Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, July 2021

Outlooks from our Investment Team

- Calamos Growth Fund (CGRIX): Growth Stocks Back in Leadership Role

- Calamos Growth and Income Fund (CGIIX): As the U.S. Economy Transitions to Mid Cycle, We Expect Less Volatile Equities to Lead

- Fixed Income Funds: Fiscal Policy Will Be Key for Defining Just How “Transitory” Inflation Will Be

- Global/International Funds: Synchronized Global Recovery Delayed, Not Dismissed

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): Small Caps Are in the Early Stages of a Multi-Year Move of Outperformance

- Calamos Convertible Fund (CICVX): U.S. Convertible Market: Numerous Reasons for Optimism, Abundant Opportunities

- Calamos Global Convertible Fund (CXGCX): Vaccinations, Valuations and Reopening: A Favorable Backdrop for Global Convertibles

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Positioning Update

- Calamos Phineus Long/Short Fund (CPLIX): A Robust U.S. Economy Can Push Equities to New Heights

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

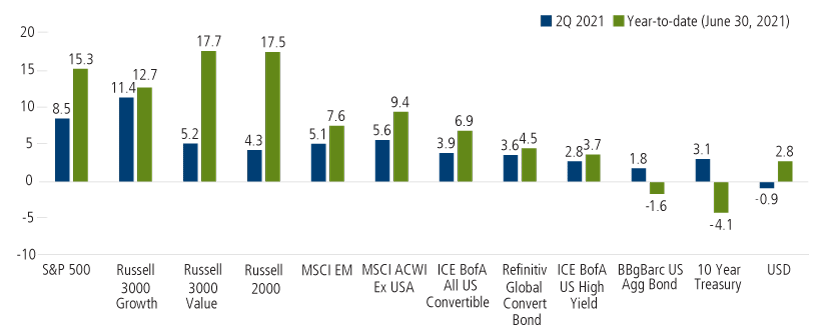

During the second quarter, crosscurrents related to monetary policy, fiscal uncertainties, the pace of economic growth, rising interest rates and inflation drove market performance. Equities and convertible securities posted healthy gains, with U.S. stocks leading the way. In recent commentaries, we’ve encouraged investors to be prepared for volatility and leadership rotation—both proved to be par for the course during the quarter, with growth equities coming back strong to lead over value. In the fixed income markets, both investment grade and high yield bonds advanced, with the latter outpacing the former.

Looking to the second half of the year, investors should be prepared for sideways moving markets. Many of the concerns that have shaped markets during the first half of the year will remain at the forefront of investors’ attention. Uncertainty surrounding inflation, interest rate hikes, and the impact of Covid variants will contribute to choppy markets in the second half of the year. Fiscal policy will also contribute to volatility, as markets contemplate potential changes to the tax and regulatory environment.

Total Return % as of June 30, 2021

Source: Morningstar. Past performance is no guarantee of future results.

From an asset allocation standpoint, we encourage investors to stay invested, diversified and focused on the long term. The flipside of volatility is opportunity, and we see plenty of runway for active managers in a stock pickers’ market, as well as opportunities in convertibles and select areas of the fixed income market.

The economic recovery in the U.S. has been especially robust, supported by Covid vaccination progress, fiscal stimulus, strong consumer activity, job growth, and corporate innovation and profitability. This economic backdrop and strong corporate fundamentals provide ample reason for optimism. The rise in inflation that we’ve seen so far this year may have been sudden but is not out of control, nor is it surprising given the broader landscape. More recently, inflation data has come in a bit—both in terms of real data and future expectations. While oil and other commodity prices remain high compared to pandemic levels, we’ve also seen those come in as well.

In June, the Fed indicated that short-term interest rate hikes could begin sooner than many anticipated, leaving some investors unsettled. What’s important to remember is that a rate hike and a policy mistake are not the same. No one can predict with certainty when the Fed will begin tightening, but a well-timed Fed rate hike would not bring the market crashing down, especially if economic recovery is on track and the consumer is strong. A timelier start to a tightening cycle could reduce pressure on the long-end of the yield curve and be preferable to the Fed waiting too long and having to play catch up.

Also, many investors are wondering how much further the stock market can advance and if stock prices have risen too high. Valuations may be high relative to history, but by and large, they remain attractive relative to underlying company fundamentals, positive earnings announcements, growth potential and interest rates. In this period of accelerated disruption, many corporations are exceeding earnings expectations, both through innovative business strategies and by making cost cuts and adjustments that have significant positive impacts to the bottom line. Of course, there are pockets in the market where valuations are stretched—to me, this once again underscores the importance of active management and risk-aware bottom-up security selection.

Our investment teams continue to find many well-priced opportunities across asset classes, market caps, industries and geographies. These include long-term secular growers as well as beneficiaries of economic reopening. As they will discuss in their posts below, our teams are seeking well-run businesses with sustainable growth prospects, and securities that offer attractive compensation for their risks.

We’ll be adding commentaries from more of our teams in coming days, as well.

