Investment Team Voices Home Page

Investment Team Voices Home Page

As Long-Term Interest Rates Rise, Here’s What Investors Should Be Thinking About

John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

After years of artificially low interest rates and inflation, it’s understandable that some investors are disoriented by the current headlines—and worried about what to do next. Long-term yields have moved up very quickly from 0.93% on December 31, 2020, to close at 1.71% on March 18, 2021. Market volatility and a leadership rotation—from growth stocks to cyclical and value names—have added to the unease many investors are feeling.

In my view, some of the turbulence we’ve seen has been driven by sentiment, rather than fundamentals. However, there’s no doubt that as the U.S. and global economies accelerate, there will be new opportunities and new risks. Fiscal policy uncertainty, including the potential for tax increases, is likely to fuel volatility and rotation in the markets and, depending on the outcomes, the longer-term growth trajectory of the economy as a whole.

For many investors, now is a good time to review their current asset allocations. Here are some points to keep in mind:

-

What we are seeing on the inflation front is neither surprising nor out of control. The economy is re-opening, and pent-up consumer demand is being released in line with expectations. It’s important to remember that inflation has been extraordinarily low for many years, and the ramp-up in inflation that has occurred is a change based off these very low levels. We’re likely to see this trend continue over these next quarters. For perspective, however, inflation is still trending well below the Fed’s target on its preferred measure, with January Core PCE coming in at just 1.5%. What we are seeing today is much more benign than what occurred in the 1970s or 1980s, when we had sustained periods of double-digit inflation.

-

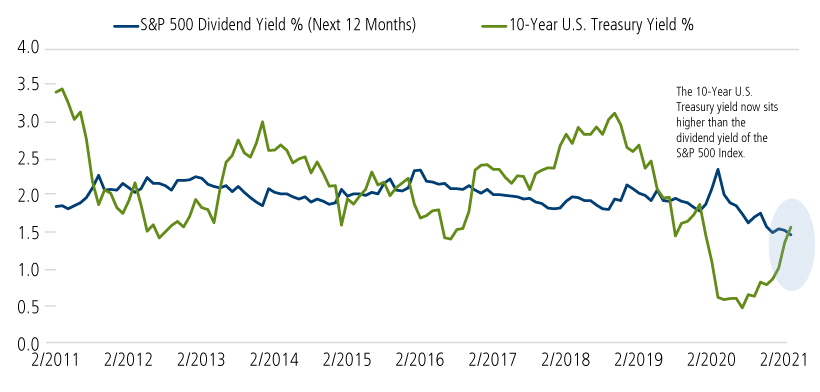

A more normal relationship between dividend yields and Treasury yields has re-emerged. Although it hasn’t necessarily been the case over recent years, investors have traditionally looked to bonds for yield and to stocks for capital appreciation. Treasury yields were kept artificially low in 2020 through the extraordinary actions that the government and Federal Reserve took in response to the pandemic. Now, however, as the chart below shows, these lines have crossed back to a more normal relationship.

Figure 1. 10-year Treasury yields versus S&P 500 dividend yields

February 2011-March 15, 2021 (%)

Past performance is no guarantee of future results. Source: Bloomberg.

-

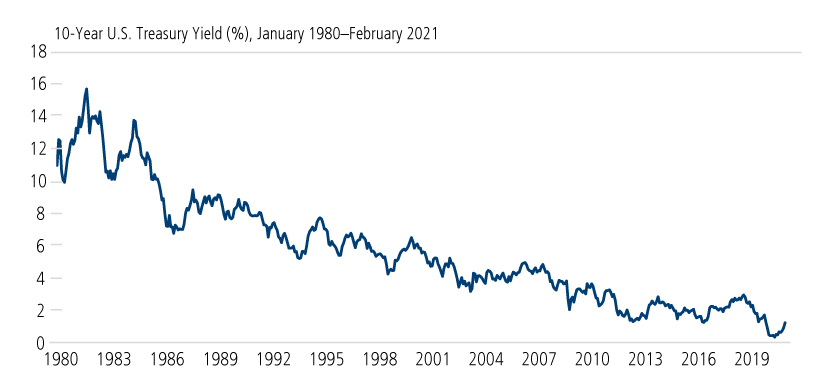

The U.S. economy is in a period of healing—not overheating. The change in 10-year yields reflects a return to growth, supported by employment gains and a resumption of consumer activity. Although rates have risen quickly, they are still relatively low if we look back over decades (Figure 2).

