As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

Liquid alternative funds have been battling skepticism for years.

Many liquid alts were established after the Great Financial Crisis, inspired by hedge fund success in using alternative strategies to diversify away from traditional long-only stock and bond portfolios. Liquid alts promised to bring risk management techniques previously employed by hedge funds for institutional investors to Main Street.

But U.S. equities have gone mostly straight up since then, posing little opportunity to stress-test the mostly new funds. As a group—as tracked by Calamos Weekly Alternatives Snapshot—liquid alternatives’ absolute performance results have failed to wow, fund flows have slowed and non-believers abound.

And hedge funds? In October, the HFRI Fund Weighted Composite Index fell 2.98%—its worst monthly decline since 2011.

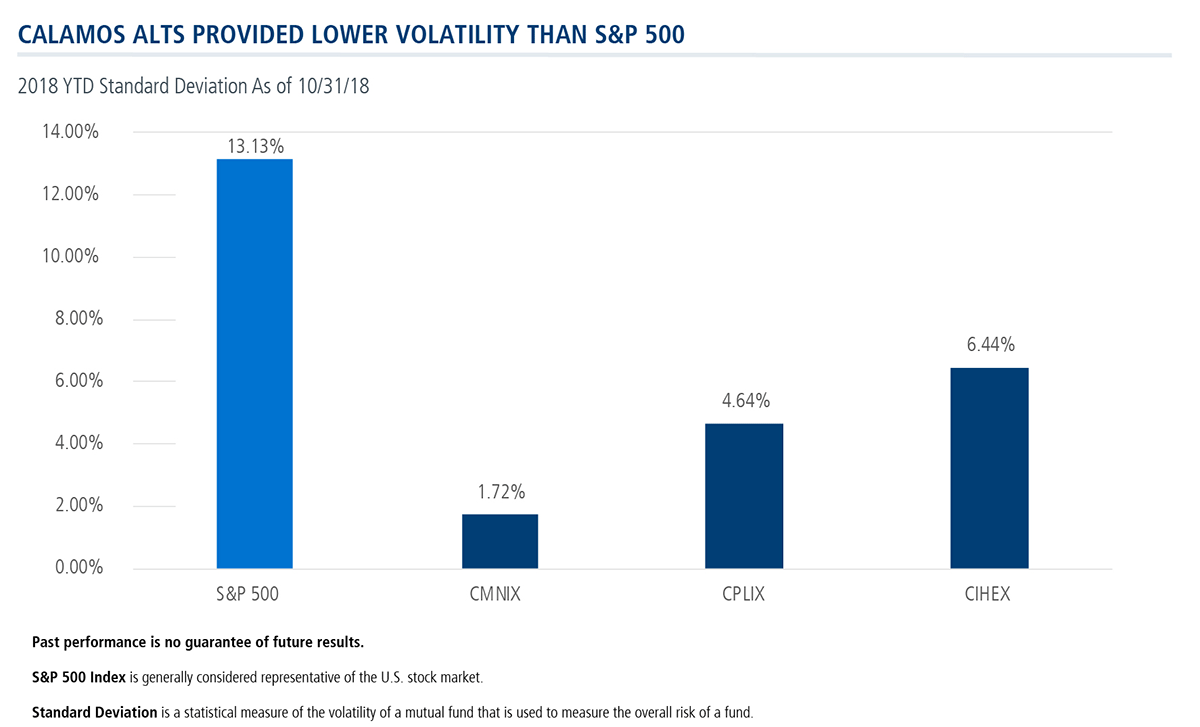

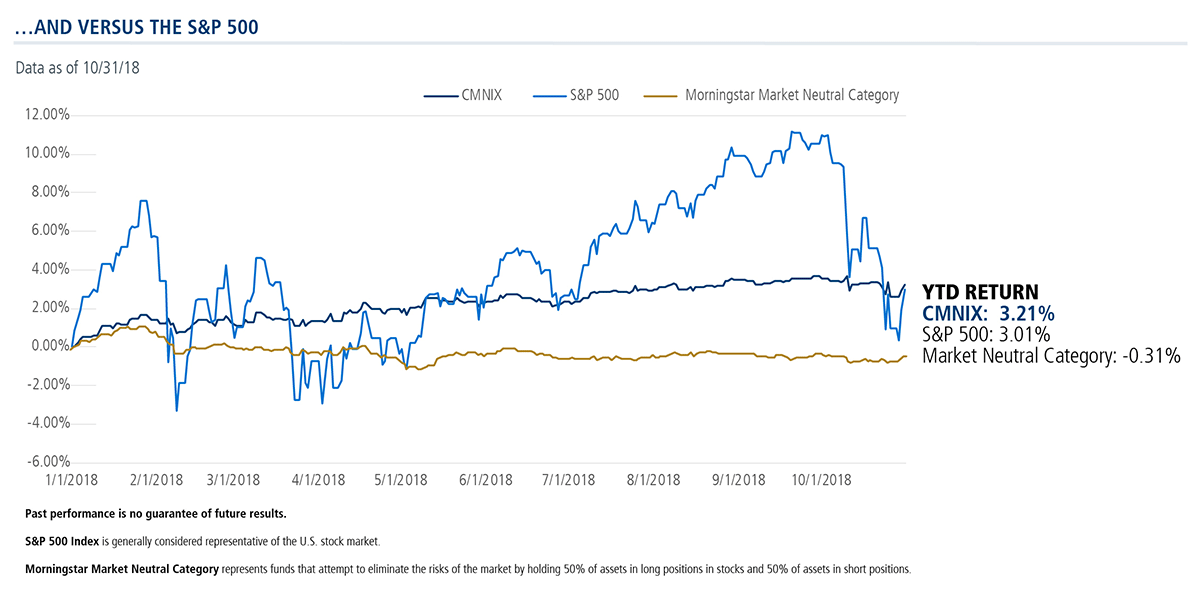

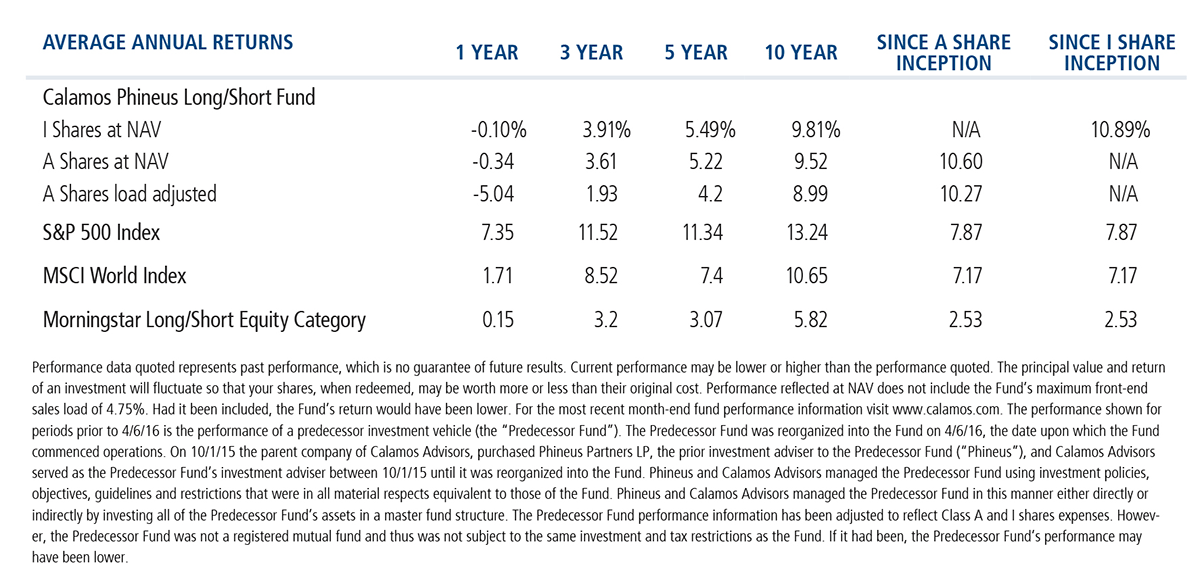

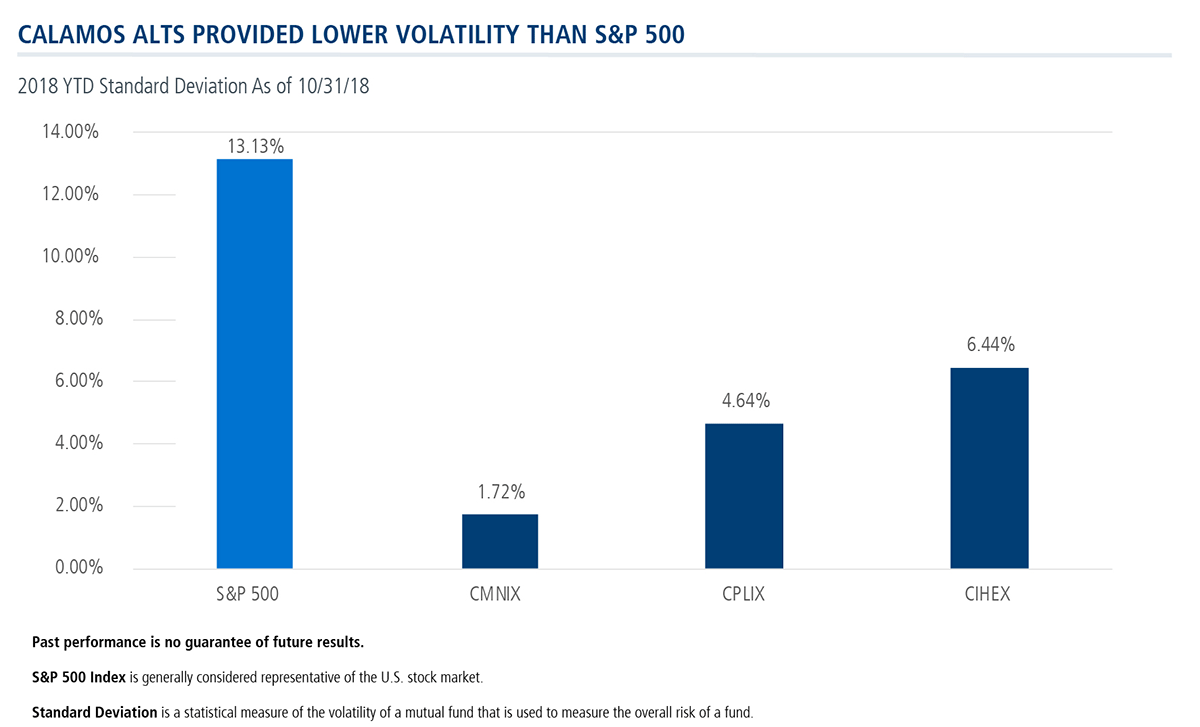

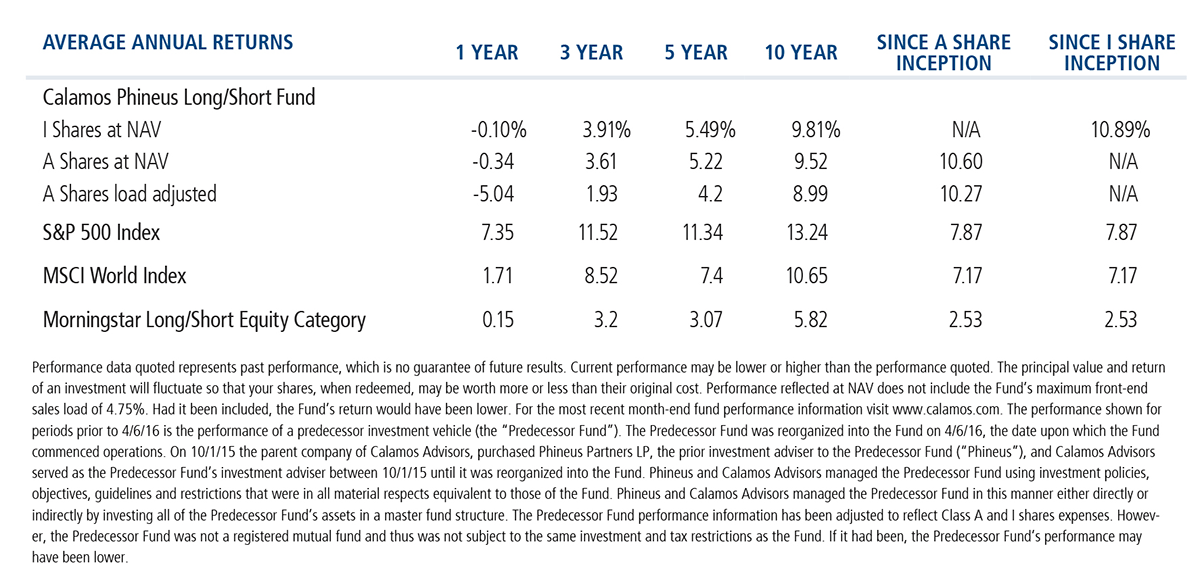

All of the above is why we like to seize the opportunity when we can to assert that our alternatives—two of three of which predate 2008—work. They’ve worked over full market cycles, as evidenced by their standardized average annual returns. They’ve worked during bursts of the kind of volatility that shake investors’ resolve. And, their performance results this year further set them apart from their Morningstar category peers.

Our recent post A Nasty October Should Give Way to More Equity Upside, Expects CPLIX’s Grant described Calamos Phineus Long/Short Fund’s year to date and October performance. The three charts below provide a year-to-date update on Calamos Market Neutral Income Fund (CMNIX) and Calamos Hedged Equity Income Fund (CIHEX).

