Having Navigated the Global Funds to the Top Decile During the Pandemic, Niziolek Anticipates What’s Next: Global Recovery

For many, COVID-19 was a bolt out of the blue, an exogenous factor that disrupted investment theses and led to disappointing investment results. The opposite was true for the Calamos Global team.

Thanks to its monitoring of the virus breakout in China and seeing it quickly spread to Europe, the team was early to de-risk and batten down the hatches. Weeks later, after talking with company managements and convertible securities issuers confident of their management of liquidity, the team made the decision to re-risk portfolios and take advantage of dislocations that were being priced in.

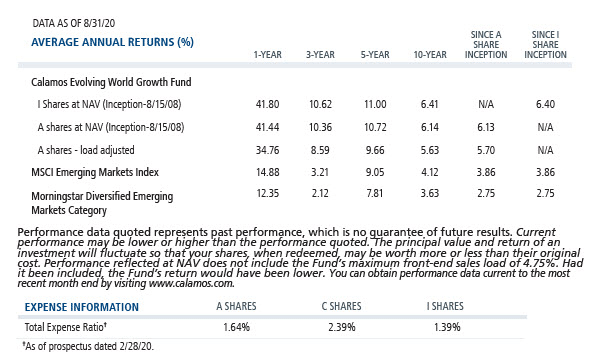

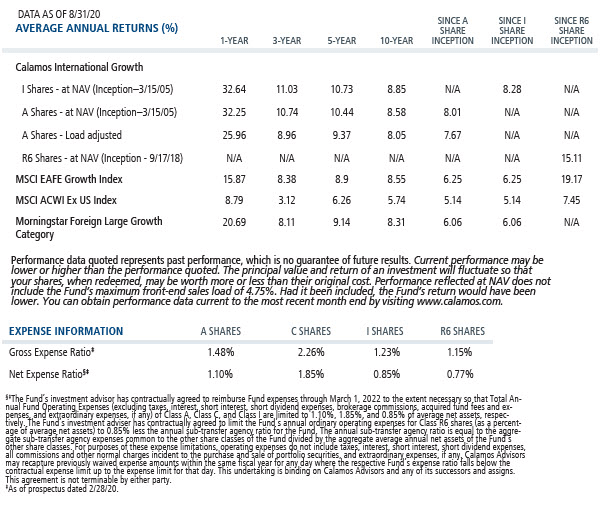

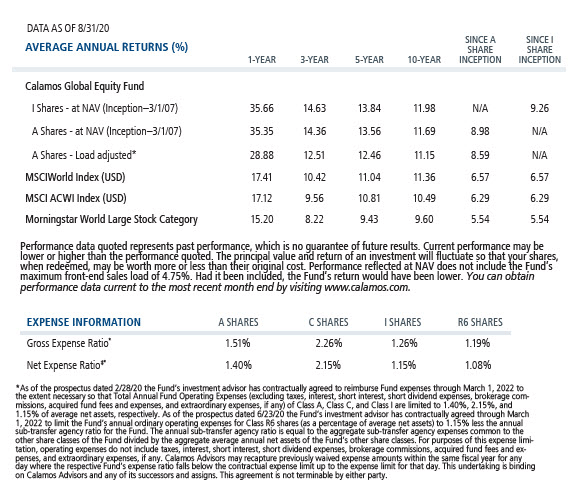

The result: Secular themes and trends that the team had been anticipating for years were pulled forward (see this post). As of August 31, 2020, the four funds in the Global suite are among the top performers in their Morningstar categories (see below).

Now, Co-CIO Nick Niziolek considers COVID a catalyst that sets the stage for a synchronized global recovery, and the team is repositioning by adding to their cyclical growth exposure.

While valuations of overseas markets have been attractive for quite a while, “valuation alone is not a catalyst, you need something to unlock the value,” Niziolek, Head of International and Global Strategies and Senior Co-Portfolio Manager, told investment professionals in last week’s CIO call (listen to replay here).

The catalyst has come in the form of a global fiscal and monetary policy response so significant that Niziolek believes the opportunity today “is more skewed to overseas markets.”

