Rising Rates Don’t Intimidate Fixed Income Alt CMNIX

James Carville

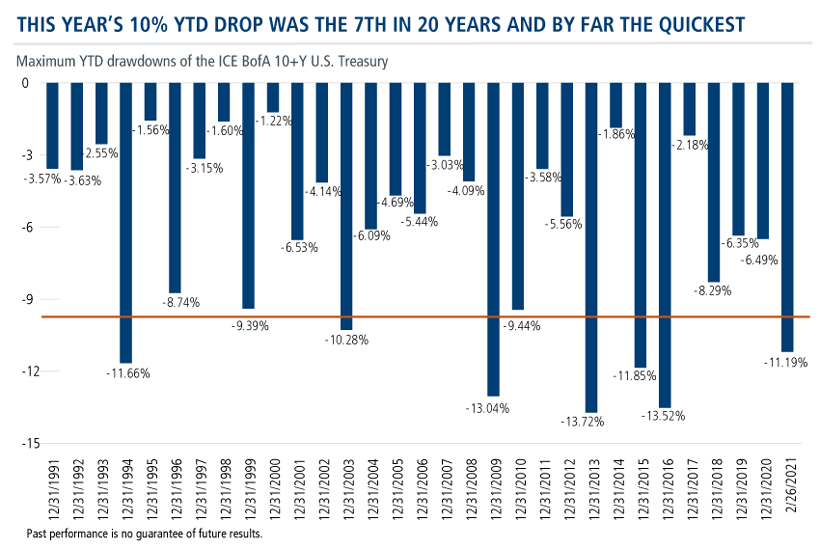

If it's true that rising interest rates can jeopardize investment success, last week left no doubt that it’s time to batten down the hatches. The 10-year Treasury closed Thursday at 1.54%—a 102 basis point increase from the August 4, 2020, low of 0.52%.

With a speed eerily reminiscent of last year’s stock market correction, it’s taken just 38 days for the return on the 10-year Treasury to drop more than 10%. That's a record.

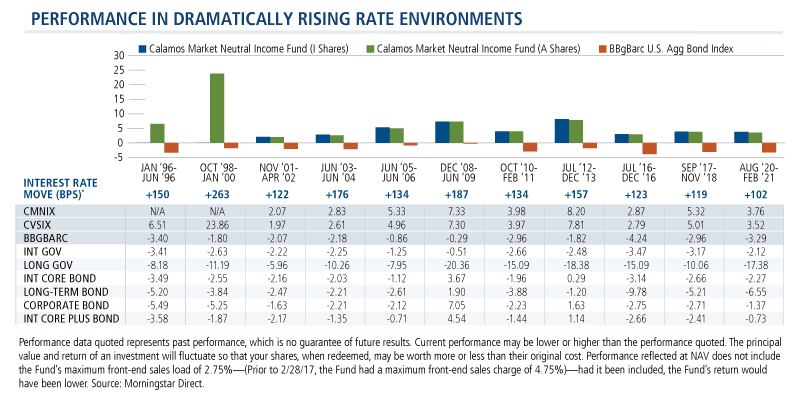

But there’s no reason to be intimidated. These are the times that help illustrate the benefit of diversifying with a fixed income alternative. Below you’ll see the performance of Calamos Market Neutral Income Fund (CMNIX) compared to traditional fixed income.

CMNIX has a 705-basis point advantage over the Bloomberg Barclays U.S. Aggregate Bond Index since August. But note its performance, too, against other bond fund categories, all of which bear duration and credit risk. To be sure, rising rates can pose challenges for investors; from our perspective this is yet another argument for active management.

Source: Morningstar Direct.

