Morningstar Remaps Liquid Alts, Industry-leading CMNIX Moves to New, 'Unrated' Category

Reassignments also involve CIHEX, CPLIX, CIGEX

Morningstar on the Category Changes

Calamos applauds Morningstar’s continuous commitment to improving investor understanding of mutual fund offerings. Morningstar has stated that their category changes are designed to achieve the following benefits:

- Help investors make more relevant comparisons between strategies that are driven by similar market dynamics and pursue similar objectives by splitting large, heterogeneous categories into smaller, more focused peer groups.

- Align alternative category classifications across regions to provide greater consistency for investors in selecting strategies.

- Differentiate between alternative strategies that aim to minimize exposure to traditional market risks and strategies that employ similar instruments and techniques—such as heavy use of derivatives, shorting, and options overlays—while maintaining exposure to traditional market risks.

We've said it for many years: Calamos Market Neutral Income Fund (CMNIX) is a fixed income alternative with few peers. Investing in a combination of convertible arbitrage and hedged equity strategies, the fund stands out among liquid alternative funds for its consistent, low volatility return profile, and is a unique solution for a conservative portfolio allocation. With such a distinctive offering the fund presents challenges to fund raters such as Morningstar, who we commend for their commitment to continually deepen investors’ understanding of the still evolving liquid alts landscape.

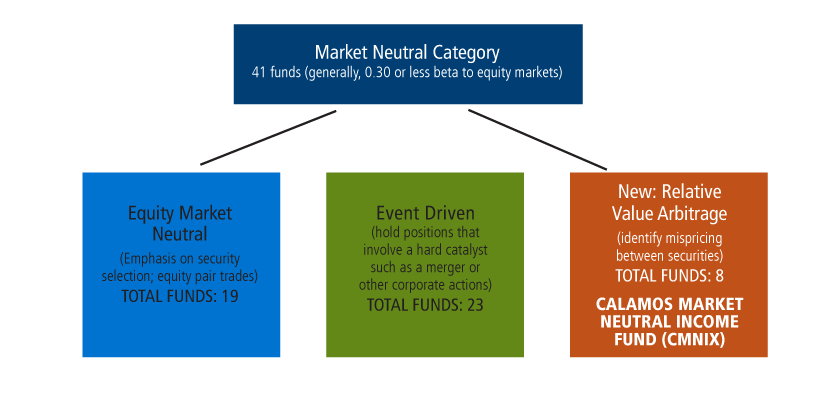

Morningstar’s April 30 recategorization of several alternative funds (see sidebar) has resulted in CMNIX moving into a new category, Relative Value Arbitrage, a group of only eight funds. With such a small set of data points, Morningstar has determined that funds in this category will not be assigned a star rating.

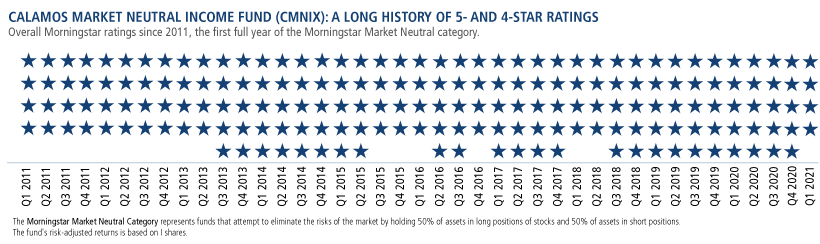

This category reassignment follows a 10-year period when the fixed income alt consistently earned five and four stars while in the now defunct Market Neutral category, which had been created by Morningstar in 2011. As one of the earliest liquid alts, CMNIX last year marked its 30th year as a bond portfolio diversifier with proven experience in capitalizing on equity volatility. Its AUM of $12.7 billion as of 3/31/2021—making it one of the industry’s largest alternatives, as well—is a measure of the extent to which investment professionals rely on the fund to meet the needs of client portfolios.

Below is the quarter-by-quarter detail on CMNIX’s star ratings, and the number of peers in the Morningstar Market Neutral category, since 2011.