Figure 2. 10-year Treasury yields have risen but are still low versus long-term levels

Past performance is no guarantee of future results. Source: Federal Reserve Bank of St. Louis.

While long-term rates can be influenced by many factors, we believe the Federal Reserve’s stance—including its attentiveness to financial conditions overall—can help prevent an unchecked steepening of the yield curve. In his March 17 comments, Federal Reserve Chairman Powell affirmed the Fed’s commitment to an accommodative approach, including its intention to hold off on short-term rate hikes until 2022 or 2023 while maintaining its bond purchases until the economy has strengthened further.

-

Asset allocations should change over time, but the principles of asset allocation don’t. The evolving economic environment may mean that it’s time for you to make adjustments to the mix of strategies that you hold, but you shouldn’t lose sight of your risk tolerance or the long-term benefits of maintaining a well-diversified portfolio that includes a breadth of asset classes.

-

Long-term focus and risk management never go out of style. This year, we’ve seen the S&P 500 hit new highs. There’ve been headlines about astronomical, out-of-nowhere gains in a handful of stocks, and value stocks have rallied with added strength. These sorts of events cause many investors to wonder if they should go where the action is, but chasing performance is never a good long-term strategy—especially in fast-moving markets like these. You’re far more likely to miss the upside and capture the downside. This is especially important given the likelihood of continued rotation and volatility in this phase of the market cycle.

-

There are always opportunities for long-term investors. I began my investing career in the difficult financial markets of the 1970s, and there are important lessons from those years that I always carry with me. My experiences helping my clients navigate staggering inflation, soaring interest rates and market volatility helped me forge the investment philosophy I rely on today. The foundation of this philosophy is the belief that there are opportunities in every environment for the long-term and risk-conscious investor.

However, finding this opportunity often requires looking off the beaten path. For example, in the 1970s, stocks and bonds both faced headwinds—which made the potential of convertible securities that much more intriguing. Then, convertibles were an underfollowed hybrid asset class that offered the best of both worlds, as they have through the decades since. Today, I see bright prospects for convertible strategies—either within an enhanced fixed income allocation or as a way to achieve lower volatility equity participation. Issuance continues to be strong, as companies continue to seek access to capital in a growing economy, with lower borrowing costs than non-convertible debt.

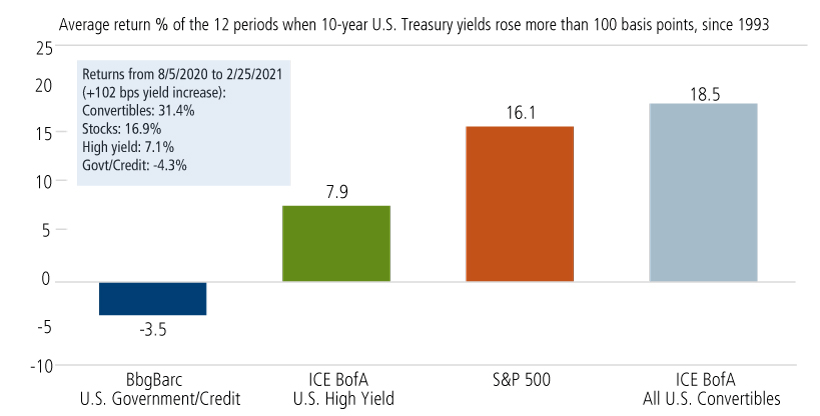

While convertible securities allow their issuers to monetize the volatility of their underlying stocks and borrow at a lower rate, there are considerable benefits to investors as well. The chart below highlights how convertible securities have historically provided a way for investors to hedge against a rising interest rate environment, including through this most recent period of rising rates.