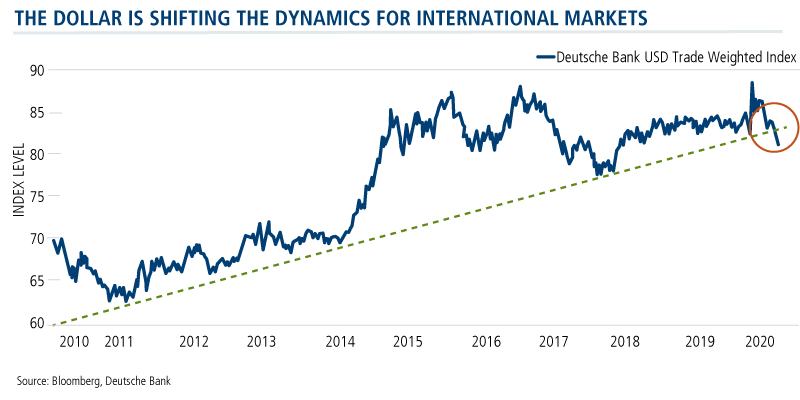

The Significance of the Weakening Dollar

The weakening U.S. dollar is core to the Global team’s outlook. “The dollar is an important factor when you’re thinking about allocation to overseas risk assets,” said Niziolek. “Typically, the dollar acts inversely to overseas markets. When the dollar is weakening, we tend to get outperformance from European and emerging markets.”

Niziolek cites the significant growth of the Fed’s balance sheet, which has expanded much more quickly than those of the European Central Bank or Bank of Japan. Based on recent Fed meetings, the Fed is willing to continue to accommodate and for much longer, he said.

Subsequent dollar weakness likely will be more gradual—“a 10% decline is not the slope we’d expect,” Niziolek said. “It’s likely to be more gradual from here with periodic counter-trend corrections” over a three- to seven-year period.

Niziolek provided a region by region report, including:

-

Europe. A $750 billion European recovery package, announced this summer, gives the team confidence that Europe is on a sustainable path for economic recovery. While Europe previously had significant monetary support, this fiscal support—including the contribution of the economically strong Germany—should be meaningful in lifting Italy, Spain and France, Niziolek said. He expects the stimulus, along with other reforms, to support a stronger euro as the European economy evolves to be more focused on its internal growth and less dependent on exports.

Acknowledging reports of a resurgence of COVID cases in Europe, Niziolek said the team believes the spike is “well controlled” and not involving the level of deaths and hospitalizations that could force another economic shutdown, but will continue to monitor these developments. -

Japan: Japan is a market where most funds are underweight, but the team has been adding exposure to Japan recently and likes the opportunities there.

The transition in leadership from Japan Prime Minister Shinzo Abe to Yoshihide Suga should result in both a continuation of existing reforms focused on improving corporate governance and capital efficiency—and new initiatives to promote technology and efficiency in the public sector.

A mask-wearing culture, the Japanese have managed the COVID crisis well. However, explained Niziolek, “this event shed light on how far behind many Japanese companies are on IT investing and work-from-home capabilities.” Recognition that Japan was behind other countries, including emerging markets, should result in heightened IT investment.

Japan also appeals to the team as a place to be when the recovery is underway and the global economy enters a more reflationary period. “Many companies and industries that dominate the Japanese equity universe are geared toward global growth, reflation and are attractively valued. We’d anticipate the Japanese equity market would do very well in a reflationary environment,” said Niziolek, noting that Japan is the only major market with positive returns in September. -

China: The recovery continues in China, and Niziolek described the team as “very positive” on its sustainability. “We initially saw the snapback in the industrial segment, and we’re starting to see retail too. Our view is that China will be a source of opportunity for the rest of the world,” he said.

What the team’s watching: Significant demand has been met with existing inventory. As inventories get depleted, they will need to be replenished quickly. “Once we see restocking, coupled with demand, that’s another leg of growth,” said Niziolek.

Long term, Niziolek says there is no doubt that the U.S. and China are decoupling. “There’s no surprise there,” he said. “The U.S. wants to reduce its dependency on China. The countries have different ambitions long term. The economies probably became too intertwined for both [countries’] comfort.”

However, according to Niziolek, headlines about conflict between the two tend to overstate what’s really happening. A few examples: There was concern that the Phase 1 trade update meeting wouldn’t happen but it did. The TikTok/WeChat faceoff has gone from a worst case scenario to negotiations. On the subject of delisting ADRs, a compromise now seems possible (see this post).

“What happens is that headlines create volatility and that creates opportunity for us,” Niziolek said. Over the long term, he said, there will continue to be significant opportunities to invest in China growth, including those focused on China’s National Champions and Dual Circulation (Consumption) initiatives.

