Investment Team Voices Home Page

Investment Team Voices Home Page

2021 Outlooks from the Calamos Investment Team

Outlooks from our Investment Team

- A Broader Opportunity Set for Growth Stocks (CGRIX)

- Enormous Economic Momentum Supports Sustained Equity Gains in 2021 (CPLIX)

- Maximizing Convertible Opportunity with a Balanced Approach (CICVX)

- Positioned for Conditions to Begin Normalizing in 2Q 2021 (CXGCX)

- The Bullish Case for Small- and Mid-cap Growth Stocks (CTSIX), (CTIGX)

- Fixed Income Opportunities: Improved Liquidity Conditions and Trading Levels Provide Tailwinds (CIHYX), (CTRIX), (CSTIX)

- Perspectives on Volatility (CMNIX), (CIHEX)

- Global Tailwinds Strengthen (CNWIX), (CGCIX), (CIGEX), (CIGIX)

Introduction: Active Management, the Difference Maker in 2021

John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

Our teams see many opportunities in 2021, supported by continued economic recovery, the rollout of Covid vaccines, and accommodative monetary policy from the Federal Reserve. However, individual security selection and risk management will be essential, as I discussed in my recent post, “Key Themes for Successful Asset Allocation in 2021.” We expect elevated volatility in this next phase of the economic cycle, as market participants react to fiscal policy developments, inflation expectations, a steepening yield curve and evolving information about the pandemic. The fourth quarter of 2020 was characterized by leadership rotations, and we are prepared for such shifts to persist and/or intensify as the world moves closer to a post-pandemic paradigm. New investment themes will emerge, and the divergence of fortunes among companies will continue.

Earlier this month, I wrote, “There are many good reasons to invest. This is not a time to stay on the sidelines." Echoing this theme, our investment teams share their outlooks and how they are positioning the funds they manage. We’ll be adding more commentaries and perspectives over coming days.

A Broader Opportunity Set for Growth Stocks

Matt Freund, CFA, Co-CIO and Senior Co-Portfolio Manager

Brad Jackson, CFA, SVP, Associate Portfolio Manager

Michael Kassab, CFA, SVP, Chief Market Strategist

Bill Rubin, SVP, Associate Portfolio Manager

Last spring, at the depths of the market lows, few could have envisioned that equity markets would finish 2020 at new all-time highs. This strong recovery in equity prices was initially led, in large part, by secular growth stocks—including many technology-driven companies that benefited from the continued digital transformation of our economy, a trend that was only accelerated by the “stay at home” mandates.

In the final couple months of the year, however, the opportunity set for growth stocks expanded to include cyclical growth companies, which have been the most negatively impacted by lockdowns. While the stock prices for many of these firms had partially recovered, as a group they notably lagged secular growth stocks through mid-November. However, once the first two COVID vaccines were revealed to be highly effective, investors began to more earnestly reassess the depressed valuations for companies from adversely-affected industries such as travel and leisure, consumer lending, and transportation.

We expect this healthy environment for both secular and cyclical growth stocks to persist for at least the first part of this year, as the prospects for reaching herd immunity in the U.S. by mid-to-late 2021 now seem within reach. With that, comes an eventual reopening of the global economy that will likely trigger a surge in pent-up consumer and business spending, and a potential return to normalcy by year-end.

We know the road to this end point won’t be without its twists and turns, and the landscape will likely be permanently changed for many businesses. However, we believe investors will continue to push back into more cyclically-oriented businesses that should experience a strong rebound in both revenue and earnings.

This is especially true given the sustained strong fiscal and monetary backdrop we anticipate over the next several quarters. With the new administration determined to pass another massive stimulus bill and a Federal Reserve that remains incredibly accommodative, we expect the U.S. economy to remain above trend as the recovery fully unfolds. Consumer balance sheets remain quite healthy, especially considering all that we’ve been through during the pandemic, and the corporate earnings backdrop remains poised for another couple of strong bounce-back quarters.

The markets will also likely continue to reward firms with disruptive business models and open-ended growth prospects—particularly those that can generate sustained profit and cash flow growth in what we anticipate to be a continued low interest rate environment. With this in mind, the fund maintains an outsized exposure to secular growth companies across multiple sectors. Our analysts have identified many such attractive opportunities throughout the large-cap, mid-cap, and small-cap segments of the market.

