Looking to De-Risk? Consider CGIIX

September 11, 2018

The longevity of the current bull market has financial advisors and their clients wondering how long it will last. “It’s as if investors believe the markets are playing a board game and there’s a timer—and the longer you play, the more nervous you get,” says Scott Becker, Calamos Senior Vice President, Head of Portfolio Specialists.

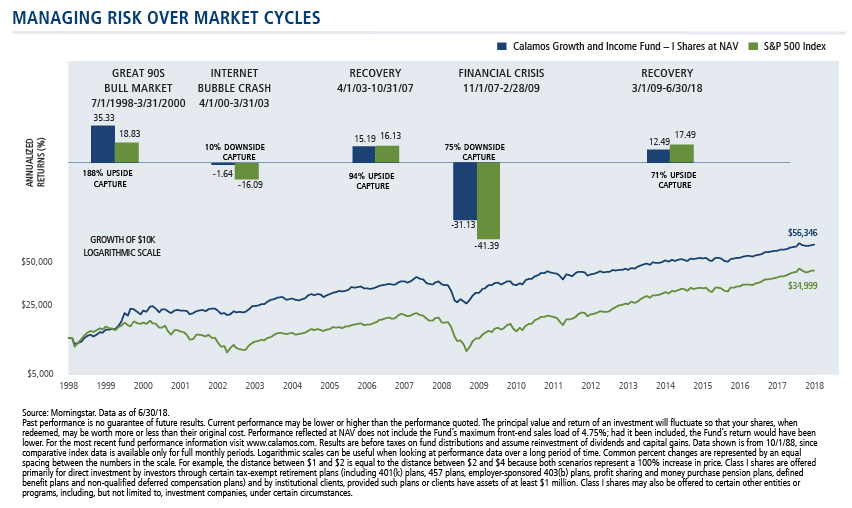

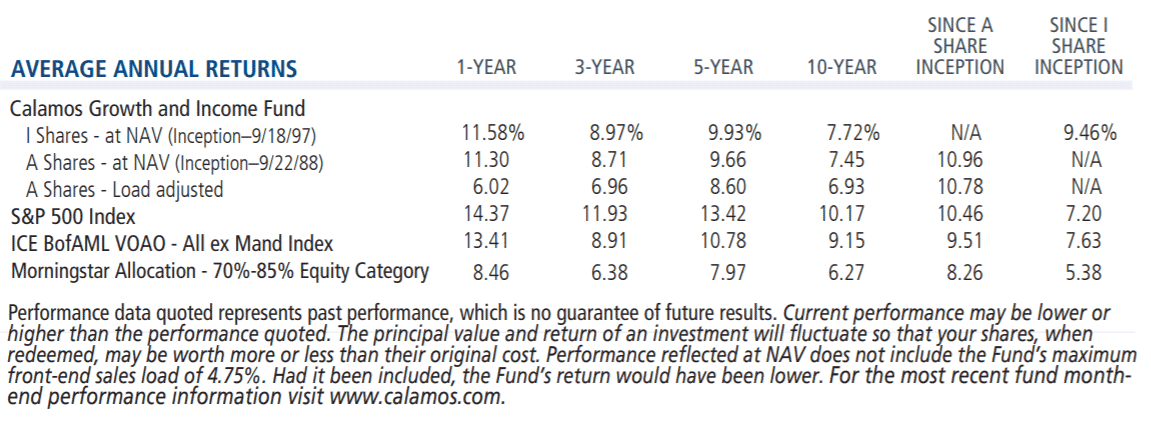

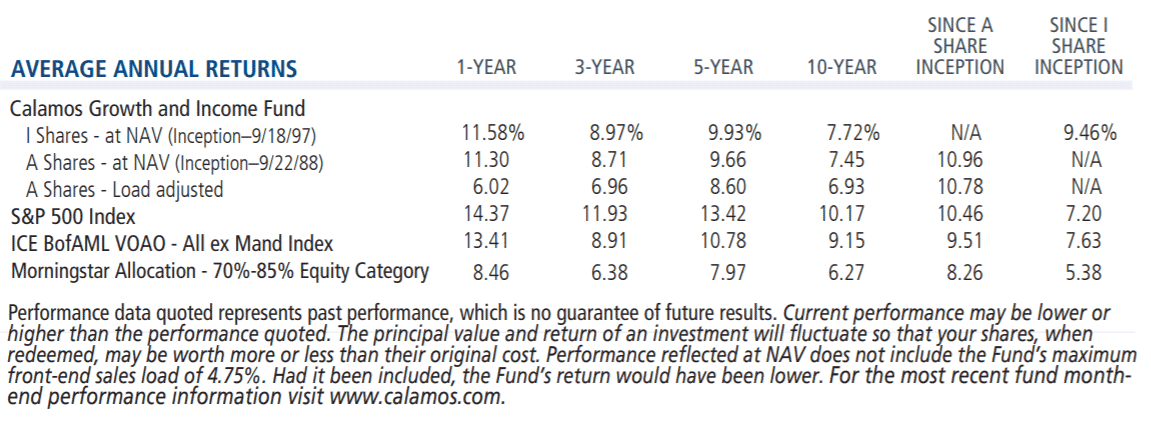

Here’s an idea for such an uncertain environment: Calamos Growth and Income Fund (CGIIX). CGIIX’s performance has consistently compared favorably to the S&P 500 through various market conditions and over market cycles. The fund invests primarily in U.S. equity and convertible securities in an attempt to manage risk and reward while providing growth and income.

