Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, July 2022

Outlooks from our Investment Team

- Calamos Phineus Long/Short Fund (CPLIX): The Case for Economic Slowdown, Not Recession

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Update

- Calamos Growth Fund (CGRIX): The Opportunity of “Fortress Growth” Companies

- Calamos Convertible Fund (CICVX): US Convertible Securities: We See Drivers for Favorable Risk/Reward in 2H22

- Calamos Global Convertible Fund (CXGCX): Maintaining Caution Around Re-Risking

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): Small Caps: Valuations at Extreme Lows Set the Stage for Long-term Upside

- Calamos Growth and Income Fund (CGIIX) Near-term Defensive Posture with Confidence in the Long Term

- Calamos Fixed Income Funds: Increasing Quality to Address Uncertainty

- Calamos Global and International Funds: Global Market Opportunity Amid Volatility

- Calamos Global Sustainable Equities Fund (CGSIX): ESG: Regulatory Shakeout Can Restore Trust

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

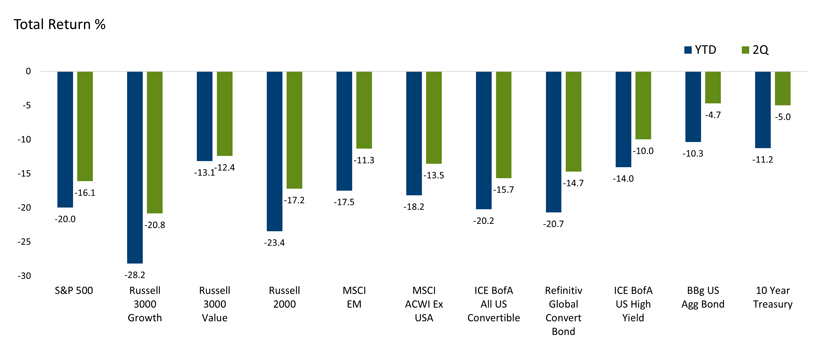

The first half of 2022 has tested the resolve and discipline of investors in a way that few periods have. Sustained inflation, geopolitical turmoil, recession fears, and an increasingly hawkish Federal Reserve have left investors wondering when—or if—the tide will turn. Although many companies continued to meet earnings expectations and individuals still hold strong household balance sheets and benefit from full employment, markets have delivered a wild ride. Equities declined sharply worldwide, with the S&P 500 Index entering bear market territory in June. The yield of the US 10-year Treasury bond was also volatile, reaching 3.49% in mid-June and finishing the quarter at 2.98%, nearly double where it stood at the end of 2021 (1.52%).

Global Asset Class Performance: A Painful 1H22

Source: Morningstar. Past performance is no guarantee of future results.

Looking to the second half of the year, individual security selection and an experienced approach will be more important than ever. Investors should be prepared for continued volatility as markets focus on Fed policy and how corporations and consumers are holding up. As midterm elections approach, fiscal policy uncertainty will add to the challenges markets face. As we have observed through the years, fiscal policy has tremendous implications for individuals, as well as small businesses, and large corporations. Reasonable levels of regulation and policies that foster entrepreneurship and encourage capital market activity provide tailwinds for economic prosperity, whereas policies that de-incentivize these activities have the reverse effect. Moreover, fiscal policy will also have a direct impact on determining which businesses and investment themes are most likely to win.

Also, I encourage investors to stay focused on the long term and to draw lessons from history. It is easy to forget all the unprecedented hurdles that the economy has navigated. For example, I began my investing career more than 50 years ago in the difficult financial markets of the 1970s, a time characterized by soaring inflation; rising rates; difficult conditions across asset classes; and geopolitical uncertainties, including the Cold War. There were still many ways to turn volatility into opportunity. And it wasn’t that long ago that people thought the Covid-19 pandemic would change the way businesses operated and people interacted forever, and global markets overreacted to the downside. However, markets sprang back in a similarly dramatic fashion as pandemic fears receded. Today, markets are reacting to a different set of circumstances, most notably, the conflict in Ukraine, inflation and Fed tightening.

Sentiment-driven behavior will always be part of the markets, but active management can help navigate a market environment driven by emotional decision-making and a short-term perspective. Although markets are generally efficient over the long term, they may be anything but efficient over the short term, which can create opportunities for experienced investors with long-term horizons.

In an environment characterized by equity market volatility and rising interest rates, investors may benefit by adding alternatives to either the equity or fixed income sleeves of their asset allocations. Our alternative funds employ a broader set of strategies to navigate markets or interest rates than traditional funds and are managed with keen attention to adjusting to market risks and opportunities. (Calamos Phineus Long/Short Fund and Calamos Hedged Equity Fund are equity alternatives, and Calamos Market Neutral Income Fund is a fixed income alternative.) Pairing these funds with our traditional “long-only” funds can provide a compelling way to enhance overall portfolio diversification.

This recognition of the role of alternatives is a cornerstone of our history. We have long appreciated how alternative strategies may help investors diversify or modify risk factors in an asset allocation. Back when I started using convertible securities as a way to help my clients navigate the difficult market conditions of the 1970s, they were very much an alternative to traditional stocks and bonds, and they may still be thought of as alternative today.