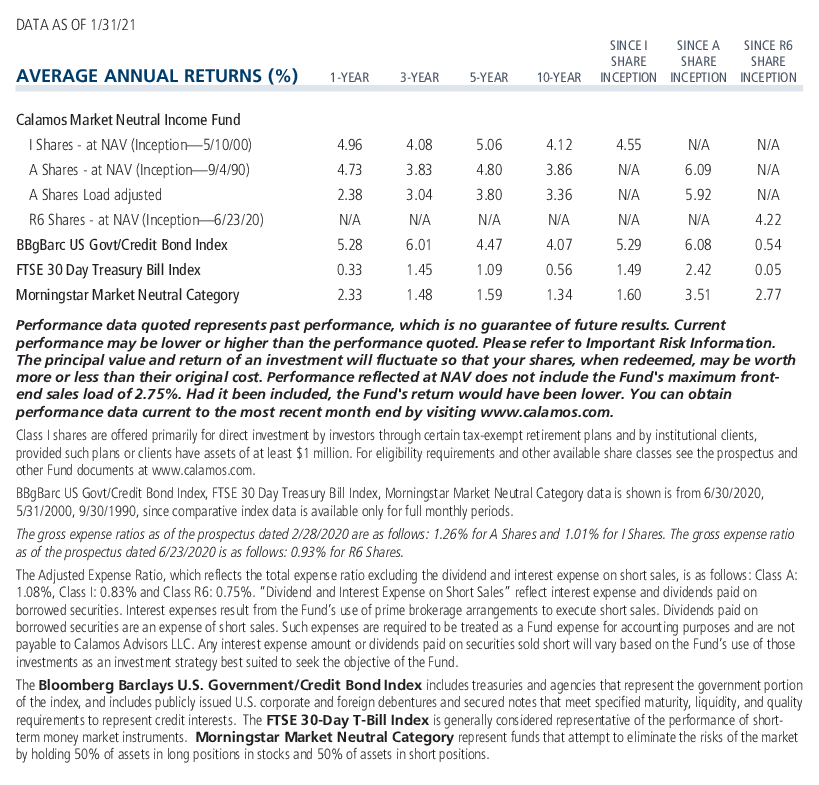

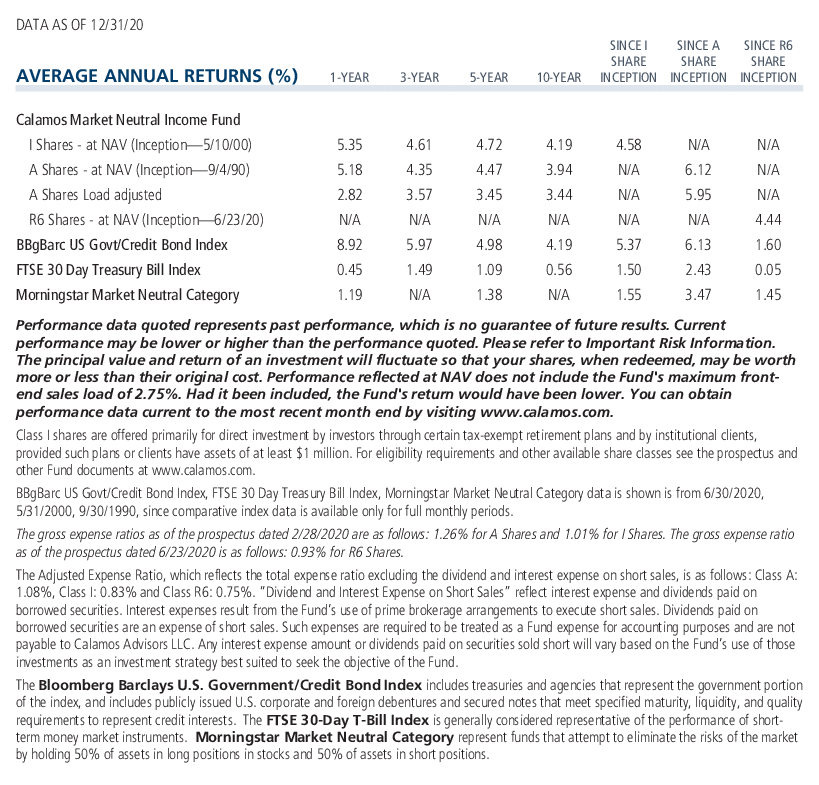

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.75%. Had it been included, the Fund's return would have been lower. You can obtain performance data current to the most recent month-end by visiting www.calamos.com.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

