Investment Team Voices Home Page

Investment Team Voices Home Page

Copper: Cyclical Winner in a Shift to a Greener World

Jay Stewart, CFA and Mike Burke, CFA

Even companies that are traditionally considered to be “cyclicals” can benefit from long-term secular trends. In this post, we discuss the opportunity that our team is finding in copper and other commodities—opportunity that is supported by a variety of tailwinds, including the global move to renewable energy (a secular shift), as well as reflation and a weak dollar.

The race to reduce carbon emissions globally has accelerated in recent years. Individual countries have implemented their own “green” initiatives to reduce dependency on fossil fuels. For example, China is targeting carbon neutrality by 2060, while the European Union has similarly ambitious goals of achieving a 60% cut in carbon emissions by 2030 (relative to 1990) and reaching climate neutrality by 2050.

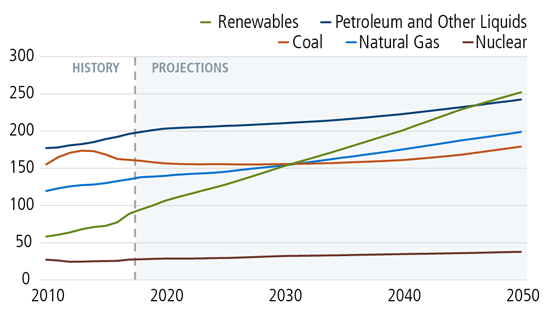

Against this backdrop, renewable energy will continue to take share from conventional power generation in the coming years, growing from approximately 5% of global power generation to nearly 20% by 2030. The U.S. Energy Information Administration projects that renewables will be the most used energy source by 2050, globally.

Quadrillion British thermal units

Source: U.S. Energy Information Administration, “U.S. Energy Information Administration’s International Energy Outlook 2020,” Dr. Linda Capuano, EIA, October 14, 2020, using “U.S. Energy Information Administration, International Energy Outlook 2019.” Note: petroleum and other liquids incudes biofuels.

As countries pursue these targets, we expect a continued proliferation of renewable energy production and electrified transportation (passenger vehicles, commercial trucks, and rail transport). Commodities such as copper and iron ore should benefit from continued investment in renewable power, with a weaker dollar providing an additional tailwind (see our team’s post, “Cyclical Themes: Outlook for the U.S. Dollar”). Moreover, stimulus measures to combat the global slowdown caused by coronavirus should lead to higher energy-efficient investments as governments look to reflate their economies (see our team’s post, “Perspectives on Growth and Inflation Expectations for a Post-Covid World”). Our global team has been increasing our exposure to commodities as we expect these drivers to be a tailwind for commodity prices (and producers) in the coming years.

Copper is a major enabler of the transition to a carbon-neutral environment because its highly conductive nature allows for its extensive use in the power grid. Renewable energy generation is approximately five times more copper intensive than conventional power because it is more decentralized and requires multiple, smaller units to be connected to the main grid. A single onshore wind turbine requires more than four tons of copper. Offshore wind turbines are the most copper intensive, requiring approximately 15 tons per megawatt of installed capacity. Renewable power installations with drive demand for other commodities as well: Building a single 100-megawatt wind farm requires 30,000 tons of iron ore, 50,000 tons of concrete, and 900 tons of non-recyclable plastic.

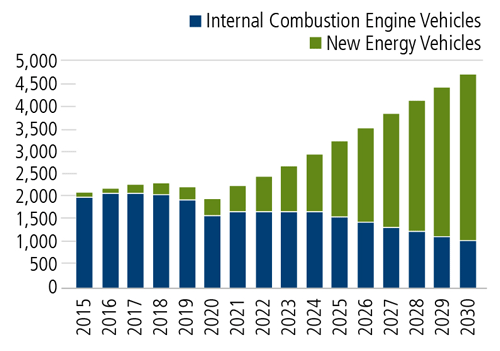

The transition to electric vehicles (EVs) is an additional tailwind for copper demand. An electric vehicle includes approximately four times more copper than a similar internal combustion (ICE) vehicle, with approximately 83 kilograms of copper on average versus less than 20 kilograms for an ICE vehicle. Additionally, each EV charging station requires approximately 10 kilograms of copper per station. Regulatory requirements will drive this shift to electric vehicles in the coming years. China is targeting 20% of its vehicle sales to come from new energy vehicles (NEVs, which include hybrids and battery electric vehicles) by 2020 while the UK is looking to ban ICE vehicle sales starting in 2030. In the US, California will stop allowing ICE sales in 2035.

Source: UBS Global Research, “Copper/Wind & Solar: How big is the demand opportunity?”, October 26, 2020, using UBS research.

Conclusion

Copper will be a major beneficiary in the shift to a “green” society. Given future demand growth from renewable power and electric transportation along with the expected supply deficit from years of under-investment in new mines, copper prices should continue to rise. These rising prices and sustained elevated demand should benefit mining companies and equipment manufacturers. To capitalize on this multi-year investment opportunity, we have increased exposure to commodities such as copper and iron ore in our global and international portfolios.

For more on our views, see our team’s blog posts.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information.

18853 1220 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.