Investment Team Voices Home Page

Investment Team Voices Home Page

Understanding EM Opportunity Requires Looking Past the Headlines

Nick Niziolek, CFA and Kyle Ruge, CFA

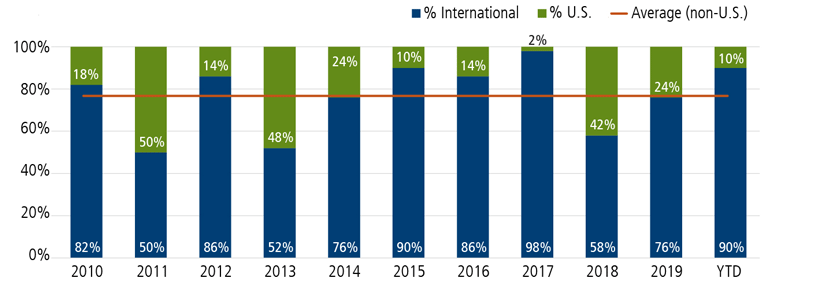

Despite headlines about the outperformance of U.S. equities over global equities over the past decade, a different picture develops when you look under the hood. Although broad U.S. market indexes may lead their global counterparts on an overall basis, non-U.S. companies are better represented among the world’s 50 top-performing companies. As shown below, over the past decade, more of the world’s top- performing companies have actually come from outside the U.S. Additionally, year-to-date in 2020, 76% of the top 50 performers have come from China.

Past performance is not a guarantee of future results. Source: Bloomberg. Data is as of 6/30/2020, based on the MSCI ACWI Index. The MSCI ACWI constituents were derived at the beginning of the year and categorized as either International (i.e. Non-US) or U.S. Performance (total return) was captured for each constituent from 1/1 to 12/31 of the appropriate year and then ranked. The number of international companies that were slotted in the top 50 best performers were counted and compared to the number of U.S. companies that made the list.

Data like this supports the case for global investment allocations, including to emerging markets. However, it also highlights the importance of individual security selection and rigorous research. Understanding the risks and opportunities of non-U.S. markets is about more than companies and industries. We also must have a clear view of regulatory and political conditions around the world.

In our efforts to stay on top of developments with these international investment opportunities, we recently attended an SEC panel discussion on emerging markets. While this panel was framed with emerging markets as the topic, in reality, it was a more targeted discussion on China, an area where we believe there are significant investment opportunities, but these opportunities are often misunderstood or overlooked due to headline noise.

As a quick background, this past May, the U.S. Senate passed a bill that could potentially result in the de-listing of Chinese ADRs if those Chinese companies don’t comply with a review of audited statements by the U.S. Public Company Account Oversight Boards (PCAOB) for three consecutive years. Companies also must attest that they are not controlled by a government agency. This bill is still being hammered out and has not yet been voted on by the House.

This recent SEC panel provided an opportunity for members of the SEC to listen to U.S. market participants, consultants, experts, auditors, and accountants weigh in on the issue at hand. There were a few consistent messages:

- While there was a call for more disclosure from and oversight of Chinese firms that can be accessed through U.S. markets, there was not a strong or consistent view that forced de-listings was the solution.

- Overall, investment managers and capital allocators were opposed to a blunt approach of forced de-listings, and noted:

- Forced de-listings would disrupt the U.S. publicly listed markets, while Chinese companies that get de-listed may just end up tapping U.S. private markets instead.

- Investments in emerging market equities, including Chinese equities, provide clear diversification benefits. De-listing Chinese ADRs would hinder access to a number of investment opportunities in good companies.

- It would not be appropriate for regulators and market participants to use a broad brush when approaching risks in China and other emerging markets.

Our team continues to believe that China’s growth potential and the ability to access it via Chinese ADRs remains an important value offering. We acknowledge the highly charged political environment but take the view that the headlines around this topic can be worse than reality, a view which was confirmed from our attendance at this SEC panel.

Our team is also in favor of more and better transparency globally, consistent with our long-established focus on economic freedoms. But, fraud can happen everywhere, including in larger developed markets—as the recent Wirecard fraud case illustrates. Coming up with an appropriate level of oversight that serves and protects investors requires a thoughtful, unemotional debate that factors in multiple perspectives and acknowledges differences across economies.

Conclusion

Non-U.S. companies, including those domiciled in China and other emerging markets, offer significant potential benefits for long-term investors. From an asset allocation perspective, we believe the pandemic has contributed to a risk environment that supports increased diversification globally. China’s economy (the first to face the pandemic) is already showing a real recovery, and a broader global recovery would be expected to benefit non-U.S. assets, including emerging markets. However, active management and comprehensive analysis are key to maximizing this opportunity, which sets up well for our risk-managed, time-tested approach. We believe our commitment to understanding the many forces that influence companies, markets, and economies will continue to provide us with key advantages.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

Diversification and asset allocation do not guarantee a profit or protect against a loss.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The MSCI All Country World Index is a market capitalization weighted index designed to provide a broad measure of equity market performance throughout the world. Indexes are unmanaged, do not include fees or expenses, and are not available for direct investment.

18808 0720 OC

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.