In these challenging environments, our investment teams remain committed to turning volatility into opportunity. In the posts below, they discuss fund positioning and their outlooks. We will add posts in the coming days, and I invite you to subscribe to our blog here so you’ll receive updates to your email address.

Calamos Phineus Long/Short Fund: The Case for Economic Slowdown, Not Recession

Rising inflation has led many to draw comparisons between now and the 1970s. We think the post-WWII period is a better example. WWII ended in 1945, but its economic footprint lasted until 1949. Post WWII, inflation normalized because supply was rebuilt throughout the economy. Capitalism ultimately solved inflation without central bank intervention. Corporate profits proved resilient, following nominal GDP rather than real GDP.

Today’s landscape is littered with consequences of the pandemic that are similar to the post-WWII era in many ways, including labor and supply shortages and rising inflation. Normal cyclical or economic logic has worked poorly since the pandemic began. It may remain a poor guide until supply chains normalize.

We see the long era of price stability giving way to quasi-price instability rather than the persistently high inflation of the 1970s. The proper diagnosis is that future rates of inflation will be more variable than recent decades. The focus on inflation should peak this summer. The repricing of developed world debt markets is climaxing now and as this becomes evident across the developed world, inflation expectations should ease and support a stabilization in equity markets.

The Fed needs to “hit the pause button” in September to avoid the yield curve inverting and signaling recession. As in the post-WWII era, the answer for inflation is capital investment in supply—not weaker demand. Economic growth rather than austerity is the remedy.

Economic Slowdown, Not Recession

After the markets’ horrible start to 2022, investor trauma is translating into fear of recession. Yet, financial and economic data is consistent with below-trend growth rather than recession. While real GDP is near zero in the first half of 2022, the National Bureau of Economic Research is unlikely to designate this officially as recession.

For recession to be probable, we need to see weak rather than strong employment; weak rather than elevated surveys of corporate activity; surging rather than controlled credit spreads; and an inverted yield curve. Recession has never occurred without three-month money becoming more expensive than 10-year money in advance.

The horizon at which recession risk is elevated has drawn nearer, but recession does not appear imminent. Financial conditions are only moderately restrictive. Credit spreads and other indicators of financial stress are far from extremes. Housing is the most leading indicator of aggregate demand and its outsized role in the Great Financial Crisis has reinforced that perception. Neither housing nor employment imply that recession is imminent. Households are protected by their accumulated savings, while substantial segments of the corporate sector enjoy financial health.

Material recession risk is unlikely until 2024 or 2025, although a Fed policy mistake could bring this forward into 2023. Notably, inflation-induced recessions tend to be shorter and milder than balance sheet recessions.

Corporate Profitability: Cracks in the Wall?

The true enemy of equities is not inflation but deflation in output and profits. We do not see deflation as a material risk until 2024 at the earliest. Equity markets have been repriced for slower growth. The trajectory of corporate profits will now determine if the bear market is complete. Conviction in a soft landing rather than recession will drive style and industry performance.

The corporate sector determines intermediate input prices. Profitability is therefore leveraged positively to inflation and supply limitations. We should anticipate a widening gap between real GDP (sluggish) and corporate profitability (sustained). Operating leverage is shifting from goods to services. Healthy nominal GDP (6-8% in 2022) implies corporate profitability can be sustained into 2023.

The profit cycle is transitioning from the extreme sweet spot of 2021 to something more challenging—cracks in the wall are appearing. Investors are right to be wary of rising borrowing costs, but this is not a major driver of margins over short horizons. This will evolve slowly.

Bloated inventories across the “Covid bubble” winners could be a problem, especially across durable and nondurable consumer goods. Yet the recovery in the services sector is early and sustainable. The logic of eventual recession implies quality and profitability lead, while valuation can provide material protection.

Places to Hide

The rules of a bear market are straightforward: capital preservation prevails above all else.

Today’s apprehension and despondency is a consequence of the prolonged dependency upon monetary drugs, which most investors and businesses had become accustomed to, but which can no longer be extrapolated. Investors know they have lost the protection of central bankers, at least until something breaks. Secondary factors include war in Ukraine and zero-Covid lockdowns in China.

At the start of 2022, the risks were skewed negatively. Today, the mix of opportunity and risk is more balanced depending upon “the bridges to cross.” Sector and style biases will be key in a market that remains volatile but range-bound into autumn. There is no precedent for losing money over the five years following a 20% bear decline in equities. However, results can be lackluster and especially when compared with inflation. Avoiding losses in highly overpriced areas of the equity world will be key.

Alternatives Update: Calamos Market Neutral Income Fund, Calamos Hedged Equity Income Fund

Eli Pars, CFA

Calamos Market Neutral Income Fund (CMNIX) is a fixed income alternative designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on interest rates.

We actively manage the allocations based on our view of market conditions and relative opportunities. The fund ended the second quarter with a 52% allocation to hedged equity and a 48% allocation in arbitrage, in line with weightings at the start of the quarter. Within the arbitrage allocation, the composition was also largely unchanged. At 36%, convertible arbitrage remained the largest weighting at the end of the quarter (versus 38% at the start), special purpose acquisition company (SPAC) arbitrage closed the quarter at 10% (versus 9% at the start), and merger arbitrage was 2% (versus 1% at the start).