In closing, we believe it is important for the Calamos Growth Fund to cast a wide net this year across all sectors, styles, and market caps. However, with valuations for many growth stocks now elevated relative to recent history, there is less margin for error when forecasting each company’s prospects. Ultimately, this will likely be another year where picking between “winners” and “losers” remains a critical component for success.

Enormous Economic Momentum Supports Sustained Equity Gains in 2021

Michael Grant Co-CIO and Senior Co-Portfolio Manager

The outlook for sustained equity gains in 2021 is propitious. We believe risk assets will be supported by the strongest year for global GDP in more than two decades as mass vaccinations lastingly sever the link between Covid and economic activity. Our base case S&P 500 price target range for 2021 is 4000 to 4,400, with heightened risk beyond May as the market is likely to have priced in a full recovery.

Major tail risks should keep subsiding in coming quarters. Monetary policy should remain highly accommodative, credit markets are well behaved, the fiscal cliff will likely keep being pushed out, the U.S. dollar could weaken, and trade uncertainty should abate. U.S. economic activity will unfold robustly through 2021 driven by easy base effects and a fading Covid impact.

We see two principal risks. First, investors may be underestimating the eventual upside for interest rates. The pandemic dynamics mark the beginning of the end of the deflationary era that accelerated post-2008. Investors must be prepared for greater active allocation across sectors and styles in coming years. Momentum as a factor may lose its leadership. Of course, another risk is the potential for Covid to get out of control yet again.

For now, vaccination relief from the tyranny of Covid is the assumption that defines 2021. We see a sustained cyclical upswing in the context of a social “return to more normal” throughout the developed world beginning in the second quarter. This upswing in growth is occurring in a landscape of unprecedented liquidity, all underpinned by a new fiscal regime.

The lasting impact of the pandemic is the resuscitation of the role of Big Government, which entails higher public spending, higher debt levels and greater government interference in many walks of life. The policy world is shifting to an unprecedented partnership between central banking and fiscal expansionism. This convergence is symbolized by the appointment of Janet Yellen as the new Secretary of the U.S. Treasury.

The multiple consequences of the persistent expansion of indebtedness are not immediately apparent to policymakers or investors. They have been transferred to the future. Policymakers have embraced the proposition that “a good crisis should never go to waste.” The seeds are being sown for financial turmoil in the 2020s. Today’s race to spend without any consideration of the cost, and without any coherent exit strategy is a policy of capitulation. It is a product of expediency and a confession of failure.

But what matters today—for the horizon that matters for clients—are the conditions for a strong cyclical catch up in economic activity into 2022. These conditions are fermenting pricing pressures as the deflationary effects of the pandemic fade. In this respect, the behavior of the American consumer through this year will be decisive.

As long as yields are rising in anticipation of better economic activity, the equity risk premium can move lower. So far, the rise in the U.S. 10-year Treasury yield is the good type. Inflation expectations are rising and thus, real interest rates remain low and reflationary. When the U.S. 10-year yield approaches the 2% level, however, our models imply constrained valuation upside for the S&P 500. The forthcoming battle at this frontier of yields will be the intriguing market story of 2021.

2020 was largely a year of managing beta. 2021 will be more about how much recovery has been properly priced across industries and companies. What eventually emerges as a “normal economy” may be very different from 2019 depending upon how long Covid lingers, even in a world of mass vaccination. Much of this has been embraced by the consensus since November, which is driving a bullish capitulation into equities. This can continue to work for a time, but the fault lines of the past decade are beginning to fade.

The real problem for equities will emerge when the pandemic passes and the debate over how to withdraw all of this stimulus begins. What happens to interest rates when the pandemic is perceived to be over? How do central banks react to the unleashing of pent-up demand? There will eventually be a constraint upon the new U.S. policy regime. Its barometer is interest rates. Financial markets, not governments will eventually change the rules of the game.

Since March of 2020, we leaned into the equity opportunity by raising the net equity exposures. We prefer cyclicals over defensives and we prefer less mega-cap exposure. We prefer companies that can exhibit strong operating leverage in an ongoing recovery and thus, rise more than the potential valuation compression in the major benchmarks. Within the cyclical and recovery cohort, we are focused on companies that will generate earnings in 2022 that are comfortably above 2019 levels.

