Investment Team Voices Home Page

Investment Team Voices Home Page

Will Inflation Rise in 2021? Yes. Will It Be Insurmountable? No.

Matt Freund, CFA

Investors should be prepared for a transient rise in inflation over the next several quarters, but it’s important to maintain perspective. We’re likely to see a short-term wave of inflation in 2021, but it’s more likely than not that the long-term trend returns to a 1.5% to 2% grind. Of course, inflation has implications for investors, but a well-diversified asset allocation can effectively address the ebbs and flows.

Here are some points that investors should keep in mind about inflation:

The starting point matters. Governments and central banks have taken extraordinary steps in response to Covid-19. Both the magnitude of the shutdowns and the backstops put in place to counteract the shutdowns have been unprecedented. As a result, many economic measures have experienced wild swings, and year-over-year comparisons will be distorted by these shifts through 2021. For example, the shuttering of economies and the collapse in demand caused inflation to plummet during the first half of 2020, off a very low base. The inflation numbers that we see in 2021 will reflect these base effects as well as 2020’s unprecedented conditions.

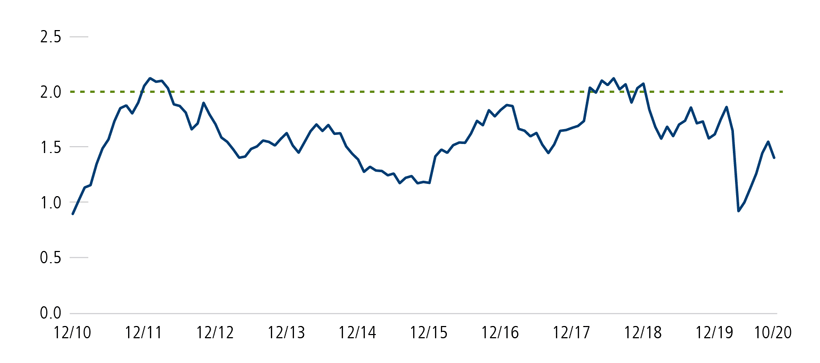

Core PCE Inflation (% change, year over year)

Source: Bloomberg. Core PCE is a gauge for inflation, measuring personal consumption expenditures excluding food and energy prices.

If moderate inflation is occurring because of economic growth, that’s not a bad thing. This is a key point that our Founder and Global Chief Investment Officer John P. Calamos, Sr. often makes, and he’s absolutely right. If our economy is growing at a healthy pace with job gains and rising production, then that should contribute to pricing power and inflation as excesses in the economy are reduced. Provided that inflation stays contained and doesn’t run hotter than gains in household wealth, corporate profitability and asset price appreciation, investors can take a more sanguine view. Deflation is a much greater danger.

In 2021, expect pent-up demand to be released, contributing to inflation. Although we need to be vigilant to changes to fiscal policy that could hinder sustainable economic expansion, these next several quarters are likely to feel good as far as the U.S. economy is concerned. Consumer balance sheets are in good shape overall, albeit with material discrepancies across income brackets. A Covid vaccine, recovering corporate profits, employment gains, a highly accommodative Fed, and a weakening U.S. dollar should contribute to U.S. economic prospects in 2021, leading in turn to higher consumer confidence and spending.

Inflation trends will not be uniform across economic sectors. The havoc wrecked by Covid has varied from sector to sector and recovery trajectories will as well. Some of the most battered areas of the economy are in the “close-contact” services sector (for example, airlines and tourism). With a long way to go before demand closes in on supply, inflation in services seems unlikely. It’s more reasonable to expect inflation in goods as consumers loosen the purse strings for discretionary purchases as the reopening gains momentum.

There are long-term “known unknowns.” While it is quite clear to us that inflation will be increasing over the next three to five quarters, the long-term trajectory is less certain. We know we don’t know what the new administration’s plans are and if Congress will go along. We also don’t know how the relationship between the Fed and the Treasury will change. (A closer relationship may allow for the implementation of untested monetary policies, including modern monetary theory or MMT.) Another wild card is debt forgiveness—to states, student borrowers or businesses that took government loans during the pandemic. Finally, in a post-Covid world, the trend toward de-globalization of supply chains could ultimately lead to higher prices for finished goods in the U.S. All of these factors have the potential to substantially increase inflation for years to come.

Global crosscurrents can keep U.S. inflation from running rampant, however. There are factors that mitigate the likelihood of high long-term U.S. inflation. The decades-long struggles of Japan and Europe illustrate how hard it is for countries dominated by aging populations and high debt levels to sustain inflation. Additionally, regardless of where the U.S. stands on the de-globalization/globalization continuum, technology innovation is keeping productivity high while steadily lowering costs. This has the effect of lowering inflationary pressures.

Long-term rates should remain well contained. Historically, higher inflation has resulted in higher interest rates, but there are some important countervailing factors at play today. The Fed has made it clear that it intends to hold short-term interest rates low for quite a while even if inflation runs hot. With short-term rates well anchored, long-term rates are likely to trend up but do so gradually. As a result, we expect the yield curve to steepen.

Implications for Asset Allocation

It’s never a good idea to fixate on single data point. Investors need to be aware of inflation, but it’s just one part of the picture. With an articulated target of the U.S. returning to full employment, the Fed is “all in” in regard to keeping short-term rates low and doing whatever it can to help the economy over rough patches. Although the exact nature of fiscal policy and stimulus remains “TBD”—especially until there’s clarity around the makeup of the Senate—we expect a Biden administration to provide plenty of support. Liquidity is also not a concern. These factors, combined with pent-up demand and a vaccine, suggest that the U.S. and global economies will continue to grow.

These conditions provide a favorable backdrop for a wide range of stocks, including growth stalwarts, quality-oriented cyclicals, and a variety of market caps. Hybrid instruments, such as convertible securities and high yield bonds, are also attractive in an environment that is likely to bring a modest increase in inflation. In the traditional fixed income market, long-term government bonds hold limited appeal, but there are opportunities in the corporate credit market, including in less-followed areas like short-duration bank loans.

For investors, diversification remains key. Active risk management is also important. None of us have a crystal ball, so it’s essential to be able to respond and adjust as circumstances change. For example, inflation can be influenced by many other factors, such as geopolitical shocks and other unexpected events. History has shown that inflation does not rise in a linear fashion and can rise quite suddenly, which means a risk-conscious investor should favor investment managers who can make nimble adjustments as conditions unfold.

Asset allocation and diversification do not guarantee a profit or protect against losses.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

High yield securities entail increased credit and liquidity risks compared to investment grade bonds. Convertible securities entail default risk and interest rate risk. Duration is a measure of interest rate risk with high durations indicating greater sensitivity to changes in interest rates. Equity securities entail the risk consisting of market prices declining in general.

18855 1220O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.