With equities and bonds both down double-digits and credit spreads widening, there has been no place to hide. So, it is not surprising to us that the convertible arbitrage sleeve has posted a small decline year-to-date. However, our book has cheapened in the process. Currently, 55% of the convertible arbitrage book is below par (this bucket was much smaller in prior years) and yields 6.6% as of the last week of the quarter.

The hedged equity sleeve of CMNIX has been our biggest loser year-to-date, a flip from last year when it was our big winner. This is partly because of the beta of the strategy in equity market that has declined 20% this year and partly because of how hedge strategies have performed this year (a topic we explore further in our recent blog post). As of the close of the quarter, CMNIX’s hedged equity strategy has a hedge ratio that is on the high side of our targeted range. (The higher the hedge ratio, the less exposure the fund has to equity market downside.) The hedge is positioned with a larger put purchase and the addition of put spreads, above and beyond the outright long put allocation we always maintain in the fund. However, the call-write position is smaller.

In our last commentary, we noted that equity-related issuance—including in the convertible and SPAC new issue markets—was slow because of market volatility, and this continued to be the case in the second quarter. However, when equity capital markets are closed, convertibles have usually been the first to reopen, and the early deals are often attractively priced. So, although it still may be a bit longer, it’s likely we will get a deluge of paper once the market begins to open up. The SPAC market is more of an unknown, but since we use SPACs opportunistically, it has less of an impact.

Beyond expectations for convertible issuance, we see other reasons to be excited about the opportunities in convertible arbitrage. In prior drawdowns, convertible securities were not immune from declines, but often enjoyed strong tailwinds when things settled down. Also, the silver lining of a rising Fed funds rate is that our return expectations for convertible arbitrage ratchet up with the cost of overnight money.

Calamos Hedged Equity Fund (CIHEX) is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. The fund has provided some level of shelter from the S&P 500 Index’s large drawdown this year but not as much as we would have liked. This is partly because of the grinding nature of the selloff but more largely because of quirks in the option market. Among other things, fixed-strike volatility is actually down year-to-date, despite the equity market being down 20%. (We discuss this in our recent blog post as well.)

CIHEX’s hedge is at about the middle of our targeted range, versus starting the quarter closer to the lower end. The hedge is positioned with a larger put purchase and the addition of put spreads, above and beyond the outright long put allocation we always maintain in the fund. However, the call-write position is smaller. Despite the unusual conditions we’ve seen in the market, we maintain conviction in our approach and believe CIHEX can continue to provide investors with an attractive hedge against equity market volatility.

The Opportunity of “Fortress Growth” Companies

Matt Freund, CFA, Michael Kassab, CFA

The first half of 2022 is finally over. That’s the good news. The bad news is that we are only at the midpoint of the year and far from out of the woods. What started out as a modest sell-off in the markets—brought on by the collective realization that the Federal Reserve had to end its overly accommodative pandemic policies—quickly accelerated into bear market territory as it became clear the Fed needed a much more aggressive path to combat stubbornly high inflation, even though economic growth had peaked.

These past several months have been especially bruising for growth stocks, as investors have been reassessing just how much they are willing to pay for earnings that may not arrive for years to come, if ever. With these concerns front and center, valuations for so-called “concept stocks” have come under severe pressure. Much of this valuation reset in high-growth stocks seems warranted in a higher rate environment. In our view, many of these former market darlings will remain in the penalty box until they demonstrate a much more convincing path not only to earnings but to positive cash flows as well.

As we begin the second half of the year, several questions remain front and center:

- How much further will the Federal Reserve need to hike interest rates to get inflation under control?

- How much longer can US consumers stay afloat with record gasoline prices and runaway food inflation cutting into spending elsewhere?

- Is there still any hope of a “soft landing” for the US economy or is recession inevitable at this point?

- With headwinds abounding, will corporate earnings projections need to be revised materially lower?

- Will Covid-19 return to disrupt supply chains and the global economy?

And then there is the biggest question of them all: Has most of this negativity already been priced into the markets or is there another significant leg down on the horizon?

It’s clear that the next several data points on inflation are the key numbers to watch. With mortgage rates putting a serious dent in housing activity, equity prices slowly chipping away at consumer net worth, and food and energy costs starting to take their toll, the latest batch of retail spending data indicates a slowdown is formally underway. Although a spending slowdown increases the odds of recession, this may be the only way to solve the supply-demand imbalance that has been the core driver of multi-decade-high inflation levels.

Signs of inflation easing would allow the Fed to take its foot off the brake just enough to keep any flickering hope of a “soft landing” alive. That would certainly be the best scenario for equity prices going forward, and one that we believe is still somewhat plausible. No one can say with any level of certainty whether we can avoid a recession. But even if we do dip into one, this does not necessarily mean it needs to be protracted and deep. Perhaps the most likely scenario is that we do experience a contractionary period (from unsustainably high post-Covid levels), but by the time we get there, the Federal Reserve could be poised to quickly pivot back to a much more accommodative stance before significant job layoffs and earnings cuts take their toll.

