As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

Options trading by a liquid alternative fund? No one is born understanding how it works.

Fortunately for those who understand the basic premise of using options to hedge equities, Eli Pars, Co-CIO, Head of Alternative Strategies & Co-Head of Convertible Strategies and Senior Co-Portfolio Manager of Calamos Hedged Equity Income Fund (CIHEX), can explain exactly what his team does—and why it has worked.

CIHEX’s objective is to use covered call writing to achieve the total return of equity markets with lower volatility, and its first quarter 2018 performance more than delivered. Pars was profiled last week by ticker magazine, and the interview includes an extended explanation of the hedge that’s been in place since last summer.

For the full interview, please download the full reprint.

The Baseline Trade

When constructing the long equity portfolio, the team adds constraints on managing industry, sector and factor exposures of S&P 500 holdings.

On the option side, Pars explains, “We start with the baseline trade which is selling 80% notional of the portfolio with calls and at least 40% notional put protection. Overall, we try to make that hedge better and we look for opportunities every day.”

Current Hedge Started 6 Months Ago

During last summer’s volatility, the team “decided that we weren’t getting paid enough to sell call options out of the money. But on the put side, we were getting paid a lot more from a volatility perspective for more out of the money puts.”

They layered in put spreads on top of CIHEX’s typical 40% notional put protection.

“For example,” Pars explains, “when we were buying an S&P 500 strike put and selling the same quantity and expiry, our potential profit is the 200 points in the S&P between the upper and lower strike. That’s a way to generate more at the money protection.

“On the call side, because we weren’t getting paid a lot for selling 5% out of the money calls, we sold more at the money calls and then bought some 1 to 2 months and 3% or 4% out-of-the-money calls. So, instead of just selling calls, we were selling call spreads.”

The difference? “We get a little less income but because the cost of it was relatively low, we got much better upside participation.”

Pars continues, “In a covered call strategy with puts like ours, as the market goes up, our delta or the size of our hedge goes up, but our beta to the S&P goes down. If the market goes down, our protection from the calls goes away and comes closer to the number of notional puts we have, or about 40%.”

“With the additional put spreads to the downside and because we are using call spreads instead of calls to the upside, the risk/reward profile is a lot more attractive,” Pars says. “As the market goes up, our sensitivity to the market goes up, but the hedge goes down. As the market goes down, our sensitivity goes down and the hedge goes up.”

Why the Strategy Outperformed the Market

Ordinarily, this trade can be expensive but with the team’s active approach and opportunistic philosophy, they were able to achieve it last year for a reasonable price. The trade performed well last year but was constrained because of the market’s limited volatility. At the start of 2018, with the return of upside volatility in the first few weeks, the calls that CIHEX were long started to capture delta.

“Our sensitivity to the market went down and we were making a lot of money on these long calls,” Pars says. “Every time the market moved up, we would pocket some of the cash and use it to either roll up the strike of our puts or buy additional puts or put spreads.”

By the end of January, the team had captured a relatively large share of the upside move in the market.

And then the market reversed and CIHEX’s hedge “became quite high, our beta to the market became quite low, and we were able to protect a lot of the downside.”

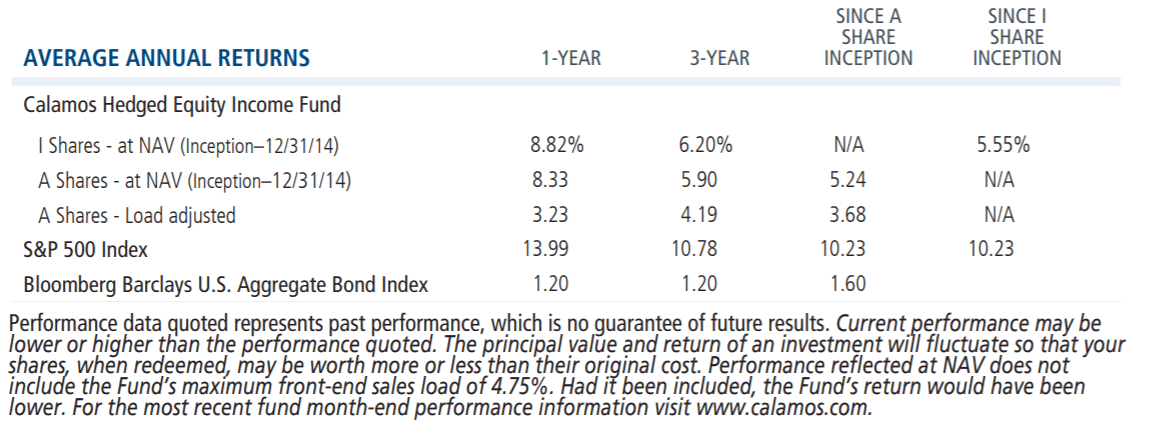

The fund’s first quarter return was 3.5% versus the S&P 500’s -0.76%.

“You wouldn’t normally expect a hedged strategy like ours to outperform the equity market in an upward case,” acknowledges Pars. “It happened because we captured a big piece of the upside in January and didn’t capture a lot of downside.

CIHEX is not a market timing strategy, he stresses. “It is all about how we construct and trade the hedge. We were somewhat forced to sell as the market went up, and that allowed us to deliver that performance.”

2 More Examples

How about two more examples, from the same interview, that suggest the repeatability of the process?

June 2016: The team had no opinion on Brexit, but saw a potential major market moving event and the volatility was relatively cheap.

“We did some incremental hedging both to the upside and the downside and we traded around that event", Pars says. “It worked really well.” (Financial advisors, ask your Calamos Investment Consultant for additional detail.)

Third Quarter 2015 market sell-off related to the Chinese currency: Pars remembers: “At that time, our trade was very similar to the baseline trade. We had some put spreads on top of it, but we didn’t have any long calls. Going into that period, the index was about 2100 and we sold calls that were 2100 and 2150 and 2200 strike.

“Over several days, the market sold off several hundred points, so the calls we had sold for $20 became $3. Typically, we would try to buy back a good part of those calls if we’ve captured more than 75% of the value. In that case, we captured 90% of the value.”

Advisors, for information about where CIHEX fits in your clients’ portfolios, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Calamos ranks sixth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 3/31/18.