As of March 1, Calamos Hedged Equity Income Fund’s name has been changed to Calamos Hedged Equity Fund.

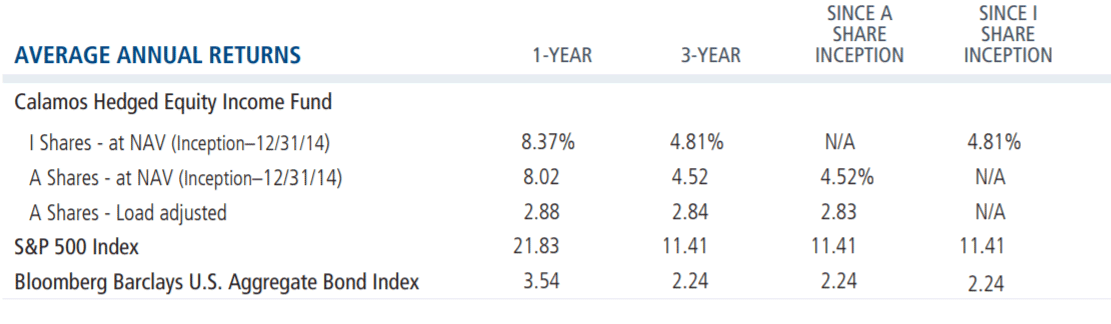

Having crossed the three-year anniversary mark on December 31, 2017, and the next month earned its first star ranking from Morningstar, Calamos Hedged Equity Income Fund (CIHEX) is enjoying increased attention from advisors looking to achieve three objectives:

- Upside participation in equity markets with less exposure to the downside. Our portfolio management team, the same team that manages Calamos Market Neutral Income Fund (CMNIX), draws on its 10 years of covered call writing experience to sell index call options and purchase put options.

- Potential diversification thanks to its low correlation to traditional fixed income, and an attractive risk/reward profile versus long-only equities.

- Income from options premiums

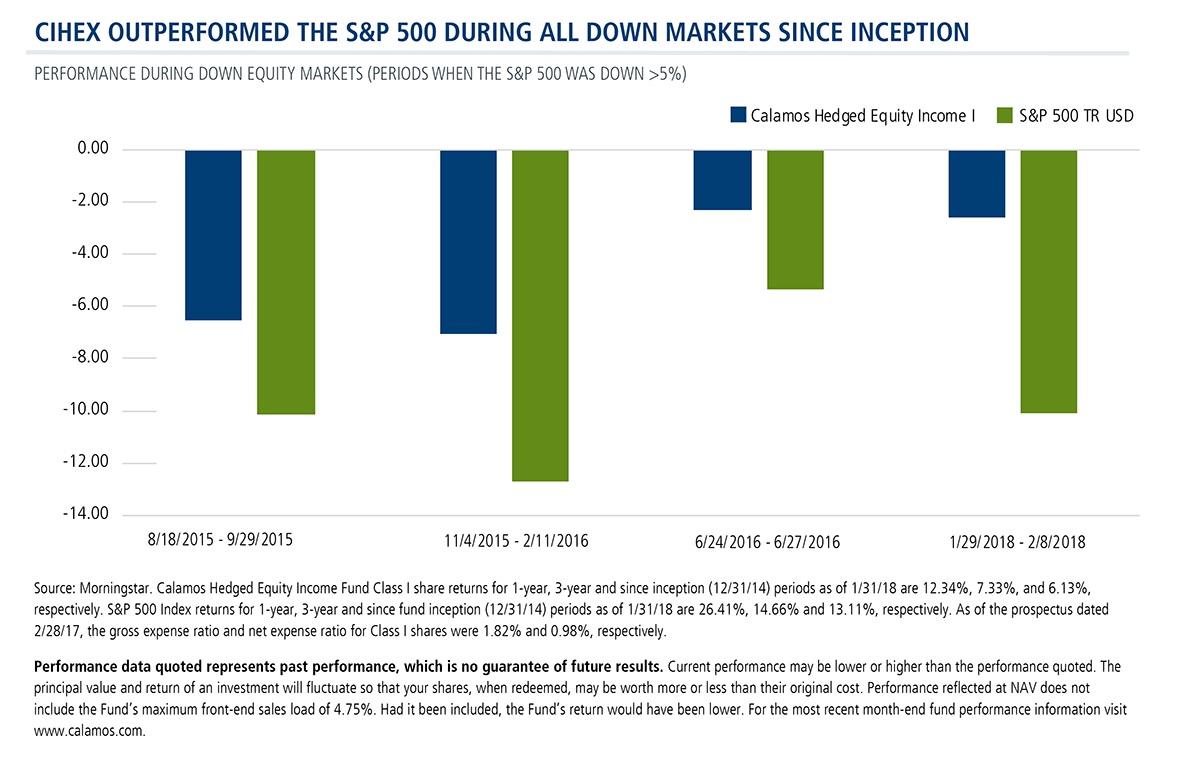

Given this year’s volatility, we find ourselves talking most about CIHEX’s resiliency in equity down markets.