Although it would certainly be a stretch to argue equity markets have already priced in a significant recession (and a much more aggressive cut to earnings projections), it seems more reasonable to believe a quick and shallow recession may not necessarily lead to another major leg down in equity prices. It is still too early to place a high level of confidence in any of these scenarios, so a more cautious stance to managing Calamos Growth Fund (CGRIX) is the most reasonable approach at this stage. This positioning translates into higher-than-normal cash levels, selective hedging, a general increase in quality, and a commitment to remain flexible and nimble as the path forward comes into better focus.

Experience has shown us that long-term investors tend to make their most profitable purchases during bear markets, although it often takes an uncomfortably long time to prove out. We acknowledge that growth investing during times of severe valuation resets can be painful. Even so, we believe investors will ultimately be rewarded if they take advantage of the dislocations and capture long-term opportunities at significantly reduced prices.

We see many such opportunities in what we call “fortress growth” companies that arguably have been unduly caught up in the broader sell-off. These are industry champions with well-established economic moats and reliable cash flow generation for years to come. We also remain committed to a smaller handful of disruptive “next-gen” tech companies with undisputed leadership positions in their respective areas, along with a more manageable timeframe to true profitability. Finally, we have maintained our exposure to smaller cap, dynamic growth names that can quickly benefit from a rebound in the US economy.

We continue to believe that prudent stock selection, constant risk management, and patience are the keys to success in markets such as these.

US Convertible Securities: We See Drivers for Favorable Risk/Reward in 2H22

Jon Vacko, CFA and Joe Wysocki, CFA

The second quarter of 2022 was another turbulent period in the financial markets as the debates around inflation, economic growth and the path of future monetary policy continued to dominate headlines. This uncertainty caused sharp declines in the equity and credit markets with many asset classes experiencing the steepest declines we have seen at this point in a calendar year, most notably in the credit markets.

However, we believe these conditions leave the US convertible securities market in an interesting spot. Convertibles are hybrid securities that can act like equities or bonds, depending on movements in the markets. The overall equity sensitivity of the convertible market is currently at the lower end of the historical range because of declining equity prices and wider credit spreads. We believe this low level of equity sensitivity, coupled with the majority of convertible bonds trading below par and closer to their bond floors, argues for improved structural risk mitigation going forward. At the same time, reduced equity valuations, positive yield-to-maturities and longer-term optionality embedded in convertible structures can be powerful drivers for future upside returns.

In periods of larger-than-typical moves, such as those we have seen recently, convertible market dynamics can change rapidly. As a result, we remain focused on actively managing the risk/reward trade-off of Calamos Convertible Fund (CICVX) We maintain our preference for the balanced portion of the market where convertibles’ structural asymmetrical profiles offer more potential upside than downside. We also are seeing increased opportunities within the lower-delta area of the market where underlying stocks have declined, credit risk is minimal in our opinion, and convertible structures offer downside risk mitigation with positive yield to maturities and upside potential.

After back-to-back years of record totals, new convertible issuance remains subdued this year. Year-to-date, $11.2 billion of new convertibles have been brought to market globally, well below the amount typically seen at this point of a year. Although we have anticipated a deceleration in the annual volume, we believe heightened global macro uncertainty has materially impacted totals. We expect an eventual calming in the overall markets should lead new issuance to resume a more traditional seasonal pace.

Only time will tell how the macro uncertainty plays out, but as we have seen over many prior market cycles, actively managing the changing dynamics of convertibles has been a useful tool for navigating short-term volatility and positioning the fund for long-term opportunities.

CXGCX: Maintaining Caution Around Re-Risking

Eli Pars, CFA

With May’s inflation number pushing the Federal Reserve to be more aggressive in raising short-term interest rates, it’s hard to see the US avoiding at least a technical recession in the next 12 months. Layoffs at the mortgage units of JP Morgan and Wells Fargo may be the canary in the coal mine that the housing sector may be cracking. It does not appear the eurozone economy is any better than the United States, especially because of Europe’s energy dependency on Russia and concerns about Italy’s ability to handle a significant rise in rates.

In Calamos Global Convertible Fund (CXGCX), we are focused primarily on maintaining a good risk/reward profile. Often, this involves increasing equity sensitivity after markets decline. However, we have not been aggressive adding risk back in the wake of the most recent decline. We are looking for signs to do so, but do not believe we are there yet. That said, the fund’s equity sensitivity (or “delta”) is only modestly less than that of the global convertible market, as measured the Refinitiv Global Convertible Bond Index.

From a sector standpoint, the fund’s biggest deviations from the market on an absolute basis remain an overweight to technology and an underweight to Europe. On a delta-adjusted basis, the fund’s technology weight is much closer to the market, but the underweight to Europe endures.

Convertible issuance has been very slow in 2022. IPO, secondary, and SPAC markets have been quiet, too. This slowdown in convertible issuance is what normally happens during periods of equity market volatility. After Lehman went under in 2008, I don’t believe we saw a new issue until March of 2009. Although we don’t expect that long a lull in issuance and we saw a trickle of deals in June, it may be a bit longer before the taps reopen. But it is likely we will get a deluge of paper once the market begins to open up. Usually when equity capital markets are closed, convertibles are the first to reopen. And the early deals are often attractively priced.

