The Crisis Has Accelerated the Opportunities for Strong, Growth Disruptors: Co-CIO, Head of International and Global Strategies Nick Niziolek

Calamos Evolving World Growth Fund (CNWIX)

Morningstar Overall RatingTM Among 718 Diversified Emerging Mkts funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 3 stars for 3 years, 5 stars for 5 years and 4 stars for 10 years out of 718, 646 and 423 Diversified Emerging Mkts Funds, respectively, for the period ended 6/30/2024.

In a turbulent period for the markets, Calamos has been hosting a Calamos CIO Conference Call series for investment professionals.

Below are notes from a call Wednesday, April 22, with Nick Niziolek, CFA, Co-CIO, Senior Co-Portfolio Manager. As Head of International and Global Strategies, he leads the team that manages Calamos International Growth Fund (CIGIX) and Calamos Evolving World Growth Fund (CNWIX). To listen to the call in its entirety, go to https://www.calamos.com/CIOglobal-4-22

For highlights on last month's calls, see this post.

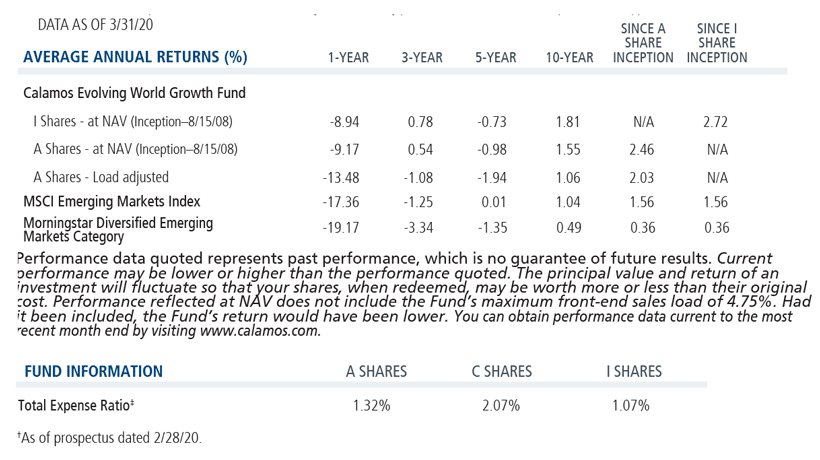

Over the last several weeks, the Calamos Global/International team has demonstrated the impact that active management can have in fast-moving markets. Taking steps early to reduce risk ahead of others and then confident to re-risk as others remained concerned has resulted in a significant performance advantage for Calamos Evolving World Growth Fund (CNWIX), in particular.

Top-down insights, bottom-up research, valuation analysis and opportunity identification helped achieve the fund’s goal of producing more of the upside and less of the down—and adding alpha—during an extremely volatile period, Niziolek said.