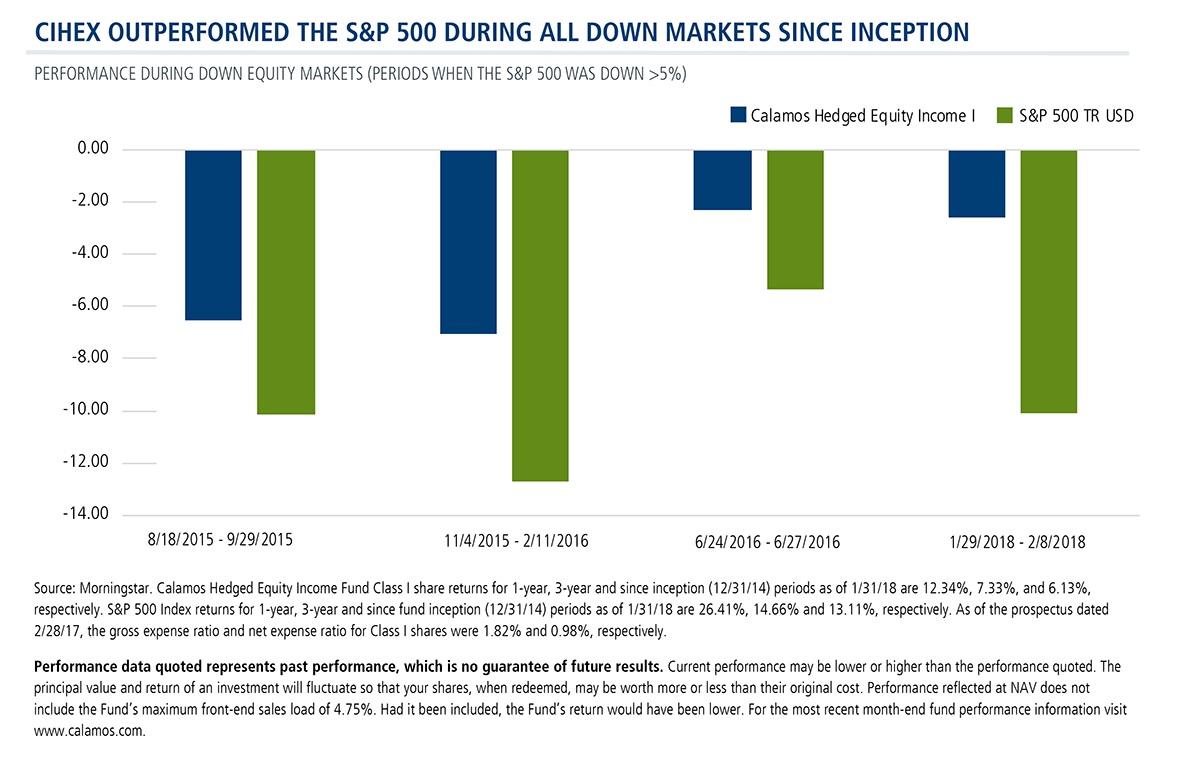

When the Market’s Down >5%

Since its 2014 inception, there have been four periods when the S&P declined more than 5%.