Small Caps: Valuations at Extreme Lows Set the Stage for Long-term Upside

Brandon Nelson, CFA

The second quarter was shockingly ugly as investors grappled with concerns relating to inflation, economic recession, and the trajectory of the Federal Reserve interest rate tightening cycle. Continuing the first quarter’s trend and generalizing for the overall stock market, the second quarter saw stock price valuation multiples fall sharply but without a drop in analyst earnings estimates. Even though estimates have held-up, there is a growing fear that recession risk is rising and that estimates will need to be revised lower in the future. During the quarter, many companies we follow closely reported strong results with upbeat outlooks, yet still saw their stocks decline. In general, the stock market was too obsessed with macro uncertainty to give these companies much credit. This pattern was noticeable among companies of all sizes, large and small.

Unfortunately, it's been an extremely rough year for investors (assuming you were long equities), but where do we go from here, specifically for small cap and SMID cap growth stocks? The bottom line is that the short-term (the next two to three months) could be choppy as the market likely needs to find its footing and base for a while, but the intermediate- to long-term set-up has the potential to be extremely favorable for investors. We believe inflation will eventually cool and the Fed’s hawkish rhetoric will soften, providing a catalyst for equities to rally, especially for small and SMID cap stocks, where valuations are at extreme lows (the lowest in 20 years).

Although past performance does not predict future results, it does provide a valuable perspective for the long-term investor. Our small cap and SMID cap growth portfolios have seen big drawdowns like this before and have had a strong tendency to rally in the subsequent 12 to 24 months. Something else to keep in mind: midterm elections are in November, a mere four months away. Long-term historical research from Jefferies* shows that equity markets have tended to rally sharply following the elections and that small caps and micro caps have tended to lead the way. Specifically, 12 months after the elections, large caps are higher by an average of 15.4%, small caps by 20.7%, and micro caps by 23.6%!

Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), continue to have exposure to long-term secular growers and certain cyclical growth stocks that we believe should benefit meaningfully from specific pockets of strength in the economy. A noteworthy portfolio change we made during the second quarter was to increase the funds’ exposures to certain consumer staples, a sector with more defensive, albeit still growthy, characteristics. We also increased exposure to certain health care stocks that have tended to have more recession-resistant business models and a propensity to outperform in advance of midterm elections.

Calamos Growth and Income Fund: Near-term Defensive Posture with Confidence in the Long Term

John Hillenbrand, CPA

In challenging economic and market environments, we believe balancing the long-term and short-term outlooks provides the best insights on portfolio positioning. Focusing on either one exclusively can lead to overly optimistic or pessimistic positioning that may not be warranted in the volatile markets.

Despite extreme circumstances over the past two years, we remain confident that the positive long-term growth trajectory of the US economy and the cash flow generation capabilities of US companies are intact. We see attractive long-term upside in the US equity market from current market levels, supported by current valuations that are generally between our long-term base and downside scenarios.

In the short term, the extreme conditions (both positive and negative) that occurred during these two years have not yet reverted to a more normal environment or to the long-term mean. Since mid-2021, our expectation has been for a lower growth environment in 2022 and 2023. This slower growth outlook has been exacerbated by the war in Ukraine and China’s Covid-19 shutdowns. These two factors have also worsened the inflation environment, causing most central banks around the world to raise interest rate, which should further slow growth. As we have seen in 1H22, slowing growth and rising inflation have led to significant declines in asset prices. We have yet to see significant reductions in earnings estimates, but we can expect that to occur in the near term for any number of reasons.

A mean reversion transition needs to occur for the challenging short-term environment to migrate to the more normalized long-term trend. We are watching several factors that would indicate this trend is occurring. These include improved labor market participation, a normalization of consumer spending versus income including lower real goods consumption, lower retail inventory levels, improved supply chain for certain areas of manufacturing sector, improved supply/demand for commodities (oil and food), central banks slowing their restrictive policies, resumption of China activity, and a reduction in military activity in Ukraine. This list is long and many of these factors may take a long time to occur. However, the equity markets are forward looking, so improvement in any of these factors should be positive for asset markets.

We believe the best positioning for this environment remains a defensive posture with a focus on lower-risk areas including lower-beta, high-quality balance sheets and higher return-on-capital businesses. Areas such as healthcare, staples, defense, software (cyber defense and system software) and parts of telecom provide some of those attributes. We have been positive on the supply/demand environment for energy, but we are turning somewhat cautious on this area as global growth slows. From an asset class perspective, cash and short- term Treasuries are now a useful tool to lower volatility in a multi-asset class portfolio given their now-positive yields. Despite elevated absolute volatility, we are selectively using options to gain some cyclical exposure in case our watch factors surprise to the upside.

Fixed Income Funds: Increasing Quality to Address Uncertainty

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Risk premia are back. Investors are demanding a higher level of compensation for any level of assumed risk across asset classes and securities, including higher requirements for equity investments in the form of lower multiples, higher spread compensation for credit risk, and higher term premia for duration risks. Some of these shifts were bound to happen as the Fed unwinds years of extraordinarily easy monetary policy as we emerge from the Covid-19 pandemic. And some of these shifts are related to outlooks that expect weaker growth and employment data to start showing up alongside of persistent, generationally high inflation. We expect the uncertainty and associated higher levels of compensation to endure.