Growth Stocks Back in Leadership Role

Matt Freund, CFP, Brad Jackson, CFA, Michael Kassab, CFA, and Bill Rubin

The environment for growth investing remains attractive, with strong tailwinds from a rapidly improving economy, surging corporate earnings, exceedingly supportive fiscal and monetary policies, and a welcomed retreat in long-term interest rates. We believe the Calamos Growth Fund (CGRIX) is well-positioned to benefit from this current backdrop. Our team has identified ample opportunities within several long-term secular growth areas, as well as more near-term cyclical growth industries benefiting from the ongoing normalization of consumer and business activities.

During the second quarter, the U.S. equity markets continued to gain ground, with the S&P 500 Index now up about 15% year to date. The pace of the equity market gains have been quite remarkable, as the index has established a new all-time high each calendar month since the vaccine announcements in mid-November. Even more notable, the S&P 500 Index has not endured even a single 5% pullback throughout this stretch.

Although the stock market has been steady on the surface, one look underneath the hood paints a more interesting picture. Value stocks, powered by the industries best positioned to benefit from the global recovery, led the way for the first five months of the year. Since the start of June, however, growth stocks are once again decisively back out front.

This renewed strength in growth stocks has been led by the mega-cap, highly profitable technology companies, as these “rested champions” have regained their leadership position from years past. What happens from here largely depends on trends in several key factors—economic growth, corporate earnings, interest rates, and inflation—along with just how much the new Delta variant leads to renewed Covid concerns.

If there is one thing most investors can agree upon, it is that the U.S. economy is firing on all cylinders. Manufacturing data remains robust, as businesses continue to play catch-up to outsized demand. At the same time, consumer spending continues to surge, with pent-up spending fueled by stimulus checks, increasing payrolls, and healthy household balance sheets. With this as a backdrop, corporate earnings are poised to hit record levels this year and next.

Inflation. The problem, of course, is that this simultaneous resurgence in business and consumer demand, both here and abroad, is driving up the cost of just about everything. While it is true that a little bit of inflation can be a good thing for both the economy and stock prices, a prolonged period of elevated inflation comes with its own set of risks. While Fed Chairman Powell has held firm that the surge in inflation measures will prove “transitory,” a growing crowd believes the higher pricing environment could stick.

While we are closely monitoring the current inflation dynamics, we tend to fall more into the “transitory” camp. Prices within the manufacturing sector will understandably remain elevated until logistics disruptions fade and manufacturers ramp up production to satisfy outsized demand. The same is true for the services sector. Anyone in the market for a new or used car, or trying to book a long overdue vacation, knows there is no choice but to pay up this year—but few would believe these price increases are permanent. With that mindset, we believe forward inflation expectations should ease in coming months and investors will continue to look-through elevated measures for now. However, certain sources of pricing pressure, including higher wages and regulatory/tax changes, may prove longer lasting.

Valuations. In our mind, the more interesting debate centers on valuations, and by extension, interest rates. While it is true that forward price-to-earnings multiples are above the long-term average, we would hardly characterize the market’s overall valuation as exuberant—particularly when taken in context of the current interest rate environment. We expect corporate earnings growth to remain robust for the next several years given sustained economic strength, and equity prices typically do not peak much before earnings peak in a given cycle. With that said, we are wary of select long-duration “concept stocks” that grab headlines, but exhibit valuations stretched beyond our comfort level. These stocks are also the most vulnerable to any future spike in long-term interest rates.

Putting it All Together. Overall, we believe Calamos Growth Fund is well-positioned for this next phase of economic expansion, but we know markets do not go up in straight lines forever, particularly with negative Covid headlines reemerging. With that in mind, we remain vigilant for the challenges that remain ahead and know that enhanced diligence and discipline are key requirements for continued success.

As the U.S. Economy Transitions to Mid Cycle, We Expect Less Volatile Equities to Lead

John Hillenbrand, CPA

The U.S. economy is transitioning from early cycle to mid cycle as the positive impacts of fiscal and monetary policies and the vaccination rollout begin to wane and are replaced by more traditional, sustainable, but less robust growth drivers. We expect positive returns for risk assets during this transition period, with equity market return leadership shifting toward more profitable and less volatile companies.

The transition to mid cycle should result in lower but still above-longer-term trend GDP growth rates in 2022. Most of the Covid-related fiscal programs are set to roll off in 3Q21, and many of the emergency monetary programs have already been wound down. A significantly large QE program and a near-zero-interest fed fund rate remain, but we expect more restrictive policies in 2022 and 2023. Finally, vaccination efforts in the U.S. have yielded positive results, but the pace of vaccinations has slowed considerably, and a meaningful proportion of the population remains unvaccinated. These policies should continue to have positive, but more muted, impacts on economic growth in the future.

Despite the slowing positive effects of these policies, we believe this decelerating growth will be in the form of a soft landing for most parts of the economy. Economic growth drivers will transition away from policy programs and toward higher consumer spending levels (supported by strong balance sheets, improved employment and wages) and higher corporate capex spending and inventory rebuilding (supported by increased productivity and profitability). Demand for consumer services continues to increase, and demand for goods should moderate but not decline in aggregate. In 2022, we expect employment levels to transition back to pre-Covid levels, although many people may end up in different jobs with likely higher wages.