Calamos Phineus Long/Short Fund has maintained an overwhelming bias to U.S. versus non-U.S. equities for years. That said, we see the balance shifting more in favor of non-U.S. equities (ex-Europe) as the global recovery broadens, and as the Biden administration calms nerves on the trade front. The political picture has begun to clear in the UK as the Brexit deal was agreed upon, and we prefer the UK to continental Europe. The outlook for emerging market equities is the best it has been in many years.

Maximizing Convertible Opportunity with a Balanced Approach

Jon Vacko, CFA, SVP and Senior Co-Portfolio Manager

Joe Wysocki, CFA, SVP and Co-Portfolio Manager

2020 was a near record for U.S. convertible issuance, which surged to $106 billion for the full year. Issuance was broad based, coming from both secular growth companies as well as from more cyclically orientated firms. Almost 100 new issuers entered the convertible market for the first time. This strong issuance helped broaden the opportunity set and expand the U.S. convert market size to more than $350 billion, the largest it has ever been.

While rising underlying equities and pockets of increased issuer concentration have pushed the overall equity sensitivity of the U.S. convert market near the higher end of its historical range, there remain compelling opportunities in the balanced portion of the market where we prefer to have our greatest exposure. We’re positive on the prospects for new issuance heading into next year as we believe the recent liquidity funding and refinancing needs will transition toward growth, expansion, mergers, and innovation through increased R&D into 2021.

We enter the year positive on the overall economic recovery in part due to significant fiscal stimulus, current accommodative monetary policy and continued progress with Covid vaccinations. In addition, we expect a strong boost from consumers as pent-up demand will eventually be unleashed as people return to more normal activities. The pandemic has been a challenging time for consumers in general, but we believe they will emerge from this on a solid footing, helped by targeted stimulus and returning to work. They also stand to benefit from low mortgage rates as well as an increase in net worth supported by strength in equity and housing markets.

We do however see the potential for continued volatility in financial markets as the transition to reopen the economy may be choppy in the short term, which could result in periods of uncertainty and market rotations. In addition, the U.S. has a different fiscal policy to adapt to and as the year progresses, we may be debating the implications of the eventual withdrawal of liquidity provided by monetary policy that was key to stabilizing the financial markets in 2020.

Our focus continues to be on improving the overall risk/reward of Calamos Convertible Fund (CICVX) and maintaining a balanced profile. We prefer names that provide a healthy measure of upside equity participation while also offering potential downside resilience. In terms of positioning, we are seeking fundamentally sound businesses that have navigated through the turbulent times and are now in a position to capitalize on the growth opportunities that have emerged. We see these opportunities within long-term secular themes that we believe have accelerated, such as working from home, learning from home, medical treatment from home, shopping from home, and entertainment at home (e.g. gaming, streaming, online media). We also believe existing secular themes such as cloud computing, internet security and e-payments will provide durable growth prospects over the long term. However, equity valuations in some of these areas have risen so we are pursuing these opportunities selectively and doing so by favoring convertibles that participate on the upside, but also potentially mitigate downside.

To balance the high-growth names, we are also positioning the portfolio to benefit from our expectations of an increased cyclical tailwind heading into 2021. Recent convertible new issuance has brought opportunities from companies that we believe can profit as the economy recovers. These issues span multiple industries such as airlines, cruise lines, retail, entertainment and semiconductors. Overall, our largest absolute allocation remains to the information technology and consumer discretionary sectors while our largest relative underweight exposure is to more defensive areas such as the financial sector where we believe convertible structures are unfavorable.

Looking out over the next 12 months, we’re optimistic on an economic recovery but see the potential for continued heightened volatility in financial markets. With that backdrop, we believe the strategic case for an actively managed convertible strategy remains a compelling opportunity to seek further upside participation in equities while managing downside risk.

CXGCX: Positioned for Conditions to Begin Normalizing in 2Q 2021

Eli Pars, CFA, Co-CIO and Senior Co-Portfolio Manager

We anticipate vaccinations to start turning the tide in the fight against Covid-19 in the next month or so. Therefore, we expect travel and leisure (airlines, cruise ships, Vegas) to start normalizing in the second quarter of 2021. And this will drive the economy and employment. Pairing this with very loose fiscal and monetary policies should propel equities higher, despite the likely headwinds from rising taxes and more onerous regulations. Headline inflation may jump up but we do not expect any uptick to be sustainable. Overall, we believe the Fed’s money creation and the likely 2021 Covid recovery can offset the tax and regulatory impacts of a Biden presidency.

