Investment Team Voices Home Page

Investment Team Voices Home Page

Key Themes for Successful Asset Allocation in 2021

John P. Calamos, Sr.

Amid its unprecedented challenges, 2020 affirmed long-standing truths about the resilience of the economy and markets. For investors, the year also reinforced the benefits of a long-term perspective, diversification and active management. Below, I discuss why these principles will be just as critical for successful asset allocation in 2021 and beyond.

-

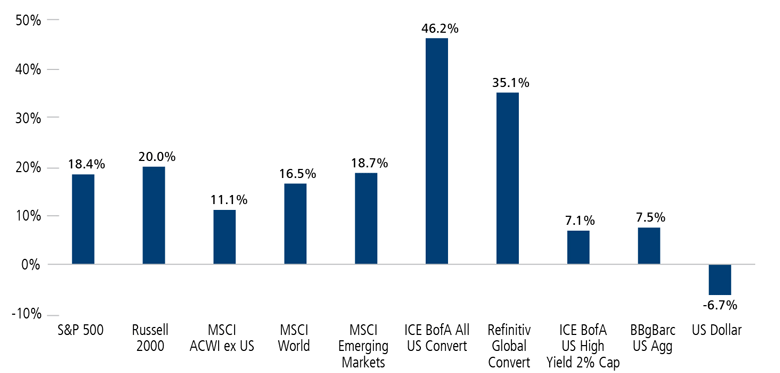

The economy and markets find a way through unprecedented challenges. Throughout the years, we have often reflected on the ability of humankind to adapt and innovate in the face of hurdles—even those that seemed insurmountable. As the pandemic took hold, central banks and governments acted decisively to support financial markets, businesses and households. Thanks to this intervention, liquidity was quickly restored to the markets. These programs also served as incentive for many companies to seek capital, with new issuance providing long-term investment opportunities and invigorating markets. In the global convertible market, for instance, new issuance for 2020 totaled nearly $159 billion—the largest amount since 2007—and included many first-time issuers. Meanwhile, many businesses capitalized on technological innovation to quickly transition to a new “at home” reality. Finally, on the medical front, ingenuity and determination have led to improved treatments and promising vaccines in record time. Against this backdrop of resourcefulness and innovation, markets rallied from their first quarter lows. U.S. and global equities and convertible securities wrapped up 2020 with very strong returns, and high yield and investment grade bonds delivered solid returns as well (Figure 1).

Figure 1. Global Markets: Navigating 2020’s Uncertainty, Looking Forward

Total Return, 2020 (%)

Past performance is no guarantee of results. Source: Morningstar. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

-

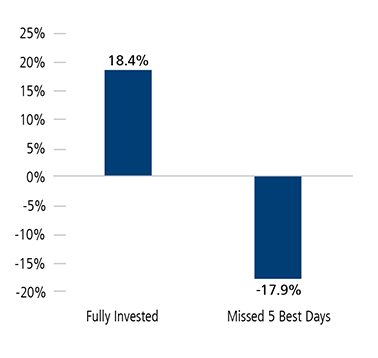

Market timing is dangerous. One of the key lessons of 2020 was simple: Don’t try to time the markets. You’re likely to end up catching the downside, but missing the upside. In 2020, investors who hopped in and out of the market could have been very disappointed with the results. Figure 2 compares two different hypothetical investments in the S&P 500 Index. If you missed the best five days of the index’s performance in 2020, you would have seen your return reverse from a gain of more than 18% to a loss of near-equal magnitude.

Figure 2. Short-Term Perspective Can Have Damaging Long-Term Consequences

S&P 500 Return, 2020 (%)

Past performance is no guarantee of future results.

