Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, April 2021

Outlooks from our Investment Team

- Calamos Growth Fund (CGRIX): The Case for Growth Remains Strong

- Calamos Phineus Long/Short Fund (CPLIX): Too early to lean against the cyclical recovery, but not too early to think about regime change

- Calamos Global and International Funds: Positioned for Synchronized Global Recovery

- The Small Cap Leadership Cycle Has a Long Way to Go

- Calamos Growth and Income Fund (CGIIX): Improved Company Fundamentals Can Push Equity Markets Higher

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Positioning Update

- Calamos Convertible Fund (CICVX): Abundant new issuance supports active management, rebalancing

- Calamos Global Convertible Fund (CXGCX): We expect the global convertible market to resume its advance

- We see many attractive pockets of opportunity in fixed income

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

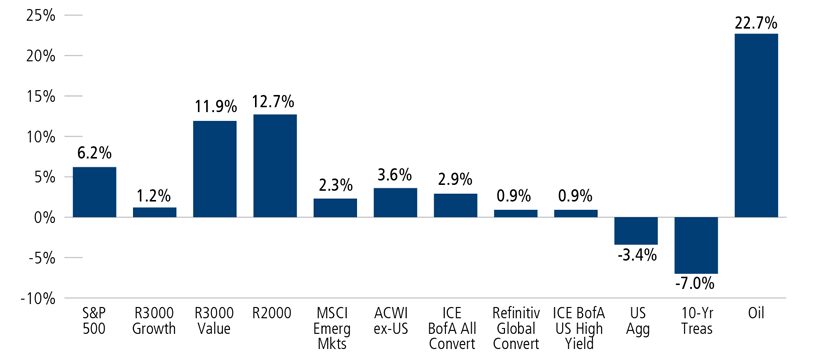

Vaccination rollouts, positive economic data, fiscal stimulus and accommodative monetary policy gave market participants reasons for optimism during the first quarter. Stocks and convertible securities extended their advances, albeit with considerable volatility. As investors contemplated the strength of the economy, rising interest rates and inflation pressures, market leadership rotated from growth stocks to cyclical and value names. Small caps surged and oil prices soared. The yield of the 10-year U.S. Treasury bond climbed sharply, rising from 0.93% on December 31, 2020 to close the quarter at 1.74%.

Total Return %, 1Q 2021

Past performance is no guarantee of future results. Source: Morningstar. Data shown in USD, unless otherwise noted.

There will be many opportunities through this phase of the cycle, but security selection and active management will be absolutely essential. Market volatility is likely to remain high. We are prepared for ongoing rotation and leadership shifts as the economy accelerates and ultimately settles into a new post-pandemic normal. As I discussed in my March post, “As Long-Term Interest Rates Rise, Here’s What Investors Should Be Thinking About”:

- Fiscal policy uncertainties—including the potential for tax increases and more regulation—are likely to fuel market turbulence. As always, fiscal policy will have a significant impact on the longer-term growth trajectory of the economy as a whole.

- Inflationary pressures may be unnerving to some investors but are not surprising given the combination of low base effects, economic re-opening and a release of pent-up consumer demand. It’s important to remember that inflation is still trending well below the Fed’s target and not soaring to the double-digit levels of past decades.

- While it’s understandable that investors are worried about rising rates, what we’ve seen so far reflects a return to growth. Although the yield of the 10-year Treasury has risen quickly, it is still low if we look back over decades. Additionally, we believe the Fed’s accommodative stance, and its attentiveness to financial conditions overall, can help prevent unchecked steepening of the yield curve.

- Value stocks have rallied strongly, but growth stocks are an asset allocation cornerstone, and thinking of growth and value as an “either/or” proposition is a mistake.

- From an asset allocation standpoint, we believe the case is strong for maintaining broad diversification—by asset class, investment style, market capitalization, and geography. In particular, many investors may be under-allocated to small caps and emerging markets, areas that have tended to perform well during recovery periods.

- Alternative strategies can provide enhanced tools for navigating the rotational and volatile equity market we expect will continue.

- In rising rate environments, traditional bonds face added headwinds. However, actively managed convertible securities, high yield bonds and fixed income alternative strategies have been less vulnerable to rising rates and can provide compelling asset allocation benefits.

In this environment, our investment teams are relying on their time-tested approaches and long-term perspective to identify opportunities and navigate risks. Below, they share their outlooks and discuss how they are positioning the funds they manage. We’ll be adding more commentaries and perspectives over coming days.