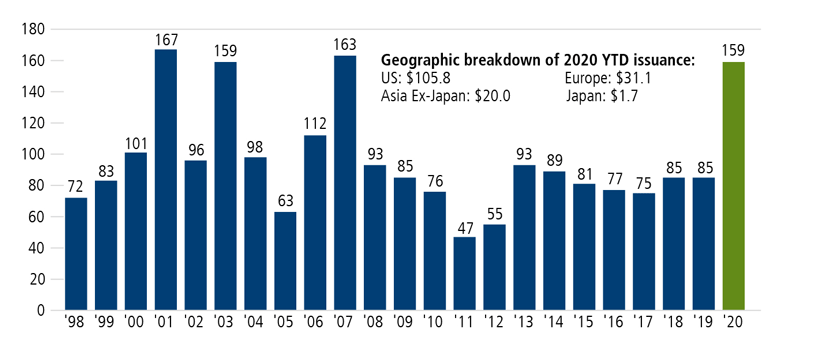

In 2020, global convertible issuance surged, with $159 billion in new paper, the most since 2007. This robust supply has included many attractive structures with good risk/reward attributes, from both cyclical and traditional growth industries. As of December 31, 2020, the global convertible market assets stand at $509 billion.

($ billion)

As of December 31, 2020. Source: BofA Global Research. The ICE BofA Global 300 Convertible Index is a global convertible index composed of companies representative of the market structure of countries in North America, Europe and the Asia/Pacific region.

We are actively rebalancing Calamos Global Convertible Fund (CXGCX) to maintain an attractive risk/reward profile. Even with high levels of issuance, the market’s equity sensitivity continues to rise, leaving us underweight the market delta. However, the fund’s equity sensitivity is not out of line with where it was in prior periods. In terms of regional allocation, the fund is neutral to the U.S. relative to the Refinitiv Global Convertible Bond Index. The fund is underweight Europe, but this is primarily the reflection of our view of bottom-up convertible opportunities versus a macro call.

In regard to sector positioning, the fund is overweighted in “Covid recovery” industries, including cruise operators and airlines. However, we have pulled back on these areas a bit, as the market prices in a higher probability of a 2021 recovery. The fund is overweight to the technology sector, its biggest sector weight on an absolute basis as well. A large part of our rebalancing activity has been in technology, where we have sought to enhance risk and reward characteristics.

The Bullish Case for Small- and Mid-cap Growth Stocks

Brandon Nelson, CFA, SVP and Senior Portfolio Manager

For the last several months, we have been bullish on small- and mid-capitalization growth stocks. Despite the recent outperformance, that bullishness continues.

Smaller capitalization stocks tend to perform well in the early stages of a new bull market and when the economy is coming out of a recession. It’s become conventional wisdom that a new bull market started in late March of 2020 and that the economy is on a positive trajectory, working its way back to pre-Covid levels.

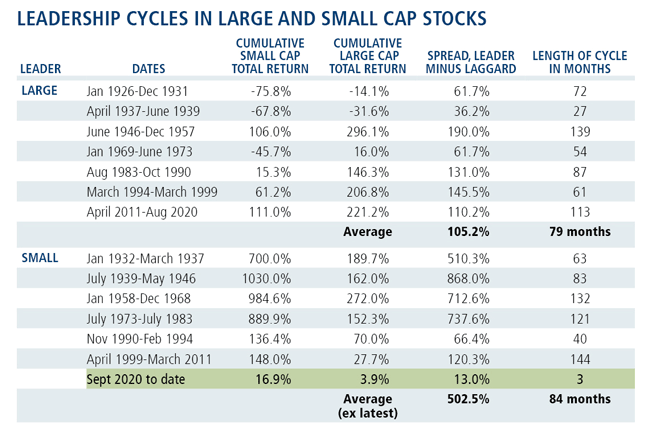

The stock market is starting to embrace this bullish thesis of smaller capitalization strength. Since September of 2020, small caps have been a leading asset class. This marks a significant regime change and is likely to continue. History shows that when small caps regain a leadership role, they tend to win big and sustain their leadership for 84 months on average, with the shortest period of leadership on record being 40 months (see the chart below). At the end of 2020, we were only four months into this new trend.