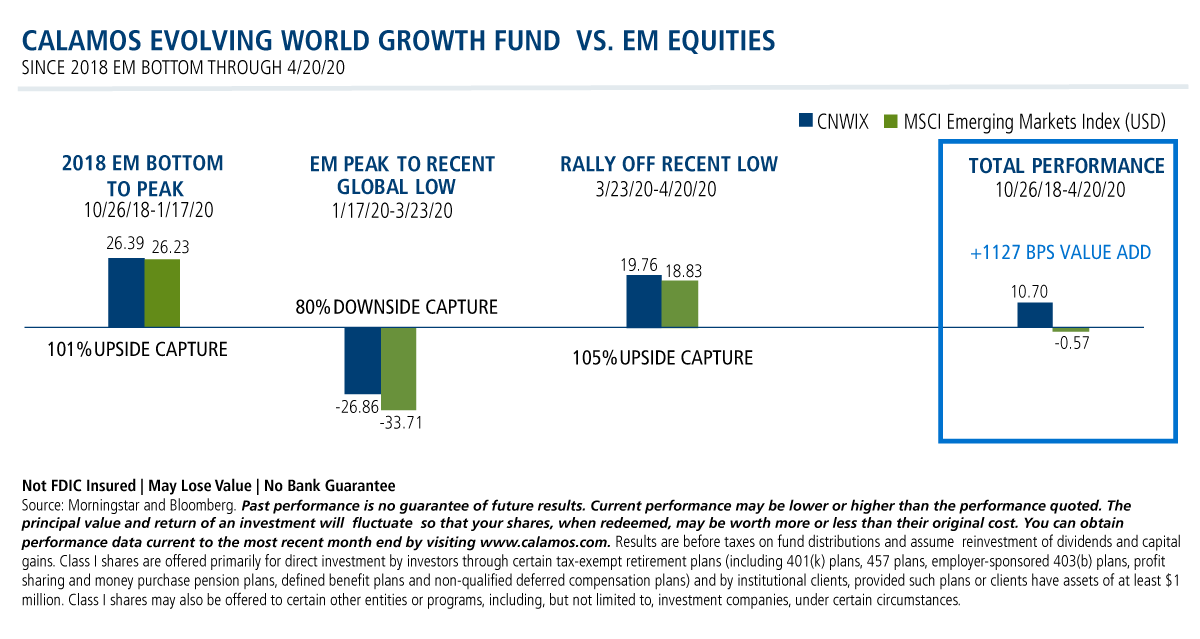

CNWIX captured more than 100% of the 26% emerging market rally from October of 2018 through January 17, but just 80% of the 33% from January through the March 23rd lows. Since then and through April 20, the fund captured 19.76% versus the MSCI Emerging Markets Index’s 18.83% return.

The experience for the client, then, is that the fund was up more than 8% through April 21, while the index was down 3%. “That means we have more capital ready to reinvest and take advantage of the next opportunities going forward,” said Niziolek.

After the recent strong, sharp rally, Niziolek and team continue to be very positive about the prospects for global equity markets ahead.

Niziolek disagrees with those skeptical about today’s rally, saying they mistakenly believe that the economy and earnings need to get back to the levels seen in January and February in order to justify the valuations being paid at that time.

“You have a very significant new buyer—central banks around the world. By our estimates, balance sheets of the top 25 central banks increase by $10 trillion. And then couple that with the fiscal response, which we’ve seen is $3.5-$4 trillion. Those are very significant numbers…This in itself will increase equity multiples.”

The Post-Quarantine Post-COVID-19 New Normal

But Niziolek cautions that “the next leg is likely to be more discerning.” Here again he’s optimistic about the team’s ability to prevail, given its advantages. At the highest level, Niziolek cites the team’s structure, process and global scope in establishing a “holistic view.”

“We do full capital structure research. We’re looking at equities, we’re looking at convertibles, we’re looking at straight fixed income. Many of our products have the flexibility to invest between these aspects of the capital structure,” he said.

The key advantage of the team’s global approach and full capital structure research is that insights seen in one area can be leveraged for another. For example, Niziolek said, developments the team saw in credit markets gave them the confidence to build back their equity exposure. Similarly, what they see in Asia informs adjustments they make to exposures in Europe, the United States and elsewhere. Their closeness to the credit and convertibles markets influences their equity decisions.

Niziolek is especially enthusiastic about secular growth themes that he says the recent disruption is accelerating.

In digital payments and ecommerce, for example, what the team had previously expected to take years is now occurring in months. While Niziolek has been intrigued by cash replacements for years, governments are now quickly acknowledging that cash is dirty. They are quickly driving to the cashless society that innovative payments systems can support, thereby expanding the total addressable market.

Nearly half of the value-add created year to date in CNWIX has come through the team’s favoring of innovative secular growth companies within the payments and online commerce space.

“These opportunities were already in our portfolio going into this crisis, and they’ve been a significant driver in helping us to hold up in the downside and then also participate in this recovery,” according to Niziolek.

Niziolek says the team’s optimism in the global consumer is one of its more controversial calls. “When we get to the other side of this, we think the consumer is going to be in better shape than they were going in,” he insisted.

Most employees around the world are earning the same, if not more, and savings rates are climbing as expenses have fallen, notes Niziolek. The team looks for a big release of pent-up demand, as is already happening in China where restaurants are now operating at better than 60% capacity and luxury demand has turned up.

“People want to get back to their lives,” said Niziolek.

One-quarter of the value-add in CNWIX year to date was a result of the team’s favoring emerging market consumer consumption opportunities earlier in the year over infrastructure/commodity exposure. That position has since been flipped on the expectation that some of the infrastructure plays will benefit from Chinese stimulus, and they’ve become attractively valued.

More to Come from China

Another significant driver in the team’s outlook is the stimulus yet to come from China. While the U.S. has committed a significant 30% of GDP to the country’s recovery, China has been slow to stimulate, with measures amounting to less than 15% of their GDP. The hesitancy, Niziolek explained, is China’s desire to avoid inflation.