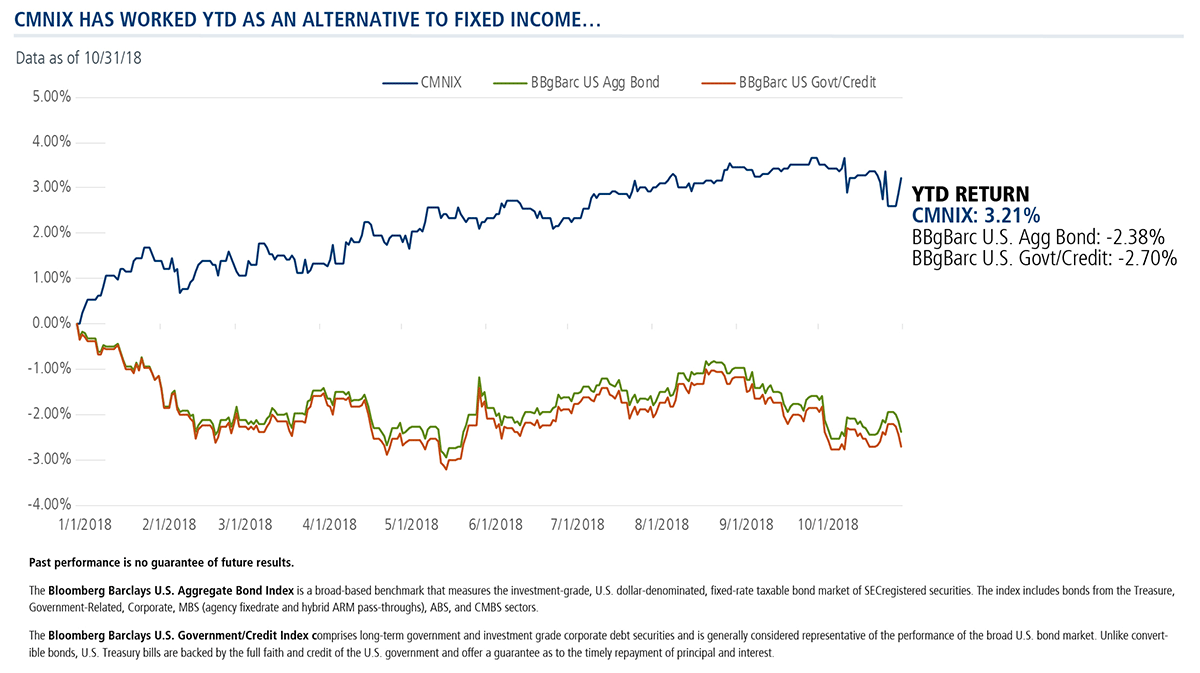

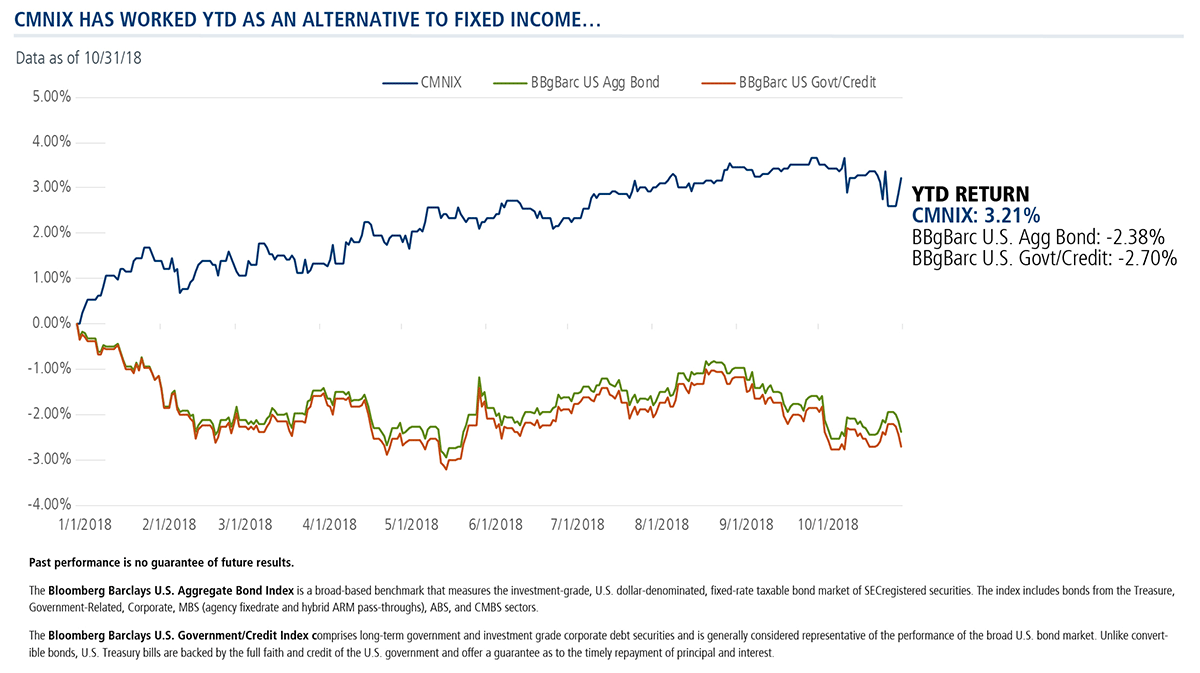

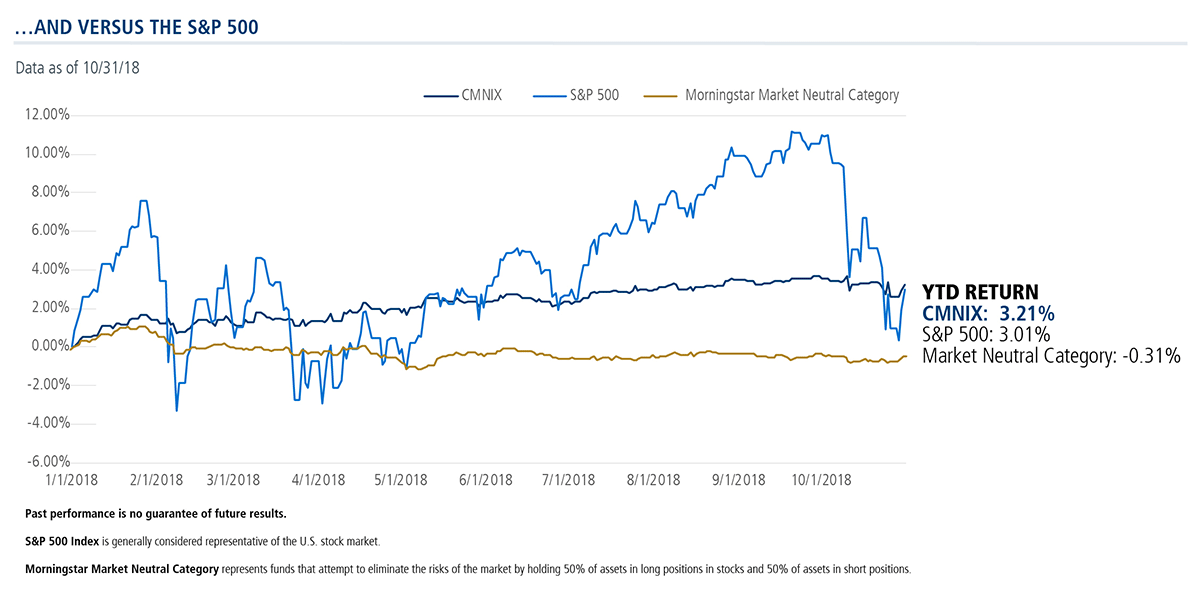

CMNIX: Volatility in Volatility

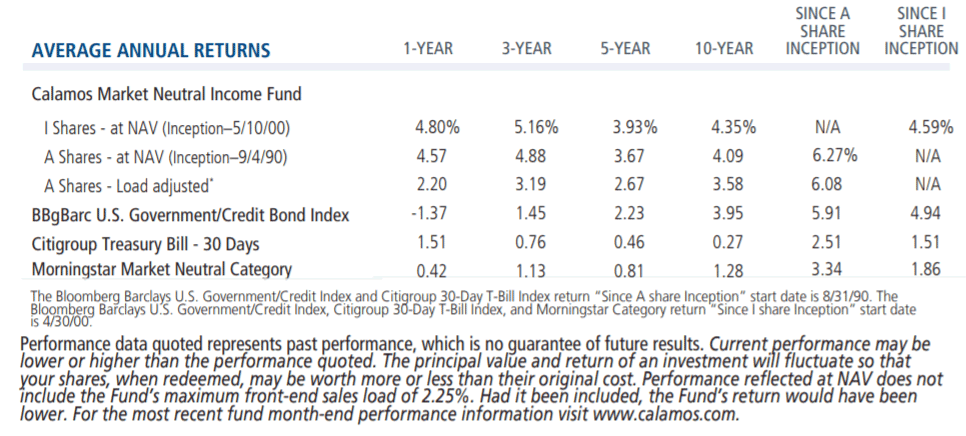

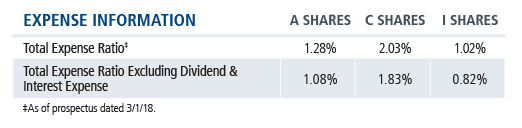

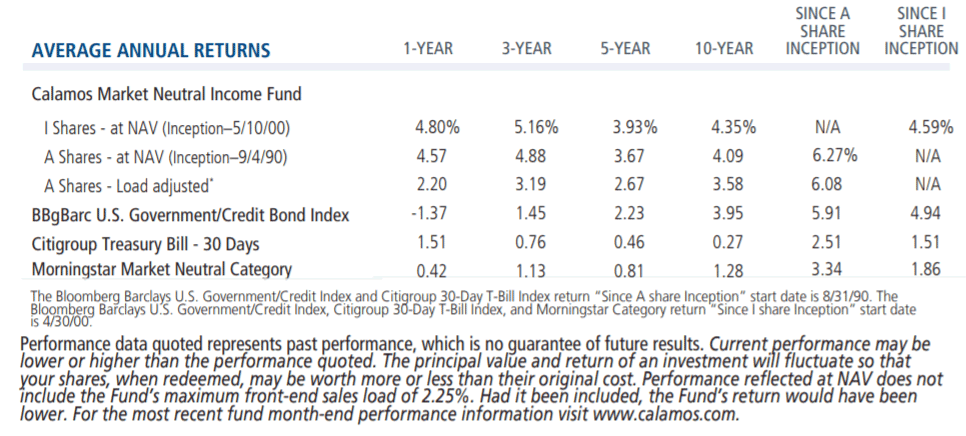

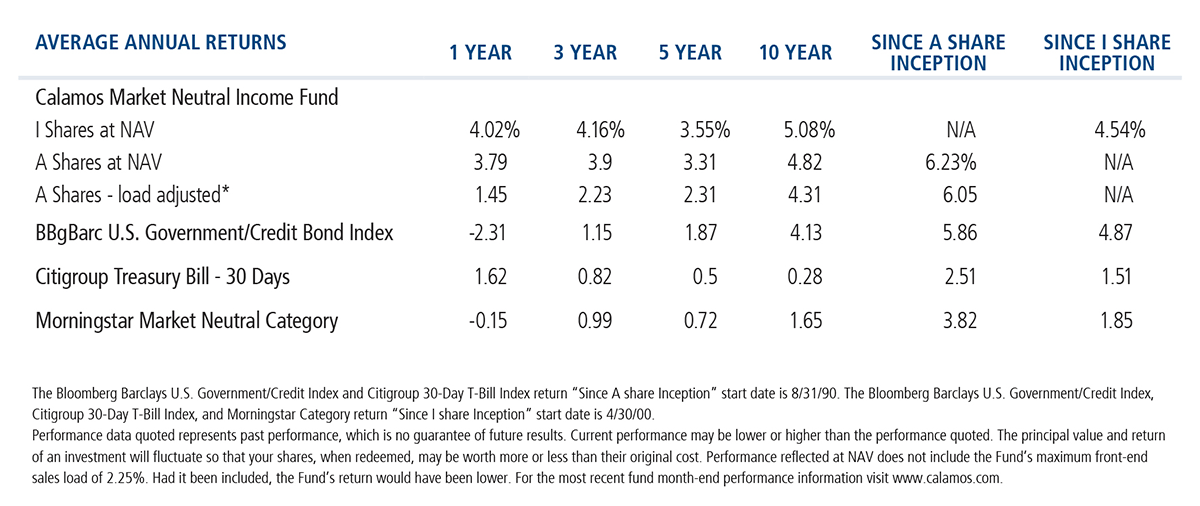

CMNIX has shown how it benefits from “volatility in volatility:” whether from the rebalancing opportunities higher volatility provides to convertible arbitrage or from the potential to receive higher call premiums in the covered call allocation.

With equity and bond market volatility expected to continue, the inclusion of CMNIX in an investment portfolio should provide a means for financial advisors to reduce equity sensitivity. As illustrated in the chart below, CMNIX can provide stability. Historically, it’s provided bond-like returns with bond-like risk without having bond-like interest rate sensitivity.