Corporations have ample liquidity and more streamlined cost structures to appropriately address increased demand, related input inflation and near-term supply shortages. Increased levels of mergers should provide opportunities for revenue and cost synergies and growth investments. We believe the Biden administration’s two-part spending and infrastructure policy plans are positive for some parts of the economy, but increased taxes and regulation may mute some of the positives.

We expect this soft-landing period will be characterized by volatility in economic data as a sustainable equilibrium is found in labor and good markets, resulting in stabilized inflation and interest rates. Risks include further slowing growth in low vaccination geographies, a greater slowdown in goods consumption and overly aggressive increases in taxation and regulation. The Covid Delta variant is also expected to be a source of economic volatility, especially in places where vaccination rates are low, both in the U.S. and internationally. Although we view rising cases and deaths from the Delta variant as a temporary factor, we do believe it can have a negative effect on consumer behavior and market sentiment.

This change in the economic cycle and growth drivers should result in positive equity returns over the next 12 to 18 months but at more muted levels than the prior 12 months. This investment regime change should see market leadership transitioning away from the higher-risk equities (in both cyclical and growth areas) toward higher return on capital, improving margins and less volatile companies. From an asset class perspective, our positioning of Calamos Growth and Income Fund (CGIIX) continues to favor equities over fixed income, with convertible securities being the most favored fixed income security. With a decline in equity volatility over the last six months, we favor option strategies to manage risk, including creating synthetic convertibles with call options and buying put options for potential downside mitigation.

Fiscal Policy Will Be Key for Defining Just How “Transitory” Inflation Will Be

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

- The U.S. economy is booming after a government mandated cessation of activity. We can think of the economy as being like a beach ball that is held down under the water and then released. It explodes upward and hits the water with force, but over time, the ripple effects moderate. There’s still plenty of upside in the recovery, but after an extended period of upside surprises, U.S. economic data is by-and-large coming in at expectations, suggesting this moderation may have already begun.

- Fiscal policy will be key in driving inflation down, as unemployment benefits are distorting demand and supply for workers.

- The Fed is not planning to take away the punchbowl this year. At most, the Fed is paring back on how much it is pouring into the punchbowl. We expect short-term rates to remain near-zero for the remainder of the year.

- We continue to expect the yield of the U.S. Treasury to remain in a range of 1.40%-1.60% throughout most of the year, though potentially drifting a bit higher as 2021 comes into focus. Against this backdrop, we expect a modest steepening of the yield curve.

Right now, one of the central debates in the market hinges on a single word: “transitory,” which the Fed has used to describe its expectation for how long higher inflation will last. The consensus expects the higher inflation data of the last two-to-three months to fade quickly, as the impact of low base effects and reopening spending wanes. However, expectations that inflation may fade as soon as this fall may be premature because supply chain disruptions may persist longer and there’s still a lot of pent-up demand. Adding to the uncertainty, Fed survey data and comments indicate that governors expect “transitory” inflation could potentially last as a year or longer.

Many would say a year is not exactly fleeting, but Federal Reserve Chairman Powell has an incentive to state conservative timeframes at this stage, which provide the Federal Reserve with more latitude. The Fed wants to avoid a Japan-type scenario. This worse-case scenario would have the Fed raising rates too soon, with the curve flattening at current levels. Instead, the Fed wants the long end of the curve to rise up first, giving the Fed the latitude to pull short-term interest rates up.

We don’t have a crystal ball, but we do believe this burst of inflation is likely to fade as inventories are rebuilt, supply chains adjust to the post-Covid world, and the labor market stabilizes. We also believe the market may be overreacting to recent Fed comments and to the data itself. Inflation has not been surprising, especially when we consider how unusual this recovery has been. Another aspect to consider is that there were some very large outlier contributors to recent Consumer Price Index data, including used car prices, airline fares, and leisure lodging. On the other side, rental data in the CPI has been surprisingly low.

Raw material prices are an area where we may see a downward shift in inflation. Copper and lumber, both significant inputs for infrastructure and home construction, are down 10% and 50%, respectively, from recent highs. In the case of lumber, prices had skyrocketed due to supply disruption, a circumstance that still exists in many industries. These moves lower should be reflected in June’s Producer Price Index report. Should these declines be sticky, they would pass through to lower consumer prices in a matter of months, including to areas that are large inputs to core inflation.

Whether high consumer price inflation is a trend or transitory also comes back to whether the experience of wage inflation is a temporary phenomenon. It is hard to walk into a business of any kind at this point without hearing, “I’m really sorry for the wait, we’re understaffed …” According to recent surveys, as many as nine million jobs are currently available in the United States. As employers attempt to draw idle workers back into the active working population, they are continually confronted with the demand for higher hourly wage rates and salaries. As the Fed has stated, it does take time to match open positions with qualified candidates, particularly for skilled labor. While many of the positions available do not require advanced skills, employers are still fighting against large unemployment benefits in many states. The headwinds are particularly stiff in states with large urban centers that are participating in the federal pandemic unemployment program.