Calamos Growth Fund (CGRIX):

The Case for Growth Remains Strong

Matt Freund, CFA, Co-CIO and Senior Co-Portfolio Manager

Brad Jackson, CFA, SVP, Associate Portfolio Manager

Michael Kassab, CFA, SVP, Chief Market Strategist

Bill Rubin, SVP, Associate Portfolio Manager

As the U.S. economy continues to re-open and rebound sharply, the current environment for growth investing is quite robust, with ample opportunities across many industries and sectors. Calamos Growth Fund (CGRIX) remains well positioned in both longer-term secular growth themes—from cloud computing to electric vehicles to digital payments—and cyclical growth themes in the consumer, industrial, and financial sectors that are particularly compelling, given the accelerating recovery now underway.

With a vaccine rollout outpacing those of global peers, a Federal Reserve fully committed to accommodative policies, and a White House willing to inject unprecedented amounts of stimulus (and then some), the U.S. is poised to lead the global recovery in 2021. Current projections by the International Monetary Fund show the U.S. economy expanding by 6.4% this year. If achieved, this would represent the country’s highest real GDP annual percent change in nearly 40 years.

These rapidly improving economic conditions are contributing to a very strong backdrop for corporate profits. The recovery in earnings for U.S. companies has come faster than most expected, with S&P 500 EPS projected to cumulatively grow 25% this year and surpass 2019 levels by 9%. Most importantly, the reopening of the U.S. economy has significantly widened the opportunity set for the Fund beyond the traditional secular growth segments of the market.

With this as a backdrop, we have broadened our holdings to capture the pent-up demand of a global reopening. Our expanded portfolio includes exposure to companies poised to profit from a normalization in travel and leisure, casino gaming, and on-premise food and beverage services. Many of these businesses offer high operating leverage that should fuel strong earnings growth as activity continues to pick up.

Looking forward, we expect the U.S. macro backdrop to remain quite healthy for the rest of this year and next, as the “return to normalcy” fully takes hold. With that comes the likelihood of further upward pressure on inflation and interest rates, which could pose a risk to the more speculative segments of growth market. This was seen in the first quarter, when a faster-than-expected return to pre-pandemic interest rates led to sharp losses for many traditional growth stocks, particularly those with less certain, multi-year pathways to profitability.

The rise in interest rates stabilized by late March and ultimately retreated some in recent weeks. This allowed growth stocks to reassert their leadership once again over more value-oriented segments of the market. While this respite was a welcomed development, we believe the upward trend in rates will resume shortly, as the economic healing continues. However, we believe these increases will be better tolerated by the market as long as they are gradual, rates remain historically low (at 1.6%, the 10-year U.S. Treasury is still yielding less than the expected rate of inflation), and are viewed as a sign of continued economic normalization. In any case, we continue to believe that growth stocks, particularly those with sustainable, highly profitable business models, and visible growth trajectories, represent an attractive opportunity for long-term investors as the economy reopens and beyond.

Calamos Phineus Long/Short Fund (CPLIX):

Too early to lean against the cyclical recovery, but not too early to think about regime change

Michael Grant

The central theme across financial markets has been the recognition that vaccines are becoming widely available and delivering their promised effectiveness. Thus, 2021 will enjoy one of the strongest economic backdrops in decades. While investors are persuaded that the world is heading back to normal, many are slow to understand the scale of the demand acceleration due to the unprecedented circumstances. Shifts in the political and social landscape are equally portentous.

This story of cyclical resurgence amidst unprecedented policy support is not a mirage. It will continue through much of the year, possibly climaxing in early 2022. U.S. bond yields will move higher, with the U.S. 10-year breaching 2% in the next six months. Equities can incorporate this repricing as it is accompanied by a rising tide of expectations for economic activity; measures of profitability are improving almost everywhere. The speed of rate adjustment will become more critical beyond May as more of the economic recovery has been priced into equities.

Our investment strategy prefers higher rather than lower interest rates. This is not only a forecast, but a judgment that equities will respond positively to higher rates. This implies markets are already sensing regime change. While central banks are pushing against rising yields, we think the Fed will become more comfortable with economic recovery and more tolerant of rising yields by late summer.

The important insight is that cyclical outperformance has historically been coincident with rising yields and a steepening yield curve. Investors rarely pre-empt the rise in bond yields, tending to favor cyclicals as long as yields move higher and earnings momentum remains superior to the more defensive parts of the market. Calamos Phineus Long/Short Fund (CPLIXs) therefore remains biased toward the consumer and industrial reopening trade and financials.

The rotation since November has been impressive and benefited the fund’s positioning, but it is premature to lean against cyclical recovery. Cyclical underperformance would require peaking economic data, weaker relative earnings and an end to rising bond yields. We will consider fading this bias nearer autumn or early 2022 when the acceleration in activity is largely understood and when the tailwind from fiscal stimulus is complete.

