Unconcerned by Rising Rates and Cheering Volatility, CMNIX PMs Like 2021 So Far

Market volatility generally benefits the Calamos Market Neutral Income Fund (CMNIX).

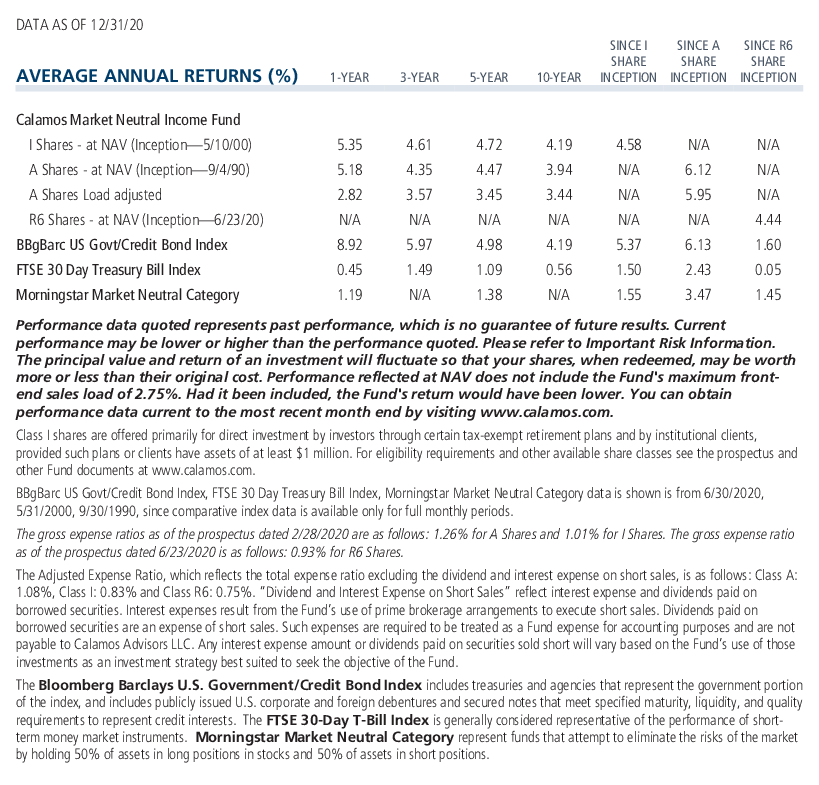

That was true last year, when the fund returned 5.35% (versus the Morningstar Market Neutral Category return of 1.29%). It was difficult to add alpha during the market’s quick, sharp COVID-19 correction, but the fund benefited from the embedded value in the convertible arbitrage book as the market normalized, which Calamos Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager Eli Pars explained on yesterday’s CIO call (listen here).

And, a different kind of volatility happening this month also has been positive for the fund, with heightened trading attributed to speculation driven by social media platforms including WallStBets (Reddit) and Robinhood.

“These specific retail segments are causing major swings that really don’t have much of a fundamental basis,” said Jason Hill, Senior Vice President, Co-Portfolio Manager.

”This kind of uncertainty is typically really good for us as it just creates potential spillover residual volatility to companies, industries and sectors. The volatility doesn’t have to be in a convertible bond-specific name or even a position in our book to create volatility throughout this strategy. We can trade that back and forth to make money.”

Hill named multiple catalysts with the potential to create short-term market shocks this year, including ongoing political and social issues, corporate earnings announcements, COVID/vaccine delays, equity valuations and social media’s continued role in the markets.

“All of these present a good opportunity to have increased volatility that flows through to valuations to convertibles and something we can possibly monetize,” said Hill.

Convertible Arb at 60%

Overall, the call was a positive update on both sleeves of the strategy: convertible arbitrage and hedged equity. With a 60% weight since the middle of last year, the convert arb piece is at the higher end of the historical range “because of how we feel about the opportunity set and overall risk/reward of the strategy. It has more to do with how much we like convert arb right now versus not liking hedged equity,” said Hill.

Jan. 27: One of the Most Volatile Days

1990-2021

| Rank | Date | Prior Close | Close | % Change |

|---|---|---|---|---|

| 1 | 2/15/2018 | 17.31 | 37.32 | 115.6% |

| 2 | 2/27/2007 | 11.15 | 18.31 | 64.2% |

| 3 | 1/27/2021 | 23.02 | 37.32 | 62.1% |

| 4 | 11/15/1991 | 13.96 | 21.18 | 51.7% |

| 5 | 7/23/1990 | 15.63 | 23.68 | 51.5% |

Many favorable conditions are continuing from last year's robust convertible market. The new issue market is healthy, the fund is finding pockets of volatility, and credit conditions are stable if not positive.

The year is not likely to match 2020. For example, Hill said, January’s new deals are smaller and allocations may not be as attractive. “Terms have richened a bit from our perspective, although the deals so far have all easily gotten done, were well oversubscribed, and are trading positive in the secondary market,” he said.