Bonds tend to lose value in an environment of rising interest rates. However, convertible returns have tended to more closely reflect equity returns than bond returns when the 10-year Treasury yield has risen more than 100 basis points. With active management, the benefits may be even more pronounced. (For more on the opportunity of actively managed convertibles see “When Rates Rose, CICVX Outperformed Both Stocks and Bonds.”)

Figure 3. Convertible securities can be a ballast against rising interest rates

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Indexes are unmanaged, do not reflect fees or expenses and are not available for direct investment. Source: Morningstar. Data shown is cumulative. Rising rate environment periods from troughs to peak based on data available through February 28, 2021, the most recent month end.

-

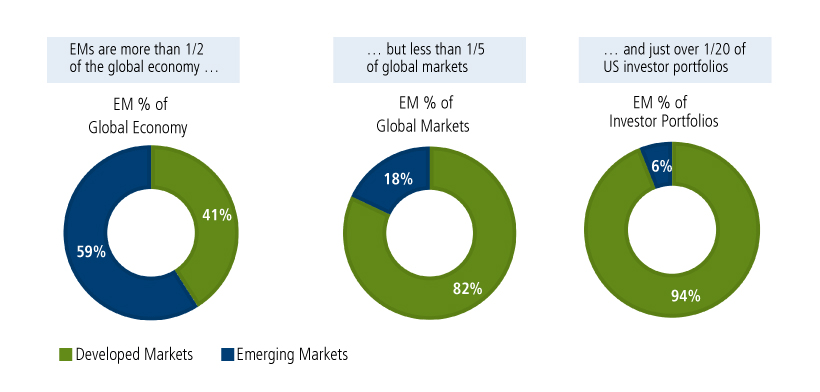

Guard against “home country” bias. Many investors are short-changing the diversification and growth potential of their portfolios by underallocating to non-U.S. markets, including emerging markets. There are significant long-term opportunities in the emerging markets, supported by a combination of global economic recovery, a weak U.S. dollar regime, and a variety of long-term growth themes. (This was the focus of our March 10 webcast, available as a replay for investment professionals.)

Indeed, the term “emerging markets” has become a misnomer—these economies have truly emerged. Together, emerging markets represent more than half of the global economy, but less than 1/20th of investor asset allocations.

Figure 4. Emerging market equities: Overlooked opportunity

Past performance is no guarantee of future results. Source: GSAM January 2019, IMF, SIFMA Fact Book.

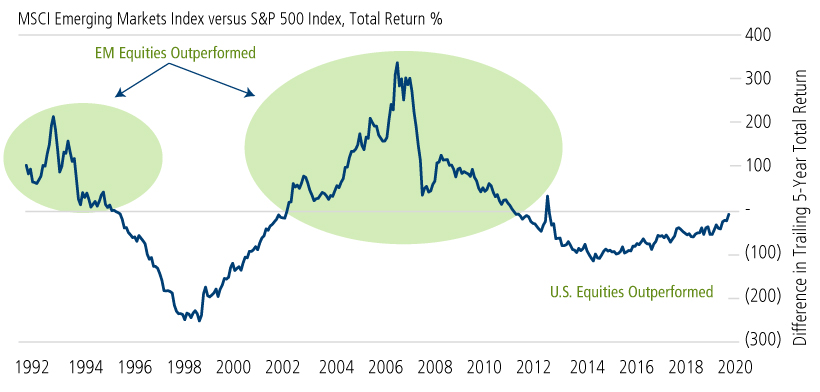

Additionally, emerging market equities and U.S. equities have alternated leadership. As shown below, these leadership regimes have been sustained over extended periods. Although emerging markets have paused recently as investors focus more exclusively on the strength of the U.S. recovery, we expect emerging markets to benefit from many tailwinds as recovery becomes more synchronized globally. Investors who have strategic allocations to emerging markets may be better positioned in the long run.

