Better Catch Up—We Believe the New Bull Market Is Off and Running

Who’s ready to mix things up? After watching the largest of the large caps drive the overall market to new highs this year, it just may be time to look beyond technology and beyond the large caps that have dominated the last few years.

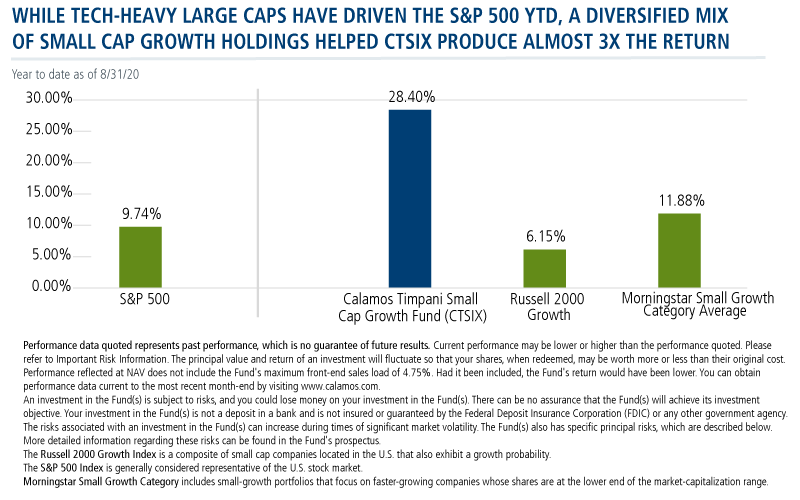

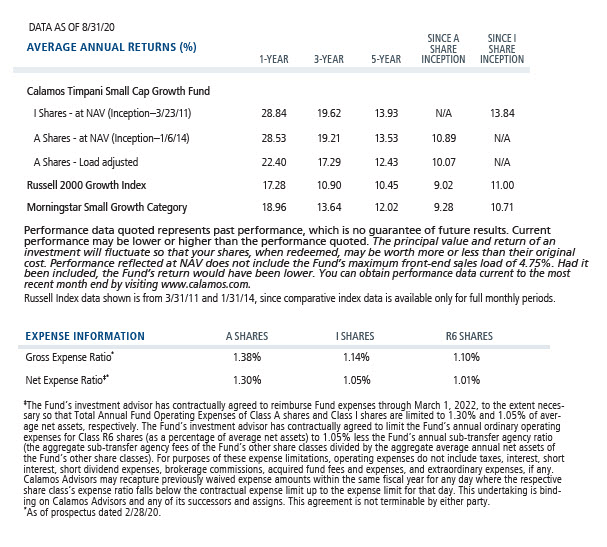

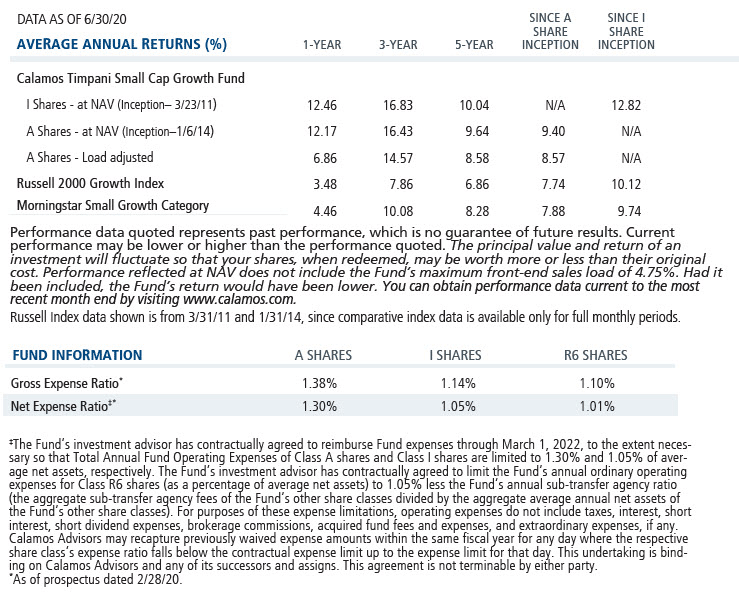

Because there’s a new bull market underway, and it’s proven to be quite hospitable to the diversified small cap growth stocks that Calamos Timpani Small Cap Growth Fund (CTSIX) invests in. CTSIX has returned 28.40%—or almost three times the return of the large cap S&P 500—through August 31, and is now a four-star Morningstar fund.

