Investment Team Voices Home Page

Investment Team Voices Home Page

Central Banks’ Digital Currency Aspirations Provide Tailwinds to Current Leaders in the Global Payments Ecosystem

Dave Gallagher, CFA and Alex Wolf, CFA

Powerful trends in the payments industry are supporting growth opportunities for companies around the world. We explored these themes last year in a pair of posts: “Field Notes: Insights on the Global Payments Ecosystem” and “Opportunities in Disruption: Finding Growth Opportunities in the Payments Ecosystem”. The migration from cash-to-card and overall digital adoption are crucial to these trends, and both are natural beneficiaries of growth in digital currencies.

Digital currencies offer many potential positives, as our team discussed last year in a post focused on Facebook’s plan to launch its own digital currency, Libra. We noted how difficult a journey it would be for Facebook without government and central bank support. Our team wrote, “Governments have a strong vested interest in retaining a monopoly on money creation, particularly for global reserve currencies, and are unlikely to let this slip away easily. It seems unlikely any of us will ever be able to pay our taxes in Libra.”

Recent developments in China play perfectly into this theme. While Libra is now being revamped and delayed, and other central banks remain in the early exploratory stages of launching digital currencies, there is growing movement within the People’s Bank of China (PBOC) to become the first central bank to launch a digital currency. The PBOC has already started trial payments in select cities.

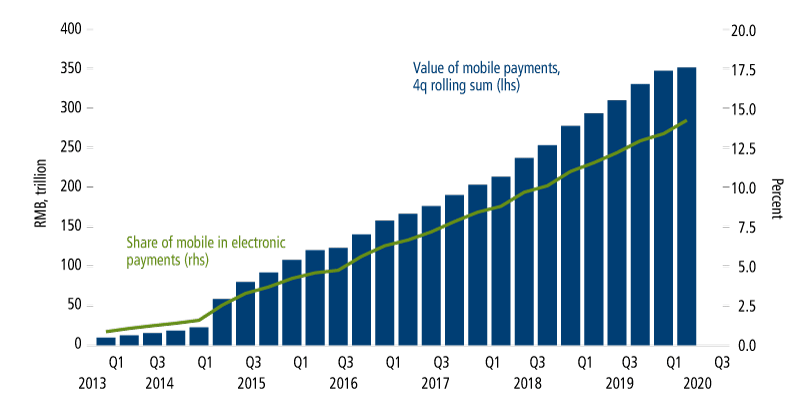

China is already a global leader in digital payments, with the share and value of mobile payments ramping up steadily over recent years. Clearly, the Chinese government is looking to take the lead in digital currencies through the utilization of a two-tier system, which would ensure it maintains control over the money supply, leveraging rather than disintermediating the current financial system.

Source: GavekalDragonomics, “Questions On The Digital Renminbi,” Xiaoxi Zhang and Wei He, July 30, 2020.

Conclusion

China’s approach should help further drive the adoption of digital payments to the benefit of companies that are already positioned for that trend, many of which are represented in our portfolios. If the PBOC and other central banks have a vested interest in winning the digital currency race, this will likely ensure that the banking system won’t be disintermediated and current payment players will remain the key beneficiaries.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

18813 0820 O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.