Why CTSIX’s Nelson Is Optimistic About the Recovery, Corporate Profitability and Small Caps

In a turbulent period for the markets, Calamos has been hosting a Calamos CIO Conference Call series for investment professionals. Below are notes from a call Tuesday, April 21, with Brandon Nelson, CFA, Senior Portfolio Manager of the Calamos Timpani Small Cap Growth Fund (CTSIX). To listen to the call in its entirety, go to https://www.calamos.com/CIOsmallcap-4-21

For the March commentary, see this post.

One month after the depths of the equity market decline, Brandon Nelson expresses optimism about the prospects for the country’s health, corporate profitability and what he calls “exciting” small companies in the Calamos Timpani Small Cap Growth Fund (CTSIX) portfolio.

He’s encouraged, he said, that the virus metrics are dropping, the health care community is becoming better equipped to properly deal with the virus, and that potential treatments and vaccines are progressing. He described the monetary and fiscal stimulus as “shockingly robust.”

“These positive data points, combined with extremely oversold market conditions, have been the recipe for a powerful recent surge in the stock market,” he said.

“The good management teams are not just sitting on their hands, watching their businesses collapse. They are finding creative ways to reduce expenses and increase efficiencies in an attempt to minimize the profitability hit,” he said.

Profits Could Recover Faster

Nelson acknowledged the lack of consensus about the shape of the eventual economic recovery. But he believes profits could recover faster than expected—“even if the recovery takes longer to materialize or is less robust than expectations.”

To illustrate, Nelson offered this example:

Let’s say that a consumer company pre-virus was generating $10 million of revenue and 50 cents of profit per share. The virus hits and revenues collapse to $6 million, and profits go to zero. Now, fast-forward a few months into the recovery. Because of the expense reductions and improved efficiencies, coming out of the downturn, the company is generating 50 cents per share once again, but this time, with only $9 million of revenue. In such a case, the trajectory of the profit recovery is steeper than the trajectory of the revenue recovery.

“I think we are going to see a lot of this, and it will have meaningful, positive implications for the stock market, given that profitability is such a key valuation metric,” he said.

The Outlook for Small Caps

Nelson commented on the fact that small caps have lagged meaningfully for multiple years versus large caps. He called the asset class “especially compelling” today, citing three points:

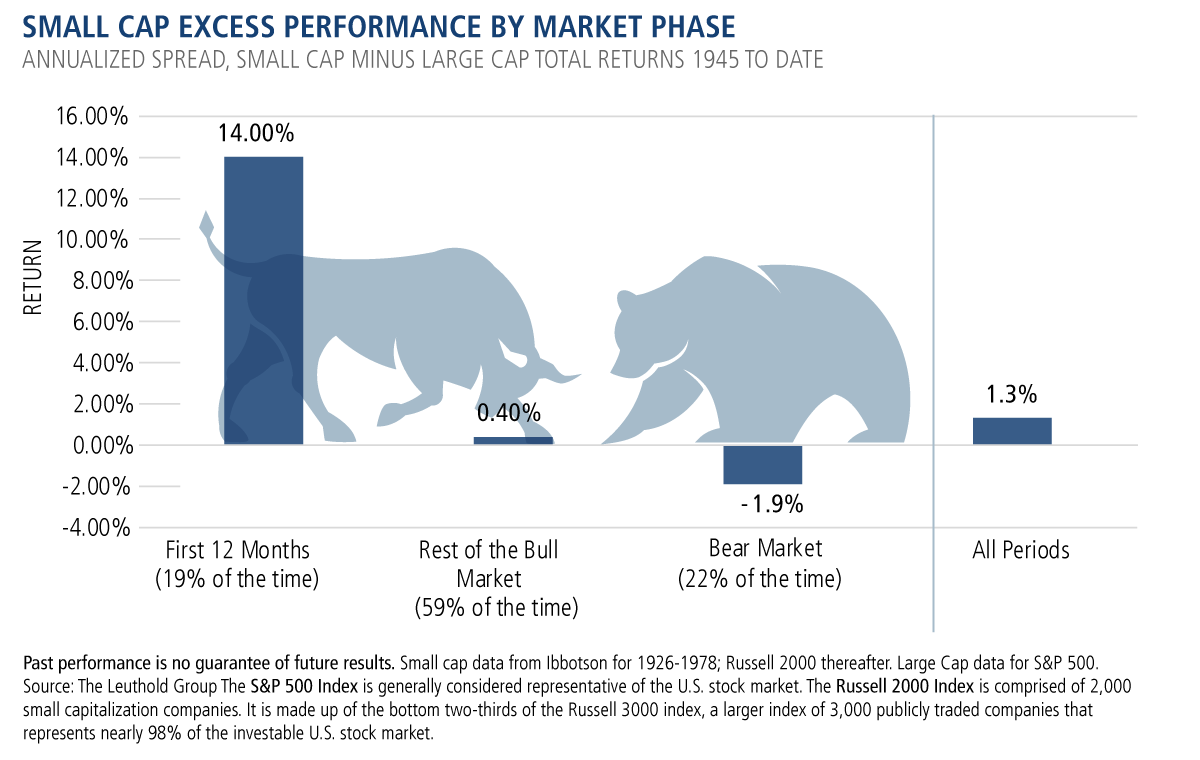

- Small caps’ historic significant outperformance—1400 basis points, as shown below—in the first 12 months of a new bull market following an economic downturn.