“My biggest day-to-day challenge,” says Calamos Senior Portfolio Manager Brandon Nelson, “continues to be deciding what to sell in order to fund the increase of certain weights or to fund the purchase of new names.” The team is so optimistic that the fund is essentially carrying zero cash, says Nelson.

CTSIX secular themes include healthcare, ecommerce, cloud-based communications, and software security, all of whose growth has accelerated since COVID-19 hit the United States. Other themes relate to consumer discretionary stocks that are benefiting from changes in consumer behavior (read more in this post).

Small Cap FOMO?

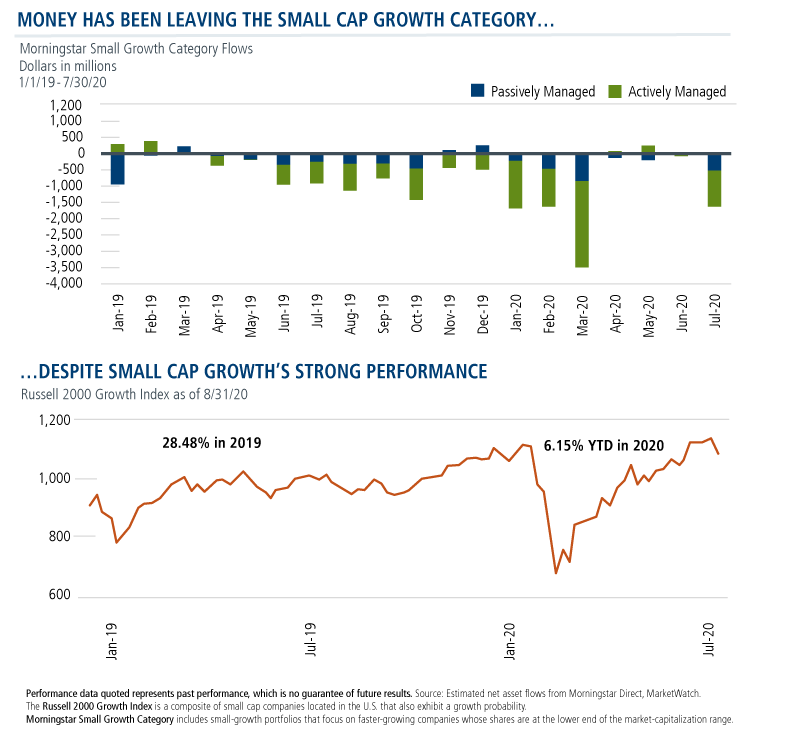

But while Nelson likes small caps' prospects, the data suggest that many investors are missing out. The unfortunate timing that characterizes large cap investing (see this chart) also is in play in small caps today. As shown in the chart below, monthly flows into the Morningstar Small Growth category have been mostly negative despite small cap growth's strong performance.

What’s Ahead

Looking ahead to how the new bull market could play out the rest of the year, Nelson sees several possible scenarios as the country continues to deal with multiple challenges, including the COVID-19 healthcare crisis, recession, social unrest, and the unpredictable nature of the U.S. presidential race.

- Large growth leadership may pass the baton to small growth, driving up small caps overall. “This happened in late 1999/early 2000 and could easily happen again,” says Nelson.

- Small caps could assume their historical role and lead the market out of recession. As discussed in this post, the first 12 months of a new bull market following an economic downturn have historically involved significant outperformance—1400 basis points—by small caps. The asset class’s reversion to mean has yet to materialize.