The probability of left-tail risk (e.g., a recession, supply chain issues, a return to Covid lockdowns) is increasing along with the median expectation for growth moving materially lower. This calls for a risk-off environment with lower asset prices. So far, we believe little of the Fed’s activity has transmitted to the real economy. Even if we apply the shortest of historical lags, we are barely three months removed from the first step higher in overnight rates, and even less so from the moves of greater magnitude. However, the market has done a lot of tightening of financial conditions on its own.

Inflation is rotating away from goods and toward services as more consumer dollars are spent on experiences outside the home post pandemic, including travel. This is a negative development from our perspective because goods are largely produced outside the United States while services are almost entirely produced and consumed domestically, leading to a greater likelihood of a price-wage spiral. Additionally, the massive moves higher in shelter components of the Consumer Price Index will continue to play out over the next year as those measurements are gradually included in the calculation. The Fed’s inflation fight is likely to be more difficult and longer than most market participants are acknowledging. The associated elevated volatility being applied to account for a wide range of potential outcomes is unfortunately here to stay for a while.

Given that economic growth at the aggregate level is all about marginal activity, we also expect real economic growth to roll over much more quickly and prominently than broad market expectations. People in the bottom income quartile have exhausted their pandemic savings and are faced with costs of essentials that are hundreds of dollars a month higher than they were a year ago. Although a technical recession may be avoided, this level of deterioration in economic activity will feel like a recession to many Americans.

We may be near the peak differential between economic data and market outlook. Something will have to give. Our bias is toward economic activity deterioration as opposed to risk assets moving meaningfully higher. Even so, yields have increased significantly and fixed income securities now offer investors a return for taking these risks. (For more on how credit is now delivering yield, see our post, “Breaking up with TINA.”) In addition, quality assets should provide more of their traditional safe haven status if a bear case were to occur.

Positioning implications. Our base case continues to expect further spread volatility and a move to moderately higher interest rates across the Treasury curve in the balance of 2022. We have been looking for low-cost opportunities to migrate portfolio quality higher through senior and secured structures. Additionally, our appetite for credit risk and duration risk have moved closer to parity, given the growing likelihood of recession. We extended duration across the funds during the quarter, and while we continue to doubt that the above-trend inflation environment will lead to drastically higher interest rates in long-dated maturities, we are maintaining slightly cautious duration implementation across fixed income strategies.

Global Market Opportunity Amid Volatility

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

With inflationary pressures persisting and monetary policy tightening, the market remains uncertain, and we expect global equity volatility will continue until these risks resolve. Despite this complicated backdrop, we continue to identify ways to capitalize on volatility, including the opportunities we’ve highlighted below.

Energy: Energy has been an area of opportunity for our portfolios for some time, but the war in Ukraine has put the issues we have highlighted previously under the microscope. The world remains in a global oil-and-gas supply–demand imbalance, and we have yet to see a policy response that can realistically address the supply side of the equation. Although the Russian–Ukraine conflict is often cited as the primary factor behind today’s elevated energy prices, we believe the issues extend well beyond these near-term disruptions, which provides us with the confidence that energy prices will remain high even if the conflict is resolved.

Historically, energy companies have aggressively added capacity to take advantage of rising prices, only to induce the end of the rising oil cycle due to oversupply, frequently alongside a global growth slowdown. However, in the current cycle, we have yet to see capital chase growing supplies or production in this elevated price episode. A shift in global energy policy toward green initiatives, including ESG-based investing and shareholder activism, currently limits companies’ willingness to deploy new capital in an environment where carbon-producing companies are demonized.

This is in addition to the last energy cycle’s scar tissue, where significant capital was destroyed in pursuit of growing reserves and production in US shale, leaving non-ESG shareholders with a similar message for managements to deploy capital reluctantly although for different reasons. As we wrote in our recent post, “Perspectives on Quality in the Energy Sector,” we see investment opportunity based on a durable increase in fundamental quality across the energy sector. Oil and gas prices can remain elevated to support the top line, and cost efficiency and capital discipline yield stronger cash flows, debt reduction, and attractive returns to shareholders via dividends and share buybacks. A significant global economic downturn and associated demand destruction represent near-term risks, but over the medium and long term, this likely only exacerbates the underinvestment issue and supply–demand imbalance, and it further solidifies the case for owning businesses in the energy sector.

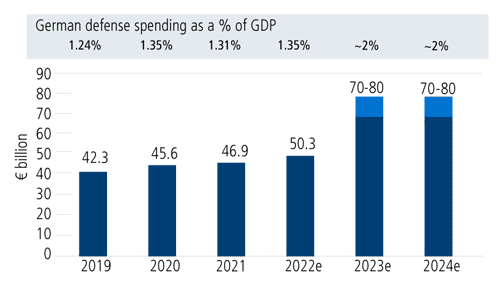

Playing Offense with Defense: Geopolitical tensions have forced countries, companies, and individuals to reassess their own military, cyber, and food security. In Europe, most countries were not spending the 2% of GDP on military defense capabilities required by NATO. Following the invasion of Ukraine, this underspending is being addressed via new spending bills and plans to rebuild defense capabilities to deter future threats (the graph below shows the planned surge of spending in Germany). The equities of European defense companies have been out of favor for most of the past decade because of this under-spending and the inability of ESG funds to directly invest in these companies. ESG-based investors and gatekeepers have reassessed this stance in recent months, reflecting the evolving view that these companies may protect and deter future violence. As a result, we’ve seen both an improvement in fundamentals on increased demand, but also a rerating of the sector as more investors allocate to this space.