Although we only have a couple of weeks of data available so far, states that have discontinued federal pandemic benefits are seeing more applicants per available position and a greater number of people returning to work than those states that continue to offer crisis benefits. So, after federal benefits lapse in September, we expect more people will return to work nationwide, which should relieve some of the pressure on wage growth and inflation.

It is important to point out that changes in inflation and changes in interest rates are not the same. Expected inflation ranges do factor into the pricing of intermediate- and long-maturity debt. However, the measures do not move as one, and often move in opposite directions. That said, our team’s expectation that inflation will eventually prove to be transitory informs and influences the positioning of our portfolios.

Calamos High Income Opportunities Fund (CIHYX). We continue to view bank loans as an attractive way to help manage overall interest rate duration through a barbelled portfolio construction. (Bank loans typically have shorter durations, which we pair with longer-duration high yield debt.) With overall credit spreads nearing all-time tight levels, it has become a credit picker’s market. The team has been migrating portfolio credit quality higher by adding BB-rated positions while selling down our CCC-rated credits. As always, we apply our active, bond-by-bond approach to take risk when we believe shareholders are being well compensated.

While off the peak issuance volumes from early this year, a high volume of new debt is consistently brought to market and has met strong demand. The technical backdrop for high yield continues to be favorable, in our view. Just as last year’s supply-demand technical environment was heavily influenced by “fallen angels”—bonds that joined the high yield market as a result of downgrades—we expect many issuers to exit the market as “rising stars”—bonds that are upgraded to investment grade status. The resulting shrinking of the market size should further support the strong technicals.

Calamos Total Return Bond Fund (CTRIX) and Calamos Short-Term Bond Fund (CSTIX). In seeking to provide an income advantage to respective benchmarks, each of the funds continue to overweight corporate bonds and asset-backed securities. Similar to the high yield market, each of these market segments benefits from heavy demand, which is supporting the tight spread trading environment.

We believe we could see higher long maturity rates before year end, resulting in a steeper yield curve. As such, Calamos Total Return Bond Fund is positioned with a shorter duration than its benchmark, particularly through an underweight to securities with a duration of 10 years or greater. Given our confidence in the Fed’s guidance that overnight borrowing costs will remain near zero in the second half of 2021, we continue to maintain a neutral benchmark duration position in Calamos Short-Term Bond Fund.

Synchronized Global Recovery Delayed, Not Dismissed

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

The following is an excerpt from our 3Q 2021 outlook, which you can read in its entirety

The second quarter brought new concerns for changes in monetary policy and the threat of a Delta variant on global growth outlooks, contributing to a highly rotational market. While we monitor these risks, we are encouraged by the resilience of markets such as Brazil and India, which were hit hard by the Delta variant and have historically been susceptible to changes in U.S. monetary policy. These markets provide a template for how global markets can respond to these changing conditions.

In our view, the market is overstating the risk that the Fed tightens too early. We also do not believe inflation will rise to a level that forces the Fed to abandon its new framework. We expect monetary policy will remain highly accommodative for the next several quarters and likely longer. We have grown more concerned that new Covid variants, particularly the Delta variant, could become a headwind delaying the synchronization of a global recovery. Even so, we believe that synchronization is a question of when, not if. We continue to believe clearer skies are on the horizon. Reflecting this, our portfolios are positioned with a balance of cyclical growth/Covid-reopening exposure and secular growers.

United States. Significant vaccination progress has been the linchpin in a broad reopening and the ramp-up of activity across the country. Manufacturing data continues to be robust, and inventory levels remain low, which portends sustained strength. That said, economic surprises have decelerated markedly since the second half of 2020, and the rate of vaccinations is no

longer accelerating. Although job growth has been very strong and 70% of the jobs lost in the first half of 2020 have been recaptured, recovering the next 30% of those jobs will be more difficult given productivity gains and permanent disruption caused by Covid shutdowns. Overall, our positioning in the U.S. market remains largely unchanged from the beginning of the year. We continue to favor a balance of cyclical and secular growth exposure in the portfolios.

Europe. During the quarter, European companies aligned with Covid reopening trends began catching up to U.S. Covid recovery names. Even with these gains, we believe there is still significantly more catch-up potential for the European Covid recovery cohort. Supported by strengthening global product demand, European manufacturing PMI data remains healthy. Meanwhile, resurging activity in the eurozone’s contact-intensive travel and leisure industry and the brick-and-mortar retail sector are helping to drive a strong recovery in services PMI, with data in catch-up mode versus the United States. Given that services represent more than 70% of total contribution to GDP in Europe, this additional upside should have a significant impact. Moreover, this improving economic picture has contributed to a steady stream of positive EPS revisions from European companies.