Importantly, the recent strength in smaller cap stock performance has been backed and supported by fundamental momentum in the form of extremely positive earnings and sales revisions, along with unusually low relative valuations.

Regarding positioning within the Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), we continue to have exposure to both long term secular growth stocks and certain cyclical growth stocks that will more directly benefit from an overall economic uptick. In recent weeks, we have modestly increased exposure to cyclical sectors like industrials, materials, and financials, while still maintaining a secular growth tilt within the overall portfolio.

Among the secular growers, we have exposure to a variety of themes including ecommerce, cloud communications, and certain pockets of healthcare and consumer discretionary. On the cyclical growth side, we remain tilted toward semiconductors, auto retailers, outdoor leisure, and certain stocks with exposure to residential real estate.

Past performance is no guarantee of future results. Small cap data from Ibbotson for 1926-1979; Russell 2000 thereafter. Large cap data for S&P 500. Source: Leuthold Group. The S&P 500 Index is considered generally representative of the U.S. large-cap stock market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 8% of the total market capitalization of the Russell 3000 Index.

Fixed Income Opportunities: Improved Liquidity Conditions and Trading Levels Provide Tailwinds

Matt Freund, CFA, Co-CIO, Senior Co-Portfolio Manager

Chuck Carmody, CFA, VP, Co-Portfolio Manager

Christian Brobst, VP, Associate Portfolio Manager

We believe:

- Long rates will keep going up. In this post-election environment, the yield of the U.S. 10-year Treasury could rise to 1.40% to 1.60%.

- The Federal Reserve will remain extremely accommodative.

- The yield curve will continue to steepen, with the front end locked near zero.

- Inflation will return—at least for a few quarters (see our recent post, “Will Inflation Rise in 2021? Yes. Will it Be Insurmountable? No.”).

- Treasury bonds will underperform other sectors of the bond market. It’s a market of bonds, not a homogenous bond market.

- Credit, including high yield, investment grade and bank loans will do well, but future returns will be more modest.

Our fixed income funds benefited from continued improvement in both liquidity conditions and trading levels in the fourth quarter. We believe those conditions will continue through 2021. We anticipate several key shifts in 2021, including trends toward higher Treasury yields and a steeper curve. This should be driven by higher inflation expectations that are already taking hold in the first weeks of the year. However, it remains to be seen if these high inflation readings will be permanent or transitory, as we roll off the lower base effects from 2020.

Companies have been able to shore up their financial positions through a combination of debt refinancing (extending near-term maturities) and cost cutting (companies reacted to the Covid shutdown by reducing expenses wherever possible). Newly issued bonds were met with high demand, a dynamic we do not see changing in the New Year. Despite the Federal Reserve discontinuing its liquidity programs for corporate bond markets, spreads continue to trend tighter. Our expectations for credit spreads in both the high yield and investment grade markets are for tight trading ranges in coming months with a tendency for markets to grind tighter. These conditions should favor active management, as we apply our bond-by-bond, fundamentally driven process to find relative value opportunities both inside and outside of our benchmark universes.

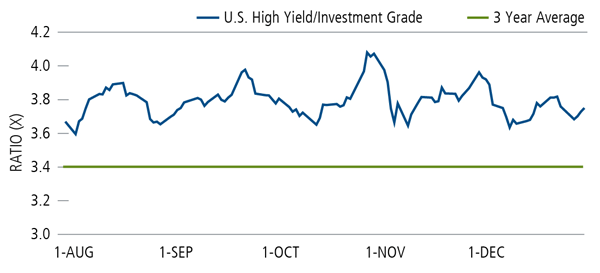

Calamos High Income Opportunities Fund. As the economy continues to recover, we believe there will be opportunities for investors to benefit from a positive tone in the high yield market. With a united government, continued stimulus spending and an accommodative Federal Reserve are likely to continue over the year. Each of these conditions should support credit markets. The high yield market also looks attractive versus investment grade bonds on a historical basis, as shown in the chart below.

Past performance is no guarantee of future results. Source: Barclays, “Barclays Tuesday Credit Call, New Year, New Hope,” January 5, 2021, using Bloomberg and Barclays Research.