Investment professionals, for more on the Calamos global suite of funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

8/31/2020

| Category Rank I Shares Shading denotes top quartile |

|||||||

| RISK-ADJUSTED RETURNS ON LOAD-WAIVED I SHARES AS OF 8/31/20 | Morningstar Category | Overall Morningstar Rating | YTD 1/1/2020-8/31/2020 |

1-year 9/1/2019-8/31/2020 |

3-year 9/1/2017-8/31/2020 |

5-year 9/1/2015-8/31/2020 |

Since Inception |

| GLOBAL EQUITY | |||||||

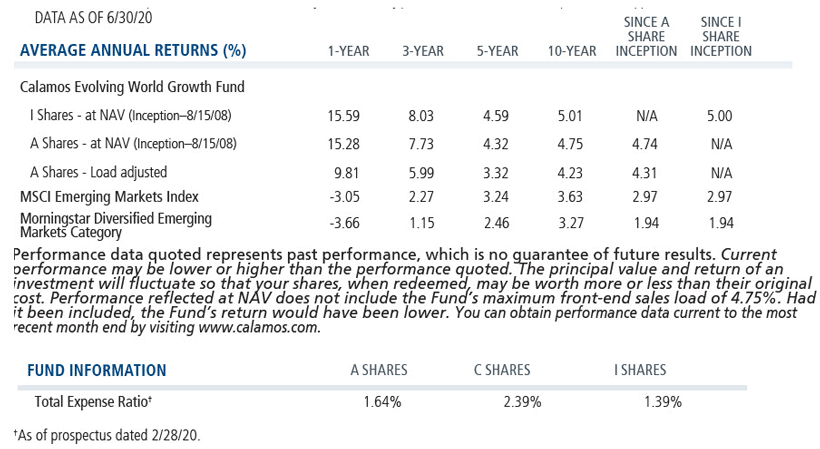

| Calamos Evolving World Growth (CNWIX) | Diversified Emerging Markets |

5 Stars

|

2 | 2 | 4 | 18 | 2 |

| Number of funds | 695 | 816 | 796 | 695 | 579 | 199 | |

| Calamos Global Equity Fund (CIGEX) | World Large Stock |

4 Stars

|

8 | 8 | 17 | 17 | 4 |

| Number of funds | 725 | 861 | 825 | 725 | 610 | 248 | |

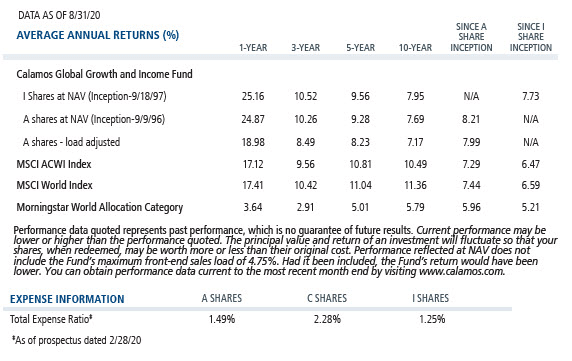

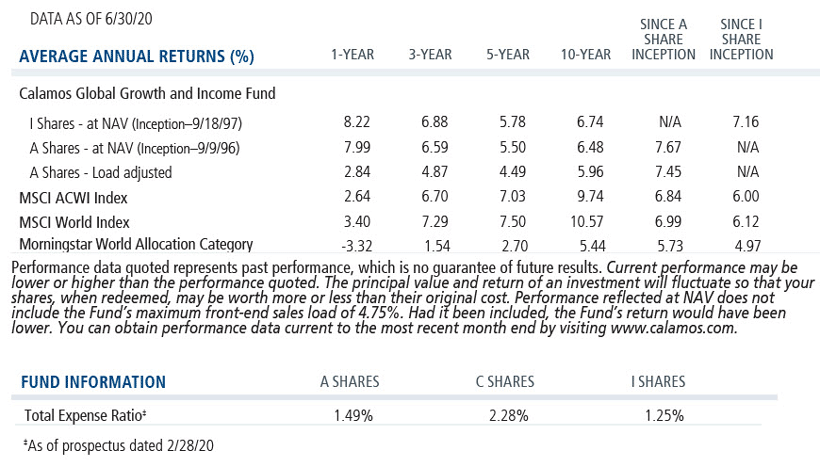

| Calamos Global Growth & Income (CGCIX) | World Allocation |

5 Stars

|

1 | 1 | 2 | 2 | 21 |

| Number of funds | 390 | 485 | 474 | 390 | 337 | 41 | |

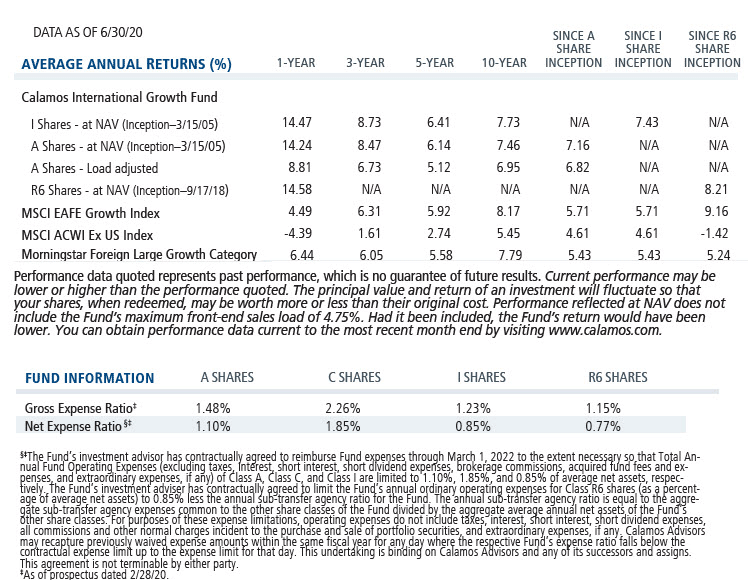

| Calamos International Growth Fund (CIGIX) | Foreign Large Growth |

4 Stars

|

8 | 9 | 15 | 23 | 3 |

| Number of funds | 413 | 487 | 469 | 413 | 335 | 137 | |

Past performance is no guarantee of future results. Morningstar category rank is based on average annualized returns since I share inception.

| 8/31/20 | 3 years | # of funds | 5 years | # of funds | 10 years | # of funds |