The fund’s risk-adjusted returns is based on I shares.

| Date | Overall | # of funds | 3 Years | # of funds | 5 years | # of funds | 10 years | # of funds |

|---|---|---|---|---|---|---|---|---|

| Q1 2011 | 4 Stars | 108 | 4 | 108 | 4 | 54 | 4 | 19 |

| Q2 2011 | 4 Stars | 47 | 4 | 47 | 4 | 40 | 4 | 15 |

| Q3 2011 | 4 Stars | 50 | 4 | 50 | 3 | 40 | 4 | 15 |

| Q4 2011 | 4 Stars | 48 | 5 | 48 | 4 | 44 | 4 | 15 |

| Q1 2012 | 4 Stars | 50 | 5 | 50 | 4 | 45 | 4 | 18 |

| Q2 2012 | 4 Stars | 50 | 5 | 50 | 4 | 45 | 4 | 18 |

| Q3 2012 | 4 Stars | 54 | 5 | 54 | 4 | 45 | 4 | 18 |

| Q4 2012 | 4 Stars | 57 | 5 | 57 | 4 | 46 | 3 | 19 |

| Q1 2013 | 4 Stars | 55 | 5 | 55 | 4 | 46 | 3 | 19 |

| Q2 2013 | 4 Stars | 60 | 5 | 60 | 4 | 46 | 3 | 24 |

| Q3 2013 | 5 Stars | 78 | 5 | 78 | 5 | 49 | 4 | 24 |

| Q4 2013 | 5 Stars | 82 | 5 | 82 | 5 | 52 | 4 | 24 |

| Q1 2014 | 5 Stars | 87 | 5 | 87 | 5 | 54 | 4 | 24 |

| Q2 2014 | 5 Stars | 94 | 5 | 94 | 5 | 56 | 4 | 24 |

| Q3 2014 | 5 Stars | 100 | 5 | 100 | 5 | 58 | 4 | 26 |

| Q4 2014 | 5 Stars | 110 | 5 | 110 | 5 | 64 | 4 | 27 |

| Q1 2015 | 5 Stars | 100 | 5 | 100 | 5 | 64 | 4 | 27 |

| Q2 2015 | 5 Stars | 100 | 5 | 100 | 5 | 59 | 4 | 25 |

| Q3 2015 | 4 Stars | 99 | 4 | 99 | 5 | 74 | 4 | 31 |

| Q4 2015 | 4 Stars | 110 | 4 | 110 | 5 | 67 | 4 | 32 |

| Q1 2016 | 4 Stars | 109 | 4 | 109 | 5 | 69 | 4 | 33 |

| Q2 2016 | 5 Stars | 114 | 4 | 114 | 5 | 66 | 5 | 33 |

| Q3 2016 | 5 Stars | 120 | 5 | 120 | 5 | 70 | 4 | 32 |

| Q4 2016 | 4 Stars | 118 | 4 | 118 | 5 | 70 | 4 | 27 |

| Q1 2017 | 5 Stars | 114 | 5 | 114 | 5 | 67 | 5 | 28 |

| Q2 2017 | 5 Stars | 111 | 5 | 111 | 5 | 74 | 5 | 30 |

| Q3 2017 | 5 Stars | 112 | 4 | 112 | 5 | 74 | 5 | 34 |

| Q4 2017 | 5 Stars | 118 | 4 | 118 | 4 | 83 | 5 | 33 |

| Q1 2018 | 4 Stars | 114 | 4 | 114 | 4 | 78 | 4 | 30 |

| Q2 2018 | 4 Stars | 129 | 4 | 129 | 4 | 86 | 4 | 30 |

| Q3 2018 | 5 Stars | 129 | 5 | 129 | 4 | 92 | 5 | 34 |

| Q4 2018 | 5 Stars | 122 | 4 | 122 | 4 | 98 | 5 | 31 |

| Q1 2019 | 5 Stars | 130 | 5 | 130 | 5 | 100 | 5 | 33 |

| Q2 2019 | 5 Stars | 121 | 4 | 121 | 5 | 95 | 5 | 33 |

| Q3 2019 | 5 Stars | 113 | 4 | 113 | 5 | 84 | 5 | 26 |

| Q4 2019 | 5 Stars | 109 | 4 | 109 | 5 | 88 | 5 | 30 |

| Q1 2020 | 5 Stars | 99 | 4 | 99 | 5 | 79 | 5 | 21 |

| Q2 2020 | 5 Stars | 99 | 4 | 99 | 5 | 83 | 5 | 21 |

| Q3 2020 | 5 Stars | 101 | 4 | 101 | 5 | 74 | 5 | 22 |

| Q4 2020 | 5 Stars | 92 | 4 | 92 | 4 | 72 | 5 | 23 |

| Q1 2021 | 4 Stars | 91 | 3 | 91 | 4 | 76 | 5 | 23 |

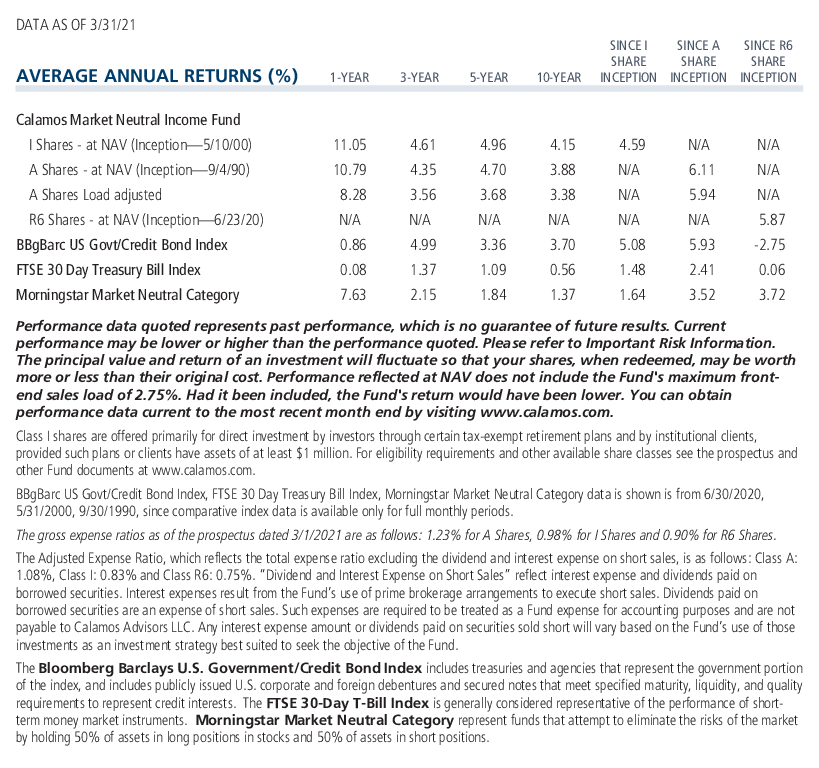