-

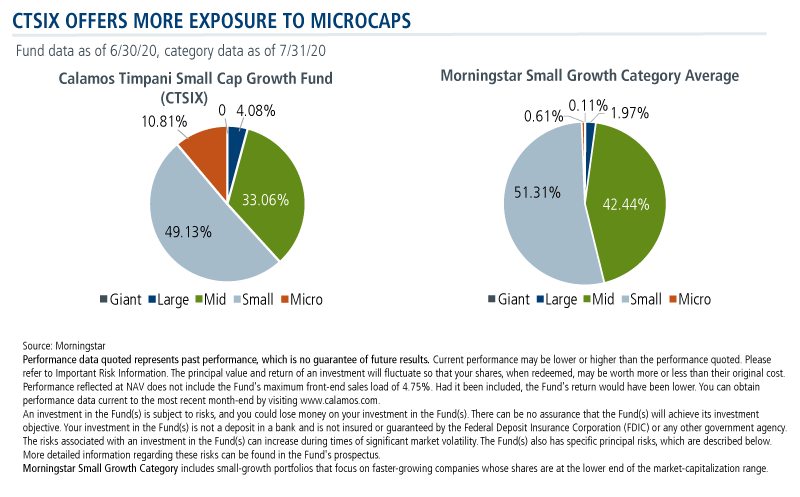

In a full swing of the pendulum, the smallest of the small could take over from the largest of the large. Such a development could favor CTSIX as so many of its Small Growth category peers are heavy into mid-caps stocks and light on microcaps (see this post).

- Nelson also allows for the possibility that small cap value could reverse its fortunes and begin to outperform small cap growth.

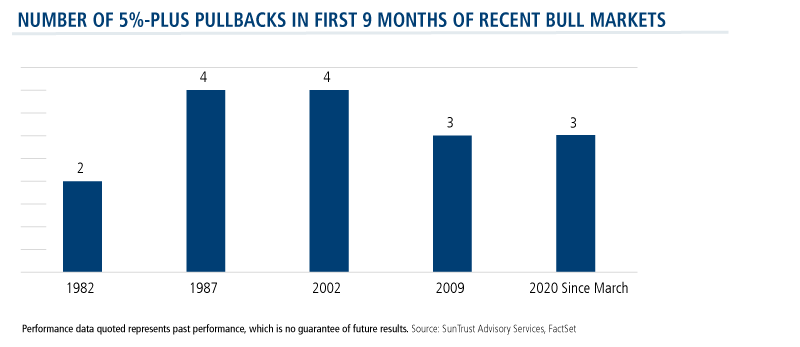

And, the market Thursday through yesterday provided a reminder that pullbacks are common in a new bull market, too.

The bottom-line, Nelson says, is that “we like small caps as an asset class even though it has lagged large caps year to date and for the last several years. As shown this year, we don’t need small caps to win for our fund to perform.”

The CTSIX team, Nelson explains, “spends its time on stock-specific opportunities where the team attempts to find fast growth and underestimated growth [i.e., fundamental momentum]. We expect to get rewarded when we find those situations, and we have historically. Macro factors such as growth vs. value performance, small vs. large performance, politics, geopolitical tensions, fiscal policy, and monetary policy can also play a role in determining how much we get rewarded.”

Finally, Nelson stresses, “We’re finding promising stocks of profitable companies in several different sectors of the economy. This diversification within the portfolio is an important point. It demonstrates our high sensitivity to controlling risk while pursuing the opportunities that are out there.”

Investment professionals, for more information about CTSIX contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The Russell 2000 Growth Index is a composite of small cap companies located in the U.S. that also exhibit a growth probability.

Morningstar Small Growth Category includes small-growth portfolios that focus on faster-growing companies whose shares are at the lower end of the market-capitalization range.

Morningstar RatingsTM are based on risk-adjusted returns for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc. All rights reserved.

802138 920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 09, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.