Investment Team Voices Home Page

Investment Team Voices Home Page

How to Respond to Market Volatility

John P. Calamos, Sr.

As volatility returns to the stock market, many investors are feeling unsettled and maybe even panicked. Since founding Calamos Investments more than 40 years ago, I’ve had the chance to invest through many different market environments, including extremely turbulent periods. Here’s what I encourage investors to remember:

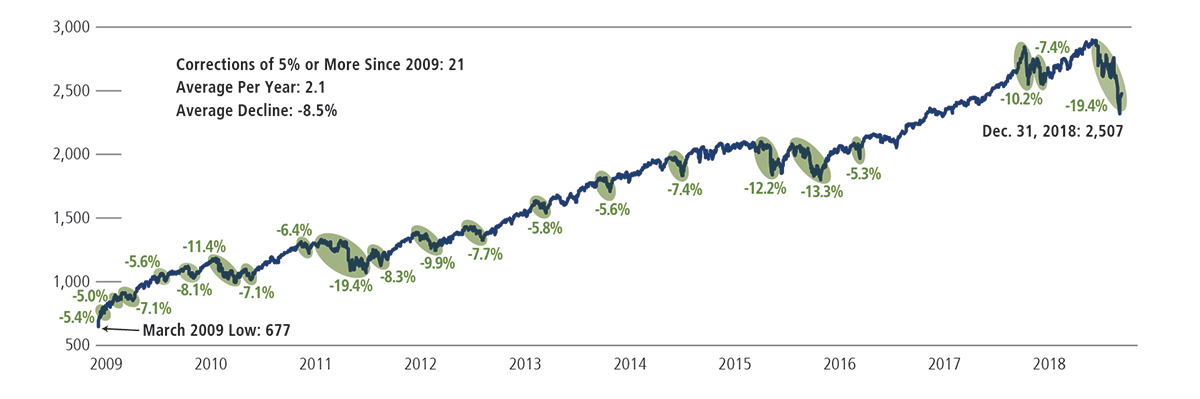

- Corrections are a normal part of bull markets. The chart below shows how much the market has gained since March of 2009. Down periods have been a part of this advance. In fact, there have been 21 corrections since 2009.

Bull market corrections (S&P 500 Index, closing price)

Past performance is no guarantee of future results. Source: Bloomberg.

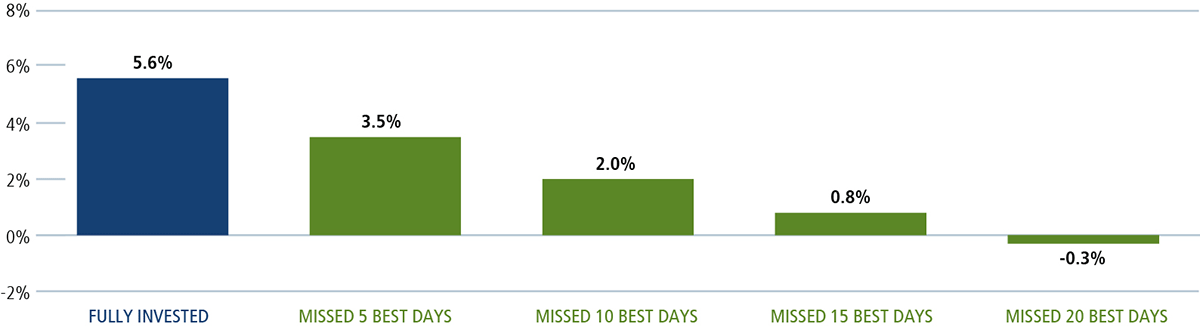

- Stay invested for the long term. Don’t time the market. Investors who try to predict exactly when the market will hit its highs and lows may end up capturing far more of the downside than the upside. The chart below illustrates the benefits of staying invested.

Staying invested is the best long-term strategy (S&P 500 Index, annualized returns over 20 years, 1999-2018)

Past performance is no guarantee of future results. Source: Bloomberg. Data is from 1/1/1999 through 12/31/2018.

- The flipside of volatility is opportunity—for active managers. When markets experience periods of short-term volatility, active managers can purchase attractive investments at lower prices. At Calamos, our teams take a long-term approach and use corrections as buying opportunities. (Passive or index strategies aren’t able to capitalize on downside moves in this way. They just have to ride it out.)

- Rely on your financial advisor, not the media. If you’re getting anxious about your asset allocation, reach out to your financial advisor or wealth management professional. They can give you the personalized advice you need. It may be a good opportunity to discuss any changes to your personal circumstances to see if you should enhance your asset allocation. This may be a timely opportunity to consider risk-managed equity or convertible strategies, alternatives or fixed income allocations.

When markets are turbulent, a disciplined approach can be hard. But in my experience, it can be well worth it in the long run.

Past performance is no guarantee of future results. Opinions are as of the publication date, subject to change and may not come to pass. Information is for informational purposes only and shouldn’t be considered investment advice. Convertible securities entail interest rate risk and default risk. Fixed income securities entail interest rate risk. Alternatives entail added risks and may not be suitable for all investors.

Active management does not guarantee investment returns and does not eliminate the risk of loss. The S&P 500 Index is considered generally representative of the U.S. stock market. Indexes are unmanaged, do not include fees or expenses and are not available for direct investment.

18171 0218O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.