The dominant theme of 2021—cyclical resurgence led by America—is still not entirely discounted by investors. At the stock level, the real opportunity lies in those businesses with material operating leverage to the ongoing “waves of reopening.” The remarkable growth story of 2021 will eventually generate its own constraints, but the upswing may not fade appreciably before the early months of 2022.

The fault lines of the past decade are beginning to fade. We imagine a very different investment cycle ahead, one whose prevailing features include the growing interventionism of the public sector, the acceleration of technological change and its impact on social behavior, and the fragmentation of the global economy amidst rising international tensions. At minimum, investors should prepare for the sector and style turmoil that appears inevitable.

The real problem for equities will emerge when the pandemic era passes and the debate over how to withdraw all of this stimulus begins. The world beyond the pandemic will not be a return to the prior status quo. All of this explains our growing apprehension for risk assets beyond 2021, when the exceptional conditions created by the pandemic begin to fade.

At that point, risk assets will face a formidable problem of “re-entry” into a new investment world. But the worm turns slowly. Stay bullish for now.

Calamos Global and International Funds:

Positioned for Synchronized Global Recovery

Nick Niziolek, CFA, Co-CIO, Senior Co-Portfolio Manager

Dennis Cogan, CFA, SVP, Senior Co-Portfolio Manager

Paul Ryndak, CFA, SVP, Head of International Research

Kyle Ruge, CFA, AVP, Senior Strategy Analyst

The following is an excerpt from our 2Q 2021 outlook, which you can read in its entirety here.

The first quarter of 2021 can be divided into two distinct periods. During January and early February, emerging markets outperformed developed markets, and growth equities slightly outperformed their value counterparts. The U.S. dollar was relatively stable versus most major currencies while U.S. bond yields appreciated at a measured pace. During the second half of the quarter, global value stocks outperformed global growth stocks by nearly 1000 basis points. U.S. equities provided the only positive returns, with emerging markets significantly underperforming on concerns about a strengthening dollar and rising rates.

While it is difficult to identify a single event that sparked rotation, the speed of vaccinations in the U.S. was a key factor. While the U.S. vaccination rollout proceeded at a brisk pace, there were vaccination delays and lockdowns overseas. This resulted in a significant near-term change in for U.S. and non-U.S. economic growth, which was reflected in the U.S. dollar and U.S. bond yields.

Despite the countertrend rally of the broad U.S. Dollar Index during the quarter, we continue to believe the dollar is in a stable-to-downward trend versus most major currencies. And, as we have noted, it’s normal and healthy to witness months or quarters of U.S. dollar strength within such a longer-term downtrend trend. The dollar remains “expensive” relative to most currencies when viewed from a purchasing power parity basis. Valuation alone is not a catalyst, but we believe the recent increases in budget deficits, trade deficits, and the Fed’s evolving inflation averaging framework provide the catalysts to unlock these valuation differentials. (For more on this, see our post, “Cyclical Themes: Outlook for the U.S. Dollar.”)

Changes in U.S. yields across the term structure have been another significant factor in the market’s recent rotation. Although we believe long-term rates will keep moving higher as global recovery continues, we also believe the pace of the ascent from here will be more gradual than in 1Q 2021. Given the amount of debt that governments around the world have added to their balance sheets during the Covid crisis, it is not in countries’ best interests to see funding costs rise too quickly. At current levels, U.S. real rates are now more competitive globally, and we anticipate foreign buyers will return to U.S. Treasury auctions if rates moved considerably higher.

Rotating our positioning toward cyclical equities continues to make sense given improving global growth and the reflationary pressures higher long-term yields reflect. However, this increased cyclical exposure has not precluded maintaining exposure to secular growth companies that continue to innovate and disrupt the industries in which they compete. In our view, the outperformance of many secular growth stocks over the past few years had more to do with improving fundamentals as adoption rates accelerated and total addressable markets increased, as opposed to a re-rating based on the decline in long-term rates. The greater vulnerability lies in defensive sectors that are more fully valued and which will not see the same fundamental inflection as cyclicals. We are also steering clear of disrupted business models that can often be viewed as “value” but which are facing permanent headwinds that will further erode what limited value they have.

United States. As more of the world catches up to the U.S. in vaccinations and the dollar returns to a downtrend, we believe we will see the kind of synchronized global growth acceleration we expected earlier and ex-U.S. markets will resume the outperformance that started in the fourth quarter.