| CNWIX Inception: 8/15/08 |

5 Stars

|

695 |

4 Stars

|

579 |

5 Stars

|

257 |

| CIGEX Inception: 3/01/07 |

4 Stars

|

725 |

4 Stars

|

610 |

4 Stars

|

359 |

| CGCIX Inception: 9/18/97 |

5 Stars

|

390 |

5 Stars

|

337 |

4 Stars

|

207 |

| CIGIX Inception: 3/16/05 |

4 Stars

|

413 |

4 Stars

|

334 |

4 Stars

|

242 |

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The Morningstar Diversified Emerging Markets Category is comprised of funds with at least 50% of assets invested in emerging markets.

The Morningstar World Large Stock Category comprises international funds having 20% to 60% of assets invested in the United States.

The Morningstar World Allocation Category is comprised of funds that seek to provide both capital appreciation and income by investing in three major areas: stocks, bonds and cash.

The Morningstar Foreign Large Growth Category is comprised of funds that seek capital appreciation by investing in large international stocks that are growth-oriented.

Morningstar RatingsTM are based on risk-adjusted returns and are through 8/31/20 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund's monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2020 Morningstar, Inc.

802166 0920

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

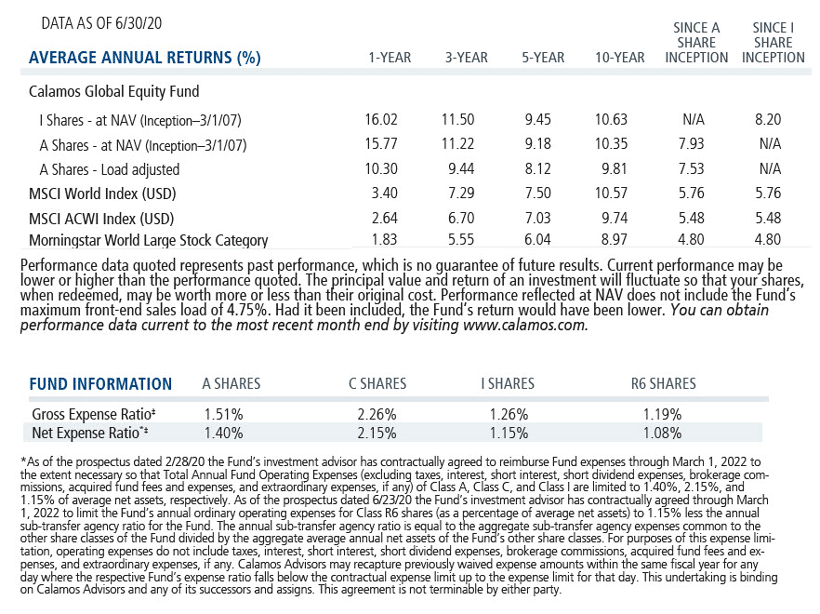

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on September 28, 2021Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.