Corporate Bond: Corporate bond portfolios concentrate on investment-grade bonds issued by corporations in U.S. dollars, which tend to have more credit risk than government or agency-backed bonds. These portfolios hold more than 65% of their assets in corporate debt, less than 40% of their assets in non-U.S. debt, less than 35% in below-investment-grade debt, and durations that typically range between 75% and 150% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Intermediate Core Bond: Intermediate-term core bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, and hold less than 5% in below-investment-grade exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Intermediate Core-Plus Bond: Intermediate-term core-plus bond portfolios invest primarily in investment-grade U.S. fixed-income issues including government, corporate, and securitized debt, but generally have greater flexibility than core offerings to hold non-core sectors such as corporate high yield, bank loan, emerging-markets debt, and non-U.S. currency exposures. Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index.

Intermediate Government: Intermediate-government portfolios have at least 90% of their bond holdings in bonds backed by the U.S. government or by government-linked agencies. This backing minimizes the credit risk of these portfolios, as the U.S. government is unlikely to default on its debt. These portfolios have durations typically between 3.5 and 6.0 years. Consequently, the group's performance—and its level of volatility—tends to fall between that of the short government and long government bond categories. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Intermediate is defined as 75% to 125% of the three-year average effective duration of the MCBI.

Short-term Bond: Short-term bond portfolios invest primarily in corporate and other investment-grade U.S. fixed-income issues and typically have durations of 1.0 to 3.5 years. These portfolios are attractive to fairly conservative investors, because they are less sensitive to interest rates than portfolios with longer durations. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short-term is defined as 25% to 75% of the three-year average effective duration of the MCBI.

Multisector Bond: Multisector-bond portfolios seek income by diversifying their assets among several fixed-income sectors, usually U.S. government obligations, U.S. corporate bonds, foreign bonds, and high-yield U.S. debt securities. These portfolios typically hold 35% to 65% of bond assets in securities that are not rated or are rated by a major agency such as Standard & Poor's or Moody's at the level of BB (considered speculative for taxable bonds) and below.

Nontraditional Bond: Inclusion in nontraditional bond is informed by a balance of factors determined by Morningstar analysts. Those typically include a mix of: absolute return mandates; goals of producing returns not correlated with the overall bond market; performance benchmarks based on ultrashort-term interest rates such as Fed funds, T-bills, or Libor; the ability to use a broad range of derivatives to take long and short market and security-level positions; and few or very limited portfolio constraints on exposure to credit, sectors, currency, or interest-rate sensitivity. Funds in this group typically have the flexibility to manage duration exposure over a wide range of years and to take it to zero or a negative value.

Short Government: Short-government portfolios have at least 90% of their bond holdings in bonds backed by the U.S. government or by government-linked agencies. This backing minimizes the credit risk of these portfolios, as the U.S. government is unlikely to default on its debt. These portfolios have durations typically between 1.0 and 3.5 years, so they have relatively less sensitivity to interest rates and, thus, low risk potential. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Short is defined as 25% to 75% of the three-year average effective duration of the MCBI.

Ultrashort Bond: Ultrashort-bond portfolios invest primarily in investment-grade U.S. fixed-income issues and have durations typically of less than one year. This category can include corporate or government ultrashort bond portfolios, but it excludes international, convertible, multisector, and high-yield bond portfolios. Because of their focus on bonds with very short durations, these portfolios offer minimal interest-rate sensitivity and therefore low risk and total return potential. Morningstar calculates monthly breakpoints using the effective duration of the Morningstar Core Bond Index in determining duration assignment. Ultrashort is defined as 25% of the three-year average effective duration of the MCBI.

CMNIX’s most recent performance extends its historical record of performance consistency during rising rate environments.

Investment professionals, your Calamos Investment Consultant can tell you all about CMNIX. Reach out to him or her at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Hedging Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

802319 321

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 02, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.