Investment Team Voices Home Page

Investment Team Voices Home Page

Economic Update and Asset Allocation Considerations, July 2020

John P. Calamos, Sr.

In our May 2020 Economic Outlook, our Investment Committee discussed our cautious optimism for a V-shaped economic recovery, and our expectation that the downturn would be severe but short-lived. Although we were prepared for rotation and volatility, we noted there were many opportunities across asset classes for our selective and fundamentally driven approaches.

We continue to hold these views. Looking forward, we maintain our expectation for a return to global growth and improved corporate productivity and profitability. Supported by more than $25 trillion in global monetary and fiscal stimulus, economies around the world are making their way back.

There is no doubt that there is a long road ahead. In the U.S., second quarter GDP plummeted by record levels, contracting 9.5% for the quarter (for an annualized rate of -32.9%), while consumer activity imploded amid soaring unemployment. However, we must remember how resilient the economy has been—both during past challenges as well as now. On a month-to-month basis, we have seen upticks in a variety of U.S. and global economic data points related to consumer and company activity. We are already seeing improvements against expectations for a number of data points, in the U.S., China and Europe. We believe there is additional upside for global equity and convertible markets through the remainder of the year and beyond, supported by unprecedented monetary and fiscal policy measures, synchronized global recovery, and attractive valuations in many parts of the world.

Although we expect overall economic conditions to trend positively from here, we recognize the many challenges ahead. The pace of recovery will vary from country to country, due to fiscal policy and differing degrees of stimulus, as well as the course of the pandemic. And despite the many support measures put in place, we cannot dismiss the pressures facing many businesses and individuals, particularly those in lower-income households. High savings rates and low mortgage rates are encouraging, but unemployment and bankruptcy risk both remain high. These are areas that we will be watching carefully, especially as more robust benefits roll off.

Many investors have become more worried about inflation, as massive monetary stimulus has propelled the U.S. and global economies into uncharted waters. As the economy heals, consumers begin to spend, and supply chains become more localized, inflation is likely to notch up modestly after 2020. Over the near term, we don’t expect these inflationary pressures to upend recovery, although they may intensify further thereafter.

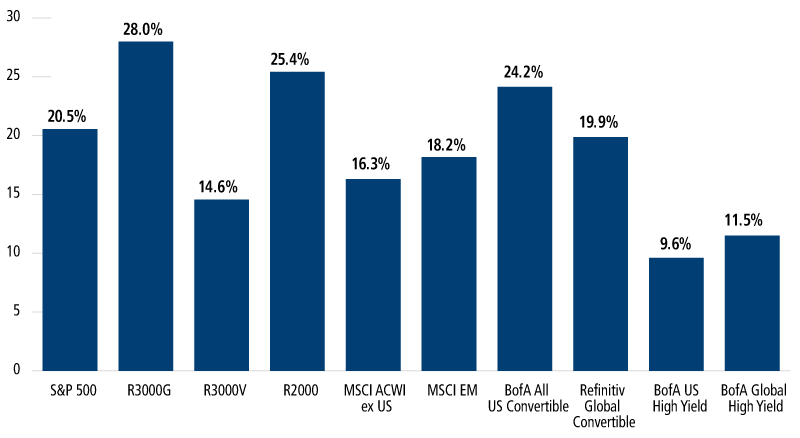

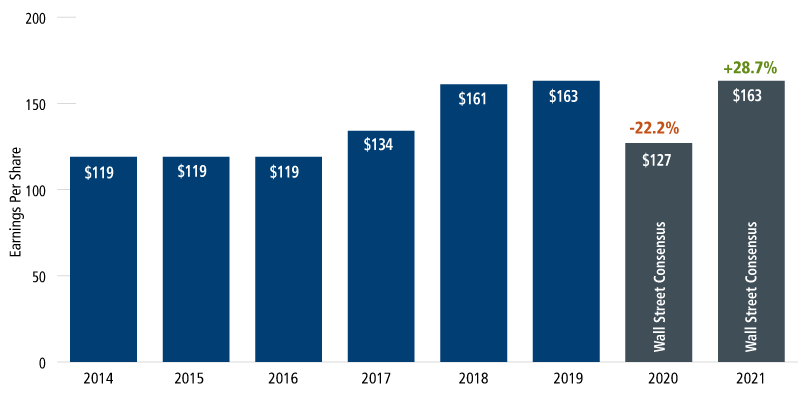

Markets have once again demonstrated their propensity to be forward looking, as evidenced by the strong gains over the second quarter (Figure 1). While the trajectory of the pandemic remains uncertain and rising cases in many regions of the U.S. and around the world are deeply concerning, market participants have not lost sight of the progress that has been made in vaccination trials. Volatility has settled down, and credit spreads have narrowed. Consensus earnings expectations for the S&P 500 Index in 2021 are quite similar to those of 2019 (Figure 2).