Corporate default rates have steadied, and because of the velocity of the economic recovery, we now expect defaults to improve with a good likelihood that we return to the long-term average of 3% to 3.5%. Several of the more heavily impacted sectors (energy, transportation, retail) could continue to face challenges, particularly if commodity prices falter or Covid-19 circumstances required widespread shutdowns.

The team is focused on building and maintaining positions in issuers with continued access to liquidity and additional capital whether through public markets or bank loans. While we have slightly increased the overall credit quality of the fund in recent months, we continue to find opportunities across the high yield credit spectrum to be well compensated for the risks taken. We also continue to find opportunities in bank loans and preferred securities that provide attractive income for the level of credit risk.

Calamos Total Return Bond Fund (CTRIX) and Calamos Short-Term Bond Fund (CSTIX). Each fund continues to be overweight to corporate bonds and asset-backed securities versus their respective benchmarks. Despite the Fed moving out of a direct support role in these markets, these allocations provide the funds with an income advantage to benchmarks while benefiting from a very strong technical environment.

Given our outlook on interest rates and the yield curve, Calamos Total Return Bond Fund is positioned with a shorter duration than its benchmark. This is largely due to an underweight to securities with a duration of 10 years or greater. Because we anticipate the Fed to follow its guidance of holding overnight borrowing rates at zero in the coming quarters, we have positioned Calamos Short-Term Bond Fund with a neutral benchmark duration.

CMNIX and CIHEX: Perspectives on Volatility

Eli Pars, CFA, Co-CIO and Senior Co-Portfolio Manager

Calamos Market Neutral Income Fund (CMNIX) employs two complementary strategies: convertible arbitrage and hedged equity. We adjust the allocation to each based on market conditions and the opportunities we see. Throughout 2020, we steadily maintained a high allocation to convertible arbitrage. Currently, the fund’s allocation to the arbitrage strategy is 60%, its highest weighting in years. The strong pace of convertible issuance in 2020 has provided many attractive opportunities for convertible arbitrage, especially as a high percentage of these new issues traded briskly in the secondary market. The weighting to the convertible arbitrage strategy has also been boosted by the market appreciation of a number of the fund’s in-the-money convertibles. Although new issuance in 2021 may not hit the levels of 2020, it is likely to be healthy as companies seek capital in a growing economy and investor demand for convertibles remains strong. Accordingly, we expect the convertible arbitrage strategy to remain the larger allocation to the fund over the coming months.

In addition to the healthy and booming new issue market, a stable and tight credit environment and individual stock volatility (due to earnings, elections, and the vaccine outlook) have also provided pockets of volatility that provide good hunting grounds for our convertible arbitrage strategy.

The weighted average delta of the convertible arbitrage strategy is also at a high, although we have been very active in the new issue market and in refinancing in-the-money convertibles with issuers, both of which drove the fund’s delta down. Our positioning includes a significant but manageable allocation to securities that were especially disrupted by the pandemic. Many of these “Covid names” came to market with some of the cheapest valuations we’ve seen since the financial crisis in 2009 and are still trading at attractive valuations today, despite the appreciation they’ve experienced. Additionally, a number of technology companies brought attractive new issues to market in 2020, and these are a core part of the fund’s convertible arbitrage book.

Calamos Market Neutral Income Fund’s hedged equity strategy is positioned with a hedge ratio that is higher than typical. Throughout most of 2020 and into 2021, implied volatility levels have been generally higher, especially relative to realized volatility. This makes it difficult to create skew, although we continue to look to add trades that improve the risk/reward profile. We have opportunistically kept a higher call-write percentage because of the elevated implied volatility.

Similar to the hedged equity strategy in Calamos Market Neutral Income Fund, Calamos Hedged Equity Fund’s (CIHEX’s) hedge is also at the high end of its targeted range. As we noted, the current option implied volatility environment and the strong run in the equity market create added challenges in getting skew. We believe option implied volatility is somewhat elevated considering equities are near highs and realized volatility has been materially lower for a while. We expect volatility to pull back to a degree once there is further traction with vaccinations.

Global Tailwinds Strengthen

Nick Niziolek, CFA, Co-CIO, Senior Co-Portfolio Manager

Dennis Cogan, CFA, SVP, Co-Portfolio Manager

Paul Ryndak, CFA, SVP, Head of International Research

Kyle Ruge, CFA, AVP, Senior Strategy Analyst

The following is an excerpt from our 1Q 2021 outlook, which you can read its entirety here.

