Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, October 2021

Outlooks from our Investment Team

- Calamos Growth Fund (CGRIX): A More Complicated, But Still Supportive Backdrop

- Calamos Global and International Funds: Navigating Shifting Crosscurrents

- Calamos Growth and Income Fund (CGIIX): Mid-Cycle Transition is Volatile and Slow, but Return Outlook Is Positive Over Next Year

- Calamos Phineus Long/Short Fund (CPLIX): It is Far Too Early for “Late-Cycle” Positioning

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Positioning Update

- Calamos Global Sustainable Equities Strategy: The Case for a Bullish Equity Narrative and ESG Investing

- Calamos Global Convertible Fund (CXGCX): Moderate Economic Expansion and Top-Line Growth Support Opportunity in Global Convertibles

- Calamos Fixed Income Funds: Early Innings of a Prolonged Recovery and Real Rates Provide Tailwinds for Credit Markets

- Calamos Convertible Fund (CICVX): As the Economy Transitions to a Mid-Cycle Growth Phase, Convertibles Are Well Positioned

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): Strong Fundamentals, Attractive Valuations Set the Stage for Sustained Small-Cap Opportunity

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

During the third quarter, economic and company fundamentals remained strong. Nevertheless, markets were choppy and rotational as investors grappled with a challenging newsfeed. Inflation fears intensified, supply chain disruptions persisted, and anxiety around the Covid-19 delta variant continued. Economic growth moderated from its double-digit pace and fiscal policy uncertainty deepened in the United States. The Federal Reserve announced it expects to begin tapering its asset purchase program soon and indicated that short-term interest rate increases could start by late 2022. The yield of the 10-year Treasury bond leapt to 1.52% by the end of the quarter, while the prices for oil and other energy-related commodities soared.

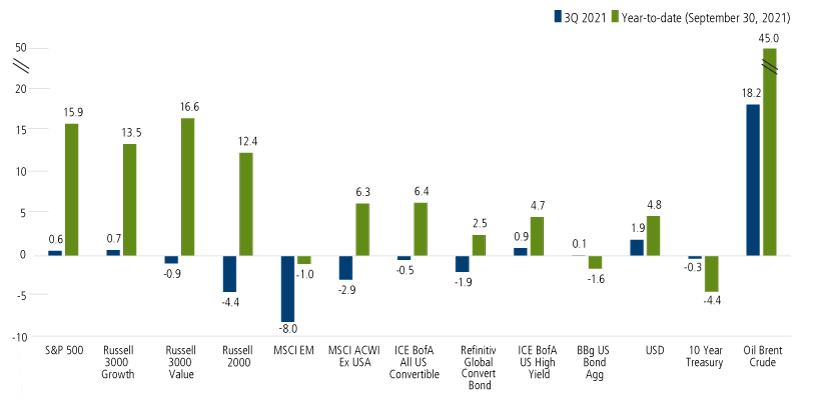

Many broad market benchmarks were generally flat or modestly down for the quarter, with year-to-date returns remaining solid (Figure 1). Growth stocks closed the quarter with a slight gain (measured by the Russell 3000 Growth Index) and value stocks finished with a slight loss (measured by the Russell 3000 Value Index), masking the considerable turmoil of the period. Emerging markets faced more pressure, as the travails of Chinese real estate developer Evergrande roiled the market. However, there were also bright spots among the emerging markets, such as India. (See our post, “India’s Stealth Bull Market.”)

Past performance is no guarantee of future results. Source: Morningstar.

Earlier in the year, there were many reasons to believe inflation would be quite transitory. As the economy moves through this unprecedented cycle, there’s mounting evidence that inflation will be more persistent, as companies struggle to entice workers and supply chain disruptions continue. (See our post, “Inflation Casts a Longer Shadow.”) Nevertheless, there is a difference between inflation pressures that investors can mitigate through asset allocation (such as increasing allocation to equities, convertible securities, and high-yield bonds) versus the sort of inflation pressures that could upend the economy. We believe the former scenario still holds.

It’s important to remember that every cycle is different. Rising inflation and slowing growth have historically set the stage for “stagflation”—but this cycle is like no other. The global economy is in the midst of an extraordinary recovery period, and a moderation of economic growth and consumer optimism should come as no surprise. We still see strong corporate balance sheets, improving margins and spending on capital expenditures. The shadow of Covid persists, but we remain hopeful as global vaccination efforts continue, and emerging treatments show promise. Although we can never rule out a policy mistake, we expect the Federal Reserve to pursue a gradual course that should continue to support economic growth and, in turn, provide tailwinds for the stock market.

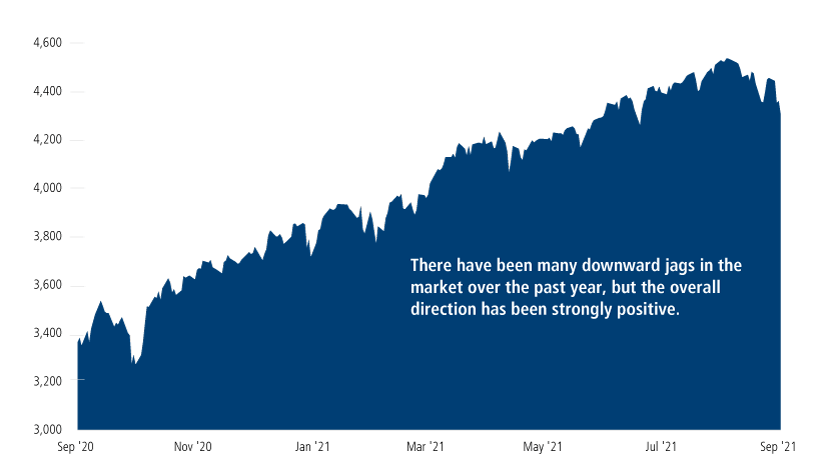

As the economy transitions from a rapid expansion to settle into a mid-cycle growth phase, investors should not be surprised by ongoing volatility and market rotation. These are a normal part of investing. Over the past year, for example, the market has risen significantly, but these gains have been earned in a saw-toothed fashion with plenty of dips along the way. Markets could become increasingly choppy, especially cyclical areas that are tied to interest rates and economic growth.