Figure 5. EM vs U.S. Leadership Cycles Over Time: Rolling 5-Year Total Return Differential

Past performance is no guarantee of future results. Source: Bloomberg.

-

Capitalize on economic recovery with small-cap growth strategies. Large-cap stocks have dominated investor attention through recent years, and many investors may have overlooked the opportunities that smaller growth-oriented companies—tomorrow’s leaders—offer. Small caps have tended to perform well during similar points of past economic cycles, with leadership regimes that have typically lasted years. (For more on these leadership cycles, see the post by Senior Portfolio Manager Brandon Nelson, “The Bullish Case for Small- and Mid-cap Growth Stocks.”

-

It’s important to maintain a balance between growth and value companies. Value stocks and cyclical names have enjoyed a nice bounce as investors have become more concerned about interest rates and the relative attractiveness of growth companies and other long-duration assets at this point of the economic cycle.

However, growth stocks are an asset allocation cornerstone—and thinking of growth and value as an “either/or” proposition is a mistake, in my view. Rising interest rates may have made the cost of capital higher, but it’s still cheap overall. Strong and innovative growth businesses can continue to deliver, benefiting from healthy balance sheets. For these sorts of companies, even incremental revenue improvements can significantly boost margins. Additionally, cyclicals may enjoy short bursts of outperformance as the economy ramps up in recovery mode, but typically these bursts don’t last long. We believe companies that can deliver sustainable growth after the current re-opening trade runs its course remain compelling.

-

Rethink—but don’t abandon—your fixed income allocation. While traditional fixed income investments—like long-dated Treasury bonds—are likely to face added pressure as interest rates rise, I encourage investors to remember it’s a market of bonds, not a bond market. In other words, there’s a great deal of variation and opportunity in the fixed income markets. A well-diversified portfolio reflects this.

In this phase of the economic cycle, high yield bonds provide compelling opportunities, as default rates decline from 2020 levels and economic recovery provides a wind in the sails for select issuers. Additionally, short-term bond strategies can provide a haven from short-term volatility in the equity markets, with relatively less duration risk versus longer-term bonds and more potential upside than cash. Convertible securities and liquid alternatives (such as market neutral income) can also enhance a fixed income allocation with less duration risk. (For more on using liquid alternatives in an enhanced fixed income allocation, see “Rising Rates Don’t Intimidate Fixed Income Alt CMNIX.”)

Conclusion

Before this year, inflation and rising rates were a distant memory for many investors, if not entirely unfamiliar. As the economy, markets, and individual companies move from 2020’s economic shutdown through the re-opening phase, volatility and rotation are par for the course. New themes and opportunities are emerging. In this environment, our teams are taking an active approach—thinking long term and capitalizing on volatility on behalf of investors.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

High yield securities entail increased credit and liquidity risks compared to investment grade bonds. Convertible securities entail interest rate risk and default risk.

Asset allocation and diversification do not guarantee a profit or protect against a loss. Alternative investments entail added risks and are not appropriate for all investors.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The MSCI Emerging Market Index measures the performance of emerging market equities. The S&P 500 Index is considered generally representative of the U.S. equity market. The Bloomberg Barclays U.S. Government/Credit Index is comprised of long-term government and investment grade corporate debt securities. The ICE BofA U.S. High Yield Master II Index tracks the performance of U.S. dollar denominated below investment grade rated corporate debt publically issued in the U.S. domestic market. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Personal Consumption Expenditures Core Price Index (PCE) tracks overall price changes for goods and services purchased by consumers.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

NOT FDIC INSURED | NO BANK GUARANTEE | MAY LOSE VALUE

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

18876 0321 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.