Europe. Our outlook for Europe remains constructive, supported by the region’s fundamental leverage to the continuing global growth rebound we expect, the encouraging resilience of the European markets during recent months of negative news flow, as well as our views on global currencies. While vaccine rollouts have had a near-term impact, we believe the longer-term fundamentals are more conducive to resumed euro stability. From a monetary policy standpoint, the European Central Bank indicated at its last policy meeting that it would speed up the pace of its quantitative easing, furthering its commitment to provide accommodative conditions.

Our positioning in Europe continues to lean toward (1) more cyclical recovery/interest rate driven names that stand to benefit from a continued global recovery, and (2) Covid recovery/re-opening beneficiaries whose rebounds have been somewhat delayed but which have “catch-up” potential to reach the same trajectory that U.S. and U.K. re-opening stocks have already achieved.

Japan. Economic headwinds remain, but we believe the companies in which we are invested are well positioned to benefit as global recovery strengthens throughout 2021.The Japanese market is highly levered to the global growth environment as Japan has many high-quality industrial, technology and manufacturing companies that export their goods to the rest of the world.

Emerging Markets. As other countries close the gap in vaccination progress and as the initial boost of U.S. fiscal stimulus passes, the dollar is likely to weaken again for the balance of the year, settling into the multi-year regime of dollar weakness we have discussed over the past year. As a result, we believe the case for emerging markets remains strong. several countries that were historically more vulnerable to episodes of dollar strength have improved fiscal and/or external balances (For more on how emerging market fundamentals have improved, see our post, “Taper Tantrum Redux? History Often Rhymes, but it Rarely Repeats.”)

In India, we are optimistic about the recent budget and reform announcement, which provided details on pro-growth stimulus and reform measures that should aid in a post-Covid recovery. We believe Indian companies across financials, real estate, industrials and consumer sectors can benefit from this pending recovery. Additionally, India also provides opportunities to invest in technology, manufacturing, and health care companies that can benefit from developed market recovery.

Over recent quarters, we have reduced our exposure to China at the margin, favoring new opportunities in India, Taiwan, Korea, and Mexico. Nonetheless, China remains our largest country exposure. We have invested in secular winners in e-commerce, payments, and online services, while also maintaining exposure to national brands. We have balanced these secular names by blending in cyclical exposure that can benefit from better global growth conditions.

Read our full 2Q 2021 outlook, “Synchronized Global Recovery on the Horizon.”

Learn more about the global and international funds: Calamos Evolving World Growth Fund (CNWIX), Calamos Global Opportunities Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX).

The Small Cap Leadership Cycle Has a Long Way to Go

Brandon Nelson, CFA

We continue to feel confident about the outlook for small and mid capitalization growth stocks. For the past several months, we have been on record predicting the stars have aligned for sustained outperformance of these asset classes. (See “After a Mighty Move in May, CTSIX Looks Forward to a Market Rotation Toward Small Caps,” from June 2020, and “Better Catch Up—We Believe the New Bull Market is Up and Running,” from September 2020, for more.*) Lately, the overall stock market has agreed. Recently, during the first quarter, we saw small cap performance lead the overall stock market, especially the microcaps, or the smallest of the small.

The small cap leadership cycle began seven months ago, but we think it has a long way to go. History has shown a typical small cap cycle generates meaningful outperformance and lasts seven years on average, not seven months! This is a key factor behind our bullishness for the asset class.

Due to our positive outlook for small caps, we have positioned our two funds, Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), to have disproportionately heavy exposure to small caps, especially micro caps. This positioning helped relative performance during the first quarter, and we believe it will continue to add value going forward.

Digging further into the specific positioning within the two funds, we continue to have exposure to both long-term secular growth stocks and certain cyclical growth stocks that we believe will more directly benefit from an overall economic uptick. In the past few months, we have modestly increased exposure to cyclical sectors like industrials, materials, and financials, while still maintaining a secular growth tilt within the overall portfolio. We believe this diversified positioning added value during the first quarter.

Among the secular growers, we have exposure to a variety of themes including e-commerce, cloud communications, and certain pockets of healthcare and consumer discretionary. We also have exposure to several companies that are ESG-friendly, whereby each is using substantial amounts of recycled materials within its manufacturing processes. On the cyclical growth side, we are tilted toward semiconductors and semiconductor capital equipment, auto retailers, transportation, outdoor leisure, and certain stocks with exposure to residential real estate.

*For other related content, see the October 2020 AssetTV Masterclass video interview, “Nelson Looks for Small Cap Rally to ‘Turbocharge’ an Already Strong Year,” and the December 2020 post “Small Caps Have Rallied Back—Why we Think There’s More to Come.”