If You Think the Trend Is Still Up…

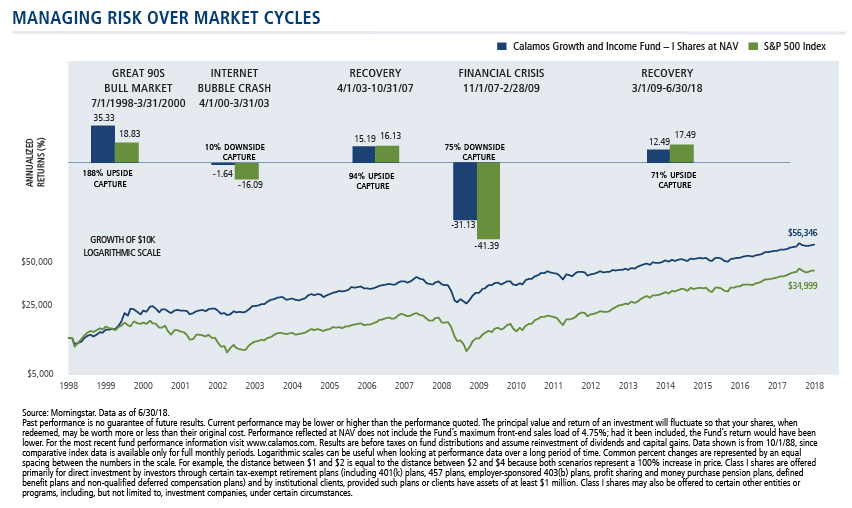

Financial advisors, do you believe the stock market will continue to climb? CGIIX has delivered strong risk-managed returns over several recent market cycles.

If You Think Time Is Almost Up…

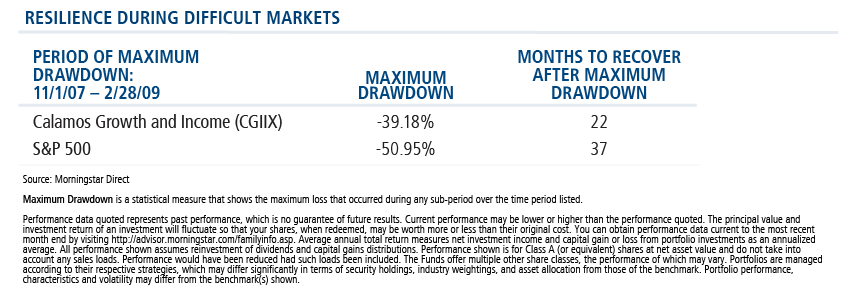

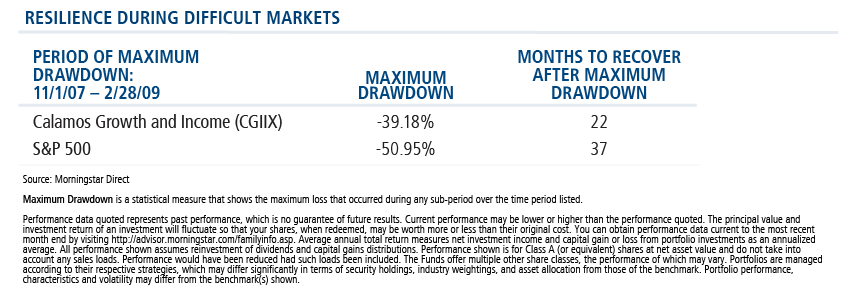

If you expect the market’s next major move is down, triggering a period of weak equity performance, check out the resilience of CGIIX. Its risk-managed approach may help lessen deep drawdowns—and that enables clients to recover from a downtrend sooner, enabling their portfolios to get back to growing.