Past performance is no guarantee of future results. Source: Morningstar.

US fiscal policy remains a key risk to both the near-term and the long-term outlook. Reasonable regulation and tax policy are key to sustaining business confidence, job growth, and household prosperity. There are many unknowns on the fiscal policy front and political tensions are running high as the timeline for infrastructure and social policy programs have been pushed back once again. However, uncertainty about fiscal policy—or interest rates—are not reasons to stay on the sidelines.

There are always opportunities, especially for experienced and active managers. We believe our teams are well positioned to navigate these crosscurrents, capitalizing on the long-term opportunities that short-term volatility produces. Our teams are focused on individual security selection and an understanding of thematic tailwinds that will drive the markets. Below, they share their perspectives on what they are seeing in the markets and how they are pursuing opportunity on behalf of investors.

A More Complicated, But Still Supportive Backdrop

Matt Freund, CFA, Brad Jackson, CFA, Michael Kassab, CFA, and Bill Rubin

As the final quarter of 2021 gets underway, the US equity markets have become choppier compared to the strong and steady upward trend that held for most of the year. This more volatile behavior can be attributed to three main issues that are worrying investors: first, economic data which while strong, has failed to meet lofty expectations; second, a Federal Reserve that is on the cusp of scaling back its pandemic-level asset purchases; and third, persistent inflationary pressures that do not appear to be going away as soon as hoped.

Each concern warrants careful consideration and should not be dismissed easily. However, our conclusion is that although the backdrop for equities has gotten decidedly more complicated, the longer-term underpinnings of the U.S. economy and corporate profitability remain strong enough to support further gains.

We believe long-term secular growth stocks with strong balance sheets and dominant market positions will thrive in this environment. At the same time, cyclical growth companies, which are more exposed to the ongoing global re-opening, should also do well.

GDP Growth

Although growth rates remain high compared to pre-COVID-19 levels, economic indicators have been flashing warning signs since late summer. We believe most, if not all, of this soft patch can be attributed to the mid-summer spike in COVID cases. With the rise in cases came renewed social-distancing mandates that disrupted the strong bounceback in travel and leisure activity, labor market gains, and in turn, consumer confidence. With the spread of the delta variant now waning, we believe the recovery can quickly resume.

We have already seen some signs of this with the latest credit card trend data, which appears to indicate a late-September uptick in spending. This is consistent with our views that US consumers remain in good financial standing with healthy household balance sheets and plentiful job opportunities. As a result, we anticipate at least another year or two of above-trend growth.

Fed Policy

We now know the Federal Reserve will begin tapering its $120 billion per month of asset purchases in the November/December timeframe and may, if the recovery progresses as we expect, begin hiking rates in the back half of next year. Stocks initially struggled with this news, as both short and long rates moved higher. However, investors soon took comfort that interest rates remain low by historic standards and are below current inflation rates (that is, real rates are negative).

Given a choice, equity investors typically prefer a dovish Fed that keeps the proverbial punchbowl filled. In this case, however, a gradual curtailing of pandemic-era levels of “emergency” monetary support appears reasonable given the economic progress to date.

Ultimately, even with a scale back in asset purchases, we still expect the Fed to remain highly accommodative. Whether rate hikes begin in late 2022 or the following year, in our view, Fed officials will only act when it is clear the economy can absorb them with limited repercussions.

Inflation and Supply Chain

When consumer and producer prices first began to pick up speed earlier this year, most policy makers and pundits agreed that this was merely a temporary dynamic. As we approach the end of the year, it appears that this was overly optimistic, and the situation seems to be intensifying rather than abating. Most of the elements that brought about this surge in inflation—from “pent-up” demand to material shortages to soaring energy prices and supply chain bottlenecks—are still largely in place. As a result, many market participants (ourselves included) are starting to rethink the timeline for just how long these issues will last.

Ultimately, we still believe the most likely scenario is for inflation pressures to fade, albeit over a longer timeline than originally anticipated. The good news, from a corporate standpoint, is that companies of all shapes and sizes appear to have relatively strong pricing power, and are able to pass through most, if not all, of their rising input costs. At the same time, businesses have adapted to the post-pandemic world by becoming more efficient and productive. As a result, we expect profit margins, which are high by historical standards, to be maintained even in the face of higher wage costs.

Conclusion

The markets always present challenges, and sometimes they seem to come all at once. Nevertheless, above-trend economic growth, low interest rates, healthy consumer balance sheets, and a resilient and productive corporate sector combine to form a constructive backdrop for the US equity markets.

We believe Calamos Growth Fund (CGRIX) continues to be well positioned, with investments in innovative companies with transformative business models that should prove resilient, even in this current choppy environment. At the same time, we remain invested in select cyclical growth opportunities that will benefit as the pace of recovery reaccelerates.

Calamos Global and International Funds: Navigating Shifting Crosscurrents

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

The world appears to be past the peak negative economic impact from Covid-19, which should sustain a positive tailwind for the reopening names, local consumption opportunities, and select reflationary beneficiaries we’ve been adding across the Calamos global and international portfolios.