Source: Morningstar. Past performance is no guarantee of future results.

Source: FactSet. Past performance is no guarantee of future results.

However, there is likely to be a significant divergence in fortunes over these upcoming quarters, with many companies struggling while recent winners continue to widen their leads. In our previous commentary, we noted our expectation for a protracted solvency phase, with many businesses succumbing to pressures and defaults. And indeed, recent weeks have brought a steady string of headlines announcing high-profile bankruptcies among companies that have not been able to withstand the pressures of the shutdown.

These troubled companies stand in contrast to those that are quickly adapting and gaining ground. We are in a period of accelerated disruption, which creates opportunity for the most innovative businesses. Many of these companies are part of the trend of “the big get bigger” which we discussed in May, including the handful of mega-cap tech and consumer names that have driven the stock market’s rebound. However, these aren’t the only winners. There are also a number of lesser-known, smaller-cap U.S. companies that have flourished, many of which are tied to themes that have gathered force in a short time—for example, telemedicine and a variety of other “at home” trends. Looking globally, key investment themes include artificial intelligence and automation, bioprocessing, global payment networks, and green energy solutions. (For more on these global themes, please visit our global and international team’s blog.)

Against a backdrop of accommodative policy and economic recovery, we expect strong reflationary tailwinds will support stocks, convertible securities and other risk assets—both in the U.S. and globally. However, active management is paramount, given the many uncertainties in the global economy, as well as the continued bifurcation we expect between leaders and laggards. In the current environment, our teams have identified opportunities both in longer-term business model winners supported by secular themes as well as higher-quality cyclical names which should benefit from improved economic growth.

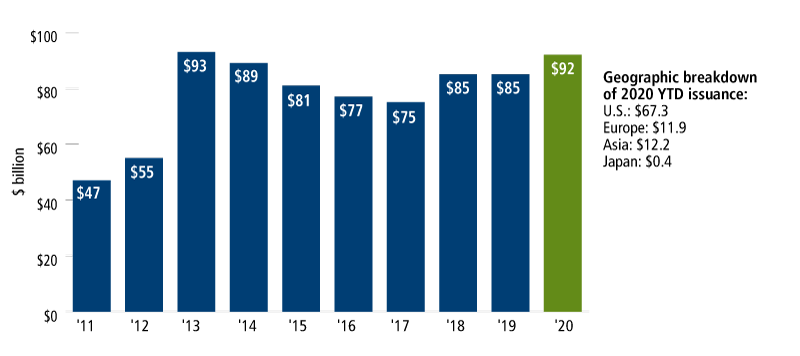

The convertible market continues to offer abundant opportunities for our active approach—and a means to invest in an exciting breadth of companies. Through the first half of the year, companies issued $92 billion in convertible securities, led by the U.S. at $67 billion—a record for 1H calendar year issuance and higher than many recent full-year totals. Encouragingly, this issuance reflects not only recovery activity but also refinancing. In our convertible strategies, we remain highly active, continually rebalancing to enhance risk/return characteristics, an approach which has proven beneficial in 2020. (Our recent mid-year report on Calamos Convertible Fund’s performance provides an example.)

As of June 30, 2020. Source: BofA Global Research.

We are also identifying a number of idiosyncratic opportunities in the high yield market. At the height of the selloff, the entire high yield market was oversold, but a selective approach has become more important as spreads have tightened.

Asset Allocation: Positioning for Opportunity in Volatile Markets

Investors should be prepared for significant market volatility and market rotation. Fiscal policy has been a key underpinning of market sentiment, so as the U.S. presidential election approaches, markets are likely to become increasingly jittery. As the saying goes, markets hate uncertainty. Although many polls currently suggest there may be a change in leadership, we don’t need to look too far back in history to see that anything is possible. This lack of visibility requires that investors maintain a long-term perspective—and focus on putting a plan in place now versus making frantic portfolio shifts in the days before and after the election.