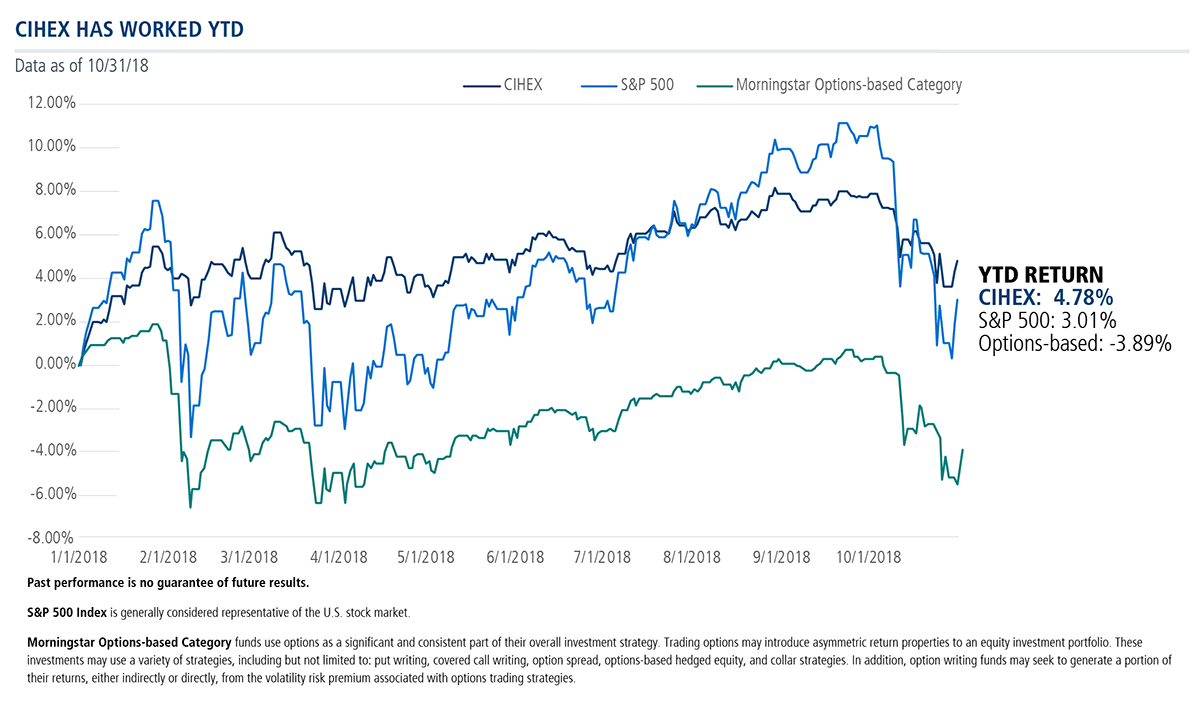

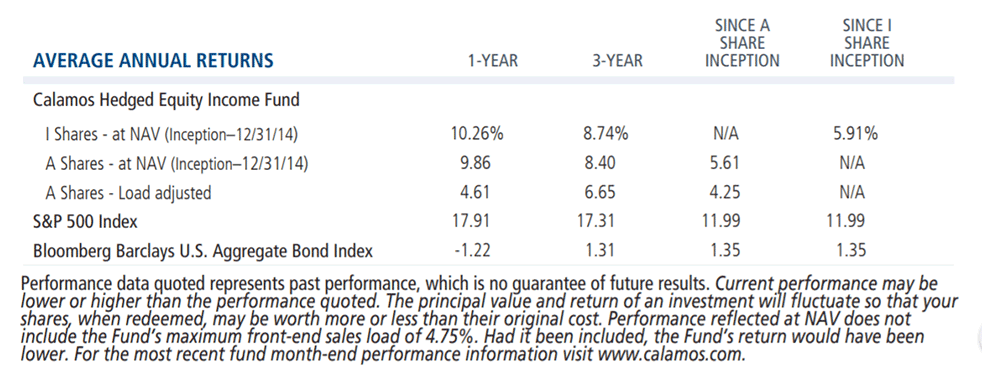

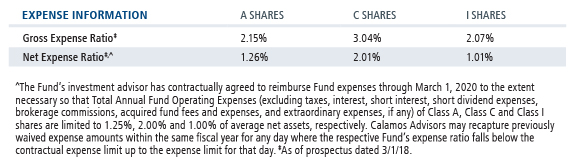

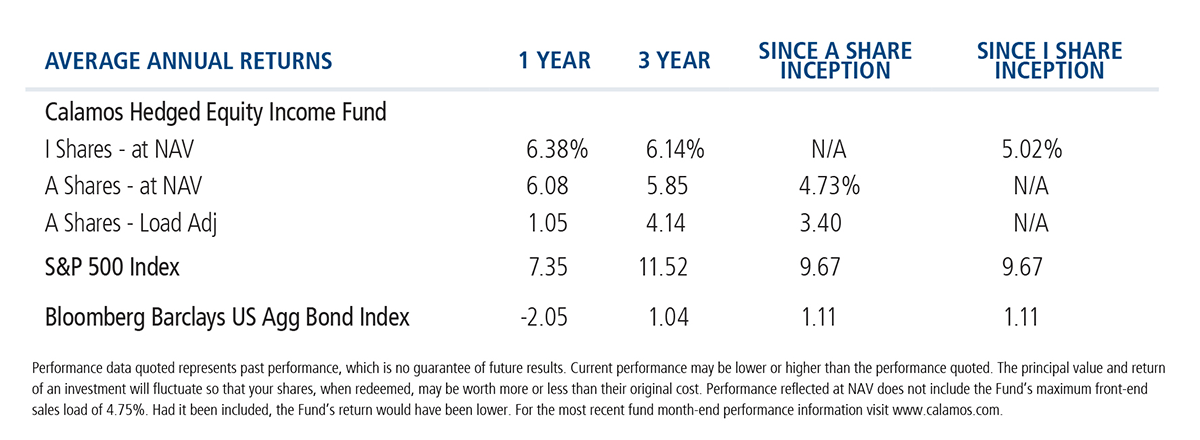

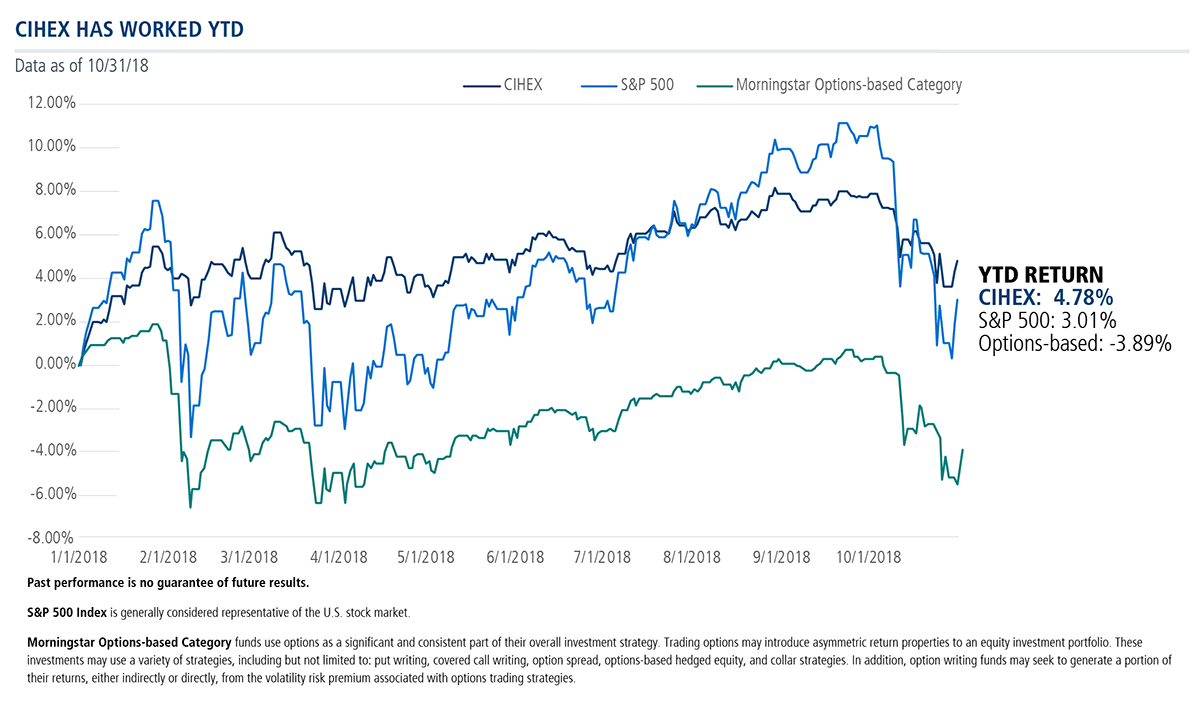

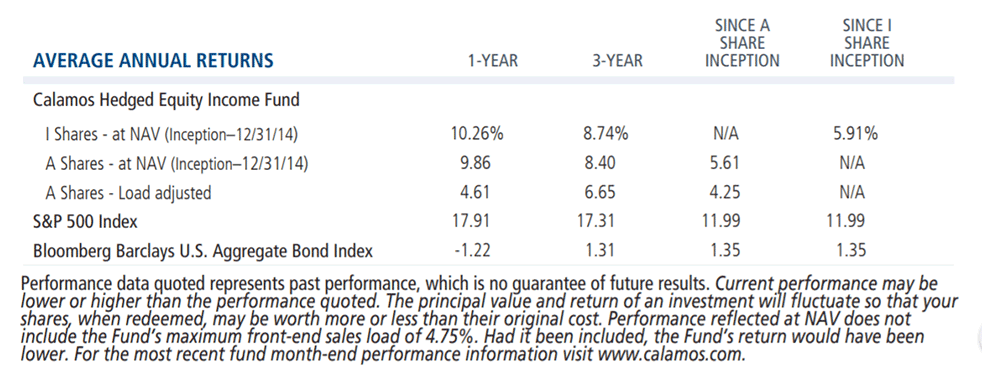

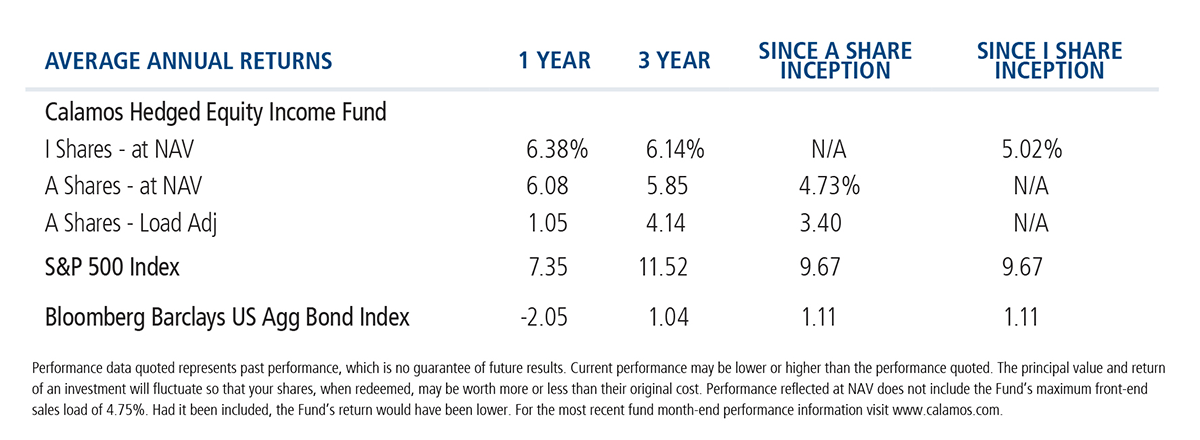

CIHEX: Hedged Equity But S&P Outperformance

We introduce CIHEX, our youngest alternative fund, as a potential fit for investors who want to participate in any continued potential market upside—while having a measure of downside protection in the event of an equity market sell-off. Its YTD results have shown how the fund hedged equity—and outperformed the S&P at the same time.

Advisors, for additional information about Calamos’ hard-working alternative funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Calamos ranks fifth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 9/30/18.

