CIHEX Played Defense in the First Half—and Finished Ahead of the S&P 500

July 13, 2018

As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

For 18 months or more, investors have been looking over their shoulders. Full valuations, rising interest rates, inflation, trade wars—when was the stock market ride going to end and how? Staying too long in the ninth year of the expansion meant flirting with losses and yet leaving early would have meant missing out.

This is where defensive equity comes in.

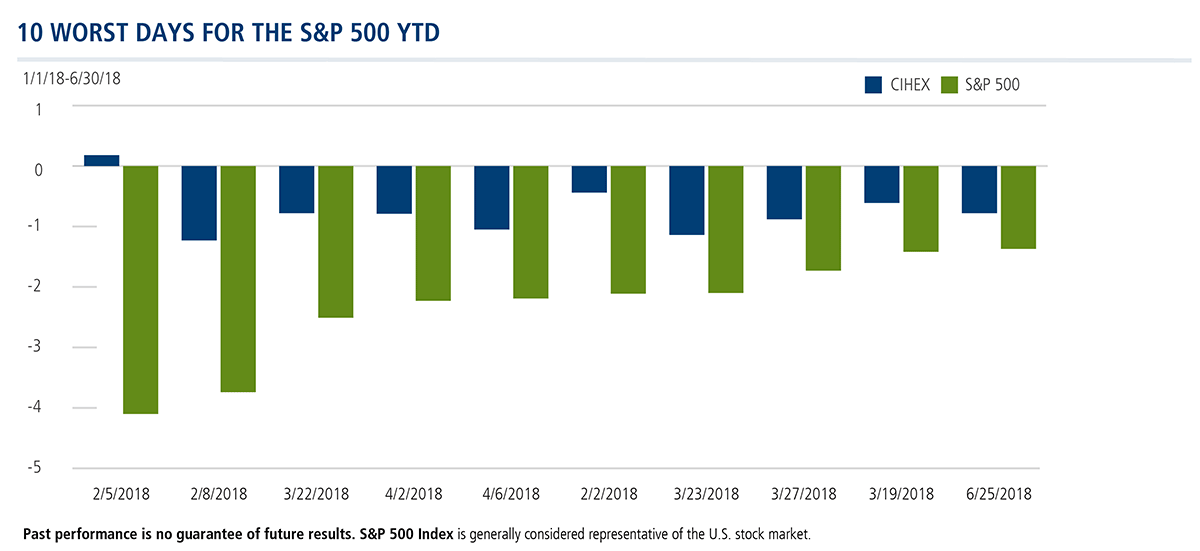

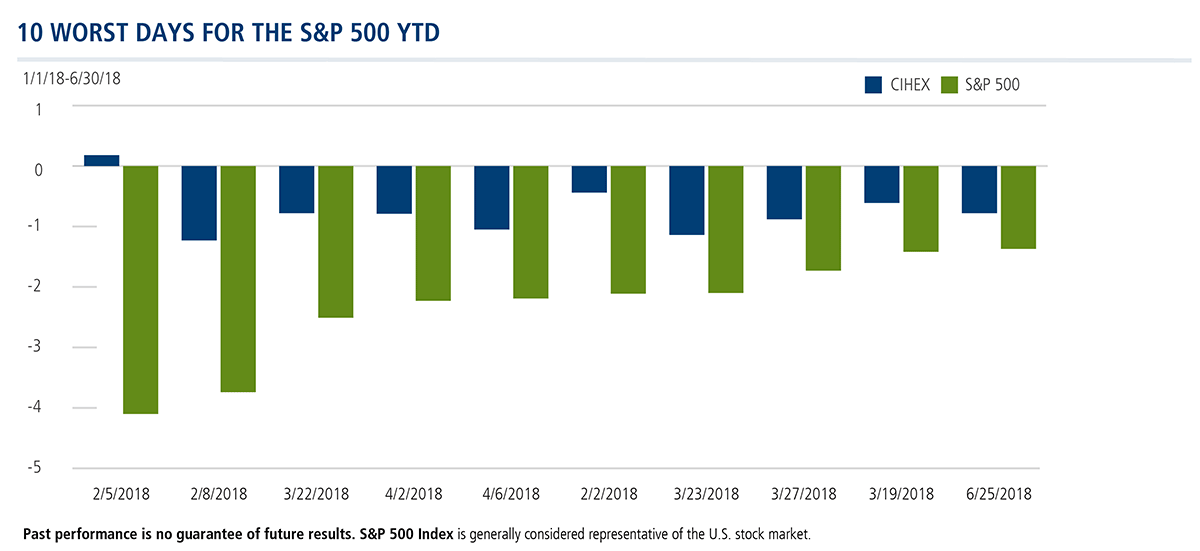

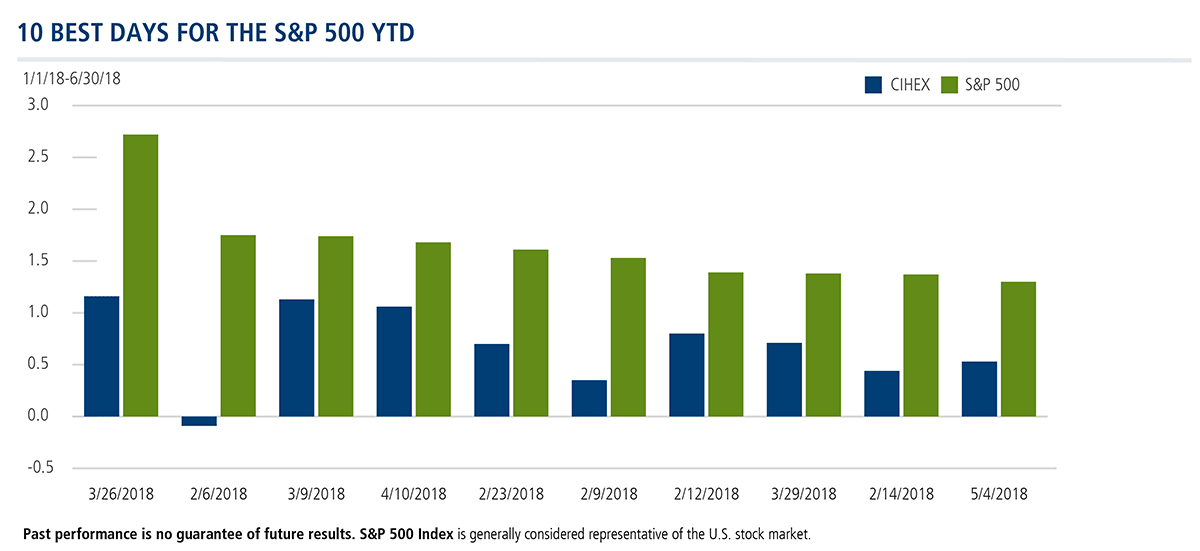

The first half of 2018 might be best remembered as the return of volatility. Sixteen days of 1% or larger declines in the S&P 500 tested those who remained invested. Any one of those days could have sent an investor to the sidelines.

But when the market was down—as much as 4% in a day—see how Calamos Hedged Equity Income Fund (CIHEX) hung in there.

