Investment Team Voices Home Page

Investment Team Voices Home Page

Convertible Securities: A Key Lever in a Dynamic EM Approach

Nick Niziolek, CFA and Todd Speed, CFA

As we have discussed in recent posts and commentaries, we believe the case for allocations to global equities—including emerging markets—is very compelling. Emerging markets have tended to do well in recovery phases (and we believe one is underway), and a variety of other tailwinds support our constructive view—including fiscal and monetary stimulus, secular growth themes, a contained U.S. dollar, and valuations.

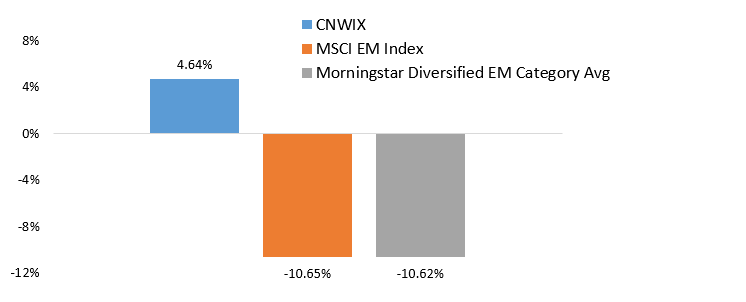

However, there is no doubt that the current uncertainty and volatility heighten the need for a selective and dynamic approach to emerging markets. Calamos Evolving World Growth Fund (CNWIX) has been able to rise to the challenges of 2020’s market (Figure 1). Relative resilience during the Q1 correction and upside participation during the recovery phase has netted to strong outperformance versus the EM market.

Total Return %, YTD as of June 12, 2020

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

The Fund’s performance over both the year-to-date and longer time periods has been shaped by a number of factors, including comprehensive capital structure research, top-down thematic analysis, and the flexibility to invest in developed market companies that are sourcing revenues from emerging markets.

The freedom to invest opportunistically in convertible securities is another key differentiator in our dynamic approach—and one which has contributed favorably in 2020. Convertible securities combine attributes of stocks and fixed income securities. With active management, convertibles can provide the opportunity for participation in equity market upside, with potential risk mitigation. Convertibles can provide potential advantages in all market climates, including periods of higher uncertainty and volatility.

How we use convertibles in CNWIX

Convertible securities aren’t commonly used in emerging markets funds, but they are a key prong of what we see as a more rational approach to the asset class. Calamos has used convertible securities since the 1970s, and CNWIX draws on this depth of experience and proprietary research. In terms of convertible positioning, a general range in the fund is from the low teens to 25%, with 15-20% as an average weight over time. We own convertibles in local EM companies and in global businesses with significant revenue ties to emerging markets.

- Convertibles have provided a risk-aware way to invest in growth companies. Convertibles help us invest in high-growth companies that often also come with higher valuations. Our investment process focuses not only on identifying attractive businesses—we go a step further and determine the most attractive investment in the company’s capital structure. On many occasions, a convertible offers better skew and risk/reward compared to the common stock. For example, we recently identified a company tied to gaming and e-commerce in Southeast Asia, a theme we’re constructive on. However, when we considered current valuations and potential upside/downside scenarios, the convertible offered a more appealing opportunity, in our view.

- Convertibles have helped CNWIX access more cyclical or value-oriented industries and countries with EM. We’ve used convertibles and synthetic convertibles* to build exposure to areas that we believe are poised for a cyclical rebound. While the fund may participate in equity upside, the convertible structure may provide a potential buffer if markets sell off. We’ve participated in new issues that we believe provide us with access to a recovery in air travel in Latin America and to telecoms in India. Beyond the new issue market, we’ve used convertibles to maintain a positive skew to the recovery we see in emerging markets more broadly.

- We think of convertibles as being analogous to a dimmer light switch versus an “on-off” light switch. In “risk-on” and “risk-off” rotations, our use of convertibles allows us to adjust the delta and equity sensitivity of CNWIX—rather than by selling large amounts of stocks during downturns and then adding exposure as markets move higher in rallies.

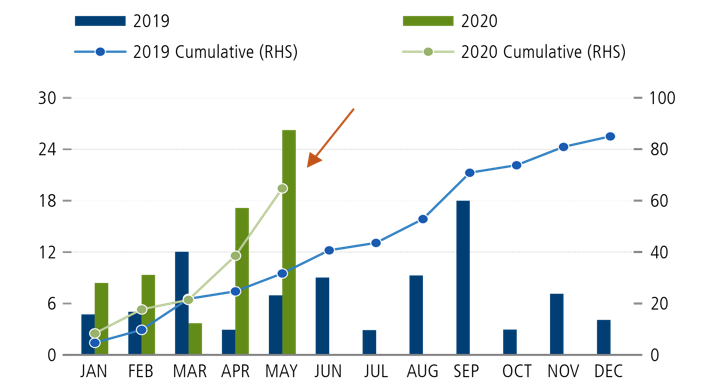

Global companies are coming to the convertible market for access to capital

As we noted, convertibles provide us with the opportunity to broaden CNWIX’s investment universe versus many of our peers. And in recent months, global issuance in the convertible market has been extremely strong, totaling nearly $65 billion year to date through May. While the U.S. and other developed markets have led, emerging markets companies are also participating. Some of the larger markets for convertibles in emerging economies include China, Taiwan, India, and Brazil. We are encouraged by the increased issuance we are seeing from companies in emerging markets, and expect these trends to accelerate as EM capital markets develop and corporations realize the benefits of raising capital at lower-interest rates and higher stock valuations over time.

Source: BofA Global Research

Conclusion

A strategic allocation to emerging markets’ growth offers many potential benefits for the long-term investor, with current conditions creating a compelling entry point. However, in a period of heightened uncertainty and volatility, not all approaches will fare equally well.

Calamos Evolving World Growth Fund seeks to provide a differentiated and rational approach to emerging market growth potential. By utilizing a number of levers in tandem, including convertible securities, we believe we can provide key advantages for the investor seeking a risk-aware approach.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

For the one-year, three-year, five-year, 10-year, and since inception periods ending March 31, 2020, Calamos Evolving World Growth Fund Class I shares returned -8.94%, 0.78%, -0.73%, 1.81%, and 2.72%, respectively. The inception date of Class I shares is 8/15/08. The Total Expense Ratio for Class I shares is 1.39% as of the prospectus dated 2/28/20.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

The principal risks of investing in the Calamos Evolving World Growth Fund include: the risk the equity market will decline in general, the risks associated with growth securities which tend to trade at higher multiples and be more volatile, the risks associated with foreign securities including currency exchange rate risk, the risks associated with emerging markets which may have less stable governments and greater sensitivity to economic conditions, and the risks associated with convertible securities, which may decline in value during periods of rising interest rates.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries. Total return assumes reinvestment of dividends and capital gains distributions and reflects the deduction of any sales charges, where applicable. Performance may reflect the waiver of a portion of the Fund’s advisory or administrative fees for certain periods since the inception date. If fees had not been waived, performance would have been less favorable.

MSCI Emerging Markets Index —a free float adjusted market capitalization index. It includes market indexes of Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect any fees, expenses or sales charges. Investors cannot invest directly in an index.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

The Morningstar Diversified Emerging Markets Category is comprised of funds with at least 50% of stocks invested in emerging markets.

*For more on synthetic convertibles, see “The Case For Strategic Convertible Allocations.”

18801 0620O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.