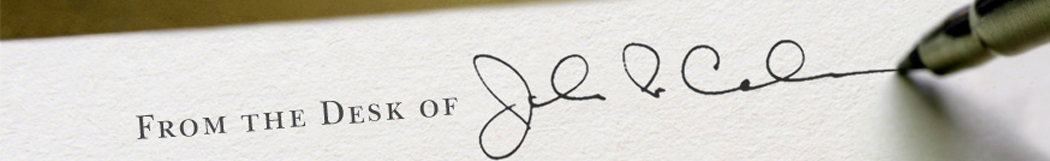

Now that midterm elections are in the rearview mirror, what are the implications for markets and investors? Markets hate uncertainty and with midterms wrapped up, there’s one less uncertainty on the list. As Figure 1 shows, markets have advanced in every year following midterm elections, no matter who wins.

Figure 1. Stocks have a history of advancing after midterm elections

S&P 500 Price Return, 12-month period following midterm elections

Past performance is no guarantee of future results. Source: Strategas Research Partners, LLC. “Washington and the Investment Landscape,” September 10, 2018.

A split Congress is likely to lead to gridlock in Washington, which may not be so bad for the markets. If the business-friendly fiscal policies put in place over recent years remain intact, I am of the view that the U.S. economy can maintain its growth trajectory in 2019, if not longer. Third quarter GDP came in at a solid 3.5%, and the fundamentals underpinning the U.S. economy are strong—including low unemployment, robust consumer and small business confidence, and increasing capital spending.

Even though I believe the markets have more room to advance, that doesn’t mean that investors should expect smooth sailing every day. Midterm elections are done, but we still have the overhang of trade disputes, less robust global growth, and all the well-known geopolitical pressures. All of these factors could make for choppy markets, particularly in the short term.

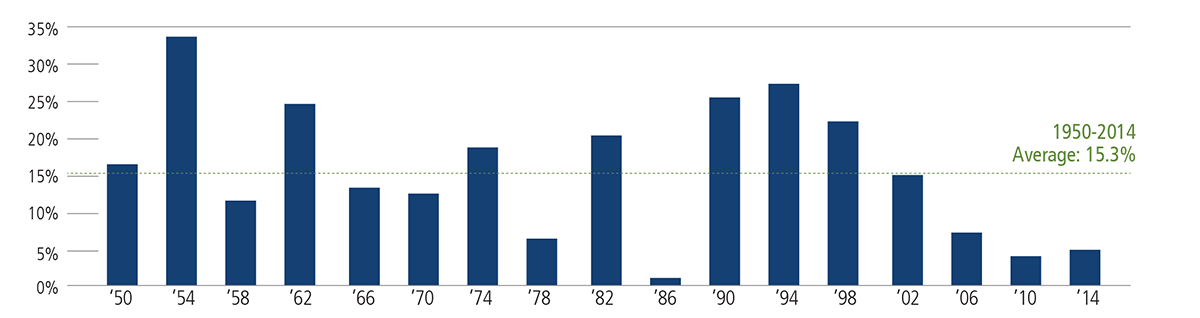

In environments like this, it’s important to maintain a long-term perspective. So far in 2018, there have been four pullbacks of 5% or more. But there have also been quick advances (Figure 2). Trying to time changes like these is nearly impossible, which is why it is so important to stay invested instead of hopping in and out. More often than not, investors get whipsawed—catching the downside but missing the upside.

Figure 2. In a grinding market, staying invested is a sound approach

S&P 500 Index closing price, year-to-date through November 7, 2018

Past performance is no guarantee of future results. Source: Morningstar.

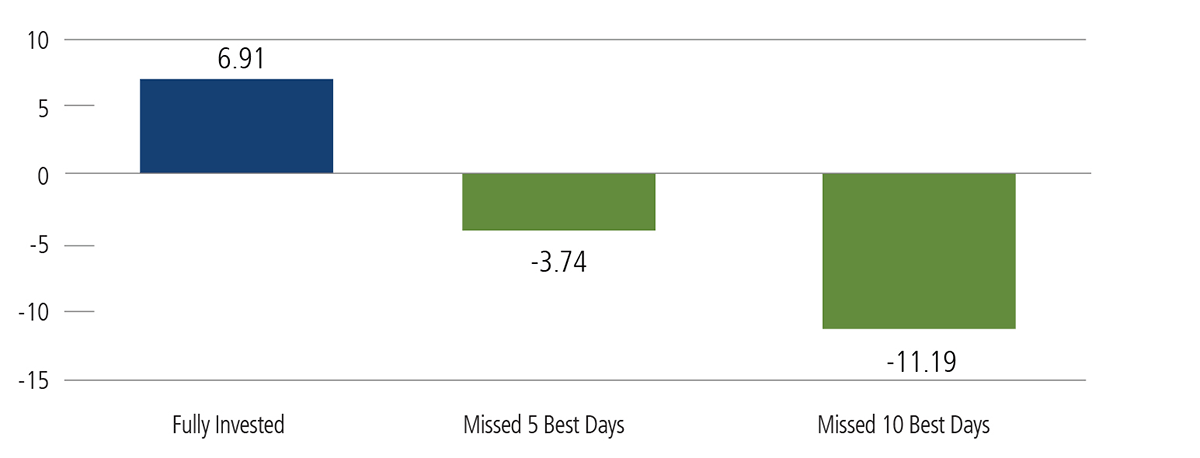

Figure 3 illustrates the dangers of market timing. For the year-to-date through November 7, the S&P 500 earned 6.91%, which is a quite respectable return in absolute terms. However, missing the five best days would have resulted in a loss of about 3.8%, and missing the 10 best days would result in a loss of more than 11%.

Figure 3. The dangers of market timing

S&P 500 Index, year-to-date return (%) through November 7, 2018

Past performance is no guarantee of future results. Source: Morningstar.

Conclusion

In addition to staying long-term in your approach, I recommend working with a financial advisor to maintain a well-diversified asset allocation with an appropriate level of downside protection. Based on your personal circumstances, your allocation could include a range of strategies, including growth-oriented equity, defensive equity (for example, convertible securities), fixed income, and alternatives. In my experience, investors who have selected a diversified group of actively managed, risk-aware strategies find it easier to navigate short-term market turbulence.