Source: Rheinmetall, “FY 2021 Conference Call, Taking responsibility in a changing world,” March 17, 2022. German defense spending based on German Federal Ministry of Finance. 2023 estimate based on German government draft and statements on the federal budget and Rheinmetall estimated budget development, 2024 estimate BIP data based on Statista.

Additionally, as companies and individuals have increasingly come under threat by foreign entities in recent years, the interest in cyber security has grown. As the sophistication of hackers increases, so does the technology employed by these cyber defense companies and the IT budgets required to maintain secure networks and operating systems. Although this trend has been in place for several years, we anticipate no change in these trends and believe there are opportunities to continue to add exposure.

Last, food security is an emerging risk that is likely to materialize over the next few quarters as supply chains remain disrupted. We are focused on products and technology that can improve the efficiency and yield of existing food sources but remain focused on identifying new opportunities to benefit from this emerging risk.

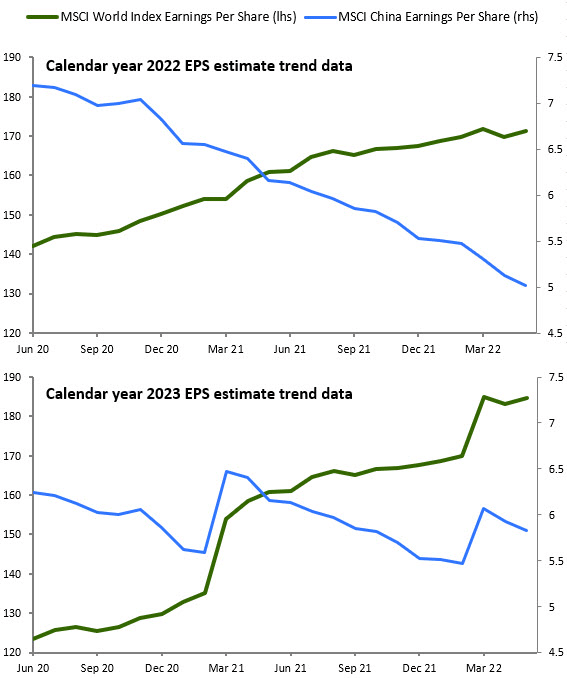

Chinese Equities: After a strong performance in 2020, when the MSCI China Index returned 29.6% versus 16.9% for the MSCI ACWI, Chinese equities underperformed significantly in the following five quarters, returning −32.79% versus 12.8% for the MSCI ACWI. Much of this pain was self-inflicted and initially the result of increased regulations and tighter monetary policy as the Chinese Communist Party sought to address risks in the real estate, Internet, and finance sectors. Continued enforcement of a zero-Covid policy that included large-scale quarantines and supply chain disruptions exacerbated this economic damage.

However, during the second quarter of 2022, Chinese equities have outperformed their global counterparts once again, and there are reasons to believe this trend could continue. As the rest of the world faces increased inflationary pressures requiring central banks to pivot to a much tighter monetary stance, China is once again in the opposite position.

Throughout the pandemic, China has been reluctant to overstimulate its economy and has just begun an easing cycle that we anticipate will accelerate through the remainder of the year. We don’t anticipate a deregulation period, but we believe the current regulatory cycle is ending, and markets will react positively to increased certainty around what the current rules and regulations are and companies’ ability to adapt. Although we see no signs of a pullback in the zero-Covid policy, we have seen signs that companies and individuals are adapting and the economic impact from the latest shutdowns were less than feared. In contrast to earnings expectations in the developed markets, which remain elevated despite the increased risks of currency movements, rising cost pressures, and the threat of an economic downturn, earnings for Chinese companies have been revised down steadily (see chart below). Equity valuations for Chinese equities are attractive relative to developed markets and history. Given these valuations, combined with lowered expectations and the potential for stimulus to contribute to upside economic surprises, we believe the Chinese equity market is well positioned as we move through the remainder of 2022.

Europe: Reopening and normalization after the most recent omicron wave of Covid had barely begun across Europe before the region was forced to confront another shock, Russia’s invasion of Ukraine. Given the importance of both Ukraine and Russia to European and global commodity supplies, the disruption to production and exports has caused an inflationary shock that is being felt most acutely in Europe where poor policy choices of recent decades have resulted in overreliance on imports for these critical areas. As prices for fuel, electricity, and food skyrocket, consumers are struggling, and overall economic activity is slowing significantly. This has made us cautious about companies with significantly European cyclical exposure.

