Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, January 2023

Outlooks from our Investment Team

- Calamos Fixed Income Funds: Credit Markets Enter 2023 with Fundamental Strength

- Calamos Phineus Long/Short Fund (CPLIX): The End of “Free Money” Ushers in New Winners and Losers

- Calamos Convertible Fund (CICVX): We See Tailwinds for Convertible Securities in 2023

- Calamos Global Convertible Fund (CXGCX): 2023: The Start of a Global Convertible Issuance Surge?

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Update

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): The Case for an Especially Upbeat Outlook for Small Caps

- Calamos Global and International Funds: 2023: A Brighter Horizon for Emerging Markets

- Calamos Growth Fund (CGRIX): For Growth Stocks, Quality will be Paramount in 2023

- Calamos Growth and Income Fund (CGIIX) Time to Selectively Add Risk

- Calamos Global Sustainable Equities Fund (CGSIX): It’s Good to Be Global

Calamos Investment Team: Review and Outlook Introduction by John P. Calamos, Sr.

- Our teams are finding cause for cautious optimism as inflationary headwinds weaken.

- In contrast to 2022’s macro-driven environment, we expect markets in 2023 to reflect an increased appreciation for a company’s fundamentals. This can provide a more hospitable environment for our active approaches and bottom-up security selection.

- Our teams are identifying opportunities across assets classes, guided by fundamental research and time-tested processes.

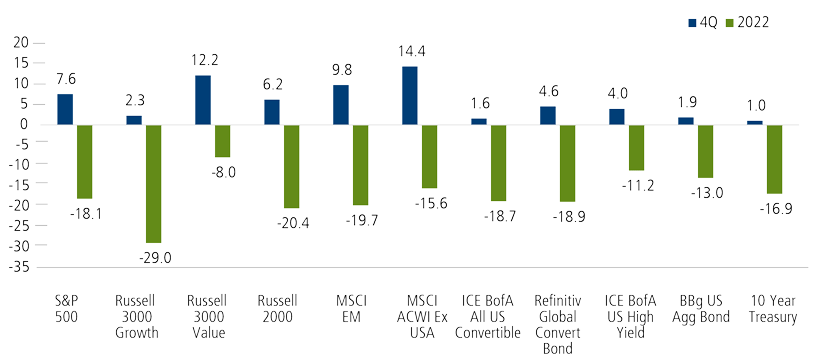

In 2022, the US equity market saw its highest level on the first trading day of the year. From there, a confluence of factors created a challenging backdrop for risk assets, including stocks, bonds and convertible securities. Indeed, it was often noted that there was nowhere to hide. The turbulent environment reflected the market’s singular focus on macro considerations, most notably the Federal Reserve’s decision to go “all-in” to try to stop inflation. This move dealt an especially painfully blow to longer duration assets like growth companies. In addition, investors grappled with the implications of the war in Ukraine, Covid lockdowns in China, global supply chain disruptions, and US fiscal policy uncertainty. This all-in or all-out analysis caused markets to swing widely, and only a few companies were able to move against the tides.

Although market participants remained jittery, sentiment improved as the year came to a close. During the fourth quarter, global markets advanced, supported by the prospect of slowing inflation later in 2023 and an eventual moderation of rate hikes. Investors also cheered solid corporate earnings and China’s long-awaited loosening of Covid restrictions.

Asset Class Performance, Total Return %

Past performance is no guarantee of future results. Source: Morningstar.

Macro themes and valuations will remain important in 2023, but we anticipate markets to expand their focus on company fundamentals (e.g., growth prospects). This increased attention to fundamentals should provide tailwinds for our teams’ active and research-driven approaches. We remain focused on security selection, understanding the macro picture, and identifying themes that can help propel individual industries and companies forward. We believe this approach positions us well given the likelihood of choppy markets and the potential for rolling bear markets, where some sectors fall and others rise.

A lot of investors have recently asked me how long it will be before things get back to “normal.” The reality is that the economy, the markets, the inflation backdrop, and the interest rate environment will never be static. The economy and the market are two different (but related) things, and their cycles have historically played out differently. For example, recessions can vary significantly, in terms of their catalysts, durations and depth—with some being quite short and shallow.

What’s most important to remember is this: there are always investment opportunities, wherever we are in the market or economic cycle. This is a lesson I learned early in my investing career in the 1970s, a period similar to today, with high inflation, stock and bond markets under pressure, fiscal policy headwinds, and geopolitical uncertainties. The stock market traded sideways for many years, but there were still opportunities where fundamentals and valuations provided the bedrock for attractive investments.