On the whole, our outlook for Europe remains constructive given a number of factors, including households’ willingness and ability to spend, further Covid reopening, fiscal support, and underlying economic strength and stability. Additionally, the structure of the market positions Europe to benefit from an environment of increasing interest rates and reflation. These dynamics provide tailwinds to a healthy number of European companies. Our portfolios also hold meaningful exposures to strong global franchises located throughout Europe that remain aligned with secular themes, such as luxury, biotech innovation, and global payments.

Japan. We remain selective, emphasizing companies that are globally competitive and benefiting from improvements in global growth and the capital investment cycle. The Japanese equity market is heavily weighted toward high-quality industrial, technology, and manufacturing companies that export goods globally—in other words, companies that would be positioned to benefit from improvements in global growth and increased capital investments. Many of these areas underperformed due to concerns about China’s slowing credit growth and the timeline for European reopening, but corporate fundamentals remain compelling. During the most recent round of earnings announcements, we were encouraged by the number of companies beating earnings expectations and providing positive revised guidance on future earnings. We also believe many Japanese companies can benefit from investments that the G7 makes as part of its Build Back Better World plan.

Emerging Markets. The resilience of emerging market equities as the dollar strengthened during the final weeks of the quarter supports our view that emerging markets are on better footing to withstand U.S. rate increases than they were in 2013. (For more on this increased resilience of emerging markets, see our posts, “Taper Tantrum Redux? History Often Rhymes, but It Rarely Repeats” and “For Today’s Emerging Markets, A Less Accommodative Fed Would Be More Bark Than Bite.”)

We have increased our emphasis on companies that are best positioned to benefit from a recovery in global growth. Central banks in emerging economies, such as Russia, Brazil, the Czech Republic, Hungary, and South Africa, have already begun rate hikes or plan to do so soon. Other countries, such as Chile, are expected to announce plans to tighten soon as well. While the market has discounted earlier rate hikes by the Federal Reserve, many emerging economies will raise rates even sooner and to a larger degree. This will likely prove to be a headwind for dollar strength as investors seek higher yields outside the U.S.

India. India is well represented across our portfolios. We continue to like India’s long-term growth potential and have used pullbacks in the equity market to add exposure. The country’s economic prospects are bolstered by its strategic partnerships with U.S. and European companies and the government’s pro-growth and stimulus measures. From a sector perspective, we have identified opportunities in the financials, real estate, industrials and consumer sectors that can benefit from a Covid recovery. India also provides opportunities to invest in technology, manufacturing, and health care companies that can benefit from a developed market recovery.

China. China is in a unique position globally, having embarked on an entirely different monetary cycle. Unlike most other major economies, China did not seek to combat the economic impacts of Covid through easy monetary conditions and significant fiscal support. As we have discussed in past commentary, China’s “first-in, first-out” experience of Covid meant that it was the first economy to recover, and strict lockdowns and management of Covid during the reopening phase have resulted in an economy requiring little stimulus or support. Because China does not need to remove aggressive monetary stimulus, it now has the capacity to ease at the margin through a recently announced cut to the reserve requirement ratio for banks.

We believe Chinese equities are in a stronger position to weather near-term Fed tapering concerns. We expect that correlations between Chinese equities and global equities will fall during the next cycle, as Beijing will be in a position to resist reacting to changes in Fed policy. Many new policies are being discussed and implemented within China across multiple industries, especially on the regulatory front. Given the nature of China’s one-party political system, these decisions may happen quickly and can have a significant impact on a variety of industries, providing either tailwinds or headwinds. (See our post, “The ‘Visible Hand’: How Beijing’s Policy Shapes Investment Opportunity in China.”)

Commodities. To us, the recent decline in the commodity complex looks more like a healthy correction; commodity prices are still well ahead of pre-Covid levels two years ago. In many instances, fundamentals support higher prices, as the commodity complex has made minimal investment in new supply over the past decade, while demand is increasing because of green infrastructure spending and traditional infrastructure investments. New green technology requires significant inputs of “dirty” commodities, such as copper and iron ore. (For more, see our post, “Copper: Cyclical Winner in a Shift to a Greener World.”) The combination of significant capital flows toward these green initiatives and away from dirty commodities provides a backdrop for a multi-year period during which commodity producers can outperform.

In terms of bottom-up characteristics, our commodity exposure includes companies that have demonstrated capital discipline over recent quarters by using strong free cash flows to pay down debt and, in some instances, to repurchase equity and support dividends. South Africa, Russia, and many Latin American and some ASEAN countries have significant exposure to the commodity complex, with banking and consumer sectors also geared to commodity recovery. Year-to-date, the currencies of these countries are among the strongest globally, and we have selectively added to financials and consumer exposure in countries positioned to benefit from this recovery.

Read our full 3Q 2021 outlook, “Holding Pattern: Synchronized Global Recovery Delayed, Not Dismissed.”

Learn more about the global and international funds: Calamos Evolving World Growth Fund (CNWIX), Calamos Global Opportunities Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX).

