Volatility is never far from our minds at Calamos Investments where our investment teams are on constant lookout for the opportunities that can present themselves. “Volatility is the flipside of opportunity,” as Calamos Founder, Chairman and Global CIO (and a pioneer in convertible securities investing) John P. Calamos, Sr. likes to say.

Even after nine years of a bull stock market, market volatility is a continuous focus of financial advisors, too—whose goal is to shield their clients from the effects of drawdowns.

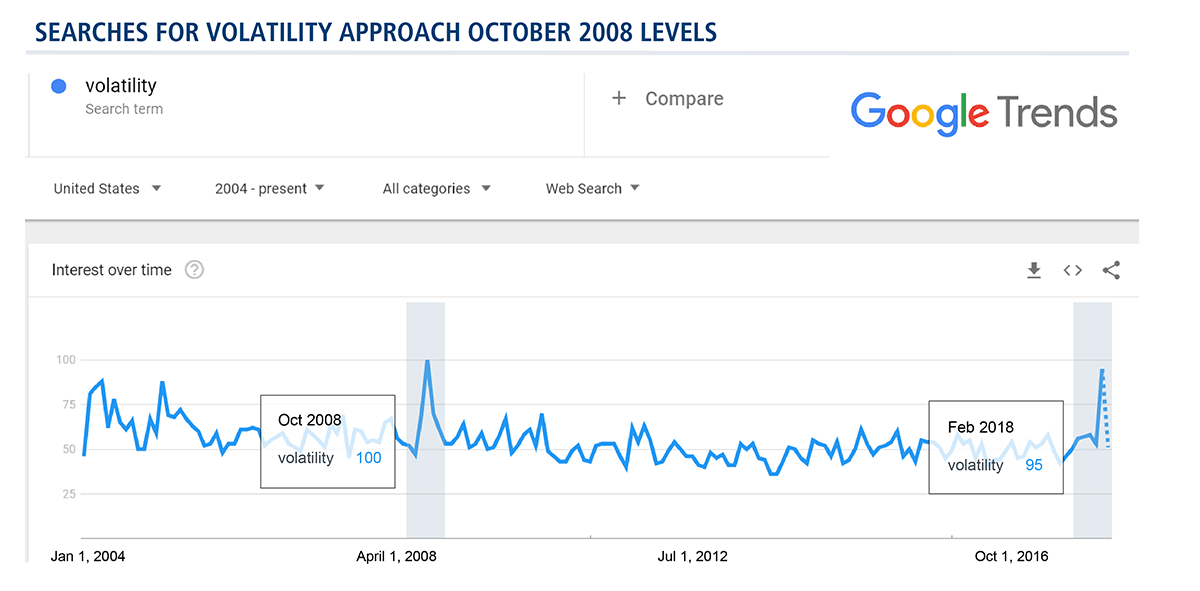

But the attention that investors pay to volatility ebbs and flows. Based on the chart below of Google search trends, it’s safe to assume that February’s 13-day 10.1% drop in the S&P 500 has gotten their attention.

Search interest in “volatility” is approaching the interest level of searchers in October 2008. A value of 100 is the peak popularity for the term, achieved 10 years ago. Google reports that “volatility” has a value of 95 in February 2018 and is the highest since the 2008 high mark.

Financial advisors, here’s a resource for the volatility conversations you’re having with clients.

The just-updated 2018 Calamos Volatility Opportunity Guide is an archive of some of the tried-and-true communications about the merits of remaining invested, including graphs and analysis on:

- The costs of timing the U.S., developed and emerging markets

- Investor behavior across market cycles

- Keeping S&P 500 market declines in perspective: even up markets see drawdowns

- Emerging market equities, major drawdowns and subsequent performance

- Asymmetric payoff profile of lower volatility equity strategies

- Convertible securities’ outperformance during periods of high volatility

- Benefits of adding alternatives to an asset allocation

- The rise of correlations between equity markets

The client-use guide includes ideas on how lower-volatility strategies can simultaneously manage risk and pursue growth. And, peppered throughout are perspectives on how volatility—including periods of low volatility such as was experienced in 2017—brings out the best in Calamos' investment professionals.

Advisors, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com for print copies.

Managing volatility is Calamos’ specialty and we welcome the opportunity to help you with your clients’ conversations and investment plans. Your rough patch, as we like to say, is our sweet spot.