With so much volatility and uncertainty on the horizon today, I encourage investors to stay focused on diversification. Looking longer-term and layering in opportunistic allocations over the coming months is a far better approach than trying to trade in and out of the market on a short-term basis. There is compelling potential in many parts of the market, including areas that were oversold in 2022—such as growth stocks with good earnings. This opportunity set includes a number of technology companies, which came under stiff pressure despite having strong balance sheets and cash flows and innovative products and services—crucial drivers of long-term growth. Market cap diversification also makes sense, especially as many small caps are supported by low relative valuations and strong growth fundamentals. Meanwhile, as we move away from the abnormally low rates of past years, I believe investors will be well served by maintaining and adding allocations to fixed income approaches, such as our short-term bond strategy.

Finally, it’s exciting to see alternative strategies, such as long/short equity and market neutral strategies, continue to gain traction in mainstream asset allocations, which I believe is a positive trend.

As active managers, the Calamos teams do not invest in the economy, the market, or an index—we invest in individual securities, which gives us a valuable advantage. In the commentaries that follow, our teams will explain where they are finding opportunities and how they are managing the risks they see today.

Fixed Income Update: Credit Markets Enter 2023 with Fundamental Strength

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

- We believe the Fed will take overnight rates to 5.0%–5.5% before pausing.

- We expect investment grade, high yield and loan markets to deliver mid-to-high single-digit returns in 2023.

- Positioning favors slightly shorter durations as we anticipate a higher-for-longer rate environment.

There is little doubt that 2022 was a challenging year that most investors will be happy to forget. As the year came to an end, most forecasters expected the economy to soften significantly and even fall into recession in 2024. This level of pessimism is unusual, and we believe it reflects continuing distortions caused by the Covid-19 echo.

The labor market is the prime example. Although traditionally a lagging indicator, it is unusual to have a labor shortage during an economic slowdown. There are currently more than 10 million job openings (according to JOLTS) versus six million job seekers, and the labor force participation rate continues to decline.

For several quarters, we have highlighted the risks associated with a rotation of inflation from goods to services. Goods, largely produced outside the United States and more subject to supply-side shocks, have seen inflation moderate. Services inflation, including shelter, has likely peaked but remains stubbornly high. Labor costs represent the largest expense for most service businesses, and the labor shortage suggests these costs will be difficult to contain. This leaves the Fed in a difficult position: if wage pressures don’t dissipate, the Fed’s only recourse will be to lower demand. Putting it all together, we expect inflation to continue falling but expect it to remain well above the Fed’s 2% target.

Our view is that the Fed will take overnight rates to 5.0%–5.5% before pausing. At the same time, it will continue to shrink its bloated balance sheet as officials assess the impact of prior policy moves. The Fed has been clear that it expects to maintain rates at these levels for most of the year. The market disagrees and is pricing in significant cuts beginning in the third quarter.

In this environment, we would expect the economy to muddle through better than feared by the market. This may put upward pressure on rates as the market begins to reflect the “higher-for-longer” environment that the Fed has been openly discussing. We would expect the Treasury curve to become less inverted in that scenario.

Credit markets enter 2023 in a strong fundamental position. Through the Covid era, management teams wisely locked in fixed rate funding at historically cheap levels. In the high yield markets, leverage is at multiyear lows and interest coverage at multiyear highs. Refinancing needs are modest until 2025 at the earliest. Although default rates remain well behaved, we do expect them to slowly return to long-term averages.

Starting point matters. Higher yields provide more return cushion against unexpected changes in yields. While coupon-like returns are unusual, we expect investment grade, high yield and loan markets to deliver mid-to-high-single-digit returns in 2023 as a better-than-feared economy, stubbornly high inflation and a higher-for-longer Fed work their way through the market.

Positioning implications. Our time-tested philosophy and process are built on bottom-up, fundamental analysis and being adequately compensated for risks taken. We believe the setup for 2023 favors active managers because credit headwinds will make it more challenging for passive products to sidestep pitfalls. Our team continues to favor slightly shorter durations as we anticipate a higher-for-longer rate environment. We are maintaining allocations to select high yield issuers where we believe we are being well compensated for the risks taken as we follow our disciplined research process and ability to identify value.

The End of “Free Money” Ushers in New Winners and Losers

- The horizon for elevated recession risk has drawn nearer, but recession does not appear imminent. We are not yet forecasting an earnings recession in 2023.

- Investors understand the logic of eventual recession, but it may not happen soon. Barring new shocks, we expect US nominal GDP to advance at an above-trend 5%-6% in 2023.

- Monetary normalization will be more visible in easing inflation rather than prospective economic weakness. The withdrawal of excess liquidity is not the same as tight liquidity. The US economy is still absorbing the massive fiscal and monetary support of the pandemic.

- If the US consumer can outlast the inflation problem, the Fed will soon be done without a recession. For investors, 2023 could be “open season” on the prospects for Fed easing.

- The key driver for markets in the coming year will be more about the inflation cycle than the earnings cycle. Beyond 2023, the structural trajectory for inflation is the decisive question.