In addition, the dynamic that this inflationary backdrop has created for the European Central Bank (ECB) is bringing the fundamental flaw in the construction of the euro currency union back under the spotlight: you cannot sustain a common currency and common monetary policy across countries that don’t also have common fiscal and banking unions. With inflation running as high as it is, the ECB, like other global central banks, has communicated that monetary policy will tighten in the coming quarters. This is a problem for an already slowing eurozone economy, but it’s a particular problem in the peripheral economies that have residual fiscal imbalances and elevated debt levels from the last crisis a decade ago. Markets are well aware of this, as spreads between core and peripheral debt have widened since the ECB first announced its intention to tighten policy.

The ECB held an emergency meeting in mid-June and has indicated it has a new “anti-fragmentation instrument” that can help to mitigate the risk to weaker and less solvent eurozone economies from tightening financial conditions. It hasn’t paid to underestimate the ability of the ECB and the EU to kick the can down the road on the issue of peripheral insolvency. And in recent years, steps have indeed been taken toward greater fiscal integration. But myriad political obstacles remain, and this is likely to be an important active fault line over the next several quarters. Regional European exposure across our portfolios largely consists of high-quality global businesses with strong balance sheets that are not heavily reliant on strong growth in Europe.

ESG: Regulatory Shakeout Can Restore Trust

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

“There are decades where nothing happens; and there are weeks where decades happen.”

—Vladimir Lenin

A lot has happened so far in 2022: Russia invaded Ukraine, China went back into lockdown, inflation is raging after years of price stability, fears over a recession have resurged and stocks suffered the worst first half of a year in decades. The first half of 2022 stands in contrast to 2021, which will be remembered as a year of record everything: record deals, record new issues, record retail expenditures, and record highs in the equity, housing and crypto markets.

The first half of 2022 has seen price declines across asset classes and geographies, driven by aggressive monetary tightening to combat inflation. After years of easing, central bankers are now saying they’re going to fight inflation even if they risk crashing the economy. Although the risk of a recession is rising, it’s not a certainty. If there isn’t a recession, then equities are too cheap. If there is a recession, then the bear market may not be extinguished until a recovery is in sight. Either way, markets will rebound over time. It’s not a matter of if; it’s a matter of when. Patient investors with a long-term orientation will be rewarded. It’s easy to forget that less than a year ago, some were predicting a post-pandemic economic boom to rival the Roaring Twenties.

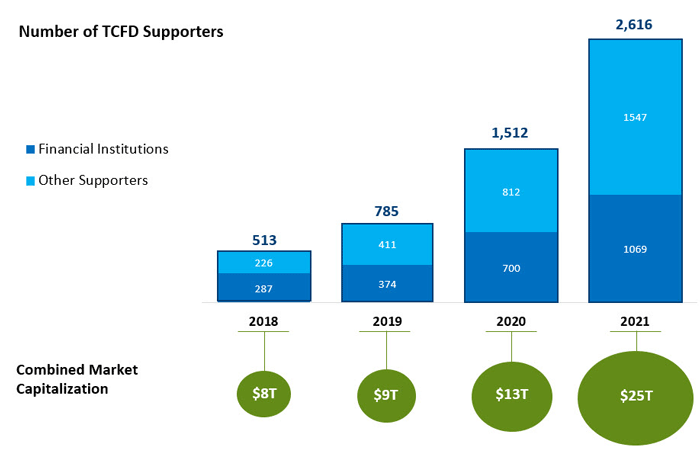

On the environmental, social and governance front (ESG), more and more companies are providing disclosure around areas such as climate risk (see the chart below). The disclosures are mostly voluntary now, but that is changing as regulatory bodies globally are pushing to make transparency around many ESG issues mandatory.

Since 2018, the number of organizations supporting the Task Force on Climate-Related Financial Disclosures has grown fivefold.

Source: carbonstreaming.com.

The main reason for the regulatory push is the materiality of the “nonfinancial” issues that ESG disclosures addressed. The case of Brazilian mining giant Vale is a prime example of this materiality. The SEC sued Vale in May 2022 because of a 2019 dam collapse that killed 270 people. The SEC’s complaint alleges that the company misled investors about the safety of the dam through its ESG disclosures.

ESG marketing spin that can be used to deceive investors is known as “greenwashing.” It can apply to unsubstantiated company information or investment vehicles that falsely claim to integrate ESG into their investment process. Given our more than 20 years of experience in the ESG space, the Calamos Sustainable Equity team has considerable experience in identifying greenwashing by companies. Additionally, our integrated approach to ESG investing has proven authentic and effective since 1997. The shakeout resulting from further regulatory scrutiny should go a long way to restoring some trust in the ESG sector.

*Past performance is no guarantee of future results. For the period from 1930 to 2018. Large caps, small caps and micro caps are classified by Jefferies. Universe includes NYSE, NASDAQ and AMEX listed names, segmented by capitalization deciles. Deciles 1-2 are large cap, deciles 3-5 are mid cap, deciles 6-8 are small cap and deciles 9-10 are micro cap.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Environmental, Social and Governance (ESG) represent the three pillars of sustainability. In a business context, sustainability refers to how well a company’s business model contributes to enduring development.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The US Dollar Index measures the value of the US dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex US Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 1000 Index is a measure of US large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18973 0722

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.