Users of liquid alts recognize that star ratings can help only so much in determining fit for client portfolios, and the Calamos Product Management and Portfolio Analytics team has consistently stressed the importance of considering a range of performance metrics (see this post).

More helpful, perhaps, is the forward-looking qualitative analyst rating from Morningstar. CMNIX was awarded a Morningstar Bronze rating last July (see post). The evaluation is based on five key factors—process, performance, people, parent and price—that the analysts believe “lead to funds that are more likely to outperform over the long term on a risk-adjusted basis.”

CMNIX’s move to the Relative Value Arbitrage category has no bearing on the management of the fund itself, of course. For the latest on the fund’s positioning, please see this commentary.

Investment professionals use CMNIX as a ballast to a portfolio in all market environments. The rise in interest rates since August has made the fixed income alternative particularly attractive (see this post). In the first three months of 2021, an excellent quarter for alternatives, the Market Neutral category attracted almost half (46%) of the net new money flowing into alts. CMNIX attracted half of those flows, according to a report in today’s Ignites. It was the second highest-selling alt fund in the quarter.

Below is an overview of the changes to Calamos fund category assignments as a result of Morningstar’s April 30 recategorization.

CMNIX and the Relative Value Arbitrage Category

Calamos Market Neutral Income Fund (CMNIX)’s new category, Relative Value Arbritrage, is similar to Event Driven strategies in that some Relative Value Arbitrage fund positions may be based on corporate transactions, but the profits of the trade are based on the convergence of values between the securities rather than the outcome of the corporate transaction.

Characteristics of Relative Value Arbitrage funds, according to Morningstar:

- Typically, a low volatility trading strategy; attempt to generate a profit despite direction of markets.

- Includes multiple security types: equities, convertibles, derivatives, fixed income, currency, among others.

- Can include event driven strategies where the investment thesis is based on the realization of a pricing discrepancy between related securities instead of the outcome of the corporate transaction.

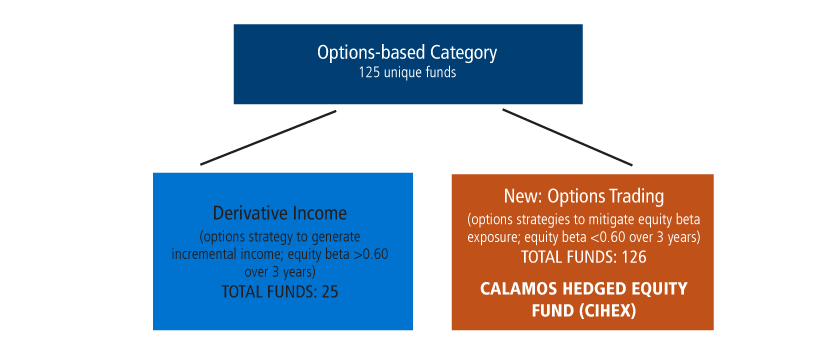

CIHEX Moved to Options Trading Category

The Options-based category has historically been one of the most heterogenous of the alternative categories. (In fact, Calamos produced a category explainer, now outdated.) Some strategies are highly correlated to equity markets while others are based on options market volatility structures.