Equity markets have been repriced for slower growth and normalized (post-Covid) monetary policy. The Fed was slow to respond to the inflationary impact of the pandemic, but policy has caught the inflation curve in dramatic fashion. The excesses of “free money,” from crypto to property prices, have been wrung dry.

The trajectory of corporate profits will now determine if the bear market is complete. Healthy nominal GDP (5%-6%) in 2023 implies corporate profitability can be sustained. Of course, operating leverage will become more muted. Conviction in a soft landing rather than recession will drive style and industry performance in coming quarters.

Drivers of valuation (inflation, interest rates and Fed policy) rather than corporate profitability will determine market performance through H1 2023. Investors are consumed by gloom, yet this mood was more appropriate 18 months ago versus today. Silver linings are emerging that argue for a more nuanced outlook if recession comes later than many expect.

The key debate is the post-pandemic inflation cycle. We see a resilient US economy in coming years, while deflationary forces still dominate large parts of the global economy. We expect inflation pressures to ease steadily in coming quarters and lead to a more patient Fed. Despite their histrionics, the Fed is adamant that a hard economic landing is not part of their plan.

Across industries, Calamos Phineus Long/Short Fund (CPLIX) emphasizes quality and profitability within sensible valuation parameters. This style “wins” as long as investors believe recession is inevitable. The era of free money is over, implying the investment landscape is being reconstituted. In other words, a new set of winners and losers are emerging versus those that characterized the long era of excessive monetary accommodation.

Growth stocks can bounce as rates peak but selectively for two reasons. First, central banks will extend their timetable to remove excess liquidity; second, corporate profitability for many has peaked structurally due to the reversal of globalization and more normalized interest rates. Too often, investors have allowed their Icarus-like optimism of the Free Money era to justify overpaying for sustainable growth.

Technology leadership can resume selectively once 2023 outlooks are de-risked in Q1. We emphasize attractive GARP quality while avoiding names without valuation support. Banks are a good cyclical hedge that are priced appropriately for the downside risks. With labor resilient and household balance sheets intact, many US consumer-facing industries are compelling in a “slowing but not slow” economic landscape.

From a geographic standpoint, we prefer US versus non-US, UK versus continental Europe, with further emphasis upon quality and profitability factors. Profitable (as opposed to the many unprofitable) small cap is intriguing. China’s post-Covid era will be an important variable. China confronts a messy transition economically and will be slower to underpin global demand industries than some hope.

As inflation pressures cool decisively, the big question is whether the Fed will ease policy in the absence of recession. As the broad measures of inflation revert to the 2%–3% levels that policymakers deem acceptable, the Fed has scope to acknowledge that a peak target for fed funds of 5% is simply inappropriate.

This implies another shifting of the monetary tides. Investors should be prepared for the hunt as today’s gloom eventually gives way to “open season” on the prospects for Fed easing. This will be a decisive development for equities and fixed income alike.

We See Tailwinds for Convertible Securities in 2023

Jon Vacko, CFA and Joe Wysocki, CFA

- We continue to emphasize balanced convertibles, with select investment in busted issues (i.e., those with more pronounced bond characteristics), while avoiding distressed issues.

- We see potentially powerful drivers for returns including reduced equity valuations, positive yields-to-maturity and longer-term optionality embedded in convertible structures.

- Issuance will likely ramp up in 2023, supported by more hospitable macro conditions.

2022 was a challenging year across the financial markets as investors grappled with uncertainty surrounding global economic growth prospects, monetary policy shifts, geopolitical events, and the lingering effects of Covid. As we enter 2023, these variables will likely continue to drive market headlines. However, as the year progresses, we anticipate that markets will get greater clarity on the path of these macro risks, and the potential shift in focus toward the opportunities that have been created by recent volatility could be beneficial for risk assets.

Against this backdrop, we believe the convertible market is at an interesting inflection point. Convertibles are hybrid securities that can act like equities or bonds, depending on movements in the markets. Declining underlying equity prices and wider credit spreads have led to a high proportion of convertibles trading closer to their bond floors, which argues for improved structural risk mitigation going forward. At the same time, reduced equity valuations, positive yields-to-maturity and longer-term optionality embedded in convertible structures can be powerful drivers for future upside returns.

Our focus through these uncertain times remains on actively managing the risk/reward tradeoffs within Calamos Convertible Fund (CICVX). To take advantage of the reset in the equity markets, we have maintained our emphasis on balanced convertibles with favorable asymmetric risk/reward profiles. Because they offer a healthy blend of equity and fixed income characteristics, these balanced convertibles can provide upside equity participation while potentially dampening downside volatility. We also see selective opportunities within the busted segment of the convertible market that can benefit from spread compression and attractive yields. However, we are avoiding the most distressed portions because we believe the cost of capital has risen and some business models may not be able to access capital as easily as they have in years past.