If You’re Expecting Markets to Move Sideways…

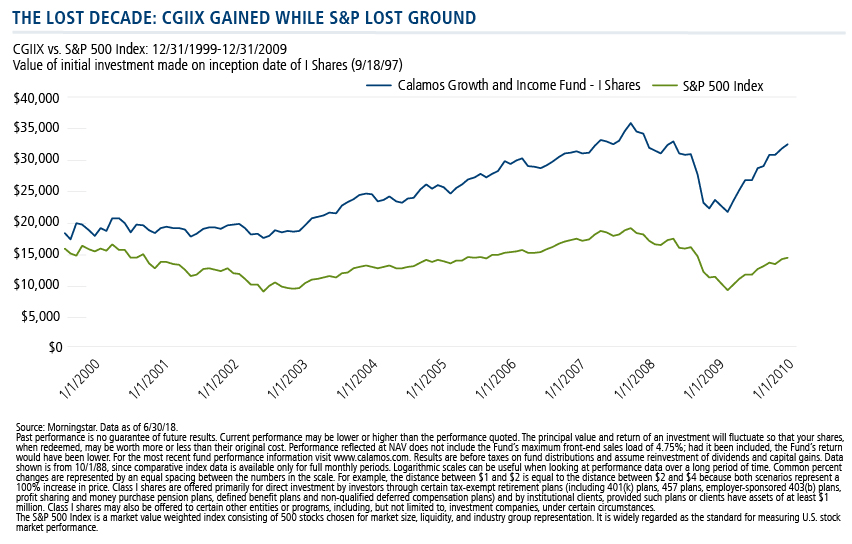

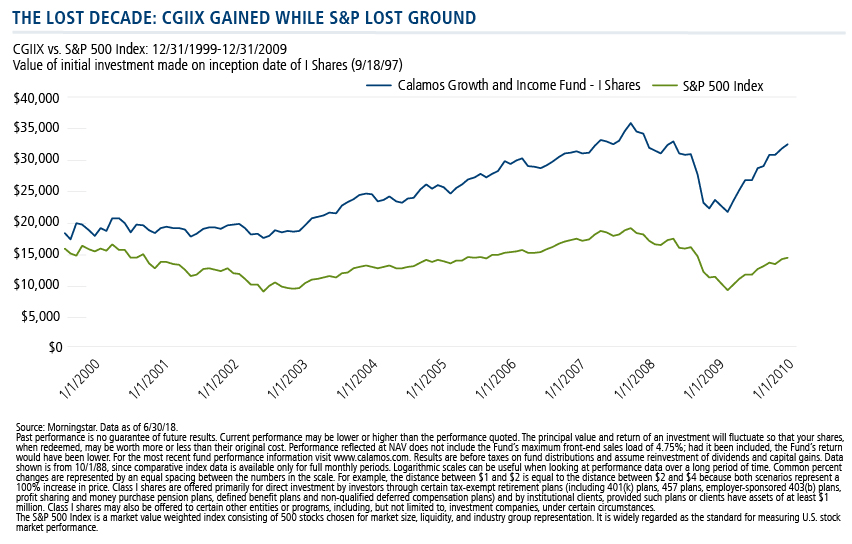

Perhaps you expect the market to drift sideways for a while. See how the fund performed during such a period, the “lost decade” that began in 2000. From 12/31/1999 through 12/31/2009, the fund’s average annual total return was 5.85%, compared to -0.95% for the S&P 500 over the same period.

Putting It All Together

By managing risk over the past several market cycles, CGIIX has delivered better performance (in terms of rolling 3-year periods) than the S&P 500, as shown below. It’s been positive in 94% of periods versus 82% for the S&P 500, as well as outperforming the S&P 500 in 98% of all 3-year periods when the index returns were negative.

“There’s no timer going on in the economic markets. There are fundamentals that will drive when things will start to slow or when things might start to invert,” says Becker. “But everyone keeps thinking that the longer this game goes on, there has to be an end so I have to do something today.”

May we suggest a different approach? Take a longer-term view of the market’s direction, building portfolios for multi-year market cycles. That’s what CGIIX is structured for.

Financial advisors, for more information about CGIIX and how it could help you manage the risks of today’s uncertain markets, talk to a Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Data as of 6/30/18

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. The opinions and views of third parties do not represent the opinions or views of Calamos Investments LLC. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and midsized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The ICE BofAML All U.S. Convertibles ex Mandatory Index (V0A0) represents the U.S. convertible market excluding mandatory convertibles. Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofAML indices and related data on an ‘as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

†Morningstar Allocation—70% to 85% Equity Category funds seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 70% and 85%.

The S&P 500 Index is a market value weighted index consisting of 500 stocks chosen for market size, liquidity, and industry group representation. It is widely regarded as the standard for measuring U.S. stock market performance.

801275 0918

Exp. 09/19