We maintain a favorable view on global equity markets based on a backdrop of tremendous monetary and fiscal support and our expectation that the health crisis is nearing an end. When economies are allowed to reopen, a wave of pent-up consumer and business demand will fuel an acceleration in growth and likely inflation. We anticipate that these conditions would drive a change in market leadership across several gradients, including sector, region, and style factor.

Most notably, more cyclically oriented businesses with higher operating leverage should see an acceleration in revenue and earnings as global GDP and inflation accelerate. Given the extent to which these companies have lagged over the past several years and relative valuations, we expect returns to be attractive in these areas. Within this view, we see a sustained period of U.S. dollar weakness, a theme we have focused on throughout much of 2020. As such, we continue to believe a more balanced approach is prudent, including increased exposure to cyclical businesses and those most exposed to economic reopening, as well as to international markets.

United States. Regulatory and tax policy stand to become less business- and investor friendly. But given how thin the Democratic majority is in Congress, it will be difficult for the most disruptive policy proposals to pass. There also are likely to be tailwinds from looser fiscal policy, including greater infrastructure spending. We see an improving outlook for reopening as vaccines are distributed, on top of massive pent-up demand from households flush with cash and a monetary policy backdrop that is clearly biased to letting things run hot.

We continue to invest in high-quality growth businesses where we believe prices remain reasonable and leave upside to the level of intrinsic value creation we see over the next several years. But it’s important to maintain a balance of more cyclical exposure, including to companies expected to benefit disproportionately by an economic reopening. And while there are many great opportunities within the U.S., conditions are in place for markets outside the U.S. to generate higher relative returns this year.

Europe. The renewed and prolonged restrictions across Europe will delay recovery until at least late in the first quarter of 2021, but growth headwinds should be less severe than during the second quarter of 2020, given consumers and businesses have learned to adapt to the Covid environment. Beyond that, we see the same significant pent-up consumer demand in Europe as in the U.S. and most of the rest of the world. Similar to the U.S., household savings rates have gone into historic territory, leaving a tremendous capacity for consumers to splurge on goods and services once they can get out of their homes and cities again.

Emerging Markets. We see many strong tailwinds for emerging markets. When the dollar is strengthening, it puts pressure on emerging markets to fund growth. When the dollar is weakening, the opposite typically holds true. Similar to Europe and Japan and in contrast to the U.S., emerging markets are positioned to disproportionately benefit from a global recovery given increased weightings to cyclically sensitive businesses. Additionally, vaccine developments from around the world are accelerating a recovery in Asia that was already further along, due to the region’s first-in, first-out experience of the pandemic, along with better response management.

Throughout 2020, we increased exposure to more cyclically oriented and Covid-recovery-driven areas within emerging and developed markets. We also focused specifically on identifying behavior changes that we believe can endure and build momentum in a post-Covid world. Similar to other geographies, though, we believe emerging markets offer many attractive opportunities in innovative and disruptive secular growth companies. A number of these opportunities are tied to industries in earlier stages of development as compared to developed markets, such as electric vehicles.

Japan. Japanese equities have benefited from a more limited impact of Covid-19 restrictions on Japan’s domestic economy relative to Western counterparts, as well as from Japan’s exposure to the Chinese economy. Additionally, the transition of power from Prime Minster Abe to Prime Minister Suga increased confidence in the continuation of economic reforms, and a new focus on the digitalization of the Japanese economy has furthered optimism. Japan is also well positioned to benefit from a strengthening global recovery. Historically referred to as the “world’s workshop,” Japan is home to many high-quality industrial, technology, and manufacturing companies. As a result, the Japanese equity market has historically been highly levered to the global growth environment. Given our outlook for a more reflationary environment, we believe Japan can experience a significant inflection in domestic and global investor positioning.

Learn more about the global and international funds: Calamos Evolving World Growth Fund (CNWIX), Calamos Global Growth and Income Fund (CGCIX), Calamos Global Equity Fund (CIGEX), Calamos International Growth Fund (CIGIX).

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Delta measures how much the convertible value rises or falls for a given stock move.

Duration is a measure of interest rate risk.

In-the-money convertible: A convertible with an underlying equity share price above the conversion price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, U.S. Government security risk, foreign securities risk, non-U.S. Government obligation risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the U.S. equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18862 0121

Calamos Financial Services, Distributor

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.