Investment Team Voices Home Page

Investment Team Voices Home Page

Rising U.S.-China Tensions Reshape—Not Erase—Investment Opportunities

Nick Niziolek, CFA

U.S.-China relations have hit another rough patch as President Trump moved ahead with executive orders that prohibit U.S. individuals or entities from doing any business with TikTok or WeChat beginning in 45 days. TikTok’s response to these concerns has been to try to sell its U.S. business to a U.S. firm, with Microsoft currently in negotiations. WeChat’s inclusion in this executive order was a surprise, and management has not yet communicated any actions it may take to address this change. Furthering the tension, the White House has also proposed that additional oversight requirements for Chinese ADRs take effect at the start of 2022. (Our recent post, "Understanding EM Opportunity Requires Looking Beyond the Headlines" provides some background this topic.)

Our job as investment managers is to protect and grow clients’ capital. This requires that we separate noise from fundamentals and take a dispassionate view of the global investment landscape and opportunity set. Through this lens, the political climate certainly factors into our analysis, but we believe neither of these recent developments undermines the overall case for emerging markets allocations or the positioning of our portfolios.

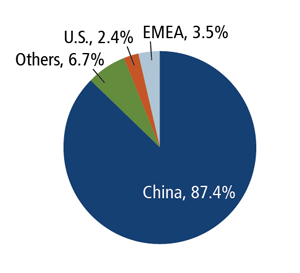

Although there is no doubt that the Chinese and U.S. economies are intertwined, they are increasingly decoupled. We are in the midst of a deglobalization phase that is unwinding much of the progress of the past 20 years. This creates new risks, but also new opportunities. We are investing in Chinese national and regional leaders, including companies that are positioned to benefit from policy tailwinds tied to the further development of domestic sectors. Headlines such as those that have just come out will contribute to near-term volatility, but the fundamental impacts have been less harsh. Chinese companies are sourcing a very small percentage of revenues from the U.S., and vice versa.

Source: Morgan Stanley Research. Data based on 2020 revenue estimates.

On the ADR news front, the negative surprise was in terms of timing. The window for compliance was shorter than we and many others originally anticipated, but not outside our expected range. We believe that the most likely outcome is that Chinese companies will continue to move their ADR listings out of the U.S. However, many U.S. investors should still be able to access many of these companies through direct investment on Chinese exchanges, particularly as a growing number of retail investor platforms now provide access to overseas markets. We believe that it is far less likely that Beijing will allow Chinese companies to comply with the direct audits that Washington seeks. However, if audits were permitted, that would be a significant positive surprise for the Chinese stock market.

As always, these disruptions create opportunities. The Stock Exchange of Hong Kong is likely to be a key beneficiary of the delisting of Chinese ADRs in the U.S. The London Stock Exchange is a possible winner as well. If U.S. companies are unable to utilize a critical platform like WeChat to advertise and distribute their products in China, this would put them at a significant competitive disadvantage vs. local and non-US competitors. Any limitation on U.S. brands’ ability to sell into China creates opportunities for local players, an area we have been focused on for the past year. While the same can be said for Chinese companies selling into the U.S., the impact should be minimal.

Conclusion

In a highly charged political environment, headlines and noise can trigger short-term volatility. However, the case for investing in China and other emerging markets is strategic (see our post, “Global Allocation: The Overlooked Opportunity") and supported by long-term growth themes. The current situation between the U.S. and China remains fluid, which further emphasizes the importance of a dynamic and adaptive process. Amid this uncertainty, we continue to identify businesses positioned to navigate these choppy waters. As a result, we believe we are well-positioned to capitalize in this period of accelerated disruption.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

The MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs). With 711 constituents, the index covers about 85% of this China equity universe. Currently, the index includes Large Cap A and Mid Cap A shares represented at 20% of their free float adjusted market capitalization.

18817 0820 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.