Calamos Aksia Alternative Credit and Income Fund (CAPIX)

A Broad Spectrum Private Credit Approach

Calamos Investments, a leader in liquid alternative funds, and Aksia, a global leader in private credit funds, join forces to offer CAPIX—an institutional-style private credit solution for access to the exciting private credit market.

Contact us to learn more about the potential long-term benefits of including Calamos Aksia Alternative Credit and Income Fund in an asset allocation.

Unlike most private asset funds, Calamos Aksia Alternative Credit and Income Fund does not require accreditation or have investor qualification standards. Investors can purchase fund shares on a daily basis.

Portfolio Management

A world-class partnership of trusted alternatives leaders. Learn more about our joint portfolio management team.

in assets under

management

in liquid

alternatives

In 7 offices

across the US

privately owned

investment

professionals

served Across 2,000+

companies globally

in advised and

managed assets1,3

in private credit2,3

in 7 offices

globally

privately owned

investment, risk and

portfolio advisory

professionals

investors

served globally3

Taking advantage of the broad spectrum of private credit

Many private credit registered funds have a narrow focus on US direct lending, whereas CAPIX sources investment opportunities across the global credit asset class.

Aksia’s sourcing coverage extends across the global private credit universe

Overview

The Calamos Aksia Alternative Credit and Income Fund (CAPIX) invests across the full spectrum of private credit, providing access to a wide range of credit investments. Additionally, a portion of assets are allocated to liquid alternatives designed to provide liquidity for repurchases, outperform cash yields and enhance overall diversification.

Structure

Interval fund with daily purchase and quarterly tenderTickers (Investment Minimums)

Class A: CAPHX ($2,500)

Accreditation

Not requiredSubscriptions

Daily point-and-click purchase through NSCC Fund/SERVDistributions

Quarterly; distributions will be reinvested automatically, unless otherwise requested by the Fund shareholderLiquidity

Quarterly repurchase offer at NAV; we anticipate 5% being made available for repurchase*Tax Reporting

1099-DIVRobust Liquidity Capabilities

minimum liquidity

We will actively manage the liquidity allocation with the goal of generating yield while prepositioning to 5% quarterly repurchase needs.

Liquid credit strategy also provides cash management efficiencies.

Opportunity of Interval funds

Interval funds are investment vehicles structured to provide access to a broader set of investment opportunities than a mutual fund, while still operating under the same regulations and tax treatments of open-end and closed-end mutual funds.

Interval Fund Potential Benefits

Access to illiquid assets

Private less-liquid investment opportunitiesNo accreditation

Broad investor eligibility with no accreditation requirementLiquidity flexibility

Maintain a fully invested asset base, without the need to manage daily redemptionsLower investment minimums

Compared to private fundsEnhanced yield potential

Supported by illiquidity premiumsOffering

Simplicity of point-and-click daily subscriptionsPricing

Shares sold and repurchased at NAVSimple tax treatment

Mutual fund tax treatment via a 1099-DIVAksia: Relationships With the World’s Leading Debt Managers

Long-standing partnerships with leading credit managers allows us to source high-quality investments.

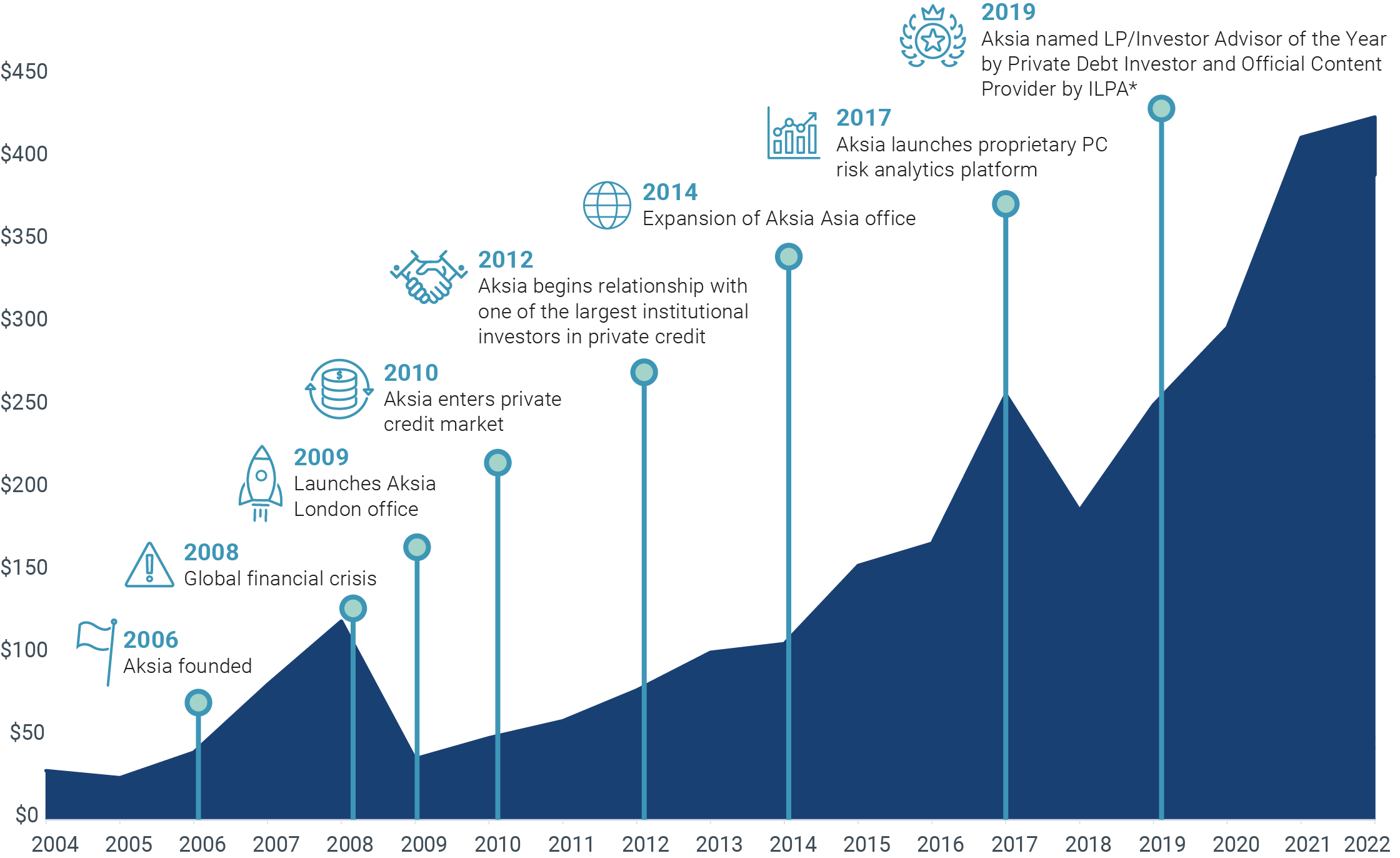

Aksia: A Leading Authority on Private Credit

Aksia has been at the forefront of the rapid growth of the private credit asset class.

Private Credit market Yearly Fundraising ($B)

Literature

About the Fund

Research & Education

Prospectus and Reports

How to Invest in CAPIX

Unlike most private asset funds, Calamos Aksia Alternative Credit and Income Fund does not require accreditation or have investor qualification standards. Investors can purchase fund shares on a daily basis.