-

There are many good reasons to invest. This is not a time to stay on the sidelines. There’s still healing to be done, but the U.S. and global economies are on a positive trajectory, which provides a favorable environment for risk assets. On the whole, U.S. economic data is still coming in better than expected, even if momentum has slowed. Manufacturing activity, initial unemployment claims and consumer activity have all rebounded impressively from their lows. The Federal Reserve is unlikely to deviate from its accommodative course. We expect inflation to ramp up, but we don’t believe it will upend the markets or preclude opportunities for the astute manager. (For more on our teams’ perspectives on inflation, see our posts, “Will Inflation Rise in 2020? Yes. Will it Be Insurmountable? No” and “Perspectives on Growth and Inflation Expectations in a Post-Covid World.”)

A business-friendly approach to taxes and regulation has been a key driver of markets over recent years. With neither political party having a significant majority in the Senate, this may mitigate the magnitude of fiscal policy shifts, and by extension, Wall Street’s anxiety.

Outside of the U.S., there are also reasons for optimism. As our global team has discussed in recent commentaries and posts, an aggressive global fiscal and monetary response is likely to fuel a reflationary environment that has historically provided tailwinds for non-U.S. equities, while countries such as China are benefiting from their first-in, first-out experience of Covid. (For more from our global team, visit their blog.)

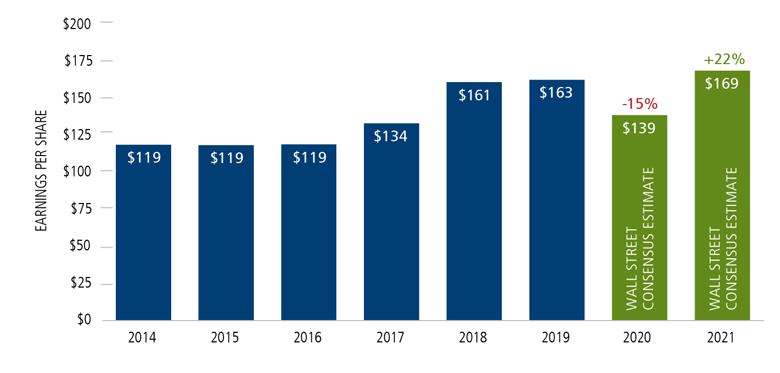

Moreover, valuations are reasonable in many parts of the equity market, especially in light of earnings expectations. As shown in Figure 3, S&P 500 constituents are projected to surpass their 2019 earnings in 2021.

Figure 3. S&P 500 Annual EPS

Bottom-Up Consensus Estimates

Source: Factset, Factset aggregates earnings estimates of Wall Street analysts that cover the underlying companies within the S&P 500 in order to derive the bottom up consensus estimates.

-

In 2021, we believe active managers have the advantage. There is considerable upside for many companies, but we expect continued market turbulence. The pandemic continues to cast a long shadow, and we are in a period characterized by transitions, accelerated disruption, and as current events in Washington have demonstrated once again, heightened political divides. We expect these factors to fuel volatility, including market rotation.

Given the potential for fiscal policy changes and inflation, this is a stock and bond pickers market, not one where “a rising tide will lift all boats.” Fiscal policies and inflationary pressures will impact the risks and opportunities for the business sector as a whole as well as for individual sectors and industries. There will be winners and losers, and these are likely to evolve over time. Active managers with tested security selection disciplines are best positioned to navigate volatility and uncertainty, building positions in attractive names during short-term selloffs or exiting positions ahead of deteriorating fundamentals. Passive managers cannot make such adjustments.

-

Revisit your small-cap growth allocation. Large-cap and small-cap stocks have typically alternated leadership in the market, which is why it makes sense to include both in a well-rounded asset allocation—especially as leadership cycles can last for years. Over recent years, large-cap stocks have dominated the markets, with the “FAANG” stocks generating outsized returns. However, toward the end of 2020, small caps began to reassert themselves. (See "Small Caps Have Rallied Back—Why We Think There’s More to Come.”) As the world moves closer to the end of the global pandemic, expect to see the market to pay more attention to opportunities in the small-cap space. We believe the case is especially strong for small-cap growth names, many of which offer very attractive fundamentals at attractive prices. Because of the idiosyncratic nature of small caps, active management and a tested discipline are essential, in my view. (Learn more about our small-cap growth approach here.)