This category is being split into two: Options Trading, which will include Calamos Hedged Equity Fund (CIHEX), and Derivative Income.

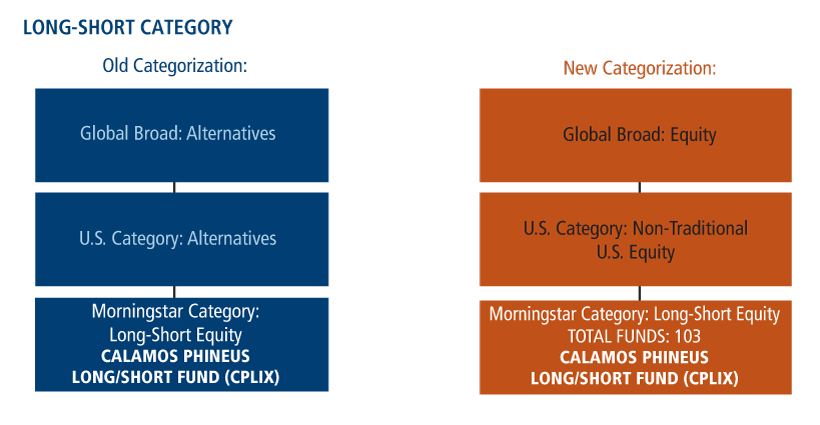

CPLIX: Category Is Moving, Peers Unchanged

The Long/Short Equity category continues but will now be categorized in the Equity Global Broad Category Group, under Non-Traditional Equity U.S. Category Group. This includes Calamos Phineus Long/Short Fund (CPLIX).

The goal, according to Morningstar, is to “differentiate between alternative strategies that aim to minimize exposure to traditional market risks and strategies that employ similar instruments and techniques—such as heavy use of derivatives, shorting, and options overlays—while maintaining exposure to traditional market risks.”

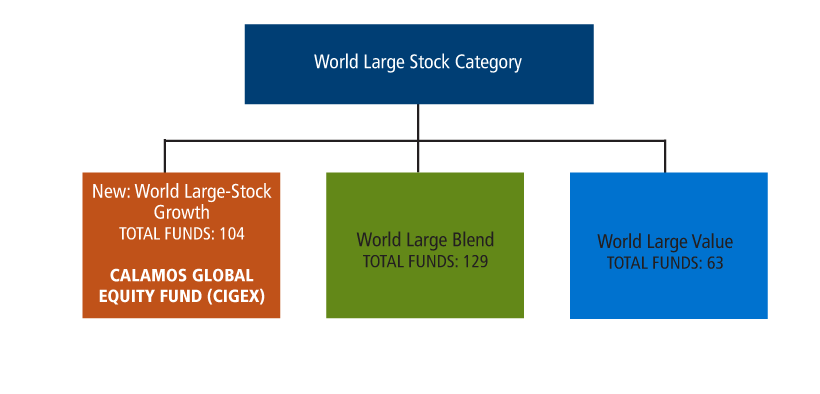

And: CIGEX Moved to World Large Growth

Finally, Morningstar also made a change to the World Large Stock category, which “had become too large and warranted differentiation across style spectrum to ensure global portfolios were compared to their closest peers.” Calamos Global Equity Fund (CIGEX) has been moved from World Large Stock to a new category, World Large Growth.

Investment professionals, for more information about these changes or Calamos funds in general, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Past performance is not necessarily indicative of future results.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Alternative investments may not be suitable for all investors.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Hedged Equity Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Market Neutral funds (pre-April 30) attempt to reduce systematic risk created by factors such as exposures to sectors, market-cap ranges, investment styles, currencies, and/or countries.

Relative Value Arbitrage strategies seek out pricing discrepancies between pairs or combinations of securities regardless of asset class. They often employ one or a combination of debt, equity, and convertible arbitrage strategies, among others. They can use significant leverage and typically seek to profit from the convergence of values between securities. Funds in this category typically have low beta exposures to major market indexes due to their offsetting long and short exposures.