Small Caps Are in the Early Stages of a Multi-Year Move of Outperformance

Brandon Nelson, CFA

Small caps are up an impressive 17.5% year-to-date through June, as measured by the Russell 2000 Index. During the second quarter, they took a bit of a breather relative to large caps, with the Russell 2000 Index trailing the Russell 1000 Index by 425 basis points.

Despite the recent relative underperformance, we believe small caps are still in a leadership role and will remain in one for the next several years. It is perfectly normal to see relative pullbacks like this within an intermediate-to-long-term trend. Two steps forward, one step back. Small caps just had their one step back on a relative basis. Interestingly, on an absolute basis since 1989, when small caps were up more than 10% during the first six months of the year, they continued to rise in the second half of the year, on average by another 12%.

So we are bullish for the short term, but why are we so bullish on small caps over the intermediate-to-long term? We believe small caps are still in the early stages of a multi-year move of outperformance. History shows us that when small caps take a leadership role, as they did in September of 2020, they tend to stay in that leadership role for an average of seven years. We haven’t even completed the first year of this run. Additionally, here is the equation I keep coming back to for small caps: fundamental momentum (rising sales and earnings estimates) + intermediate-term price momentum + inexpensive relative valuation (versus large caps) = high probability of outperformance.

Regarding valuation, despite year-to-date outperformance by small caps, the asset class still looks cheap versus large caps, currently sitting at the inexpensive 22nd percentile.* Also, don’t be surprised if the micro caps perform disproportionately well over the coming months and years. Not only are they the smallest of the small, but they are also the cheapest of the cheap, and as the small cap category attracts more assets from individual investors and institutions, the micro caps may disproportionately benefit.

Due to our positive outlook for small caps, we have positioned Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX) to have disproportionately heavy exposure to small caps, especially micro caps. We believe this positioning has added value and will continue to, in the second half of 2021 and beyond.

Each fund maintains exposure to long-term secular growth stocks and certain cyclical growth stocks that should benefit meaningfully from an economic uptick. The biggest portfolio change made during the second quarter was increasing the funds’ weightings in health care stocks, especially certain medical device stocks. Many of these stocks are considered long-term secular growth stocks but are also benefiting from a snapback in medical procedure volumes following the pandemic, giving them two potential ways to win.

U.S. Convertible Market: Numerous Reasons for Optimism, Abundant Opportunities

Joe Wysocki, CFA, and Jon Vacko, CFA

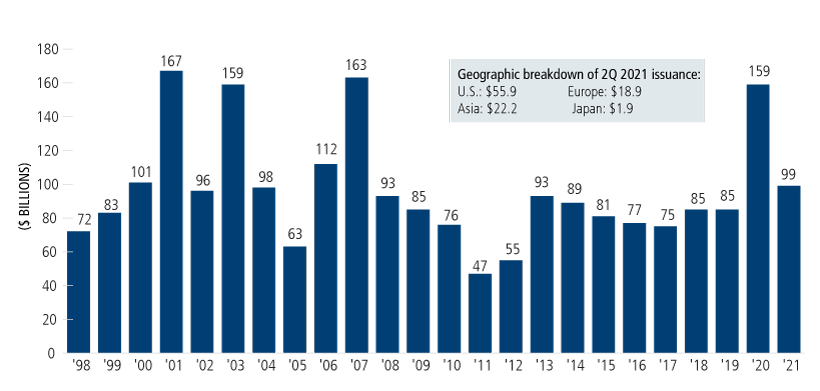

We continue to have a positive outlook on the convertible market based on our view of a broader economic recovery combined with a fundamentally attractive issuer base. Year-to-date new issuance has continued at a brisk pace with nearly $100 billion in convertibles coming to market globally—an all-time high for the first half of a year. While we may see a deceleration from this record pace, we are excited by this broadening of the convertible market, which has included a healthy mix of innovative companies issuing convertibles for the first time as well as more established companies seeking capital to take advantage of opportunities for growth, expansion, mergers, and increased research and development.

On the economic front, our team continues to see numerous reasons for optimism, including progress on Covid vaccinations, improving economic data, the lagged impact of fiscal stimulus and accommodative monetary policy. While we anticipate upcoming data points will be volatile on a year-over-year basis due to the extreme nature of this economic cycle, our view is we are tracking towards an economy that is expanding but not overheating and will ultimately transition from early expansion to a mid-cycle growth phase. While this likely results in a monetary policy consisting of higher but still very accommodative interest rates, we believe that all policy decisions—both monetary and fiscal—will be approached with the goal of continuing economic growth and avoiding restrictive outcomes that could cut off the expansion prematurely. This likely means heightened volatility for the foreseeable future as each data point will be scrutinized through this transition, but an environment of growth with moderate inflation could be a very attractive backdrop for risk assets.

Recently, there has been much debate on the rotation between growth and value stocks. Our team does not view this as an either/or decision. Instead, we seek to identify companies that are growing their intrinsic value across all market characterizations. Many convertible issuers have higher growth profiles and therefore have been caught up in the rotational waves this year. However, we believe this period of consolidation can set the stage for longer-term outperformance as many individual company fundamentals are strengthening, although equity prices have moved lower in some situations. Actively managing the structural risk/reward of convertibles offers a unique way to position for upside in these potentially market-leading companies while also managing downside risk.