As economies begin to normalize around the world, so do fiscal and monetary policies. As markets adapt to a more normalized post-Covid world, we are prepared for increased volatility, rotation, and shifting leadership. Although we expect the Federal Reserve’s policy to remain highly accommodative, the risk of a policy error has also increased, albeit at the margin. With two Fed officials stepping down unexpectedly, future Fed leadership—and policy—are more uncertain now than they were a month ago.

The sustainability of the global recovery depends a great deal upon the resolution of global supply-chain issues and the supply-side shocks in many commodities. Although supply-side inflation pressures have been frustratingly slow to abate, we maintain our view that they will be temporary, although not uniformly so. Positive developments around Covid-19 give us confidence that the synchronized global recovery we’ve anticipated can develop and supply chains can normalize.

Even within our global recovery scenario, energy commodities may face more stubborn supply-side disruption. Years of low energy prices, shareholder demands for capex discipline, and environmental policies designed to support the transition to renewable power sources have led to underinvestment in energy infrastructure. In turn, this underinvestment has curtailed the ability of the supply-side to respond to the global recovery in demand. The result is surging oil, natural gas, and coal prices around the world, with some countries rationing supplies. (See our recent post, “As Global Economy Reopens, Green Policy Creates Pricing Power for Traditional Energy”.) Much of the supply side should be able to bounce back quickly once the global recovery is on course, but to the extent that environmental policies prohibit new supply from coming online to meet increasing demand for energy, we can expect more persistent disruptions and inflationary pressures.

Positioning. We believe our emphasis on high-quality businesses that are growing intrinsic value consistently will serve the funds well. We have maintained a barbell approach, pairing cyclicals and Covid-reopening exposure with secular growers. Within our cyclical exposure, we are focused on industries with pricing power and those that are benefiting from global supply shortages. We also see a growing set of opportunities in smaller-cap stocks.

Additionally, in Calamos Global Opportunities Fund, we continue to find many opportunities in the convertible market that support our focus on lower-volatility global equity participation. In this fund, we invest across the capital structure, and this broad universe gives us more bottom-up opportunities for enhancing risk/reward over market cycles. For example, convertible securities have proven less vulnerable to rising interest rates than traditional fixed-income securities, while also offering equity upside participation. Given the rate environment and equity volatility, we believe our use of convertibles alongside stocks will continue to help us strike an attractive skew versus a single-asset class approach, allowing us mitigating exposure to a larger equity correction, while maintaining sufficient upside for meaningful participation in the global recovery.

United States. From a top-down perspective, our positioning in US markets reflects our expectation for moderating-but-still-strong growth, framed by a balance of reflationary and disinflationary forces. For several quarters, our global portfolios have been balanced across secular and cyclical growth opportunities. We believe this balanced approach continues to make sense.

Europe. Europe’s equity market remains more reasonably valued on the whole compared to other developed market equities. Although there’s already been a healthy bounce back in Covid reopening names, we see additional upside, given that economic recovery is supported by a Covid-vaccination rate that now surpasses that of the United States. We are finding many opportunities in Europe that align with secular trends, including smaller-cap names that we believe can benefit from the investment into technological capabilities, infrastructure and education. (For more, see our post, “The Big Opportunity in European Ecommerce”.) We maintain exposure to payments but are also expanding more broadly into ecommerce and IT software.

Japan. Many of the headwinds that have hindered Japan’s economy and markets earlier in the year have lessened considerably. Vaccination rates have accelerated, surpassing the United States and catching up to Europe. Moreover, we expect that a ramp-up in global capital expenditures will give many Japanese companies a lift, given the export-oriented nature of the economy. The resignation of Prime Minister Suga has also removed political uncertainty, and newly inaugurated Prime Minister Kishida has pledged a large stimulus package and is a proponent of economic reopening. Our positioning in Japan focuses on companies with attractive fundamental characteristics, such as increasing margins, strong competitive positions and exposure to global growth and the capital investment cycle.

Emerging Markets. Although the recent performance of emerging market equities has disappointed investors, we are optimistic about a rebound because much of the real pain has been self-inflicted by China, primarily via its own tighter monetary and regulatory policies. This leaves the door open for the government to make a swift course correction, especially if the negative influences of these policies on broader economic growth become more pronounced. In relatively short order, we expect to see signs that China is moving to a more accommodative fiscal and monetary stance to support economic growth. We also anticipate that the flurry of recent regulation tapers.

Although the recently enacted policies of the Chinese government have created headwinds for certain industries, there are still opportunities for companies that are well aligned with the country’s strategic priorities. (See our “Visible Hand” series for more.) These beneficiaries include companies involved with artificial intelligence, cloud technology and hardware, and companies tied to evolving consumer trends. We have used recent volatility opportunistically, to build exposure in names that we believed to be oversold (see our post “Volatility Creates Opportunity in China’s Equity Market”.)

There are many opportunities elsewhere in the emerging markets, including India. As we discussed in our post, “India’s Stealth Bull Market,” we have invested in companies positioned to benefit from more robust consumer activity, an upward turn in the housing sector, and broad global secular growth themes. We believe several ASEAN markets that have been hit hard by the Delta variant may experience recoveries similar to what we’ve seen in India, which has the potential to improve sentiment for the broader emerging market asset class. In particular, Indonesia, Thailand, and the Philippines have announced plans to remove Covid-related restrictions, and we anticipate other countries to follow.

Learn more about the global and international funds: Calamos Evolving World Growth Fund (CNWIX), Calamos Global Opportunities Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX).

Mid-Cycle Transition is Volatile and Slow, but Return Outlook Is Positive Over Next Year

John Hillenbrand, CPA

The transition from the recovery period of the Covid-induced economic cycle to the mid-cycle continues, as we discussed in our mid-year outlook. However, the transition has been volatile and will take longer than we originally thought. The demand side of the economy is still positive, as consumer and corporate spending should remain at above-trend levels as the Covid crisis abates; demand levels for services improve; and companies rebuild inventories, expand capacity, and improve productivity.