Options-based funds (pre-April 30) use options as a central component of their investment strategies.

Options Trading strategies use a variety of options trades, including put writing, options spreads, options-based hedged equity, and collar strategies, among others. In addition, strategies in this group that engage in option writing may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies. Funds in the category will typically have beta values to relevant benchmarks of less than 0.6.

Long-short equity funds (pre-April 30) hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives.

Long-Short Equity portfolios hold sizeable stakes in both long and short positions in equities, exchange traded funds, and related derivatives. Some funds that fall into this category will shift their exposure to long and short positions depending on their macro outlook or the opportunities they uncover through bottom-up research. At least 75% of the assets are in equity securities or derivatives, and funds in the category will typically have beta values to relevant benchmarks of between 0.3 and 0.8.

World Large Stock portfolios (pre-April 30) invest in a variety of international stocks that are larger. World-stock portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in developed markets, with the remainder divided among the globe’s smaller markets. These portfolios typically have 20%—60% of assets in U.S. stocks.

World Large-Stock Growth portfolios invest in a variety of international stocks and typically skew towards large caps that are more expensive or projected to grow faster than other global large-cap stocks. World large stock growth portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in developed markets, with the remainder divided among the globe’s emerging markets. These portfolios are not significantly overweight U.S. equity exposure relative to the Morningstar Global Market Index and maintain at least a 20% absolute U.S. exposure.

The Morningstar Analyst RatingTM is not a credit or risk rating. It is a subjective evaluation performed by Morningstar’s manager research group, which consists of various Morningstar, Inc. subsidiaries (“Manager Research Group”). In the United States, that subsidiary is Morningstar Research Services LLC, which is registered with and governed by the U.S. Securities and Exchange Commission. The Manager Research Group evaluates funds based on five key pillars, which are process, performance, people, parent, and price. The Manager Research Group uses this five-pillar evaluation to determine how they believe funds are likely to perform relative to a benchmark over the long term on a risk adjusted basis. They consider quantitative and qualitative factors in their research. For actively managed strategies, people and process each receive a 45% weighting in their analysis, while parent receives a 10% weighting. For passive strategies, process receives an 80% weighting, while people and parent each receive a 10% weighting. For both active and passive strategies, performance has no explicit weight as it is incorporated into the analysis of people and process; price at the share-class level (where applicable) is directly subtracted from anexpected gross alpha estimate derived from the analysis of the other pillars. The impact of the weighted pillar scores for people, process and parent on the final Analyst Rating is further modified by a measure of the dispersion of historical alphas among relevant peers. For certain peer groups where standard benchmarking is not applicable, primarily peer groups of funds using alternative investment strategies, the modification by alpha dispersion is not used.

The Analyst Rating scale is Gold, Silver, Bronze, Neutral, and Negative. For active funds, a Morningstar Analyst Rating of Gold, Silver, or Bronze reflects the Manager Research Group’s expectation that an active fund will be able to deliver positive alpha net of fees relative to the standard benchmark index assigned to the Morningstar category. The level of the rating relates to the level of expected positive net alpha relative to Morningstar category peers for active funds. For passive funds, a Morningstar Analyst Rating of Gold, Silver, or Bronze reflects the Manager Research Group’s expectation that a fund will be able to deliver a higher alpha net of fees than the lesser of the relevant Morningstar category median or 0. The level of the rating relates to the level of expected net alpha relative to Morningstar category peers for passive funds. For certain peer groups where standard benchmarking is not applicable, primarily peer groups of funds using alternative investment strategies, a Morningstar Analyst Rating of Gold, Silver, or Bronze reflects the Manager Research Group’s expectation that a fund will deliver a weighted pillar score above a predetermined threshold within its peer group. Analyst Ratings ultimately reflect the Manager Research Group’s overall assessment, are overseen by an Analyst Rating Committee, and are continuously monitored and reevaluated at least every 14 months.

For more detailed information about Morningstar’s Analyst Rating, including its methodology, please go to https://shareholders.morningstar.com/investor-relations/governance/Compliance--Disclosure/default.aspx.

The Morningstar Analyst Rating (i) should not be used as the sole basis in evaluating a fund, (ii) involves unknown risks and uncertainties which may cause the Manager Research Group’s expectations not to occur or to differ significantly from what they expected, and (iii) should not be considered an offer or solicitation to buy or sell the fund.

Morningstar RatingsTM are based on risk-adjusted returns for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc. All rights reserved.

The Bloomberg Barclays US Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

The FTSE 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

802387 521

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 06, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.