Surging market turbulence is once again testing investors’ resolve. Amid mounting apprehension about softening global growth, geopolitical risks, trade, rising U.S. rates and midterm elections, stocks have retreated and the yields of long-term bonds have risen sharply. As of October 11’s market close, the S&P 500 had declined 6.7% from its high earlier in the month.

Since the 1970s, I’ve seen my fair share of choppy markets. When volatility picks up, investors often wonder if they should head to the sidelines until things get calmer. I always caution against making rash moves and panicking out of the market. Trying to time the market usually ends up leaving investors whipsawed—they end up capturing the downside and missing the upside. Often, the upturn is sudden and unexpected.

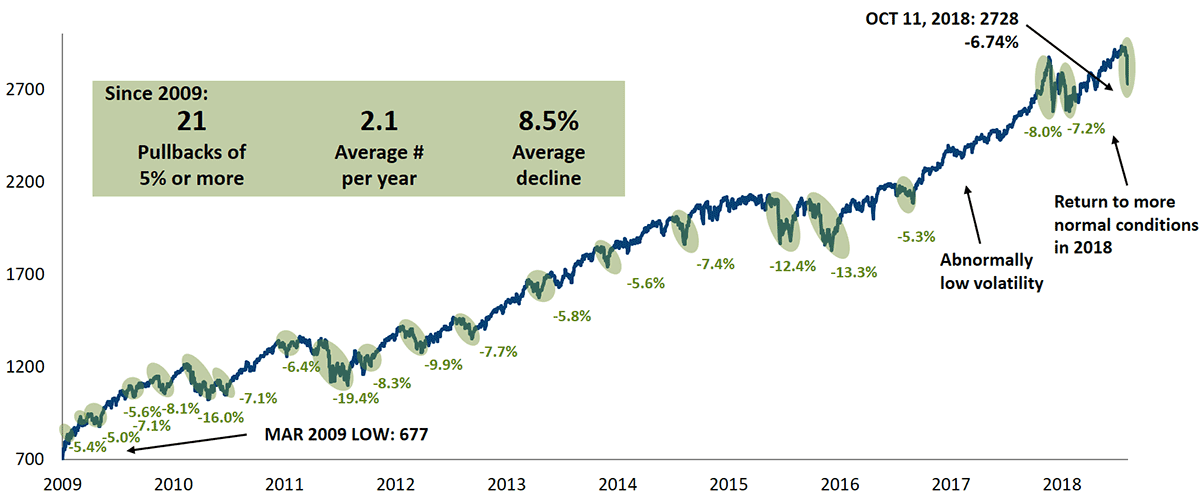

Try to view the market conditions of recent days from a longer-term perspective. Historically, the stock market has often paused and retraced some ground after a strong rise. Since this current bull market began in 2009, there have been 21 selloffs of 5% or more, including this most recent one.

Pullbacks are a normal part of bull markets

S&P 500, Daily Closing Price

Past performance is no guarantee of future results. Source: Bloomberg and Thompson Reuters.

Some investors may be concerned that this week’s volatility surge is a harbinger of imminent recession. I believe the economy can withstand this short-term pullback and continue on its growth trajectory for the next year, if not longer. There are many reasons to be positive on the U.S. economy. Deregulation and tax reform have already provided a powerful wind in the sails for U.S. economic activity, but the full measure of these business-friendly policies has yet to be fully reflected in the economy. The banking sector is in good health and financial conditions are not restrictive. Corporate earnings are robust and business sentiment is upbeat. Employment data and consumer confidence are strong. While inflation has notched up, it is still contained, and wage growth has been subdued. Given the strength of these growth tailwinds, a short-term downturn in the market is unlikely to cause the Federal Reserve to change its course. One more rate increase in 2018 still seems reasonable to me.

Even if markets move sideways over these next months and volatility intensifies, there are still many opportunities, including in equities, convertibles, fixed income and alternative strategies. Equities and convertible securities have tended to perform well during periods of economic expansion and rising interest rates. Given our expectation for a gradual ramp-up in interest rates and increased volatility, actively managed convertible securities can serve as a fixed income alternative, as well as a way to participate in equity market upside. Additionally, select high yield securities can benefit from their economic sensitivity and potentially reduced vulnerability to interest rates versus investment grade issues. Our alternative strategies--market neutral, hedged equity and long/short equity—are utilizing a range of approaches that can enhance overall portfolio diversification in volatile markets.

We’re likely to see elevated levels of rotation in the markets, which should favor active managers. Across asset classes, our teams continue to focus on being well compensated for the risks taken. At this stage of the economic cycle, we are favoring growth-oriented companies, spanning traditional and cyclical growth areas, but our risk-conscious approach has led us to take a cautious approach toward the most highly valued names. In light of a rising interest rate environment, our fixed income strategies have maintained short durations.

Conclusion

At Calamos, we’ve invested through many market cycles and I believe our teams are can capitalize on the short-term volatility and the long-term growth trends we see today. These next months could be a bumpy ride, but we believe our active, risk-managed approaches are well suited to navigate the road ahead.