“If you’re a totalitarian government and you’re the sole party, which is the Communist party in China, your biggest risk is rising unemployment and rising inflation. Because an unhappy population is the quickest means to be toppled.”

But China is coming around, announcing stimulative moves daily. Helping drive the team’s bullish thesis, Niziolek added, are the “massive” declines in the price of oil. China, India, Korea, and Taiwan—countries that account for more than two-thirds of the EM benchmark and an even larger weight in Calamos portfolios—all are huge consumers of oil. Lower oil prices will be deflationary, enabling those governments to be more stimulative, he said.

“The types of businesses we invest in, our focus on the balance sheet, our focus on credit, our focus on companies with strong moats. What that results in is companies that can compound and value over time but also that hold up slightly better during downturns. That, and a couple of other levers, provide the skew in the returns that we’ve delivered.”

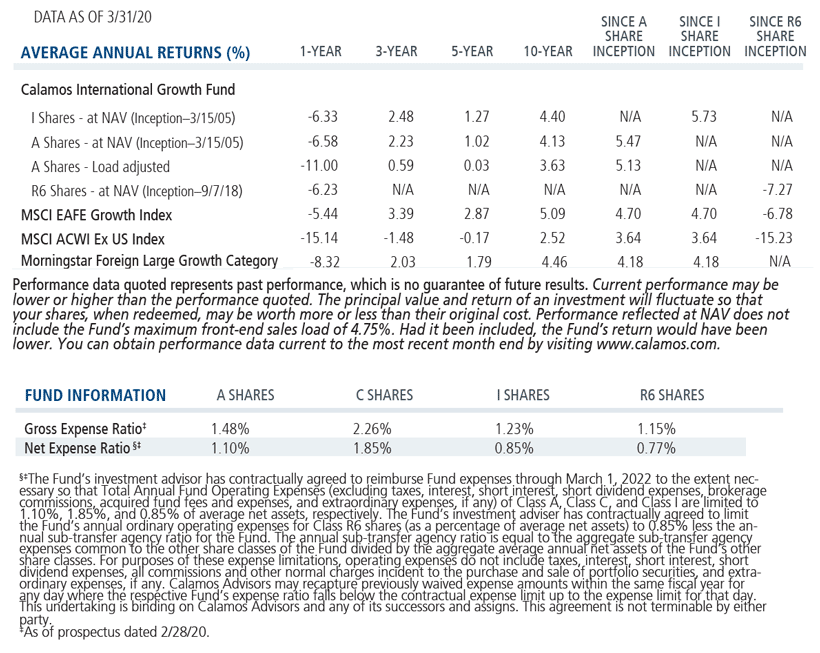

Finally, Niziolek also touched on the Calamos International Growth Fund (CIGIX), also enjoying a strong year and outperforming its benchmark (down -13.34% YTD as of April 21, or more than 800 bps better than the -21.83% return of the MSCI ACWI EX US).

While the same team and same process are used to manage the fund, the team takes a different approach to managing risk in this “pure equity” fund. This year this has led to more than twice the benchmark weight in technology, funded via a 1000bps underweight in financials. Niziolek also commented on the team’s preference for innovative health care and consumer sectors. The fund’s opportunity set includes not just emerging markets but Europe, Japan, Canada and Australia, as well.

Two additional funds in the Global/International suite are: Calamos Global Equity Fund (CIGEX) and Calamos Global Growth and Income Fund (CGCIX).

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The MSCI Emerging Markets Index is a free float adjusted market capitalization index. It includes market indexes of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses or sales charges. Investors cannot invest directly in an index.

The MSCI ACWI ex US Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 26 Emerging Markets (EM) countries.

Alpha is a measurement of performance on a risk adjusted basis. A positive alpha shows that performance of a portfolio was higher than expected given the risk. A negative alpha shows that the performance was less than expected given the risk.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Positive skew indicates asymmetry from the normal distribution in a set of statistical data. In statistics, a positively skewed (or right-skewed) distribution is a type of distribution in which most values are clustered around the left tail of the distribution while the right tail of the distribution is longer. The positively skewed distribution is a direct opposite of the negatively skewed distribution.

The Morningstar Diversified Emerging Markets Category portfolios tend to divide their assets among 20 or more nations, although they tend to focus on the emerging markets of Asia and Latin America rather than on those of the Middle East, Africa, or Europe. These portfolios invest predominantly in emerging market equities, but some funds also invest in both equities and fixed income investments from emerging markets.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

802004 0420

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on April 23, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.