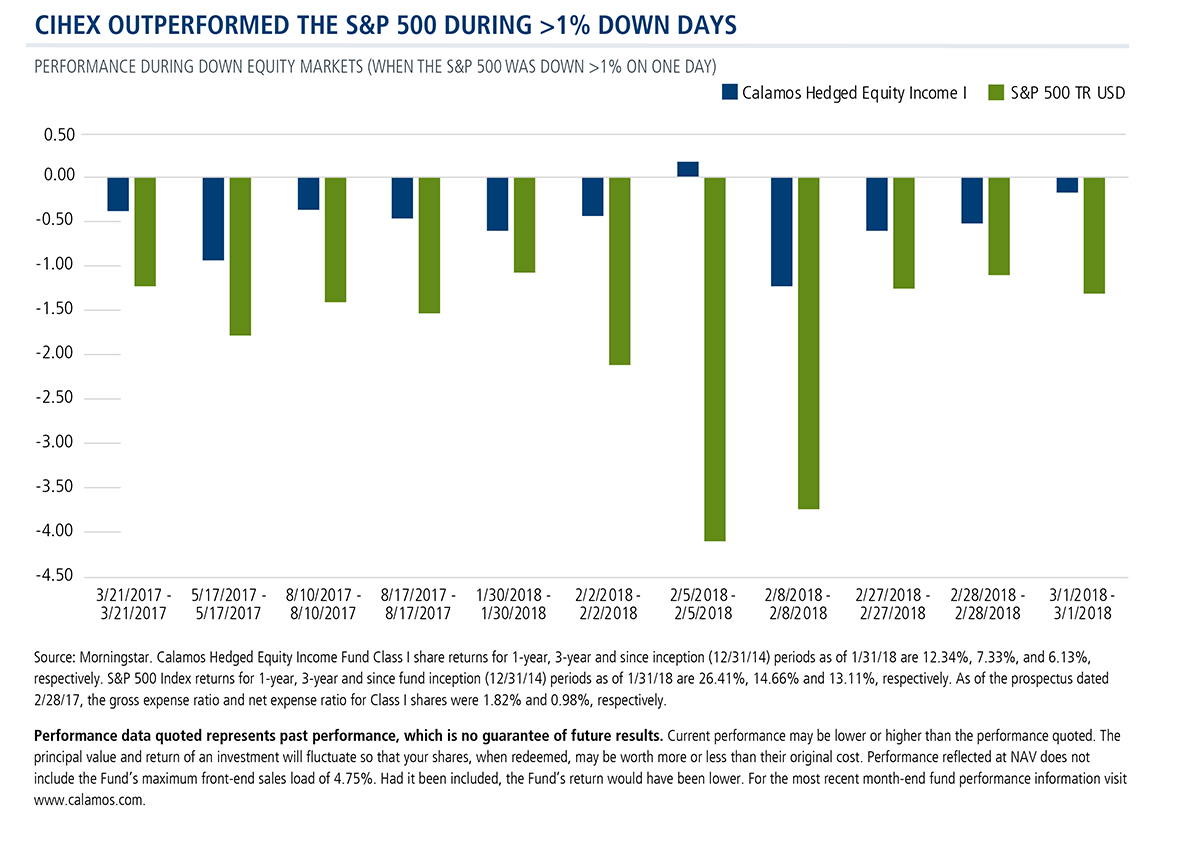

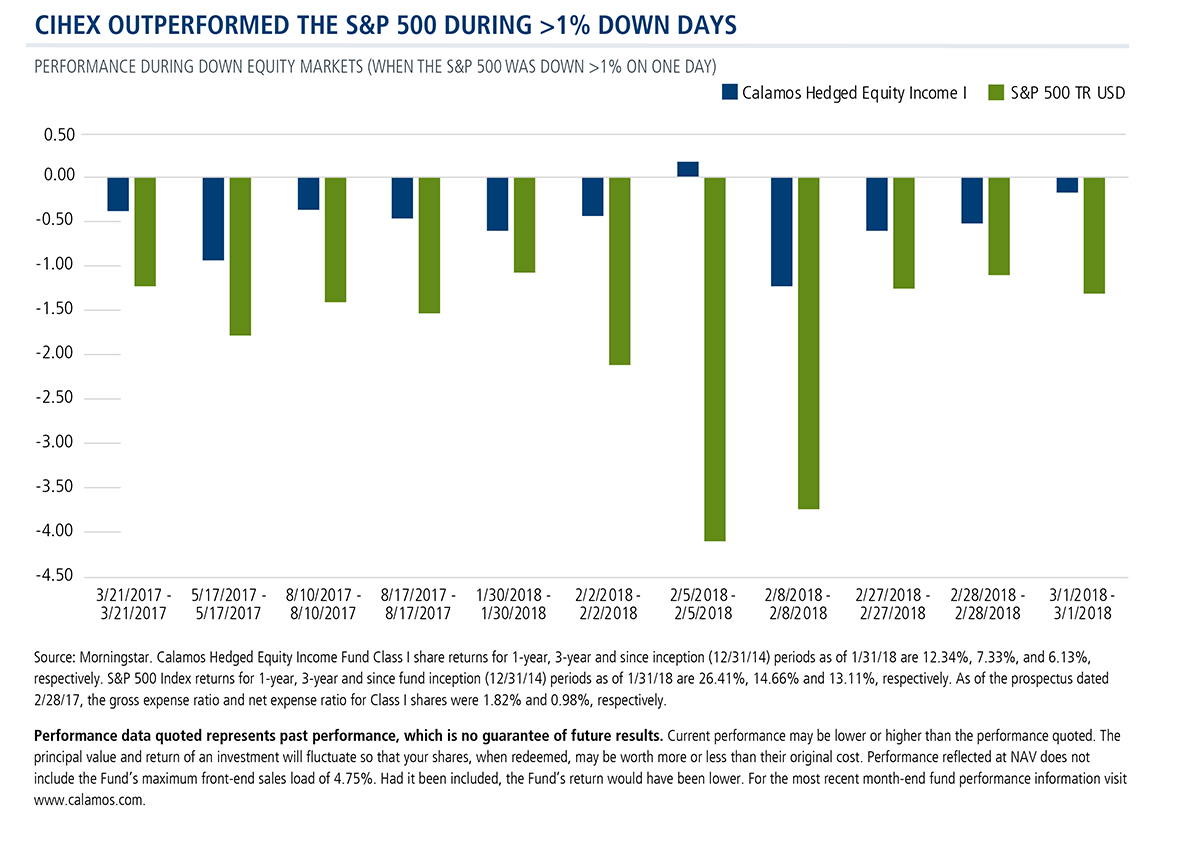

When the Market Drops >1% in a Day

Drawdowns tend to take investors by surprise, of course, and can go deep quickly. In fact, the latest correction—from 10% in 13 days—was the S&P 500’s fastest since 1950, according to BMO Investment Strategy Group citing FactSet and Bloomberg data.

Here’s how CIHEX has handled daily declines of more than 1%.

For more information about the fund, download this joint interview with Eli Pars, Co-CIO, Head of Alternative Strategies and Co-Head of Convertible Strategies and Senior Co-Portfolio Manager, and John P. Calamos, Sr., Calamos Founder, Chairman and Global Chief Investment Officer.

Advisors, for information about where CIHEX fits in your clients’ portfolios, please talk to your Calamos Investment Consultant at 888-571-2567 or email caminfo@calamos.com.

Calamos ranks sixth on the list of alternative fund managers by assets under management in the Morningstar Alternatives Category as of 12/31/17—up from its #10 position at 12/31/16.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