Calamos Growth and Income Fund (CGIIX):

Improved Company Fundamentals Can Push Equity Markets Higher

John Hillenbrand, CPA

The U.S. economy is entering vaccination recovery period, and we agree with the consensus view for above-average GDP growth in 2021. The asset markets have priced in much of this economic improvement already, and we believe the level of future asset returns will be positive but at lower levels than we have seen versus the past six months during the early phase of this recovery. Future asset returns are likely to be driven by the magnitude and duration of the economic recovery, as well as the resulting changes in corporate cash flows and businesses’ intrinsic values versus current market valuations.

We expect individual industry and company cash flow dynamics to start driving a greater part of returns versus factor influences, which have been strong drivers recently. The drivers of the magnitude and duration of this economic recovery are Covid containment/social reopening, accommodative financial conditions/monetary policy, fiscal policy, and productivity/margin improvement.

-

The uneven Covid global vaccination rollout may cause a prolonged economic ramp-up while limiting the magnitude in any one period. The vaccination process is continuing to gain momentum in developed countries, especially in the U.S. and Britain where immunization goals could be reached by summer. The pace of the U.S. rollout and access to mRNA vaccines should drive the U.S. economy to reach normalization faster than others. Availability, cost and healthcare infrastructure are impediments to vaccinations in the rest of the world, especially in emerging market countries. We expect the global vaccination process to proceed well into 2022. This staggered rollout should prolong the recovery, but it will reduce the magnitude of global growth in any one period. The risks we will be monitoring include: the rise of variants that can impede the containment process, ineffectiveness and/or health issues related to current vaccines, and the unavailability or lower effectiveness of vaccines for children.

-

Financial conditions should remain accommodative for an extended period, but the next move will be tightening. U.S. financial conditions remain very accommodative despite some recent near-term volatility. The Federal Reserve remains committed to its new reactive rather than proactive policies with its desire to keep short-term rates low until unemployment and inflation hit their targets. It appears the Fed will allow longer-term rates to move up if they are driven by market forces, not market malfunctions or breakdowns. Other contributors to financial conditions (credit spreads, equity risk premia* and the currency market) all remain favorable.

In other developed markets, conditions also look very accommodative versus history, but emerging market financial conditions look to have deteriorated slightly. The main risk for financial conditions centers on when conditions reach restrictive levels. As the Fed is moving to a reactive policy, we would expect overall financial conditions to tighten significantly when credit spread widen and equity risk increases. With the current very favorable conditions and an improving economy, it appears clear to us that the next phase of monetary policy will be more restrictive than accommodative.

-

3. U.S. fiscal policy limited the negative impact of the health crisis and provided a favorable setup for the recovery. However, future U.S. fiscal policy may have a less favorable impact, with winners and losers: The American Rescue Plan passed in March seeks to provide support over the next six to nine months for the people and areas of the economy that have been hit especially hard by the effects of the pandemic.

Our initial view on Biden’s spending plans and tax increases is that they are likely to produce a modest increase in GDP growth over the next several years, but the effects will be varied: some infrastructure-oriented parts of the economy will see added growth, while some parts of the economy may just experience higher taxes (multinationals, low tax rate companies). The longer-term results are harder to determine as the payoffs of this spending could be offset by the higher tax regime. Additionally, many countries are working together toward the goal of implementing taxation policies that would apply to all countries, which would also have an impact on growth. Finally, the political landscape in the U.S. may not be finished shifting, and any longer-term policy decisions made today may be changed in the future (for example, the 2021 planned tax code reverses some of the 2017 changes).

- U.S. productivity should show improvement and could surprise on the upside. Profit margins should reflect this productivity improvement but be offset in part by rising costs in other areas. In our opinion, productivity growth is the wildcard for next several years, but we ultimately expect it to surprise on the upside and add to the duration of growth. During the pandemic, productivity growth spiked as there was a mismatch between output and labor hours at points of the shutdowns. Different sectors experienced changes in productivity. The benefits from investments in technology, work-from-home arrangements, M&A, cost-cutting initiatives (including corporate travel) should have both short- and intermediate-term positive impacts on productivity and overall operating margins. However, increased spending on Covid-related expenses, supply chain disruptions, labor constraints in some areas and supply/transportation constraints have had a negative impact on margins in some industries.

-

The current market environment already prices in economic improvement, but company fundamentals should outperform, pushing equity prices higher. Equity market positive returns from 2Q 2020 through 1Q 2021 were driven in large part by positive expectations of improved economic growth and corporate cash flows in 2021 and beyond. Current valuations generally reflect the expected improvement in earnings over the next several years. We believe economic fundamentals and corporate cash flows can over-deliver on those expectations and cause equity prices to appreciate.