Our focus in positioning Calamos Convertible Fund is to optimize the risk/reward tradeoff and provide more exposure to upside in the equity markets than to potential downside. This involves actively rebalancing among the abundance of new and existing convertibles as well as using short-term volatility to find long-term opportunities. The fund’s largest exposures are to growth-focused sectors such as information technology and consumer discretionary where we are finding secular opportunities in areas such as cloud computing, internet security, e-payments, e-commerce and many other “at-home” trends that accelerated during the pandemic. We believe there are also strong cyclical opportunities that can outperform as pent-up consumer demand is unleashed. These span multiple industries, including airlines, cruise lines, retail, entertainment, and semiconductors. The fund’s largest relative underweight exposures are to more defensive areas, such as the financial sector where we believe convertible structures are less favorable.

In closing, we believe the fundamentals of the convertible market remain strong. Continued volatility and rotations within the financial markets may occur but are not uncommon as the economy transitions toward a more mid-cycle growth phase. We believe the strategic case for convertibles to help navigate this volatility without sacrificing upside participation remains intact.

Vaccinations, Valuations and Reopening: A Favorable Backdrop for Global Convertibles

Eli Pars, CFA

During the second quarter, the global convertible market, as measured by the Refinitiv Global Convertible Bond Index, posted a gain of 3.6%. We believe the combination Covid-19 vaccination rollouts, economic reopening, reasonable valuations, and loose fiscal and monetary policies should propel equities higher, benefiting the global convertible securities market as well.

With two-thirds of the adult U.S. population either fully or partially vaccinated against Covid-19, we are on the edge of back-to-normal. The economy is humming along, and the outlook is rosy. This should drive earnings higher. While there are pockets of excess (led by meme stocks and cryptocurrencies), the broad U.S. market doesn’t seem that expensive, especially relative to interest rates.

As economies around the world re-open and companies seek access to capital, convertible issuance has remained very strong. Globally, $98.9 billion in new convertible issuance came to market in the first half of 2021, versus $92.6 billion in the first half of 2020. The pace of issuance has slowed during the second quarter, particularly in the U.S., where companies brought a still hefty $15.3 billion in new issuance. Whether the second half of this year can match last year (and thus whether 2021 can beat 2020 for the full year) remains to be seen.

($ billion)

Source: BofA Global Research.

In addition to our constructive outlook for the convertible market as a whole, we’re optimistic about the positioning of Calamos Global Convertible Fund in particular. We believe the fund has an attractive risk/reward profile: Its equity sensitivity is a bit below the market but is at a level with which we are comfortable. At this phase of the cycle, selectivity is essential. While we did participate in the new issue market throughout the quarter, it was at a slower pace than in recent quarters.

Calamos Global Convertible Fund continues to be roughly neutral the U.S. and Asia. The portfolio remains underweight Europe, due to our assessment of bottom-up opportunities. On a sector basis, technology remains the fund’s largest sector weight as well as its biggest overweight.

Alternatives Positioning Update

Eli Pars, CFA

As rising interest rates create headwinds for traditional bonds, and rotational and choppy conditions challenge long-only equity strategies, we believe Calamos Market Neutral Income Fund (CMNIX) and Calamos Hedged Equity Fund (CIHEX) offer important asset allocation benefits. Designed to serve as an enhancement to a traditional fixed income allocation, Calamos Market Neutral Income Fund seeks to pursue absolute returns and income that is not dependent on interest rates. Calamos Hedged Equity Fund is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns.

Calamos Market Neutral Income Fund. The fund combines two complementary strategies—convertible arbitrage and hedged equity, actively adjusting the allocation as conditions evolve. As of the end of the quarter, Calamos Market Neutral Income Fund’s allocation stood at approximately 50/50 to the convertible arbitrage and hedged equity strategies. This allocation is roughly in line with our longer-term historical average. Our allocation to the convertible arbitrage strategy has declined from a high of 60% last year, which was in large measure a reflection of the soaring levels of issuance in the convertible securities market. Although issuance has slowed in the second quarter, it is still strong in absolute terms, providing opportunities for us in the fund’s convertible arbitrage book. We continue to be active in the new issue and secondary markets, replacing existing in-the-money convertibles and rebalancing with new convertible issues when possible. The weighted average delta of the convertible arbitrage strategy continues to hover near the high end of its historic range, although we have pulled it in a bit from last quarter.

Calamos Market Neutral Income Fund’s hedged equity strategy continues to be positioned with a higher-than-typical hedge ratio. The higher the hedge ratio, the less exposure the fund has to equity market downside. Steadily declining realized and implied volatility and a strong bid in the markets for out-of-the money puts, has created cheapness in put spreads. In our approach, we always seek to be positioned for as many outcomes as possible—and seek to be prepared well ahead of the curve. We liken this to buying snowblowers on sale in the summer. In this case, we have been adding more put spreads to the fund’s hedged equity book, on top of the outright long put allocation we always maintain in the portfolio.

