Investment Team Voices Home Page

Investment Team Voices Home Page

China’s Cloud Software Industry: Long Runway Supports Secular Growth Potential

Global Team Perspectives by Alex Wolf, CFA

In this post, we continue exploring secular growth themes and the tailwinds they provide. Here, we take a closer look at the cloud software market, where China has historically lagged. This is changing, creating many opportunities for growth investors who understand the opportunities in China’s domestic market.

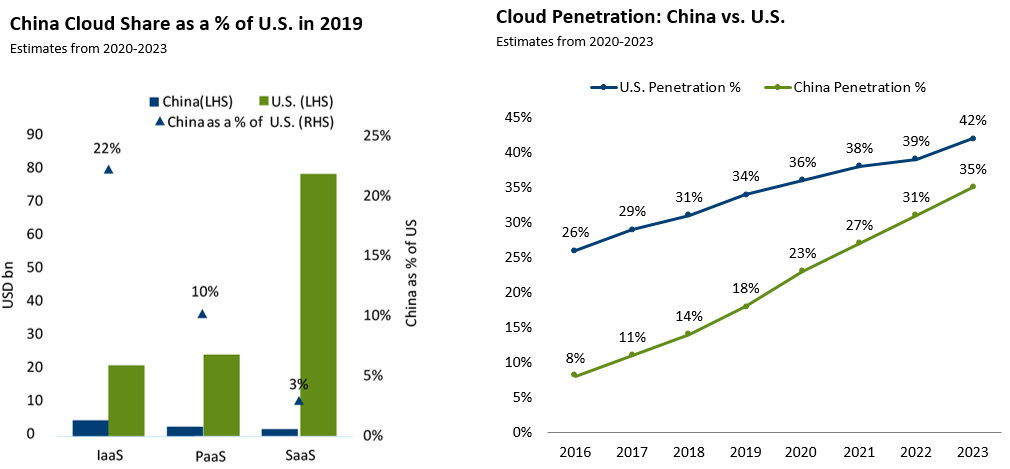

China’s cloud software market has long been an underpenetrated opportunity with vast growth potential. In recent years, the industry has started to show more signs of life across the China public cloud market, but it is still barely material within the context of the global market. Early stages of building out the industry in China have been concentrated in Infrastructure-as-a-Service (IaaS), which is the fundamental computing, networking power, and hardware that facilitates cloud computing. This represents 70% of the cloud market in China, with Platform (PaaS) and Software (SaaS) offerings making up the rest. This is a sharp contrast to the U.S., where SaaS is 60% of that market and has already developed into a more complete ecosystem with a variety of software offerings.

By just about any broad metric across technology, cloud, software, or digitization, China lags behind the U.S. and many other developed economies. This creates a long runway of opportunity.

- The U.S. spent 4% of GDP on IT while China spent 1.8% (2018).

- The China SaaS market is 3% the size of the U.S. cloud market.

- China cloud penetration is only 18%, while the U.S. is at 34%.

- Proportion of GDP in the digital economy was at 60-61% for the U.S., U.K., and Germany, but only 35% in China (2018).

Source: Bernstein, “Global Software and Asian Internet, China vs. U.S. Cloud: An industry comparison,” May 5, 2020, using Gartner, Bernstein analysis (left), and Gartner data and estimates, Bernstein analysis (right).

Despite how far behind China is on all these metrics, there is a solid base to build upon. The large tech companies have made a strong start on building the needed infrastructure and are continuing to grow and build data centers. China already represents 25% of the global server installed base.

The virtues of being a large economy with an untapped software market is certainly not enough to warrant an attractive investment. There are however, a variety of catalysts that have been playing out over the past couple years that we believe are sustainable. Fiscal policies and initiatives are going to help drive this, many of which fall under China’s “New Infrastructure” plans. Back in late 2018, government officials discussed accelerating commercial use of 5G networks and creating infrastructure for AI, industrial internet, and the internet of things (IoT). Numerous party meetings and conferences since then have reinforced that there is clearly a desire to invest in these areas. Within the past few months, there have been announcements on speeding up construction of 5G networks, data centers, and President Xi has spoken very recently about boosting tech innovation. A government backed agency* has estimated spending of $1.4T over the six years through 2025 across areas that include 5G networks and AI software. (For more on 5G, read our post.)

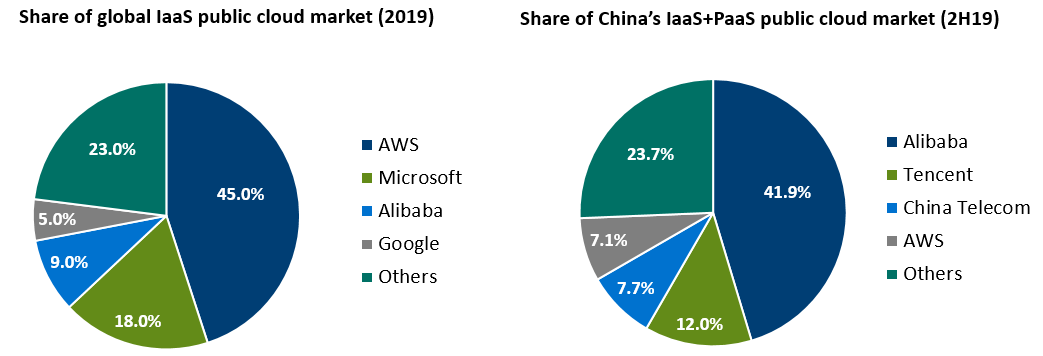

The government has also made it clear it wants the software market sourced locally as much as possible, even going so far as to mandate government offices and public entities to replace foreign-made PCs and software within three years. The investable universe within this space is vast, and we see attractive investment opportunities across both IaaS and SaaS. Thus far, the development of the IaaS market has played out similarly to the U.S. with a consolidated market dominated by a few players, which is not surprising given the high entry costs (see charts below). We view this as an attractive industry to invest in over the long term, but the SaaS market could offer more opportunities for differentiation and competitive advantages in a more nascent industry.

Source: CITIC Securities, How to invest in China Tech after COVID-19, May 18, 2020, using IDC including estimates, ICT (including estimates), Gartner, CITIC Research.

There are a multitude of attractive opportunities within the SaaS industry, as we see companies that already have attractive niches and are ready to expand. Switching to a cloud or SaaS model removes a lot of the entry barriers and high initial costs for companies and thus alleviates some of the threat of pirated software in China. Many software companies offer platform models as well, with the ability to cross-sell and increase revenue potential at individual customers.

Conclusion

Ultimately, similar to the U.S., there will be multiple winners as companies help transform the internal operations of Chinese companies across enterprise resource planning, human resources, supply chain, project management, customer relationship, office automation, security, and much more—thereby supporting the future of “New Infrastructure” in China. We believe the COVID-19 pandemic will only further accelerate many trends favorable to China cloud adoption with more demand for a digitally integrated economy.

*China Center for Information Industry Development

Sources: Bernstein May 2020 Report – China vs. U.S. Cloud, CITIC Securities May 2020 Report – How to Invest in China Tech after COVID-19, and CLSA November 2019 Report – Software as a Service.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific companies, securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to buy or sell. Investing in non-U.S. markets entails greater investment risk, and these risks are greater for emerging markets. The above commentary for informational and educational purposes only and shouldn’t be considered investment advice.

18797 0520O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.