We have positioned Calamos Growth and Income Fund (CGIIX) to include companies with improving cash flows that are driving intrinsic value growth to levels that are higher than current market values. We remain modestly concerned about rising commodity and labor costs having a negative impact on margins, so we seek companies that have some level of pricing power and those that have other sources of operating leverage.

For cyclicals, we have focused on companies with positive earnings revisions, higher-than-average operating leverage, service economy and discretionary consumer spending exposures, and companies with improved post-pandemic competitive positions. For growth companies, we have focused on companies with accelerating fundamentals in 2021 or companies that can maintain high growth rates in 2022 and 2023, improving margins, and valuations that we can characterize as “growth at a reasonable price.”

We remain underweight lower beta areas, especially those with higher equity valuations. Overweight sectors include consumer discretionary, technology and industrials. We continue to utilize convertible securities in many higher-risk areas of the market, including more aggressive growth companies as well as deeper cyclical areas, seeking to provide positive asymmetric returns in lower-risk structures. As volatility has also declined over the past several months, the fund is selectively utilizing calls and puts as we seek to further manage downside risk and provide opportunity for upside.

*Equity risk premia refers to the excess return of stocks over the return from a risk-free rate.

Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX):

Positioning Update

Eli Pars, CFA, Co-CIO and Senior Co-Portfolio Manager

As rising interest rates put pressure on traditional bond strategies, we believe Calamos Market Neutral Income Fund (CMNIX) can provide especially compelling benefits as a fixed income alternative. The fund employs two complementary strategies—convertible arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on interest rates.

The allocation to each strategy reflects our view of relative opportunities and market conditions. As of the end of the quarter, the convertible arbitrage strategy stood at 56% versus 60% as of December 31, 2020. Although the weighting of the convertible arbitrage strategy has declined modestly from levels in 2020, it is still at the high end of our historical range. This sizable allocation reflects the abundant bottom-up convertible opportunities available today. With U.S. companies bringing $40 billion in new convertibles to market during the first quarter, 2021’s issuance has run ahead of 2020’s torrid pace, providing a good hunting ground for our arbitrage activities.

Although we have been active in the new issue market and a number of the fund’s in-the-money convertibles have been refinanced by their issuers, the weighted average delta of the convertible arbitrage strategy continues to hover at the high end of its historical range. This is due to the appreciation of many convertible positions, including Covid recovery names and several technology names.

Calamos Market Neutral Income Fund’s hedged equity strategy continues to be positioned with a higher-than-typical hedge ratio. As we discussed in January, throughout most of 2020 and into 2021, implied volatility levels have been generally higher, especially relative to realized volatility. As a result, it’s difficult to create skew, although we continue to look to add trades that improve the risk/reward profile. We have opportunistically kept a higher call-write percentage because of the elevated implied volatility.

While Calamos Market Neutral Income Fund is intended to serve as a fixed income alternative, Calamos Hedged Equity Fund (CIHEX) is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. Similar to the hedged equity sleeve of Calamos Market Neutral Income Fund, Calamos Hedged Equity Fund’s hedge also continues to be at the high end of its targeted range. As we noted, the current option implied volatility environment and the strength in the equity market create added challenges in getting skew. Option implied volatility is somewhat elevated in our view, considering equities are near highs and realized volatility has been materially lower for a while, apart from some recent spurts. Looking ahead, we expect volatility will pull back to a degree as the vaccine rollout continues.

Should equity markets advance, the fund’s options positioning is poised to allow upside participation while also providing an enhanced income stream from call spreads and equity dividends. Conversely, should the markets retreat, the dividend income stream and the puts used in the fund will serve to provide potential downside mitigation.

Calamos Convertible Fund (CICVX):