The transition has been negatively influenced by the third Covid wave and the corresponding negative impacts on the supply side of the economy, including the global supply chain, transportation system and labor markets. Covid has highlighted the inflexibility of these systems and has led to a lack of availability for products and services, as well as higher prices. Although we believe the worst of the Covid healthcare crisis is behind us, the negative impacts from supply chain issues should persist through 2022, depending on end markets.

Covid has been the primary factor shaping the supply side of the economy, but other factors also are playing a significant role in the availability and prices of goods and services. These factors include income inequality (e.g., Covid relief payments made to lower-income citizens, and global governments seeking to pay for social programs by raising taxes on the wealthy and corporations) and climate change (e.g., unfavorable weather patterns, and the lack of investment in fossil fuel infrastructure). These economic drivers, and the responses of governments, corporations, and individuals to them have created a difficult environment for forecasting economic activity in the short run. Demand destruction is a short-term risk, given higher prices and the lack of availability of some products. We do expect these headwinds to resolve over the intermediate term and that economic growth will remain above trend for the next several years.

This change in the economic cycle and growth drivers should result in positive equity returns over the next 12 to 18 months but at more muted levels than the prior 12 months. This investment regime change in the short term should indicate market leadership transitioning away from the higher-risk equities (in both cyclical and growth areas) toward companies with higher return on capital, improving margins, and less volatile earnings. Third- and fourth-quarter earnings will highlight the severity of many of the issues described above, and the equity market may be volatile during this time. Once the market is past these near-term issues, we expect better progress toward a more normalized environment in the next year.

From an asset class perspective, in our positioning of Calamos Growth and Income Fund (CGIIX), we continue to favor equities over fixed income, with convertible securities being the most favored fixed-income security. With a decline in equity volatility over the last six months, we favor option strategies to manage risk, including creating synthetic convertibles with call options and buying put options for downside mitigation.

It is Far Too Early for “Late-Cycle” Positioning

The Fed’s steps toward tapering have led many to assume the boom phase of the recovery has been foreshortened. However, deceleration is built into any V-shaped recovery. The downshift from V-recovery to solid and above-trend growth should allow the risk cycle to continue despite Fed tapering.

For the past year, the news on corporate profitability has been stunningly positive. While market action into September could be interpreted as a deterioration in the outlook, we believe the key dynamic for equities will be a sustained rise in corporate earnings into 2023.

As investors search for reasons to be cautious, one popular narrative is that rising costs will damage corporate profitability. This narrative has been promoted as “supply-chain constraints,” with corporate transcript comments on this topic cropping up at record levels. Some high-profile misses in recent weeks would seem to support this trepidation especially in the auto, select industrial and retail industries.

But the argument that inflation pressures in the supply chain will undermine margins and thus profits is mistaken. The corporate sector is a producer of intermediate value-added inputs. Rising input prices put upward pressure on profit margins as other nominal and fixed costs tend to lag. For example, labor cost pressures are rising but lag the momentum of other parts of the business model that are more correlated with revenue.

There is a link from pricing pressures (or supply constraints) to profits, but it does not run directly through margins. If “supply chain issues” become a binding constraint on the output of volumes, as it has for the auto sector, that translates into a reduction in productivity. The ratio of other costs such as labor relative to nominal value added will rise and profits will be impacted negatively.

But the vast majority of businesses are not dealing with actual output restraints, with the implication that a robust PPI is still indicative of healthy corporate profits. The pandemic itself was a broad “supply-side shock,” yet profits boomed. Equally important, the supply constraints are not driven by a single cause, but by the complex interplay of ESG policies, which impact capital flows, the onset of and recovery from COVID and various geopolitical developments.

Earnings concern is premature as long as the momentum in nominal GDP is above trend, probably into mid-2022. Rising costs, either for intermediate inputs or labor, are an indication of persistent demand and manageable as long as revenue momentum is sufficient to allow margins to expand. The time to worry is when corporate managements enter an aggressive capital-investment cycle—we are not there yet.

Our investment conclusion rests upon the observation that corporate and economic momentum will continue to be robust well into 2022. While the monetary and positioning backdrop can pose difficulties at any stage of the cycle, today’s historic setting argues for leaning into risk assets as long as the fundamental momentum is apparent.

The summer rotation in favor of defensive and quality styles and the decline in U.S. bond yields highlight investor conviction that the stagnation of the past decade will persist. We believe it is far too early to be positioning portfolios for “late cycle.” The positioning of Calamos Phineus Long/Short Fund (CPLIX) is anti-correlated to this consensus, partly because markets are already priced as if this outcome is certain and partly because the post-2008 era is unlikely to be a prologue for what comes next.

The net equity exposure (delta-adjusted) concluded the quarter at approximately 60%, roughly in line with the start of the year. This broadly stable positioning for equity risk is consistent (relative to our strategic guidelines) with the bullish setting for equities. It compares with the average net equity exposure of 26% since the fund's inception in 2002.

Through 2021, we have argued for minimal pullbacks in the major equity benchmarks due to the extraordinary policy backdrop. However, the renewed rise in bond yields in late September implies rising vulnerability for long-duration equities, which are weighted heavily in today’s benchmarks. The fund has therefore implemented a number of put option risk-management strategies to minimize the impact of this.

The fund remains biased in favor of names perceived as the more cyclical and recovery positions. Our broadest cyclical exposure is industrials and transports, and then financials; we avoid the more expensive consumer cyclicals (retailing) and longer duration consumer equities (food and luxury).

While the broad themes across the portfolio have not changed, this obscures our activity at the stock level in favor of businesses that can navigate the ongoing recovery from the pandemic and thus, produce material earnings leverage. If our assumption of sustained economic expansion is correct, the fund’s industry and style bias should serve our clients well.

