Investment Team Voices Home Page

Investment Team Voices Home Page

India’s Stealth Bull Market

Paul Ryndak, CFA, and Kyle Ruge, CFA

Market headlines and the returns for broad emerging market indexes mask the stealth bull market that is developing in select emerging markets this year. Many investors would likely be surprised to learn that although the MSCI Emerging Market Index is flat year-to-date, the MSCI Emerging Markets Index ex China is actually up 9.4% this year through September 28, 2021.

Given China’s size and dominance on the world stage, what’s happening there tends to dominate discussions about emerging markets. And certainly, China’s equity market on the whole has struggled this year due in part to changing regulations and, more recently, the Evergrande fallout. However, taking too broad a view risks missing opportunity. As we’ve explained in our “Visible Hand” series and our recent analysis of Evergrande’s difficulties, our research has uncovered many areas of opportunity in China beyond the headlines—for example, in niches of the market that are enjoying policy tailwinds.

Similarly, our active approach to allocating capital across emerging markets considers a breadth of opportunities, not just China. We’re identifying other countries, such as India, that are enjoying economic tailwinds. India is quietly having a very strong year. The MSCI India Index is up 27.6% year-to-date through September 28, and up 15% in the third quarter-to-date alone.

India faced many pressures earlier in the year: A resurgence in Covid cases led to soaring hospitalizations, new lockdowns, and a sharp pullback in economic activity. In turn, these pressures contributed to a short-lived correction in equity markets in April. However, there are many positive tailwinds that have been less covered.

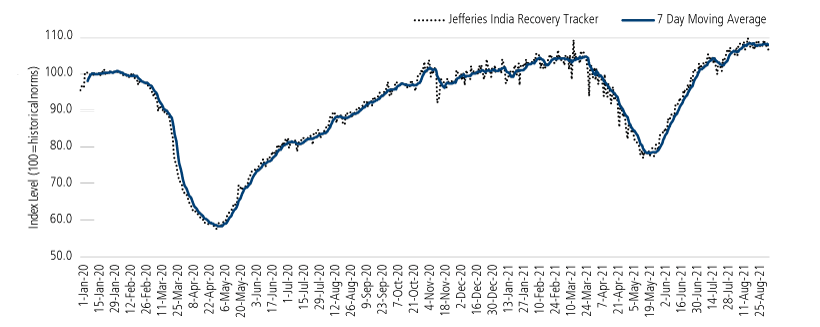

Since mid-April, the Indian equity market has bounced back strongly and is now outperforming all other major markets globally. We viewed the weakness in April as a good opportunity to increase exposure to India, particularly given the improvements we were seeing in Covid-19 data and corresponding economic activity (Figure 1), and the government’s announcement of plans to use stimulus to support a post-Covid-19 recovery. (See our July outlook, “Holding Pattern: Synchronized Global Recovery Delayed, Not Dismissed”). In addition to these short-term catalysts and opportunities, we like how the long-term prospects of the Indian economy are developing.

Jefferies India Recovery Tracker

Source: Jefferies, “Greed & Fear,” September 23, 2021.

India: A Long-Term Growth Story

We believe India is one of the most compelling long-term growth stories in emerging markets. In addition to its young, growing economy and a pro-growth government, India’s population of 1.3 billion provides a massive workforce and consumer base that should continue to purchase more as wages grow.

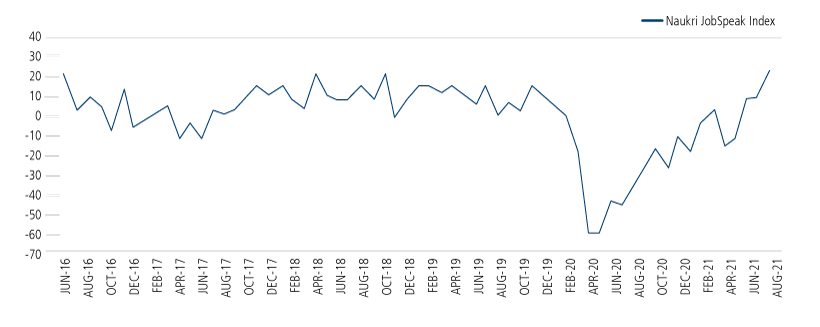

Our analysis of job opportunities within India’s economy provides valuable insights into India’s growth story (Figure 2). New business registrations are growing strongly, and new business formation in the manufacturing and agricultural sectors has more than doubled since 2019 (Figure 3). Pro-growth reforms, geopolitical considerations, and supply-chain shifts have all contributed to this surge in business registrations. India stands to reap substantial economic benefits from the relationships it has established with companies in the US and Europe, which view India as an attractive destination for reallocating key supply chains and adding capacity in new end markets. And, as the Covid-19 Delta variant wave ebbs, the reopening of service sectors and tourism further improves the employment picture.

(%YoY)

Source: Jefferies, “Greed & Fear,” September 23, 2021, using Naukri, Jefferies.

Source: Macquarie Research, September 10, 2021, using MCA, MOSPI, IndiaDataHub, Macquarie Research, September 2021.