A strong new issue market provides many benefits, including idea generation, liquidity and returns. “A high percentage of deals trade well out of the gate,” Hill added. “Historically, there’s an embedded cheapness to a new convertible issue—companies have to price deals at a discount to fair value to bring that much paper to the market at once.”

Hill also commented on opportunities for a “double win” for the fund. As explained by Hill, this occurs when a serial issuer wants to come to market to raise more capital. They’ll issue a new convertible, subsequently redeem the existing bond, and potentially convert it into equity. In that case, the fund is paid to sell its existing position at a slight premium and buy the new issue, hopefully at a discount, on Day 1.

There was an unprecedented amount of such “flushes” last year, there have already been a few this year, and the team expects to see more.

Hedged Equity Ready to be Opportunistic

As Pars mentioned on last week’s Calamos Hedged Equity Fund (CIHEX) call (see post), the disconnect between implied vol (the VIX at 22) and realized volatility (30-day realized vol at 10) makes it difficult to be opportunistic.

The current environment, according to Pars, may be driven by call buying. It may be the Robinhood effect or investors hedging upside tail risk. Some may have missed out on the second half of last year and want to avoid Fear of Missing Out (FOMO) this year.

“There is a bid to tail risk that’s interesting,” he said, “which makes put spreads interesting.”

“We buy a put closer to where the market is now and sell a lower strike put to reduce the overall cost. On a vol basis, the bottom strike put seems quite expensive relative to where the higher strike is. That’s attractive, we’ve been using that as a tool to bring down our overall risk.”

At some point the two volatility measures will likely get closer, Pars predicted, adding that he expects implied volatility to drop some as vaccinations continue. The team is looking to opportunistically add skew to the portfolio but needs a leg lower in volatility.

Limited Rate Sensitivity

CMNIX was introduced on the call by Robert Behan, President and Head of Global Distribution, as a fund for investors seeking “bond-like returns, steady performance, and without a lot of exposure to duration and interest rate risk.”

Asked to comment on CMNIX’s vulnerability to rising interest rates, Pars responded, “One of the things that’s important to understand is that the fund doesn’t have a lot of rate risk and doesn’t have a lot of rate opportunity. If the 10-year goes from 1% today to 2% in a few months or a year, or conversely, if it would go to zero or negative, that is not a huge driver of our P&L.”

Rising rates’ impact on the fund’s strategies would be limited, according to Pars. “On the hedged equity side, other than what rising rates do to equities, rates in and of themselves don’t do much.”

The same is true with the convertible arbitrage strategy. The typical convert is a five-year bond at issuance but, because of the conversion option, has a duration of a three-year bond. “Our book tends to be fairly seasoned and also somewhat in the money. As the stock price rises, convertibles’ sensitivity to equities grows and their sensitivity to interest rates declines,” said Pars.

“We just don’t have a lot of sensitivity to the rate market,” he summarized, “which is one of the things that a lot of people like about the fund as a fixed income alternative. It’s just different.” (Also see this PDF.)

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe information provided here is reliable, but do not warrant its accuracy or completeness. The material is not intended as an offer or solicitation for the purchase of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only and is not intended to provide—and should not be relied on for—accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The securities highlighted are discussed for illustrative purposes only. They are not recommendations.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Convertible arbitrage and gamma. Convertible arbitrage is an investment strategy that generally involves a long position on a convertible security and a short position on the issuing company’s common stock. A long position is the buying and holding of a security and a short position is the selling of a security that the seller does not own. Eventually, the seller must purchase the same security (hopefully at a lower price) and return it to the owner. Convertible arbitrage seeks to take advantage of dislocations in the value of a convertible security and its underlying equity. Theoretically, as the price of the underlying stock rises, the convertible value rises, and as the stock value falls, the convertible value falls as well. How much the convertible value rises or falls for a given stock move is referred to as delta. The change in delta as stock price moves is referred to as gamma.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

The VIX (CBOE volatility index) is the ticker symbol for the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options.

Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole.

Skew is the difference in implied volatility between out-of-the-money options, at-the-money options, and in-the-money options.

In the money. A call option’s strike price is below the market price of the underlying asset or that the strike price of a put option is above the market price of the underlying asset. Being in the money does not mean you will profit, it just means the option is worth exercising. This is because the option costs money to buy

Out of the money. A term used to describe a call option with a strike price that is higher than the market price of the underlying asset, or a put option with a strike price that is lower than the market price of the underlying asset. An out of the money option has no intrinsic value, but only possesses extrinsic or time value.

Call and put spreads. Options strategies when a manager buys a call/put option, while simultaneously selling a less expensive call or put/option. Because the call/put options share similar characteristics, this trade is typically less costly than an outright purchase, but still provides similar protection.

Implied volatility is a metric that captures the market's view of the likelihood of changes in a given security's price. Investors can use it to project future moves and supply and demand, and often employ it to price options contracts.

Realized volatility is the magnitude of daily price movements, regardless of direction, of some underlying, over a specific period.

The Morningstar Market Neutral Category represents funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions of stocks and 50% of assets in short positions.

Morningstar RatingsTM are based on Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/ or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc. All rights reserved.

802272 0121

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on January 28, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.