The fund is underweight the non-US economies and non-US revenues and thus, more levered to US domestic demand. This will inevitably shift when the US enters a sustained slowdown, perhaps later in 2022. For now, we struggle to allocate the long book outside the US (17.7% of total) as long as the opportunity set “closer to home” is robust.

Alternatives Positioning Update

Eli Pars, CFA

As fears of rising interest rates create headwinds for traditional bonds, and rotational, choppy conditions challenge long-only equity strategies, we believe Calamos Market Neutral Income Fund (CMNIX) and Calamos Hedged Equity Fund (CIHEX) offer important asset allocation benefits.

Calamos Market Neutral Income Fund. Designed to serve as an enhancement to a traditional fixed income allocation, Calamos Market Neutral Income Fund seeks to pursue absolute returns and income that is not dependent on interest rates. The fund combines two complementary strategies—convertible arbitrage and hedged equity—and we actively adjust the allocation as conditions evolve. At the end of the quarter, the fund’s allocation to each strategy was roughly 50/50, as it was at the start of the quarter. This split is also in line with our longer-term historical average.

In 2020, our allocation to convertible arbitrage reached 60%, reflecting soaring convertible issuance. Although issuance has slowed in the third quarter, we continue to find many opportunities. We remain active in the new issue and secondary markets, and we are replacing existing in-the-money convertibles and rebalancing with new convertible issues when possible. The weighted average delta of the convertible arbitrage strategy is near the median of its historic range, although it is a bit lower than it has been in recent quarters. We have reduced our exposure to deep-in-the-money paper and often take advantage of issuers’ willingness to pay full prices to encourage the conversion of their bonds.

Calamos Market Neutral Income Fund’s hedged equity strategy continues to be positioned with a higher-than-typical hedge ratio, which is also higher than it was at the beginning of the quarter. The higher the hedge ratio, the less exposure the fund has to equity market downside. Steadily declining realized and implied volatility and a strong bid in the markets for out-of-the-money puts have continued, which has sustained cheapness in put spreads. Consequently, we have been adding more put spreads to the fund’s hedged equity book, in addition to the outright long put allocation we always maintain in the fund.

Along with our primary strategies, the fund also has the flexibility to invest opportunistically, including in special purpose acquisition companies (SPACs). SPACs are shell companies that raise money, which they use to acquire companies seeking to go public. The closing of the acquisition is called a de-SPAC process, at which point the SPAC is usually a small-cap equity. SPACs resemble convertible securities in many ways. The typical structure of a SPAC is a $10.00 unit issue that includes a five-year warrant struck at $11.50.

We have seen the SPAC market grow briskly, and to us, this offers another way to add to value for the fund’s shareholders. There are many ways to invest in SPACs, and our use of SPACs is designed to support the fund’s historically lower-risk profile and steady returns. Drawing on our long-standing experience in convertible arbitrage, we are employing a SPAC arbitrage strategy at the margin of the portfolio, seeking positive returns with low risk. We are not investing in the volatile SPACs that often make headlines.

Similar to how we seek to isolate cheap options in the Fund’s convertible arbitrage strategy, we are using the SPAC structure to isolate cheap options with a risk profile that is similar to—and potentially even a little lower risk than—our convertible arbitrage strategy. We’re generally buying SPACs at $10.00 or less and trading out of them at $10.50 to $11.00, without adding a lot of equity sensitivity to the book.

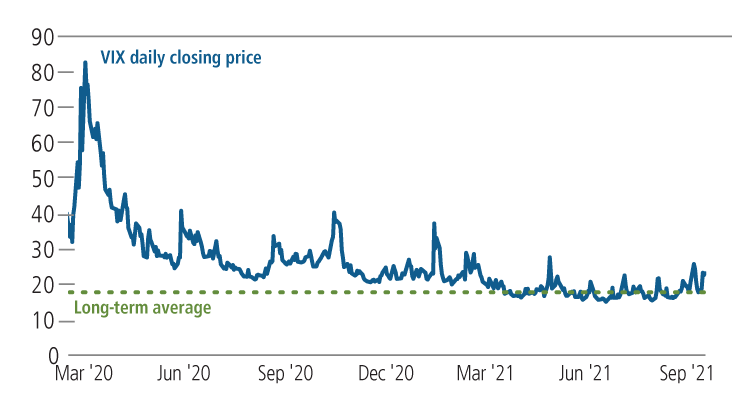

Calamos Hedged Equity Fund. Calamos Hedged Equity Fund is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. When the quarter began, the fund’s hedge was near the middle of our targeted range; declining implied volatility and the cheapening of put spreads allow us to build more skew into the portfolio. By the quarter’s end, we slightly decreased the fund’s hedge.

Similar to the hedged equity sleeve of Calamos Market Neutral Income Fund, we have layered in more put spreads than we have in several years, in addition to the outright long put allocation we consistently employ in the fund. The steady decline of volatility (realized and implied) and strong bids for out-of-the-money puts have created attractive opportunities in put spreads. This more attractive environment for put spreads has led us to reduce the fund’s call hedge.

Past performance is no guarantee of future results. Source: Chicago Board Options Exchange. Long-term average calculated from 9/30/2011-9/30/2021. The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

The Case for a Bullish Equity Narrative and ESG Investing

Jim Madden, CFA, and Tony Tursich, CFA

Markets closed out the third quarter on a turbulent note as stocks pulled back from all-time highs on persistent supply chain pressures, surging energy prices, looming Fed tapering, and political drama in the United States. Still, the longstanding bullish narrative for equities remains intact.

