Market’s Down Hundreds of Points—And All Is Calm at Calamos

“Rough week for you, huh?” a friend asked a Calamos associate last night.

“Oh, because of the market you mean? Yeah, that’s not how we see it,” said the well trained associate.

Investors can panic when markets fall, and financial advisors can be swamped with visits, calls and emails. Even some asset managers react by hunkering down until the storm blows over.

None of that—no panicking, no phones ringing off the wall and definitely no hunkering down—is happening at Calamos. For more than 40 years our Founder, Chairman and Global CIO John P. Calamos, Sr. has described volatility as the flipside of opportunity, and that’s how the volatility is being viewed today.

These are the moments that Calamos investment management prepares for. Calamos’ approach to risk management is at the top of the list of why advisors entrust their clients' wealth with us, whether via convertible securities strategies, liquid alternatives, or fixed income.

To pursue the upside while protecting on the downside: that’s the undercurrent of how Calamos manages money. Corrections are inevitable and all concerned do what they can to shield investment portfolios from the kind of short-term shocks that undermine investment objectives and investor confidence.

Portfolio Managers Embrace the Opportunity

What kind of week have Calamos investment professionals had? Hear from them directly in insights that first appeared in our Calamos Volatility Opportunity Guide (financial advisors, contact your Investment Consultant for copies to use with your clients).

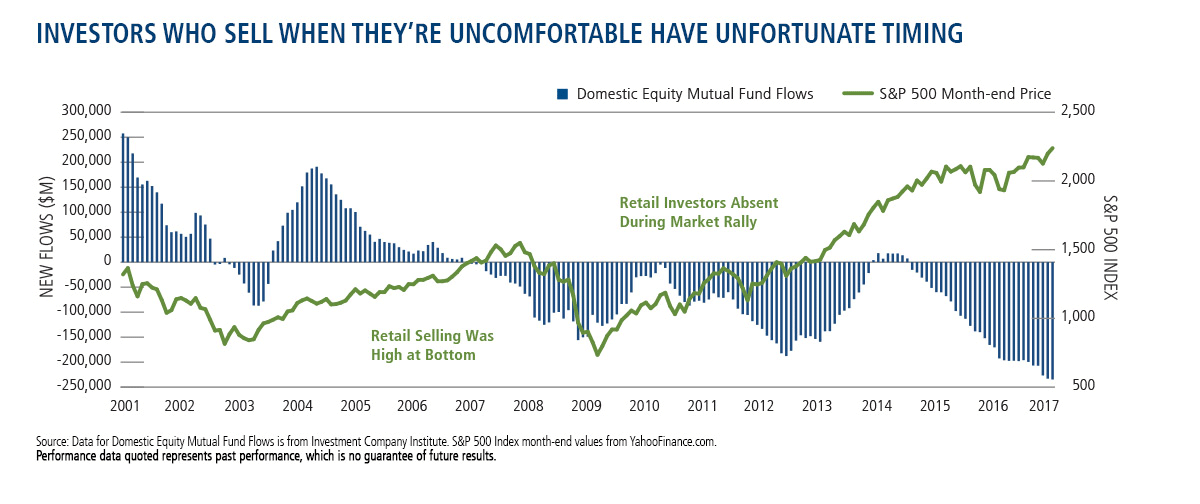

“Market volatility can lead to margin calls, regret over ‘losses’ or anxiety over the risk profile of a portfolio—resulting in investors becoming forced sellers, and forced sellers are price-takers, typically at unattractive prices. That’s unfortunate.

But there is an upside to market dynamics. For those investors who maintain healthy cash balances, manage leverage and take a long-term view, market volatility provides opportunities. This is especially true when the volatility is not related to changes in the underlying fundamentals of their investments. When an investment’s fundamentals are unchanged but now available for purchase at a more attractive price, that can be a positive. The seller’s pain is the buyer’s gain.”

Read more

“Separating the signals from the noise in the market is often the most difficult part of our job, and in periods of extreme volatility, getting caught up in the day-to-day moves can be a big distraction. One of the key lessons: You can manage the risks, but you cannot manage the returns.”

Read more

“Volatility provides us the opportunity to readjust the risk/reward of portfolios to provide what we believe will be the best profile given where we are in an economic business cycle.”

Read more

“Volatility is the sign that one should prepare to buy. While it may not feel like it at the time, periods of high volatility are invariably the lowest risk moments to own equities because the ‘problems’ are more widely understood.”

Read more

“Market movement creates opportunities for us to adjust our hedges, but also to alter or exit many of our trades and enter into new trades that didn’t exist previously. And, as volatility increases we find that asset class correlations break down.”

Read more

For more on our strategies, see these recent posts:

- Calamos Alternative Funds Are Breaking Away from the Pack in 2018

- CIHEX Took the Sting Out of S&P 500 Volatility

- Looking to De-Risk? Consider CGIIX, Using Convertibles to Manage Technology Risk

- Barron’s Profiles How CMNIX Uses Volatility to Generate Returns

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Past performance is no guarantee of future results.

The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Information contained herein is for informational purposes only and should not be considered investment advice.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end performance information, please CLICK HERE. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on November 21, 2019Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.