Strong Performance, Positive Outlook Prompts Dividend Increases in 5 Calamos Closed-end Funds

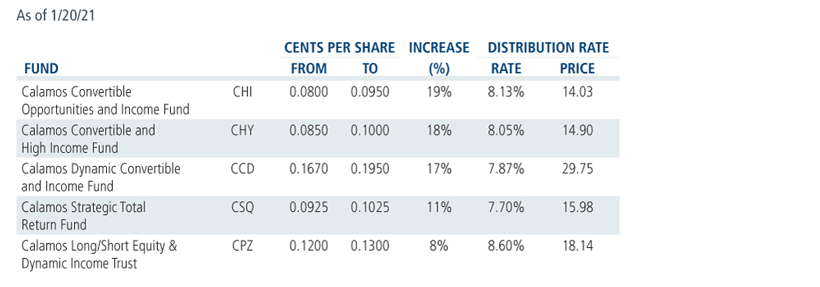

In a move designed to provide more income to shareholders as a result of recent portfolio performance and Calamos’ optimistic market view, we’ve increased the distribution levels for five closed-end funds, including:

- Calamos Convertible Opportunities and Income Fund (CHI)

- Calamos Convertible and High Income Fund (CHY)

- Calamos Dynamic Convertible and Income Fund (CCD)

- Calamos Strategic Total Return Fund (CSQ)

- Calamos Long/Short Equity & Dynamic Income Trust (CPZ)

“We are pleased these funds are well positioned to raise their monthly distributions following our effective active management, resulting in strong portfolio performance in 2020, as well as our market positioning to optimize opportunities we see for our shareholders in 2021,” said Calamos Founder, Chairman and Global Chief Investment Officer John P. Calamos, Sr. in the announcement.

“We remain committed to our closed-end fund shareholders to provide both attractive and sustainable distributions so as they may better participate in the portfolio’s returns,” he continued.

Each Fund’s payable date is February 19, 2021; their record dates are February 12, 2021; and their ex-dividend dates are February 11, 2021.

Of note, CPZ also raised its monthly distribution rate last December by $0.01 per share (see post). This amount, combined with this most recent increase, constitutes a more than 18% raise over the past two months.

Calamos CEF distributions have 0% return on capital in 2020.

Outpacing Peers

Distribution changes reflect not only the strong recent performance of the portfolio, but also consider the portfolio management team’s expectations of returns over the next several months.

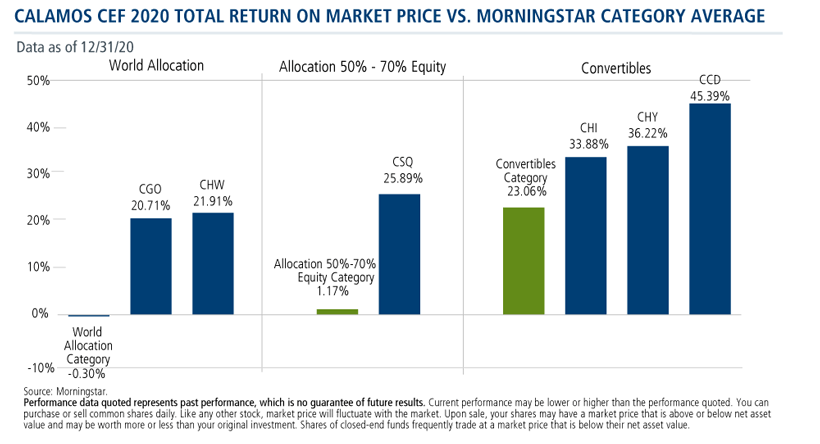

Last year all Calamos closed-end funds outperformed their respective peer group averages for both price and NAV, scoring top rankings in all respective peer groups, for both NAV and price total returns. Four Calamos funds ranked at the top, on the basis of NAV and price in 2020:

- Convertibles category: Calamos Dynamic Convertible and Income Fund (CCD) NAV, price

- World Allocation category: Calamos Global Total Return Fund (CGO), NAV and Calamos Global Dynamic Income Fund (CHW), price

- 50%-70% Equities category: Calamos Strategic Total Return Fund (CSQ) NAV, price