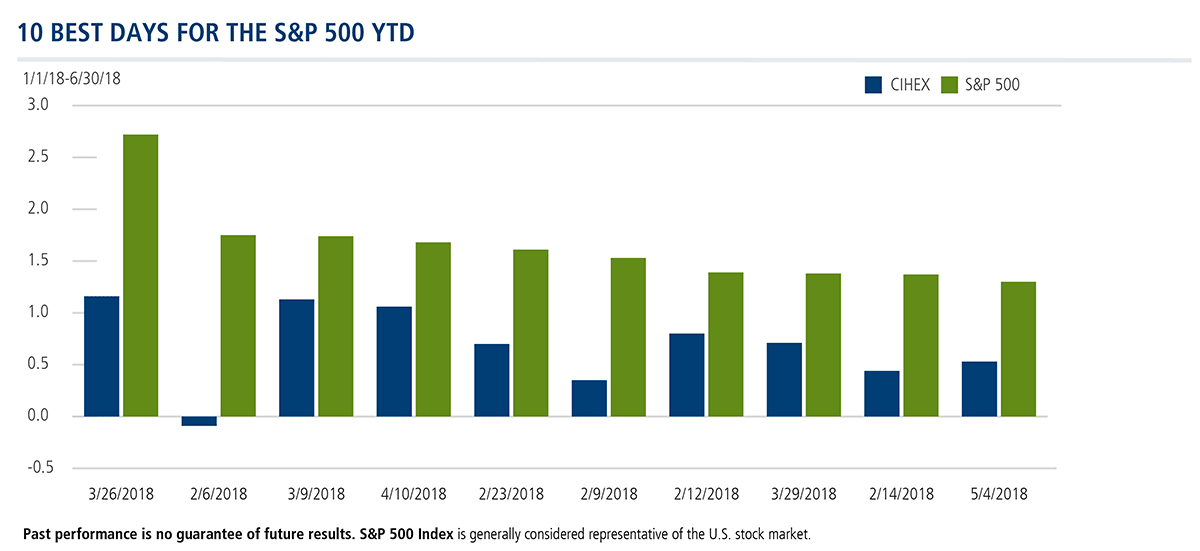

The first half also produced 20 days of 1% or greater gains. CIHEX captured an average 41% of the upside of those days.

It can be helpful to zero in on how a fund performs on large-move days, but the key takeaway is the longer-term benefit of CIHEX’s risk-managed strategy of covered call writing (see this post for a detailed explanation).

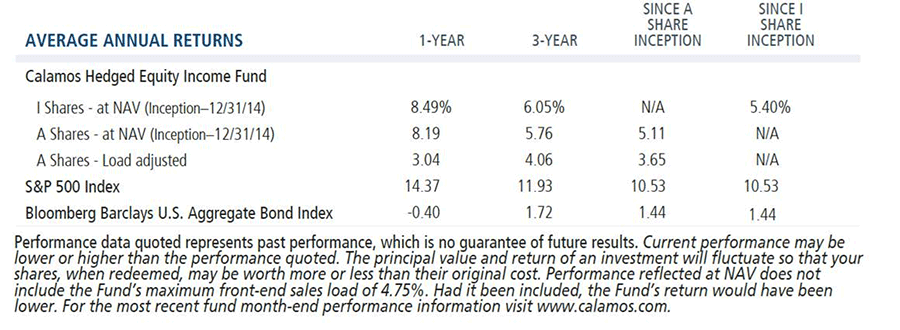

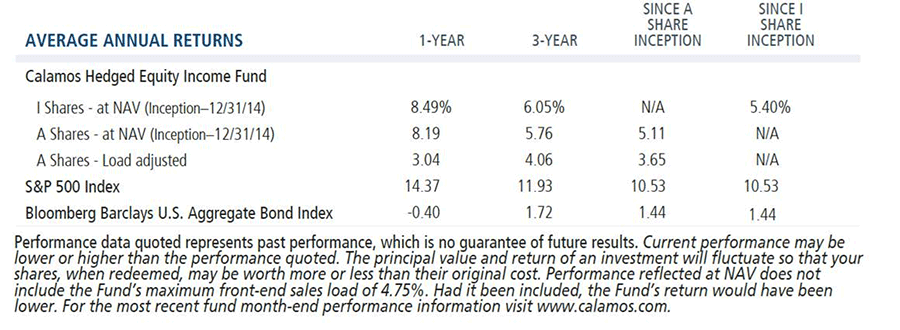

By minimizing the impact of drawdowns in the first six months of the year, the CIHEX team provided a return ahead of the S&P—CIHEX’s six-month return was 4.4% vs. the S&P’s return of 2.65%. This enabled investors to remain invested in the aging bull market.

Calamos ranks fifth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 6/30/18.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Data as of 6/30/18

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Alternative investments are not suitable for all investors.

S&P 500 Index is generally considered representative of the U.S. stock market.

The principal risks of investing in the Calamos Hedged Equity Income Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

801201 0718