-

Diversify globally. Many investors may be entering 2021 with too little exposure to international markets, including emerging markets. Unprecedented levels of fiscal and monetary stimulus from governments and central banks, respectively, are likely to provide powerful tailwinds for non-U.S. companies. Additionally, as Co-CIO Nick Niziolek and Co-Portfolio Manager Dennis Cogan discussed last year, a weak U.S. dollar environment has historically provided tailwinds to non-U.S. assets, including emerging market equities.

-

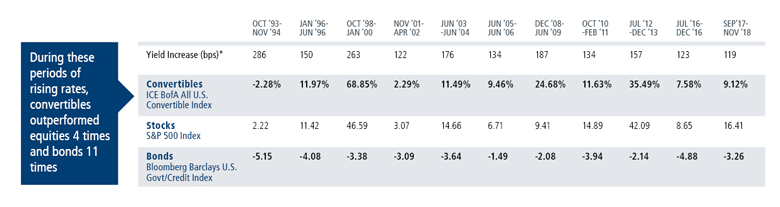

Prepare for a steepening yield curve. Last month, our Co-CIO Matt Freund noted, “With short-term rates well anchored, long-term rates are likely to trend up but do so gradually. As a result, we expect the yield curve to steepen.” While this may present headwinds for traditional fixed income strategies, there are still many ways an investor can diversify away from equities while being vigilant to interest rate risk.

Alternative strategies can be used to enhance a traditional fixed income allocation. Our market neutral income strategy pursues steady, bond-like returns without taking on a lot of interest rate risk, with a history that spans more than 30 years. Hybrid securities such as high yield bonds and convertible securities can also provide a compelling choice for investors. For example, Figure 4 shows that convertible securities have demonstrated less vulnerability to rising rates than traditional fixed income securities.

Figure 4. Convertibles Have Outperformed Traditional Bonds in Rising Interest Rate Environments

Based on periods when the U.S. 10-Year Treasury Bond yield rose more than 100 bps

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. *10 Year Treasury yield. Indexes are unmanaged, do not reflect fees or expenses and are not available for direct investment. Source: Morningstar Direct and Bloomberg. Most recent data as of 12/31/20. Rising rate environment periods from troughs to peak from October 1993 to November 2018.

-

Experience and adaptability matter. A year ago, no one could have predicted what 2020 would bring. I believe that the Calamos strategies were able to perform as well as they did because our active approaches were guided by our teams’ extensive experience in the markets, including an emphasis on managing downside risk. (For more on this, see “Volatility is Our Specialty: 2020 Confirms.”)

Conclusion

As 2021 progresses, markets will face continued challenges, but we believe that volatility will continue to sow the seeds of opportunity for the active, risk-conscious investment manager. Our teams look forward to pursuing these opportunities on behalf of those who have chosen our strategies to help them reach their long-term financial goals.

Asset allocation and diversification do not guarantee a profit or protect against losses.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations and should not be deemed as a recommendation to buy or sell the securities mentioned.

High yield securities entail increased credit and liquidity risks compared to investment grade bonds. Convertible securities entail default risk and interest rate risk. Equity securities entail the risk consisting of market prices declining in general.

The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The Russell 2000 Index measures U.S. small cap stock performance. The S&P 500 Index is considered generally representative of the U.S. equity market and is market cap weighted. The MSCI All Country World ex U.S. Index represents the performance of global equities, excluding the U.S. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of U.S. high yield debt securities. The ICE BofA All U.S. Convertible Index (VXA0) is a measure of the U.S. convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed rate bonds. The Bloomberg Barclays U.S. Govt/Credit Index is comprised of long-term government and investment grade corporate debt securities. ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

18859 0121O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.