My investment career extends back 50 years, and in my experience, a well-diversified, risk aware asset allocation is one of the best tools for navigating uncertain markets and for turning volatility into opportunity. Geographic diversification is especially important. While U.S. companies across the capitalization spectrum offer compelling growth potential, adding strategies that invest in non-U.S. allocations provides access to a broader opportunity set. As our Co-CIO Nick Niziolek discussed in a recent post, "Global Asset Allocation: The Overlooked Opportunity,” there are many tailwinds that can support strength in non-U.S. equities, including emerging markets. (Our strategies are highlighted in our Global Markets section.)

Asset class diversification is also very important. Given our expectation for rising but volatile equity markets, convertible securities offer many potential benefits. For example, convertibles can provide lower volatility equity participation or provide a hedge against rising rates and inflation. This makes them an attractive choice for investors who are worried about stock market volatility or interest rates. (Our convertible resource center provides more information on how convertibles work.) As such, dedicated convertible strategies (such as Calamos Convertible Fund) or multi-asset strategies that include convertibles (such as Calamos Growth and Income Fund) may make it easier for investors to maintain equity market participation through choppy periods.

During the extended equity bull market, many investors lost sight of the value of fixed income allocations, but the first quarter selloff has rekindled appreciation for bonds’ diversification benefits. A cornerstone allocation to fixed income investments—for example, short-term bonds or core-plus total return approaches—may help enhance the stability of an overall asset allocation as well as support income needs. Meanwhile, non-traditional strategies, such as Calamos High Income Opportunities Fund, offer exposure to higher-yielding credits. Of course, with increased income and return potential comes higher risks, which is why we use a rigorous fundamentally driven approach to identify those bonds with the most compelling attributions. At present, there are significant variations in spreads and yields in high yield—even for issues in similar industries and with similar credit ratings—providing an environment that sets up well for our fundamentally driven approach.

It’s encouraging to see how many investment professionals are helping investors explore alternative strategies, which can be used as either an enhancement to an equity or fixed income allocation. For example, strategies like Calamos Hedged Equity Fund and Calamos Phineus Long/Short Fund can deploy a broader range of tools for navigating downside risk and capitalizing on upside than traditional long-only funds. For the fixed income side of an allocation, Calamos Market Neutral Income Fund provides a time-tested approach, with income generation that is not dependent on interest rates—a key differentiator from traditional bond strategies. (Learn more in “No Matter What: CMNIX”).

In Closing

Even in these highly uncertain times, we see many opportunities for investors across asset classes. Not all companies will enjoy a V-shaped recovery during this period of accelerated disruption, but we have already seen many innovative businesses adapting and flourishing as they meet the needs of a rapidly evolving global economy. In an environment that favors active and selective approaches, fundamental research, and innovative risk management, we believe the Calamos funds are well positioned to help investors meet their long-term financial goals.

For more economic and market perspectives, please join us for our upcoming CIO conference call series, beginning August 4.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

This material is distributed for informational purposes only. The information contained herein is based on internal research derived from various sources and does not purport to be statements of all material facts relating to the information mentioned and, while not guaranteed as to the accuracy or completeness, has been obtained from sources we believe to be reliable.

Diversification and asset allocation do not guarantee a profit or protect against losses.

Investments in fixed income securities entail interest rate risk and default risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

Alternative investments entail added risks and may not be appropriate for all investors.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk - The Fund's ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the option market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund's ability to utilize options successfully will depend on the ability of the Fund's investment adviser to predict pertinent market movements, which cannot be assured.

The principal risks of investing in Calamos Phineus Long/ Short Fund include equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

The principal risks of investing in Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries

Indexes are unmanaged, do not reflect fees and expenses and are not available for direct investment.

The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The Russell 3000 Growth Index and Russell 3000 Value Index measure U.S. growth and value equities, respectively. The Russell 2000 Index measures U.S. small cap stock performance. The S&P 500 Index is considered generally representative of the U.S. equity market. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of 300 global convertibles. Oil is represented by current pipeline export quality Brent blend. ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18812 0720O R

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.