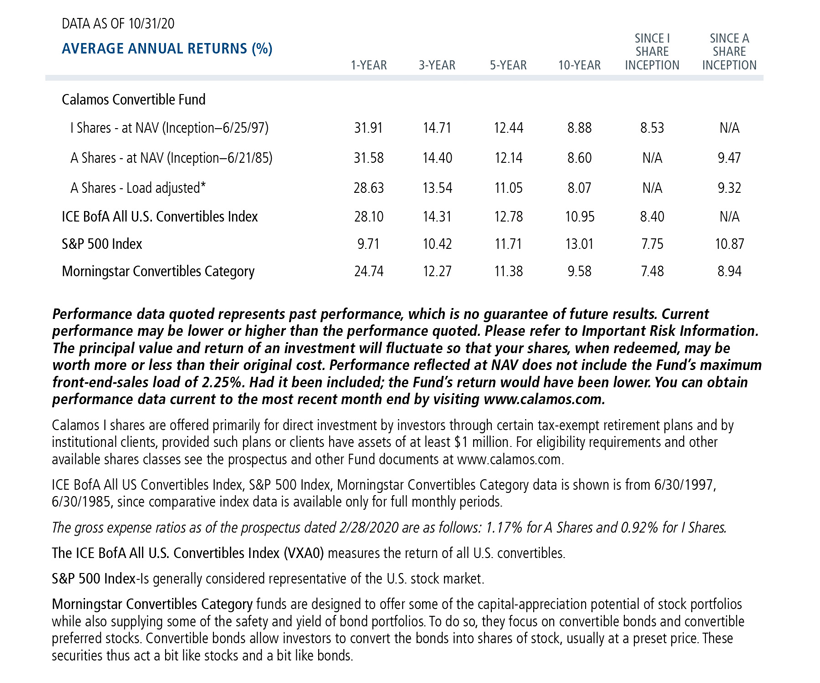

Q. Convertibles were up 21.18% YTD through 10/31, and the Calamos Convertible Fund (CICVX) gained 25.48% while the S&P 500 closed up just 2.77%. Thanks for bringing convertibles to my attention, but am I too late? Have I missed it?

A. You must remember that convertibles are not the same as common stock, the risk/reward of convertibles doesn’t change in the same manner, and we actively manage that risk/reward as the market moves as well. While the delta of our strategy and the market has moved up from market lows, it’s essentially where it was pre-COVID-19 and through much of 2017-2018.

Because we actively manage that risk/reward, we are not just owning the market. For example, there are three Tesla convertibles. As Tesla’s common stock and the convertible securities have delivered strong performance recently, we’ve reduced the weight within the most equity-sensitive convertible. And the CICVX team can and does use puts and calls to manage risks.

Active management makes a difference. When the market sold off, we added equity sensitivity. As the market ripped higher, we’ve reduced equity sensitivity. Today, we have what we would consider a traditional risk/reward relative to the underlying equities and the equity market.

So, no, it’s not too late to be considering or using convertible securities and an active manager to help you through today’s markets. We invest in a diversified portfolio of companies that include strong, secular growth opportunities in areas such as virtual services (two examples: healthcare and business meetings) as well as businesses that may see growth as the economy recovers from shutdown (e.g., travel-related companies).

Q. You present convertibles as lower risk/reward, but in the second quarter CICVX was up 30.35% while the S&P 500 gained 20.54%. That looks to me as if you’re clearly taking on more risk than the equity market—or that converts must be overbought/overvalued.

A. Great question, I’ll explain.

First, the underlying equities in the ICE BofA All U.S. Convertibles Index (VXA0) were up more than 40% for the quarter, so they outperformed those of the S&P 500. How? The index included a great combination of secular growth and recovery names coming to market for quick and affordable access to capital—a hallmark of the convertible market. While CICVX did outperform the S&P 500, it’s not because we had a massive risky bet on equities or on a V-shaped recovery.

About Delta

Delta is an interesting stat and can help “simplify conversations.” But it doesn’t capture the whole picture of risk/reward, explains Scott Becker, CFA, Calamos Senior Vice President and Head of Portfolio Specialists.

Other moving parts need to be taken into consideration, including:

- In which sectors and securities are you taking higher or lower sensitivities?

- Are you barbelled in deltas, or largely in balanced deltas?

- What is your investment premium (% above the theoretical bond floor)?

Second, our selection was even better than what was in the VXA0; the underlying equities of the convertibles in our portfolio gained 46% for the quarter. CICVX returned 30% on underlying equities that were up 46%. That’s 65% participation—a bit ahead of where our delta at the beginning of the period would have implied. Our delta was closer to 52 to start the quarter (see note on delta to the right).

Third, and just as important, was our team’s active management of securities and sensitivity. This included managing the risk/reward ahead of the downturn as well as ahead of the recovery during the first quarter, and as the broad market has returned back near prior levels during the second quarter.

Relative to the broad convertible market, CICVX still has less in high delta/equity-sensitive converts than the VXA0, and we’re focusing more on the balanced portion, which we believe offers the best upside/downside capture opportunities.

The S&P 500, as a proxy for the the U.S. equity market, is now back above where it was on its February 19, 2020, pre-COVID sell-off high (3,386 at close on Feb. 19 versus 3,562 at the close on November 12). The S&P’s return with dividends was at 11.25% YTD as of November 12. Know that the CICVX team is managing the risk/reward in the same manner today as it was in February.

Do you wish you had done more in convertibles back in February? If so, it is not too late to consider now. Calamos Convertible Fund can be a core portion of your equity allocation, offering attractive risk/reward attributes to help navigate equity markets.

What additional questions can we answer for you regarding convertibles and their place in your clients’ portfolios? Contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The ICE BofA All U.S. Convertibles Index (VXA0) comprises approximately 700 issues of only convertible bonds and preferreds of all qualities.

The S&P 500 Index is generally considered representative of the U.S. stock market.

Delta expresses the convertible's sensitivity to changes in the stock price. It expresses the change in the convertible price per unit of change in the underlying stock price.

802099 1020

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

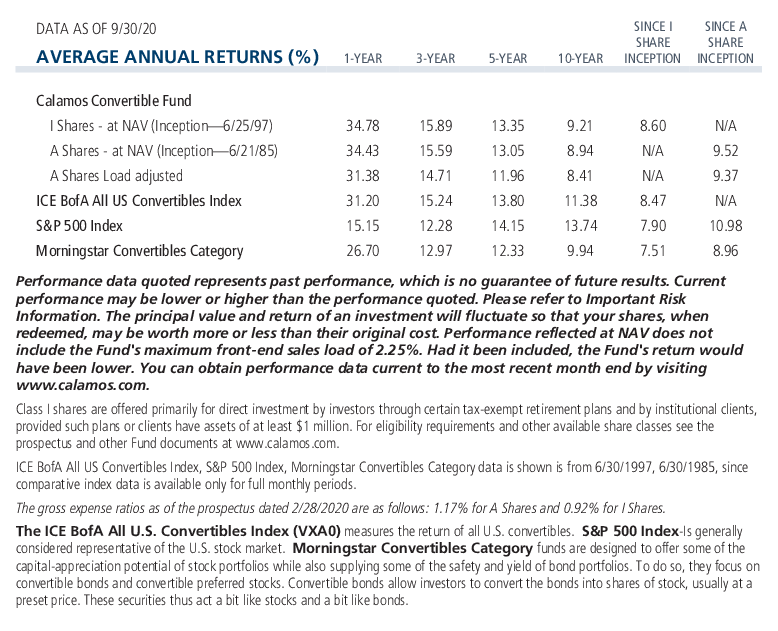

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 13, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.