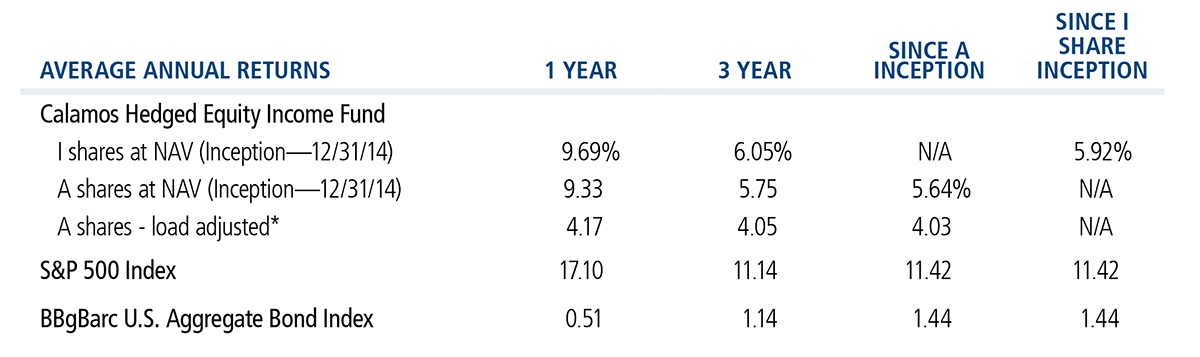

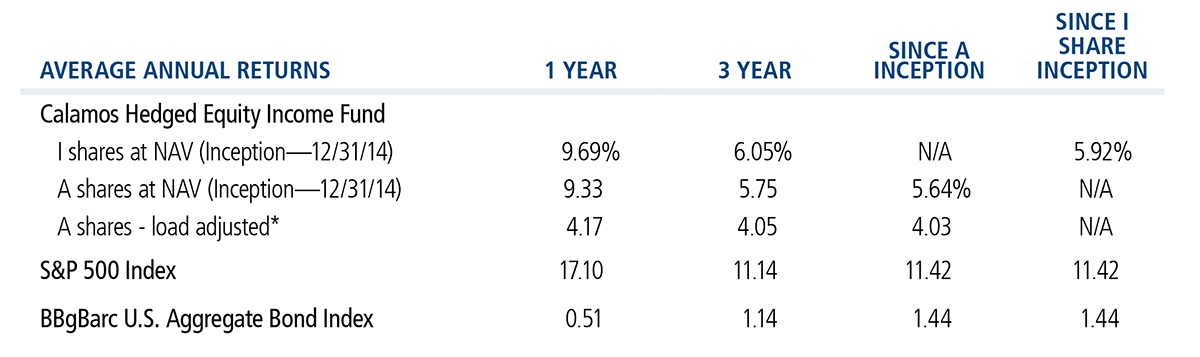

As of 2/28/18

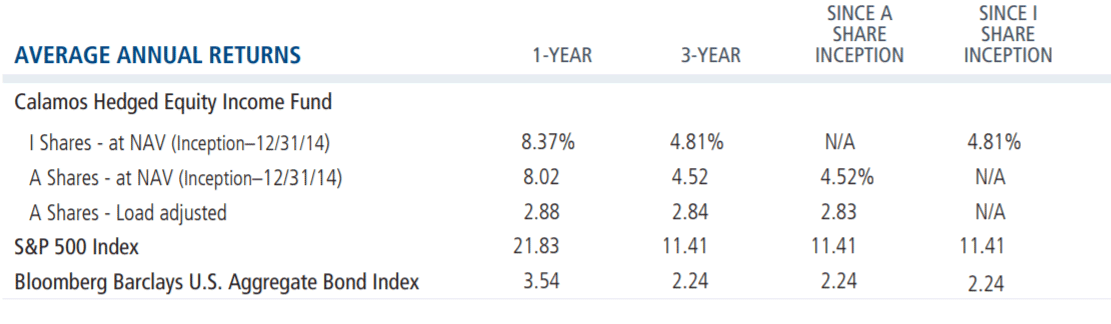

As of 12/31/17

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 4.75%. Had it been included, the Fund’s return would have been lower. For the most recent month-end fund performance information visit www.calamos.com.

Calendar year returns measure net investment income and capital gain or loss from portfolio investments for each period specified. Average annual total return measures net investment income and capital gain or loss from portfolio investments as an annualized average. All performance shown assumes reinvestment of dividends and capital gains distributions. The Fund also offers Class C shares, the performance of which may vary. In calculating net investment income, all applicable fees and expense are deducted from the returns.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and nonqualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. Opinions are subject to change due to changes in the market, economic conditions or changes in the legal and/or regulatory environment and may not necessarily come to pass. This information is provided for informational purposes only and should not be considered tax, legal, or investment advice. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Alternative investments are not suitable for all investors.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

Covered Call Writing: As the writer of a covered call option on a security, the fund foregoes, during the option’s life, the opportunity to profit from increases in the market value of the security, covering the call option above the sum of the premium and the exercise price of the call.

Convertible Securities Risk: The value of a convertible security is influenced by changes in interest rates, with investment value declining as interest rates increase and increasing as interest rates decline. The credit standing of the issuer and other factors also, may have an effect on the convertible security’s investment value.

Convertible Arbitrage Risk: If the market price of the underlying common stock increases above the conversion price on a convertible security, the price of the convertible security will increase. The fund’s increased liability on any outstanding short position would, in whole or in part, reduce this gain.

S&P 500 Index is generally considered representative of the U.S. stock market.

The principal risks of investing in the Calamos Hedged Equity Income Fund include: covered call writing risk, options risk, equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk: The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the option market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment adviser to predict pertinent market movements, which cannot be assured.

Morningstar Ratings™ are based on risk-adjusted returns and are through 2/28/18 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2018 Morningstar, Inc.

Morningstar Options-based Category funds use options as a significant and consistent part of their overall investment strategy. Trading options may introduce asymmetric return properties to an equity investment portfolio. These investments may use a variety of strategies, including but not limited to: put writing, covered call writing, option spread, options-based hedged equity, and collar strategies. In addition, option writing funds may seek to generate a portion of their returns, either indirectly or directly, from the volatility risk premium associated with options trading strategies.

801052 0318