- Long-term, small caps have produced the highest rates of return versus large and mid-caps.

- Small caps are the cheapest they’ve been in more than 20 years.

“I’m not saying that today is the bottom for small caps versus large caps. In the short term, things are messy, but if you’re an asset allocator it’s hard not to be intrigued with the intermediate- to long-term outlook for small caps,” said Nelson.

CTSIX Positioning and Q1 Review

As an update on positioning, Nelson confirmed that the fund remains tilted toward secular growth but has some select exposure to high quality cyclical names as well. “Given the macro uncertainty and many moving parts, this diversification is especially prudent,” he said.

On the March 24 call, he’d highlighted a few secular growth themes that continue in the portfolio, including:

- In technology, cloud-based communication enabling companies that target business customers (examples: RingCentral, NICE, Five9 and Audiocodes).

- Within health care, sleep apnea diagnostics and treatment solutions (examples: Inspire Medical and Itamar Medical).

Today he introduced a new theme: Public Safety Technology, which he considers “especially well-positioned in the current environment of potential social unrest.”

Three stocks in the CTSIX portfolio are:

- Everbridge, a rapidly growing subscription software company providing critical events management solutions to government and business customers. Some examples of critical events include workplace violence, IT and power outages, critical equipment failures, natural disasters, and pandemic viruses like COVID-19.

- Axon Enterprises, which sells Tasers and body cameras to police departments, and also subscription technology services that manage data produced by the hardware. The collected data plays a critical role in courtrooms and when there are questions about the use of best practices relating to police engagement with citizens.

- ShotSpotter, a subscription-based gunfire detection technology whose customers include domestic and international law enforcement. Studies show most gunfire goes unreported to authorities as people generally don’t want to get involved. With ShotSpotter technology, in less than one minute after shots are fired, police departments are given notification regarding the number of shooters, the types of weapons being used, and the exact location of the gunfire. Such intelligence is critical for officers arriving at the scene.

Finally, Nelson commented on the fund’s first quarter performance, when CTSIX produced a return that was almost 800 basis points better than the Russell 2000 Growth Index.

“Our process usually works,” he said. “It’s time-tested, consistent, proven and, most importantly, it’s repeatable. What my team and I are good at is finding and staying with big winners, and reducing our exposure to losers.”

The first quarter was an example of that, according to Nelson. “No single stock cost us more than 40 basis points in relative performance. On the flipside, we had three stocks that each added over 100 basis points of relative performance.”

The team’s trading—with sells that were especially helpful—in the first quarter contributed almost 300 basis points to the return, Nelson added. Also see How CTSIX’s Active Management Provided a 776bps Advantage in a Deep Down Quarter for Small Cap Growth.

| Largest holdings as of 3/31/2020: | % of Net Assets |

|---|---|

| eHealth, Inc. | 4.6% |

| Amedisys, Inc. | 3.2% |

| RingCentral, Inc. - Class A | 2.9% |

| Palomar Holdings, Inc. | 2.2% |

| Lattice Semiconductor Corp. | 2.0% |

| LHC Group, Inc. | 1.9% |

| Advanced Energy Industries, Inc. | 1.9% |

| Five9, Inc. | 1.9% |

| Mercury Systems, Inc. | 1.9% |

| Inspire Medical Systems, Inc. | 1.8% |

The Fund is actively managed. Holdings and weightings are subject to change daily. Holdings are provided for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned.

As of 2/28/2020, the Fund held the following weighting (percent of investments) in the securities discussed above as follows: RingCentral, 3.01%; eHealth, 3.0%; Five9, 2.47%; Everbridge, 2.66%; Amedisys, 2.05%; Teladoc, 1.83%; Yeti, 1.79%; Lattice Semiconductor, 1.64% Diodes, 1.26%; Phreesia, 1.22%; LHC Group, 1.04%; Nice, 1.03%; LHC, 1.04%; Chegg, 1.01%; Axon Enterprises, 0.97%; Varonis Systems, 0.93%; Shotspotter, 0.87%; Ping Identity, 0.76%; AudioCodes, 0.75%; SiTime, 0.75%; Addus Homecare, 0.74%; FTI Consulting, 0.68%; The Rubicon Project, 0.64%; Itamar Medical, 0.49%.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

802003 420

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 22, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.