It appears that the Fed is turning away from its employment mandate to deal with inflationary risks. Some central banks are already hiking interest rates. Steepening yield curves and volatility in risk assets may be in the offing. Furthermore, strategists who had predicted another strong quarter of economic growth are cutting estimates because of supply-chain bottlenecks and the highly contagious Delta variant. Economic data has also been falling short of expectations. The Organisation for Economic Co-Operation and Development (OECD) predicted faster inflation and slower growth in its new forecasts. It now expects G20 inflation of 3.7% in 2021 and 3.9% in 2022. Pressures will gradually soften in the United States, but the group sees the rate above 3% through next year. The OECD trimmed its global growth forecast for 2021 to 5.7% from 5.8%. Despite this, we believe accommodative monetary policy, pent-up consumer and corporate demand, and economic normalization will prevail and be broadly supportive of equities.

Our investment process tilts toward quality and growth because we believe high-quality growth companies will outperform over the long term. For the quarter, growth stocks in the MSCI ACWI outperformed, while quality stocks lagged, as measured by MSCI factor indexes. Year-to-date, growth and quality stocks have trailed value stocks, which have rebounded after years of underperformance. However, the Calamos Global Sustainable Equities Strategy has held up well for both periods, which we believe demonstrates the merits of our selection approach.

Third-quarter Chinese stock market action reminded investors why it is imperative to be on the right side of the government when investing in China. Our positioning in China emphasizes industries where development is consistent with the Chinese Communist Party’s (CCP’s) latest five-year plan, the Belt and Road Initiative, and China’s longer-term transition to a more developed consumption-driven economy, now referred to as “common prosperity.” Our focus on companies and industries that are more closely aligned with the CCP’s development plans (e.g., government-supported industries such as clean energy and advanced manufacturing) proved advantageous as the Chinese market came under pressure during the quarter.

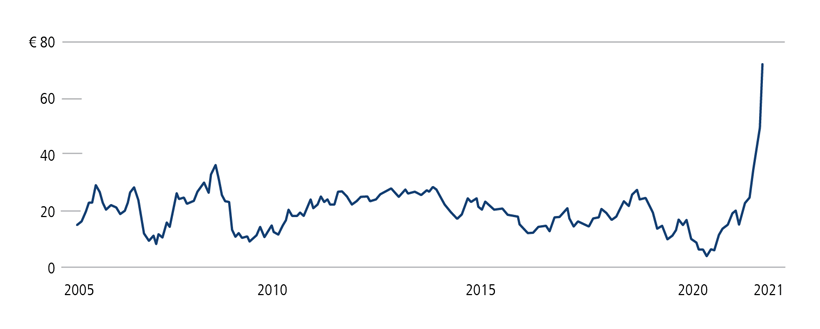

Energy has been a headwind for the Calamos Global Sustainable Equities Strategy this year but a tailwind over the long haul. We believe the oil-and-gas industry is in the midst of a long-term secular decline as the global economy continues to shift to clean renewable energy. Over the near term, however, energy sector returns dwarfed returns in global equity markets as oil and gas prices soared on supply and demand imbalances. Analysts have speculated that gas stockpiles in some European countries are 20% below normal amounts. A cold winter would add insult to injury. The energy sector was up more than 3%, compared with a decline of 1% in the MSCI ACWI for the third quarter.

European natural gas prices, per megawatt-hour

Source: Bloomberg based on data from Intercontinental Europe.

The shortages and price spikes of this current energy crisis will take time to normalize as governments address climate change by moving countries away from fossil fuels. The transition to cleaner energy is designed to make energy systems more resilient. However, the switch will take years and the journey will be volatile. In the meantime, the world will continue to rely on fossil fuels even as major producers are shifting their output strategies. Therefore, supply shocks will continue to influence markets and economies as the world transitions and electricity demand climbs. Volatility will provide opportunity for investors to participate in this long-term secular trend.

Flows into environmental, social, and governance (ESG) investment vehicles have continued at a brisk pace as investor interest strengthens. The rapid asset growth has also caught the attention of regulators, who are increasing their scrutiny of “greenwashing.” With no widely accepted definition of what constitutes ESG, companies continue to push limits in search of access to flows. Successful ESG implementation requires a clear and defined investment process that effectively addresses risk and opportunity. The Calamos Global Sustainable Equities Strategy employs a time-tested process to identify companies that have a vision and a plan to address efficiency in how they interact with the environment, society at large, and their shareholders. At the same time, there needs to be evidence that relevant factors are being effectively managed and incremental improvement is being made.

ESG factors influence opportunity and risk, and we believe our sustainable equity strategies are well positioned for both the near term and the long term. Companies with strong ESG management and oversight are less likely to experience disruptions to their growth, cash flows, and earnings visibility due to changing industry conditions and regulations.

Moderate Economic Expansion and Top-Line Growth Support Opportunity in Global Convertibles

Eli Pars, CFA

In recent quarters, we have discussed moving toward normalization in the context of getting back to activities restricted by Covid-19, and this shift starting to occur. However, this return to normalcy also means seeing a normalization in the economy. On the growth side, that means getting back to a healthy 2% real GDP growth from the much higher bounce-back levels of the last year. The resulting strong nominal GDP will be good for top-line growth and has historically been good for earnings, if costs don’t get out of line.

As growth moderates to a more typical pace, we expect inflation to follow suit. This may take a bit of time to play out, but we still believe it will be relatively shortly—in quarters rather than years. Although supply shortages and rising rates are at the forefront of investors’ minds, debt levels, demographics and technology are all still powerful deflationary forces.

The Federal Reserve may not be refilling the punch bowl as quickly as it once did, but it does not seem likely to take away the bowl any time soon. If short-term rates rise from 0% to 1%, then monetary policy is still quite accommodative. Combined with good earnings growth, this accommodative policy should propel equities higher, with convertible securities participating in the upside.