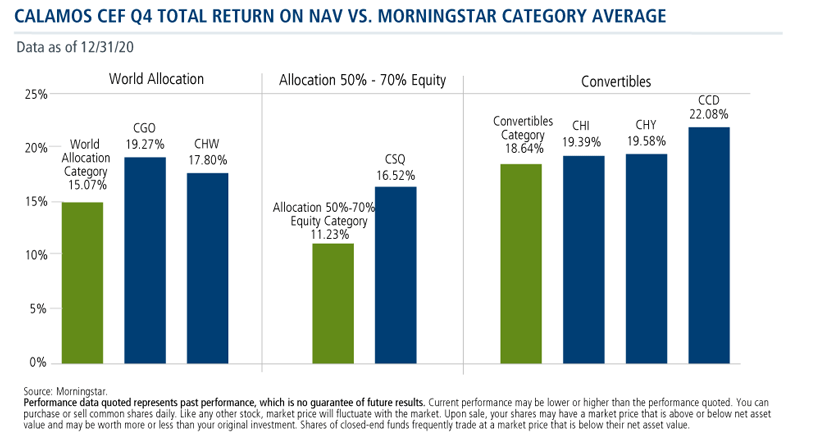

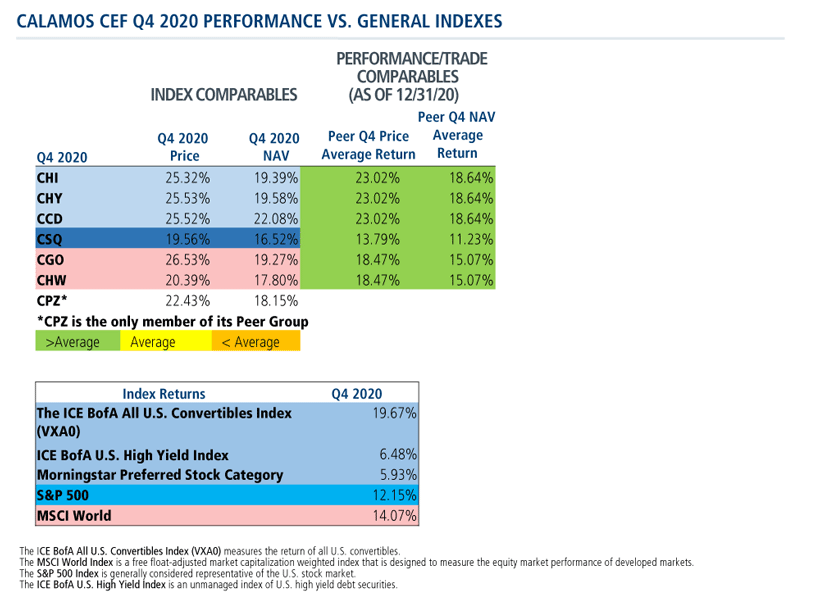

What’s more, all Calamos closed-end funds outperformed their respective peer group averages in the fourth quarter for both NAV and for price.

The Calamos Advantage

The portfolio management teams have the flexibility to invest in a range of investments to optimize returns during all market cycles. In 2020, that included what Senior Vice President and Director of Closed-End Fund Products Robert F. Bush, Jr. describes as “the Calamos advantage”—Calamos’ significant expertise in convertible securities in an outstanding year for actively managed convertibles.

Convertibles contributed to the three closed-end funds with a convertible focus (CCD, CHY and CHI), as well as three funds whose focus is general total return, and do not have a minimum investment threshold for convertibles (CHW, CGO and CSQ).

“The flexibility of these funds that do not necessarily invest in convertibles but may and did invest in them during 2020, combined with our unparalleled management capabilities in this asset class, propelled the funds' overwhelming outperformance last year on both an absolute and relative basis,” Bush added.

Inexpensive, judicious use of leverage also contributed to performance success during the year, said Bush.

Despite the funds’ strong performance, unusual pricing dynamics relative to NAV performance have created compelling value opportunities in several of the closed-end funds. They may offer solid values, and thus buying opportunities, as these assets may be purchased at excessive discounts to the NAV of the underlying portfolios, according to Bush.

For a comprehensive overview of the funds’ recent performance and a Q1 outlook from the portfolio management teams, join us this week for two webcasts. At 3:30 p.m. CST, Wednesday, Jan. 27, we’ll be hosting a CPZ-focused webcast. Our webcast the next day, at 3:30 p.m. CST Thursday, Jan. 28, will include a review of the six other funds.

Investment professionals, for more information on any of our seven closed-end funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Click here to view CHI's standardized performance.

Click here to view CHY's standardized performance.

Click here to view CHW's standardized performance.

Click here to view CSQ's standardized performance.

Click here to view CCD's standardized performance.

Click here to view CGO's standardized performance.

Click here to view CPZ's standardized performance.

Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. You can purchase or sell common shares daily. Like any other stock, market price will fluctuate with the market. Upon sale, your shares may have a market price that is above or below net asset value and may be worth more or less than your original investment. Shares of closed-end funds frequently trade at a market price that is below their net asset value.

Information contained herein is derived from sources believed to be reliable, but we cannot guarantee its accuracy, completeness, or timeliness.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Shares of closed-end funds frequently trade at a market price that is below their net asset value. Leverage creates risks which may adversely affect return, including the likelihood of greater volatility of net asset value and market price of common shares; and fluctuations in dividend rates on any preferred shares.

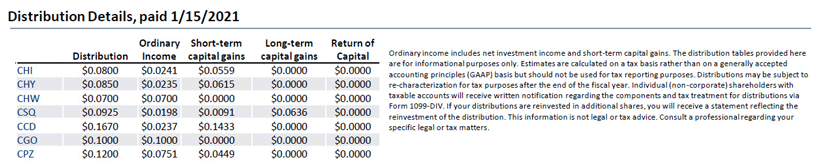

The Calamos Closed-end Funds maintain a level distribution policy. Under the Fund's level rate distribution policy, distributions paid to common shareholders typically include net investment income and net realized short-term capital gains. When the net investment income and net realized short-term capital gains are not sufficient, a portion of the level rate distribution will be a return of capital. In addition, a limited number of distributions per calendar year may include net realized long-term capital gains. Distributions are subject to re-characterization for tax purposes after the end of the fiscal year.

Investment policies, management fees and other matters of interest to prospective investors may be found in each closed-end fund prospectus.

Current Annualized Distribution Rate is the Fund’s most recent distribution, expressed as an annualized percentage of the Fund’s current market price per share.

S&P 500 Index is generally considered representative of the U.S. stock market.

802296 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 26, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.