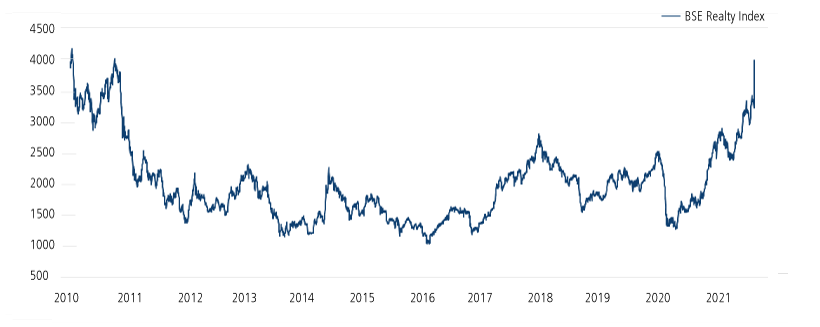

Optimism is also building around India’s housing market, and demand for housing construction offers another strong source of employment opportunities. After an eight-year downturn in the wake of policy reforms to clean up bad practices in the real estate development industry, India’s real estate sector has already gone through the deleveraging and consolidation period that is beginning to unfold in China’s real estate sector. Since 2019, India’s real estate policy has begun to turn more favorable, the overall housing market is more affordable than it has been in more than 10 years, and inventories are at seven-year lows.

BSE Realty Index

Source: Jefferies, “Greed & Fear,” September 23, 2021, using Bloomberg.

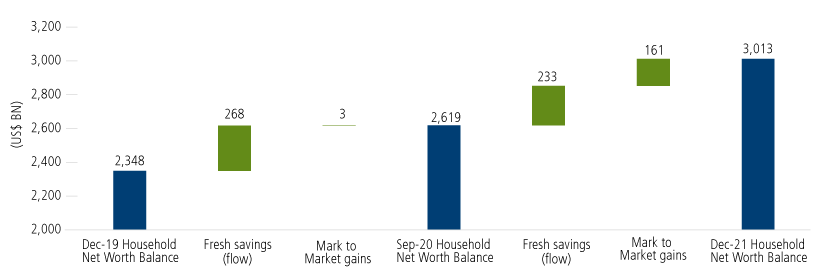

This dynamic provides volumes of employment opportunities and helps create a more virtuous growth cycle and a stronger backbone for the economy. Another positive is that the Indian consumer is coming out of the Covid Delta variant wave on much stronger footing with better household balance sheets and larger savings balances versus the pre-Covid period (as illustrated by the blue bars in Figure 5). Additionally, income levels throughout India had already been expanding and this trend is expected to continue.

Movement in household financial net worth (gross financial assets – gross financial liabilities)

Source: UBS “India Market Strategy,” September 6, 2021, using CMIE, RBI, AMFI, NABARD, CGA, SEBI, NHB, company disclosures, Capitaline, Bloomberg, and UBS.

Where We Are Finding Opportunities in India’s Equity Market

Throughout the past two quarters, we have continued to build positions in India, in areas such as financials, consumer, technology and industrials. India represents nearly 20% of Calamos Evolving World Growth Fund (CNWIX) as of the most recent month end.* We are investing in many companies that provide access to India’s emerging consumer.” These include exposure to food and beverage providers and a hotel chain operator, all standing to benefit from the trend in consumer preferences to upgrade to higher quality products and higher levels of discretionary consumer spending as the economy reopens.

Within the housing sector, we have invested in property developers that have recognized the housing cycle turn early and will potentially benefit from growth in the residential sector. We also have exposure to larger private banks within India that are positioned to benefit from a cyclical upturn in the overall economy.

In addition to the encouraging country-specific tailwinds we see, India is also participating in global secular growth themes. For example, India’s investments in technology have resulted in favorable opportunities not only for information technology companies but also for businesses in health care, payments, and e-commerce.

Conclusion

Every country offers unique investment opportunities as well as challenges—and these are always changing. As active managers, we focus on understanding these unique dynamics and using these insights as a foundation for allocating capital. This active management and nuanced approach are especially important for navigating the risks and opportunities in emerging markets. During times of swift transitions and heightened volatility, equity performance can deviate drastically among countries, with policies and market conditions changing rapidly.

In our view, our attentiveness to country-specific factors and a selective approach can continue to give us an advantage in adding value over time. We believe our current positioning in India exemplifies this and that our strategies will be well served by a breadth of companies that can benefit from the strong fundamentals that are developing in India.

Past performance is no guarantee of future results.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Unmanaged index returns assume reinvestment of any and all distributions and, unlike fund returns, do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index. The S&P BSE Realty Index is designed to measure the performance of companies in the real estate sector. It is calculated using a float-adjusted market-cap-weighted methodology. The Jefferies India Recovery Tracker (JRT) is the Indian economic recovery tracker monitored by Jefferies Indian office and shows the level at which the economy is operating. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. The index is calculated on a total return basis, which includes reinvestment of gross dividends before deduction of withholding taxes. The MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 101 constituents, the index covers approximately 85% of the Indian equity universe. The Naukri JobSpeak is a monthly Index that calculates and records hiring activity based on the job listings on the Naukri.com website month on month. The objective of Naukri JobSpeak is to measure the hiring activities in various industries, cities, functional areas, and experience levels.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

* As of August 31, 2021, the fund’s allocation to India was 18.9% of net assets. Holdings and weightings are subject to change daily. Holdings are provided for informational purposes only and should not be deemed as a recommendation to buy or sell the securities mentioned.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

18916 0921

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.