Calamos Hedged Equity Fund. When the quarter began, Calamos Hedged Equity Fund’s hedge was near the high end of its targeted range, as higher-than-normal implied volatility made it more challenging to build skew into the portfolio. Currently, the fund’s hedge is near the middle of our targeted range; declining implied volatility and cheapening of put spreads allow us to build more skew into the portfolio. Similar to the hedged equity sleeve of Calamos Market Neutral Income Fund, we have layered in more put spreads than we have in several years, in addition to the outright long put allocation we consistently employ in the fund. As we noted, declining volatility and increasing bids for out-of-the-money puts have generated attractive opportunities in put spreads.

A Robust U.S. Economy Can Push Equities to New Heights

Today’s investment landscape is striking for its crosscurrents, both near and longer term, which have left many unsettled despite the bull run in risk assets. Some of this uncertainty is due to the historic nature of the pandemic, but it is equally attributable to the transition to a new and possibly different economic cycle.

We believe nominal and real U.S. GDP will settle and maintain a pace that exceeds consensus expectations, and the S&P 500 Index will conclude this year with a calendar gain of greater than 20%. If our GDP forecast is correct, it is unwise to turn defensive and we are reluctant to fight the tailwinds of policy, liquidity and earnings.

We believe many investors remain structurally overweight the “disinflation trades,” while we are wary of that positioning. Any selloff in the markets or the cyclical recovery names into summer could prove a bear trap. We argue for balance in allocations given the uncertainties around the economic cycle, including the possibility that today’s strong economic activity remains stronger for longer.

There are two reasons to be wary of trying to trade the shift toward defensive or late-cycle themes. First, we still believe the U.S. economy will be robust and stay significantly above trend, not just through the second half of 2021 but into 2022. Equally important is the historic backdrop for corporate profitability. The July reporting season will almost certainly surprise on the upside, a trend that we see continuing into early 2022. More than anything, this historic and robust outlook for earnings should ensure equities are resilient to any negative datapoints.

There is a popular narrative that equities are dangerously overvalued. We forecast S&P 500 earnings to reach $200/share by year end, at which point investors will look ahead and see $220/share plus by year-end 2022. If the expansion continues, peak earnings could be above $250/share. Equities rarely peak much before the earnings cycle peaks and that could be years off. There are clearly pockets of exuberance, such as the long-duration concept names, yet much of the rest of the market is far from bubble territory. It is hard, for example, to argue financials or energy stocks are disconnected from historical valuations.

We don’t know where inflation is going to shake out in one-, two-, or three-years’ time. The tail risk of higher inflation is greater than at any point in the last decade, but it is still a tail risk rather than a central risk. The important point is that we do not see the inflation debate short-circuiting the economic recovery. Rather than focus on inflation, investors should consider how the tail risk of deflation is changing as well. The likelihood of more reflation and less deflation in coming years is a strong argument for investors to add more cyclical growth opportunity within their portfolio.

Calamos Phineus Long/Short Fund remains U.S. focused and highly selective overseas. We do not agree with the consensus forecast for dollar depreciation. The demand for the U.S. dollar remains robust, mirroring the superior growth trends of the U.S. dollar-based economies relative to the rest of the world. At the moment, this is reflating almost all U.S. asset prices faster than incomes and making it hard for the dollar to depreciate. In our view, the dollar will not begin to materially depreciate until we see sustained weakness in U.S. economic growth. That is unlikely to commence before the early part of next spring.

We are 12 months into an extraordinary recovery of U.S. fundamentals, both economic and corporate. Around this point in past cycles, equity values have typically paused as investors question the sustainability of recovery and interest rates are repriced for economic growth. Equities inevitably correct either in price or time. Given today’s extraordinary setting, we think any correction will be more one of time than price, dominated by internal rotation rather than a material pullback in the overall benchmark levels. We believe the odds of any market pullback greater than mid-single digits is low into early autumn.

Today’s crosscurrents are preventing investors from looking beyond the pandemic. Investors are concerned that the recovery is fully baked. Investors are convinced that inflation, the pandemic, fiscal cliff, fed tapering and so forth will short circuit the recovery, returning the world to the essential characteristics of the post-2008 era. The key development in the second half of 2021 will be the gradual realization that the economic cycle can be sustained. When that happens, we think the S&P 500 Index will again extend to new highs.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

*Past performance is no guarantee of future results. Source: Jefferies. Small caps are represented by the Russell 2000 Index, large caps are represented by the Russell 1000 Index, since the inception of the indexes in the late 1970s, Based on six different valuation metrics (trailing P/E, forward P/E, price/book, price/cash flow, price/sales, and P/E to growth, comparing small cap valuations versus large cap valuations.

Duration is a measure of interest rate risk. Hawkish refers to a Federal Reserve stance favoring the raising of interest rates. In financial terminology, delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the U.S. equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of U.S. small cap performance. The Russell 1000 Index is a measure of U.S. large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18891 0721R

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.