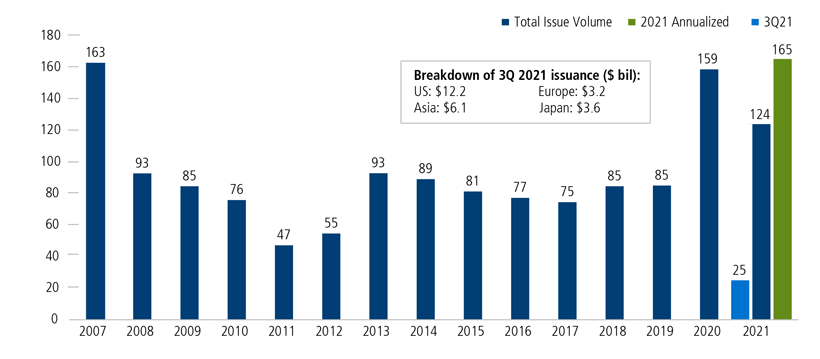

Globally, issuers brought $25 billion of convertible securities to market during the third quarter. Although running at a slower clip than during the first half of the year, this issuance is still healthy and not significantly behind the pace of the third quarter of 2020. For the year to date, issuance stands at $124 billion, roughly where it was at the same point in 2020 and well above the full-year levels before 2020.

As of September 30, 2021. Source: BofA Global Research.

We believe Calamos Global Convertible Fund (CXGCX) is well positioned with a risk/reward characteristics that offer an attractive balance of upside equity participation and potential equity risk mitigation. The fund’s level of equity sensitivity is a bit below that of the overall global convertible market. We believe this level is appropriate given the importance we place on managing downside risk.

We have maintained the fund’s roughly neutral weighting to US and Asia versus the Refinitiv Global Convertible Bond Index and are underweight to Europe. On a sector basis, technology continues to be the fund’s largest sector weight and its biggest overweight versus the Refinitiv Global Convertible Bond Index. We have remained active in the new issue market, as well.

Early Innings of a Prolonged Recovery and Real Rates Provide Tailwinds for Credit Markets

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

If we simply look at 10-year Treasury rates, we might presume little is happening in the bond market because the interest rate environment looks a lot like it did back in the first quarter. However, many things have changed. The Federal Reserve’s surprising shift in September to a notably more hawkish tone sets fixed income markets up for greater volatility in the coming weeks and months.

A taper of the Fed’s $120 billion monthly purchases of Treasury and agency mortgage-backed securities is coming—and it’s coming relatively soon. However, Chair Powell included a subtle but brilliant shift in rhetoric in his most recent remarks, redirecting the market’s focus away from when a quantitative easing program taper would begin and toward when it will be completed. The Fed has set mid-2022 as a target, providing itself breathing room to evaluate another month or two of data without pressure to begin tapering. Now that a goalpost is in sight, the pace of a taper is likely to be determined by the time remaining once the Fed implements the first reduction of asset purchases. That said, Powell’s term as chair is up in early 2022, and following the resignation of two Federal Reserve presidents over ethical concerns related to personal trading, there’s no guarantee that President Biden will nominate Powell to remain. Although a leadership change would most likely result in more dovish direction, a change of helm at the Fed opens the door to a wide range of outcomes, including unexpected shifts in policy or forward guidance.

Uncertainty around fiscal policy is another potential driver of fourth quarter interest rate volatility, as key senators on the Democratic side of the aisle stand firm on voting against a $3.5 trillion price tag on budget reconciliation. Without an known price tag or timeline for approval, the market is left to hypothesize what the related inflationary pressure might be. One thing is certain: Even in a much-reduced form, no one will accuse the budget of resembling austerity.

We continue to see signs of economic strength coming from both consumer and business-related sources. Personal income and spending both continue to grow at a strong pace, and corporate earnings are expanding to record levels. While demand remains strong, supply chain hardships remain. After the economy was closed for over a year, it’s not surprising that reopening is proving challenging. In our view, these trials are simply softening and extending the reopening period. As the economy moves from reopening to open, a return to long-term trend growth is our baseline expectation, with sustainable real GDP growth of 2% to 2.5%. It’s likely that we are in the early innings of a prolonged expansion cycle.

Inflation will drive nominal GDP growth significantly higher as the economy moves from above-trend inflation driven by transitory factors to stickier components, namely shelter and wages (see our post, “Inflation Casts a Longer Shadow”). Despite higher-than-trend inflation expectations, we expect real interest rates to remain in negative or very low territory, which will support risk assets, including investment-grade and high-yield credit markets.

Interest rates and credit spreads are trading in historically low ranges, and spread compression has driven compensation for the assumption of additional risk to near all-time lows. As such, across our fixed income strategies (Calamos High Income Opportunities Fund, Calamos Total Return Bond Fund, and Calamos Short-Term Bond Fund), we have been focused on migrating portfolio credit quality higher and being compensated for the idiosyncratic risks we are taking on behalf of shareholders. Although we do not anticipate drastically higher rates because of above-trend inflation, we are maintaining a cautious stance on portfolio durations.

As the Economy Transitions to a Mid-Cycle Growth Phase, Convertibles Are Well Positioned

Jon Vacko, CFA, and Joe Wysocki, CFA

We enter the fourth quarter of 2021 with a positive outlook on the convertible securities market based on our view of a broad economic recovery combined with a fundamentally attractive issuer base. New issuance has maintained a brisk pace with nearly $125 billion in convertibles coming to the market globally through the first nine months of the year, and we expect a busy calendar heading into year end. Companies continue to seek capital to take advantage of opportunities for growth, expansion, mergers, and increased research and development. We are excited by this broadening of the convertible market, which has included a healthy mix of innovative companies—including established convertible market issuers and those issuing convertibles for the first time.