Abundant new issuance supports active management, rebalancing

Jon Vacko, CFA, SVP and Senior Co-Portfolio Manager

Joe Wysocki, CFA, SVP and Senior Co-Portfolio Manager

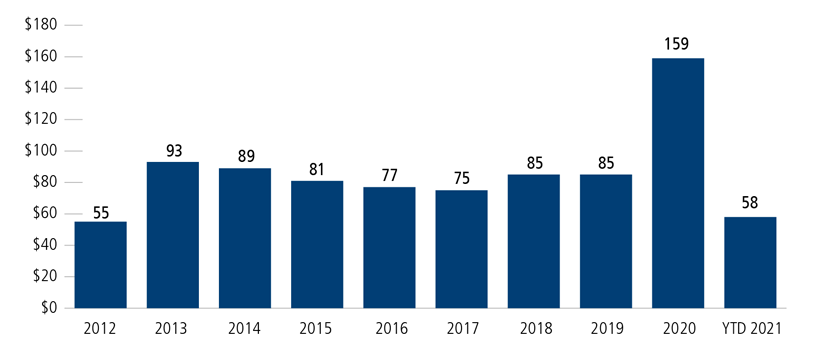

The convertible security market is off to a very active start in 2021 with $58 billion of global new issuance coming to market, $40 billion of which was from U.S. companies. This high issuance is well ahead of the typical pace for this time of year, and we’re excited to see the market grow so strongly, with numerous first-time issuers. While coupons on new deals have been trending lower and conversion premiums higher versus a year ago, many issues still offer attractive structures. Although the pace of issuance may decelerate from current levels, we expect it to remain healthy as companies seek capital for growth, expansion, mergers, and innovation through increased research and development.

New balanced issues have allowed us to rebalance structural risk/reward in areas where rising underlying equities have increased the equity sensitivity of existing convertibles. In addition, we are positive on the fundamental backdrop of many of the new companies and believe the broadening out of the issuer base can help provide opportunities to actively manage our convertible portfolios for years to come.

Our team continues to expect a strong economic recovery to unfold this year as significant fiscal stimulus, accommodative monetary policy and continued progress on Covid vaccinations all combine to provide a powerful cyclical backdrop. We do see the potential for heightened volatility, however. The transition may be choppy in the short term, which could result in periods of uncertainty and market rotations, as markets experienced in the first quarter. Fiscal stimulus and monetary policy have been key to stabilizing financial markets and driving recovery, and we may see more volatility as the specific details of new fiscal policies become clearer. At some point, we may be debating the implications of an eventual withdrawal of liquidity provided by monetary policy.

Our current focus is on evaluating both the abundant opportunities that have come to market recently as well as existing convertibles with profiles that may have changed due to recent market rotations. We are seeking ways to optimize the risk/reward profile of Calamos Convertible Fund (CICVX) while positioning it to benefit from companies that can capitalize on cyclical growth opportunities created by the reopening of the economy. These span multiple industries, including airlines, cruise lines, retail, entertainment, and semiconductors. We also believe there are long-term opportunities within secular growth areas such as cloud computing, internet security, e-payments, e-commerce and many other “at-home” trends that accelerated during the pandemic. Overall, the fund’s largest absolute allocations remain to the information technology and consumer discretionary sectors. The fund’s largest relative underweight exposure is to more defensive areas such as the financial sector where we believe convertible structures are less favorable.

Looking out over the next 12 months, we remain optimistic on an economic recovery but see the potential for continued heightened volatility in financial markets. With that backdrop, we believe the strategic case for our actively managed convertible approach remains strong, as we position Calamos Convertible Fund for further upside participation in equities while managing downside risk.

Calamos Global Convertible Fund (CXGCX):

We expect the global convertible market to resume its advance

Eli Pars, CFA, Co-CIO and Senior Co-Portfolio Manager

We maintain a positive outlook for the global convertible market, as the Federal Reserve’s accommodative stance and vaccination progress provide powerful tailwinds. Headline inflation may increase over the near term, but we do not expect a sustained ramp-up.

Vaccines in the United States are likely to go from scarce to abundant as early as mid-April. With more than 100 million people having received at least one dose already, and three million more getting vaccinated every day, the U.S. is making meaningful progress in its fight against the virus. Against this backdrop, we expect travel and leisure industries (airlines, cruise ships, Las Vegas) to be in much better shape by the third quarter, which in turn will drive economic growth and employment gains. These continued improvements, combined with very loose fiscal and monetary policies, should propel equities higher, offsetting the likely headwinds of rising taxes and more regulations.

We actively rebalance Calamos Global Convertible Fund (CXGCX) with the goal of providing more exposure to global equity market upside than potential downside. Through the end of the first quarter, global convertible issuance has remained robust, totaling $58 billion. With these high levels of issuance, the equity sensitivity of the global convertible market has come down, as measured by the Refinitiv Global Convertible Bond Index. Over the course of the quarter, the fund’s overall level of equity sensitivity has also come down and now stands roughly neutral to the global convertible market.

($ billions)

Source: BofA Global Research. Data as of March 31, 2021.

Much of our rebalancing has focused on the technology sector, which is the fund’s largest overweight and absolute weight. We also have been active in rebalancing Covid-recovery names, such as cruise ships and airlines. In January, we noted that we were paring the fund’s overweight to Covid-recovery names as many companies had begun to price in a full recovery. Throughout the quarter, we continued to reduce the fund’s exposure to a roughly neutral weighting.