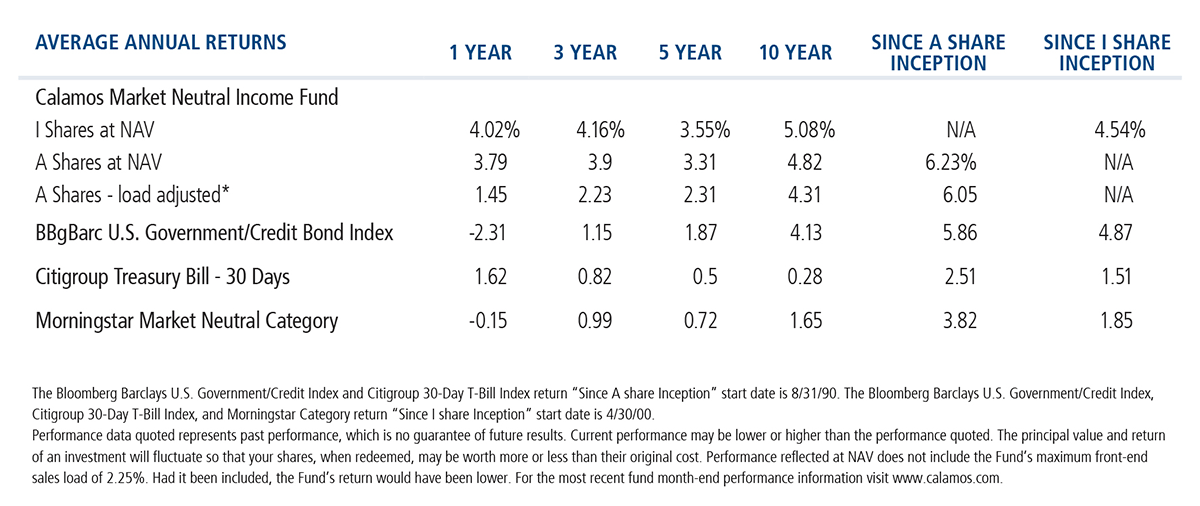

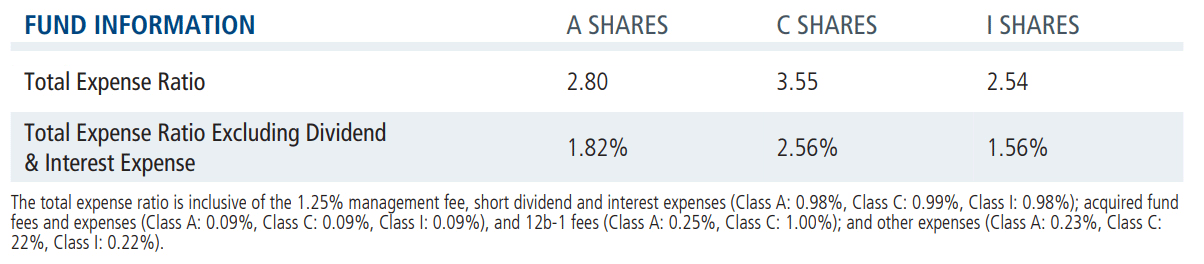

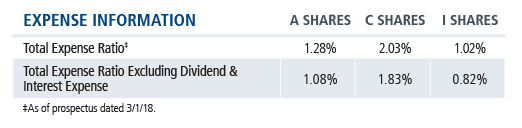

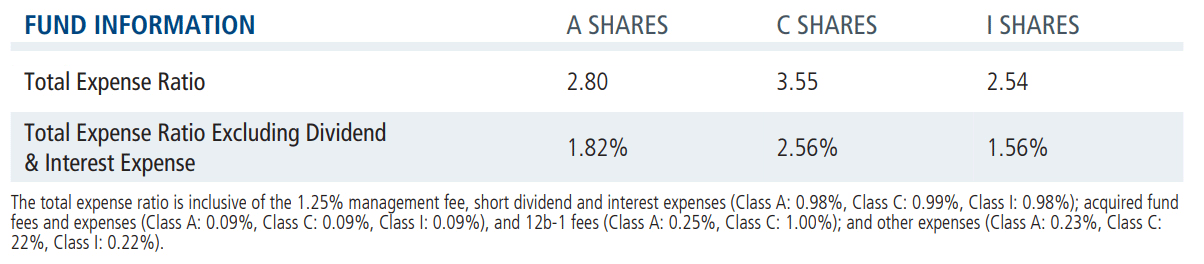

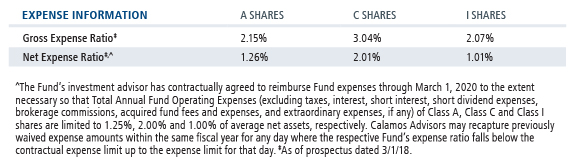

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Some of the risks associated with investing in alternatives may include hedging risk–hedging activities can reduce investment performance through added costs; derivative risk–derivatives may experience greater price volatility than the underlying securities; short sale risk - investments may incur a loss without limit as a result of a short sale if the market value of the security increases; interest rate risk–loss of value for income securities as interest rates rise; credit risk–risk of the borrower to miss payments; liquidity risk–low trading volume may lead to increased volatility in certain securities; non-U.S. government obligation risk–non-U.S. government obligations may be subject to increased credit risk; portfolio selection risk – investment managers may select securities that fare worse than the overall market. Alternative investments may not be suitable for all investors.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and non-qualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Data as of 9/30/18

Data as of 10/31/18

Data as of 9/30/18

Data as of 10/31/18

Data as of 9/30/18

Data as of 10/31/18

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Arbitrage Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, options risk, and leverage risk.

The principal risks of investing in the Calamos Hedged Equity Income Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Citigroup 30-Day T-Bill Index is generally considered representative of the performance of short-term money market instruments.

Bloomberg Barclays U.S. Government/Credit Index comprises long-term government and investment grade corporate debt securities and is generally considered representative of the performance of the broad U.S. bond market. Unlike convertible bonds, U.S. Treasury bills are backed by the full faith and credit of the U.S. government and offer a guarantee as to the timely repayment of principal and interest.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market of SECregistered securities. The index includes bonds from the Treasure, Government-Related, Corporate, MBS (agency fixed rate and hybrid ARM pass-throughs), ABS, and CMBS sectors.

Morningstar Market Neutral Category represent funds that attempt to eliminate the risks of the market by holding 50% of assets in long positions in stocks and 50% of assets in short positions.

S&P 500 Index is generally considered representative of the U.S. stock market.

MSCI World Index is a market capitalization weighted index composed of companies representative of the market structure of 21 developed market countries in North America, Europe, and the Asia/Pacific region. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect fees, expenses or sales charges. Investors cannot invest directly in an index.

801379 1118