On the economic front, recent data points have become more mixed. However, this is not uncommon for this point in the cycle. The rise in Covid cases over recent months may have contributed to some of the near-term volatility, and we are encouraged that case counts appear to be peaking, mortality rates have been contained, and there is continued progress on vaccinations. Importantly, we believe any delay in consumer activity associated with these factors will be temporary and will not derail the overall economic expansion already underway.

It has also become quite clear that the economy’s underlying strength will lead the Federal Reserve to taper its unprecedented levels of stimulus in the coming months. Although this is a directional change that could add short-term volatility to the markets, we anticipate any changes will be well communicated in advance, and overall policy will remain accommodative on a historical basis. We believe policy decisions will continue to be approached with the goal of avoiding restrictive outcomes that could cut off economic expansion prematurely.

In sum, we maintain our view that the economy is expanding but not overheating and will ultimately transition from early expansion to a mid-cycle growth phase. This likely means heightened volatility for the foreseeable future as market participants scrutinize each data point through this transition, but an environment of real growth with moderate inflation could be a very attractive backdrop for risk assets.

Financial markets have been rotational this year, and we anticipate this trend will continue. Our focus in positioningCalamos Convertible Fund continues to be optimizing the Fund’s risk/reward tradeoff by providing more exposure to upside in the equity markets than to potential downside. We seek to identify companies that are growing their intrinsic value through all market conditions, and we are identifying many individual companies where fundamentals are strengthening.

Actively managing the structural risk/reward among the abundance of new and existing convertibles can be a compelling way to position for longer-term upside in these potentially market-leading companieswhile also managing downside risk from short-term volatility. The fund’s largest exposures are to growth-focused sectors, such as information technology and consumer discretionary where we are finding secular opportunities in areas such as cloud computing, internet security, e-payments, e-commerce and many other “at-home” trends that accelerated during the pandemic.

We believe there are also strong cyclical opportunities that can outperform as consumers drive the next leg of economic expansion. These span multiple industries, including airlines, cruise lines, retail, entertainment, and semiconductors. The fund’s largest relative underweight exposures are to more defensive areas, such as the financial sector where we believe convertible structures are less attractive.

In closing, we believe the fundamentals of the convertible market remain strong. Continued volatility and rotations within the financial markets may occur but are not uncommon as the economy transitions toward the next phase of expansion. We believe the strategic case for convertibles to help navigate this volatility without sacrificing upside participation remains intact.

Strong Fundamentals, Attractive Valuations Set the Stage for Sustained Small-Cap Opportunity

Brandon Nelson, CFA

Small caps, as measured by the Russell 2000 Index, took a breather on an absolute and relative basis during the third quarter. They fell 4.36% in absolute terms and lagged the large cap Russell 1000 Index by 457 basis points. One footnote, however—during the month of September, the Russell 2000 Index broke a six-month relative losing streak and outperformed the Russell 1000 Index. Time will tell if this will mark an inflection point for small caps. Also, recall, when the Russell 2000 Index has been up over 10% during the first half of the year, it has tended to rise another 12% during the second half of the year. Given the Russell 2000 Index fell during the third quarter, we believe we could be setting up for a substantial rise during the fourth quarter. One final interesting fact: small caps have tended to outperform large caps during November, December, January, and February. Keep that in mind as we progress through the fall and early winter.

Small caps were very strong during the first 10 weeks of the year but have since been flattish. We think they are digesting a big move that began in September of 2020 and the outlook remains bright for the asset class. Fundamentals are strong and valuations relative to large caps are low by most measures. History shows when relative valuations get to these levels, the probability of small-cap outperformance over the next 12 months is high and can be meaningful. Additionally, we believe we are only one year into a sustained, multi-year leadership role for small caps.

If we are correct about the prediction for small cap strength, we also expect micro caps—the smallest of the small—to be solid investments. They are especially inexpensive and could rally disproportionately if the small cap category attracts more assets from individual investors and institutions.

Due to our positive outlook for small caps, we have positioned Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) to have notably heavy exposure to small caps, especially micro caps. We believe this positioning has added value in the past and will continue to for the rest of 2021 and beyond.

Looking more closely within the two funds, we continue to have exposure to both long-term secular growth stocks and certain cyclical growth stocks that should benefit meaningfully from a continued economic uptick. A noteworthy portfolio change made during the third quarter was to decrease our weighting in consumer discretionary stocks. This had been an area of greater emphasis but given the continued macro murkiness tied to Covid-19 and supply chains disruptions, we reduced exposure but remain overweight relative to benchmarks. Another change was to increase exposure to technology stocks, especially certain software stocks that are seeing strong secular trends.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Hawkish refers to a Federal Reserve stance favoring the raising of interest rates. In financial terminology, delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

Returns or Risk/Rewards statistics presented reflect the Calamos Global Sustainable Equities Composite, which is an actively managed composite that utilizes an integrated proprietary ESG process benchmarked to the MSCI ACWI Index to invest in common stocks, preferred stocks, securities convertible into global common stocks, and U.S. dollar-denominated American Depository Receipts, primarily in high-growth industries and companies worldwide and across all market capitalizations. On August 25, 2021, Calamos acquired Pearl Impact Capital, LLC, which has managed the strategy since its inception in 2019. The Calamos Global Sustainable Equities Composite was formerly named the PIC Global Opportunities Portfolio. This name change was effected August 25, 2021.The Composite was created January 1, 2019, calculated with an inception date of January 1, 2019. The Composite results include all fully discretionary accounts, including those no longer with the Firm.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the U.S. equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of U.S. small cap performance. The Russell 1000 Index is a measure of U.S. large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.