From a geographic standpoint, Calamos Global Convertible Fund has maintained a neutral weighting to the United States and is underweight Europe. The portfolio’s weighting to Europe remains driven by bottom-up considerations rather than a macro call.

We believe the fundamentals of the global convertible market remain strong and caution against reading too much into the market’s recent retreat. Some of the pullback is attributable to the rotation out of growth companies, which are well represented in the convertible market. Heavy issuance also contributed to softness, particularly in early March. We continue to monitor both situations and note that the softness in the convertible market has already started to reverse over the last few days of the quarter.

We see many attractive pockets of opportunity in fixed income

Matt Freund, CFA, Co-CIO, Senior Co-Portfolio Manager

Christian Brobst, VP, Co-Portfolio Manager

Chuck Carmody, CFA, VP, Co-Portfolio Manager

We believe:

- Inflation will move substantially higher in Q2 and Q3, as low base effects from 2020 contribute to sharp increases, with some level of normalization beginning in Q4 and extending through 2022.

- We have been surprised at the amount of fiscal support that has made it through a 50/50 Senate. Unconstrained expansions in federal spending create the possibility for substantially higher rates in coming months, but we expect the long-term trend for interest rates will return to trading ranges close to those of the current market.

- Credit markets, including high yield and investment grade bonds and bank loans, will remain stable in tight trading ranges driven by ongoing fiscal and monetary support. We expect more modest returns going forward given the impact of higher Treasury rates.

Our team is taking the Fed at its word that overnight borrowing rates will be on hold near-zero for the entirety of 2021 and 2022. In our most aggressive scenario, the Fed begins to taper its purchases of Treasury and mortgage-backed securities early next year.

Multiple factors supported the continued Q4 recovery in the first few months of 2021, including high levels of stimulus through Fed monetary policy, record fiscal stimulus from Congress and accelerating vaccination progress. Each of these factors is contributing to strengthening consumer and business leader confidence. At the same time, economic fundamentals are improving on both the labor and activity fronts, despite the heavy impact of unusual winter weather conditions on several large local economies in the South.

We continue to view bank loans as an attractive way to help manage overall interest rate duration as part of a barbelled portfolio construction approach. Additionally, we are identifying more pockets of opportunity in BB-rated credits, which underperformed the broad high yield market in the first quarter and may have more room to appreciate now. As always, we apply our active, bond-by-bond approach to take risk when we believe our shareholders are being well compensated.

Calamos High Income Opportunities Fund (CIHYX). Declines in new COVID-19 infections and deaths from recent peaks indicate that vaccinations are working, which should lead to improvement in face-to-face, service-related industries in coming quarters. While the reopening of businesses that require close human contact is good news for economic growth and employment participation, high yield industries tend to focus more on manufacturing and energy. This sector composition has helped drive positive returns in high yield during the first quarter, despite headwinds from higher interest rates on intermediate and long-maturity Treasuries. However, it means that security selection will be even more important in coming quarters, which we believe will favor our idiosyncratic approach.

The new issue market continues to trade strongly. Consistently high volumes of new debt have been met with healthy demand, due in large measure to the liquidity conditions driven by Fed, as well as fiscal activity. Even during periods when first quarter holidays have typically brought slower markets, new issue activity remained robust in 2021. The technical backdrop for high yield continues to be favorable, in our view. Just as last year’s supply-demand technical environment was heavily influenced by “fallen angels” (bonds that joined the high yield market as a result of downgrade), we expect many issuers to exit the market as “rising stars” (bonds that are upgraded to investment grade status). The resulting shrinking of the market size should further support the strong technicals.

Calamos Total Return Bond Fund (CTRIX) and Calamos Short-Term Bond Fund (CSTIX). Our positioning seeks to provide an income advantage to respective benchmarks. Reflecting this, each fund remains overweight to corporate bonds and asset-backed securities. Similar to the high yield market, the corporate bond and asset-backed security markets are benefiting from heavy demand, which is supporting a tight spread trading environment.

Our outlook is that we could see higher long maturity rates in the interim, resulting in a steeper yield curve. As such, Calamos Total Return Bond Fund is positioned with a shorter duration than its benchmark, particularly through an underweight to securities with a duration of 10 years or greater. Given our confidence in the Fed’s guidance for near-zero overnight borrowing costs in coming quarters, we maintain a neutral benchmark duration stance in Calamos Short-Term Bond Fund.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Delta measures how much the convertible value rises or falls for a given stock move.

Duration is a measure of interest rate risk.

In-the-money convertible: A convertible with an underlying equity share price above the conversion price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the U.S. equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.