Convertible new issuance was subdued in 2022, but we believe the pace will ramp up once macro uncertainty subsides and could return to a brisk clip. Typically, after periods of volatility-induced slowdowns in new capital market issuance, the convertible market has tended to be one of the first to reopen, and the initial deals tend to be attractively priced. Additionally, the absolute level of interest rates has increased across all traditional credit markets and the coupon-saving advantage convertibles can offer could be attractive to a broad set of issuers.

2023: The Start of a Global Convertible Issuance Surge?

Eli Pars, CFA

- We are braced for more turbulence as the lagged effects of monetary policy work their way through the economy.

- It is too early in the cycle for aggressive risk-on positioning.

- Higher interest rates and refinancing activity could set the stage for a big upside tail in convertible issuance over the next few years.

The Federal Reserve has raised rates by 425 basis points in 2022 and is not done. These hikes, combined with the start of quantitative tightening (which has barely begun) have pushed the effective overnight rate to 6.5%. We haven’t seen rates this high since the Fed tried to pop the internet bubble in 2000.

The Bull Case for Convertible Issuance

Market volatility and anxiety about the Fed has caused many companies to put growth plans on hold. We believe there is substantial pent-up demand from prospective convertible issuers once the market gets past these concerns. Most of these prospective issuers are likely traditional growth companies that have dominated issuance in recent years. On top of this, we should continue to see demand from existing issuers to refinance convertibles as they mature. Both 2020 and 2021 were banner years for issuance, with the bulk of securities issued with five-year maturities. Typically, refinancing begins a bit earlier, and we expect some of the refinancing of 2020 and 2021 issues will happen in 2023. In addition to this, we have a large high-yield maturity wall that starts in 2024.

There is a chance that issuance is even brighter than that scenario. As low-coupon nonconvertible debt issued after the Great Financial Crisis starts to come due, corporations will face a grim prospect: replacing coupons of 1% to 2% with coupons of 5% or 6%. Suddenly, the idea of issuing a 2% convertible bond looks more compelling. Although convertible issuance has been healthy since 2008, we have not seen the investment-grade issuers return. This higher interest rate environment could bring them back. And that’s when we could see the big upside tail in convertible new issuance, fueled by individual investment grade issuers bringing $1 billion to $5 billion to the market.

Although the economy has shown remarkable resiliency so far, we are still early in the process because of the lagged effects of monetary policy. None of this points to smooth sailing ahead. The market won’t wait for calm seas—it will look forward through the fog. But at the minimum it seems as if market participants will need at least some confidence that rates are headed back down. Although the Fed may stop raising rates in the first quarter of 2023, it likely won’t cut rates until it is comfortable that inflation is not only abating but is on its way to their 2% target. In the meantime, the economy must deal with the highest rates in a generation.

Our risk/reward positioning in Calamos Global Convertible Fund (CXGCX) remained relatively unchanged over the quarter. Although at the margin we continue to look to add risk to the portfolio, we believe it is too early to be aggressive. From a regional perspective, the fund remains overweight to the US and underweight to Europe. From a sector standpoint, the fund maintains its overweight to technology.

We saw a welcome uptick in new issuance during the fourth quarter of 2022. Additionally, we believe we can lay out a bull case for convertible new issuance over the next few years (see sidebar, “The Bull Case for Convertible Issuance”).

Alternatives Fund Update: Calamos Market Neutral Income Fund, Calamos Hedged Equity Fund

Eli Pars, CFA

- We continue to like the opportunity set in the arbitrage side of CMNIX, and we have begun shifting some assets from hedged equity to arbitrage, specifically to the convertible arbitrage strategy.

- Our intentions to increase convertible arbitrage reflect heightened return expectations on the back of the rise in overnight interest rates.

- We believe the value of using CIHEX as an alternative to a traditional 60% equity/40% fixed income asset allocation remains intact, particularly in light of the significant declines traditional bonds experienced.

Calamos Market Neutral Income Fund (CMNIX) is designed to enhance a traditional fixed income allocation. The fund combines two complementary strategies—arbitrage and hedged equity—to pursue absolute returns and income that is not dependent on interest rates.

We actively manage allocations to the strategies based on our view of market conditions and relative opportunities. We continue to like the opportunity set in the arbitrage side of the fund. Therefore, we have begun shifting some assets from hedged equity to arbitrage, specifically to the convertible arbitrage strategy. The fund ended the quarter with an allocation of 51% in the arbitrage strategy and 49% in the hedged equity strategy. In comparison, at the end of the third quarter, the fund held 49% in the arbitrage strategy and 51% in the hedged equity strategy. With these shifts, convertible arbitrage is now 39% of the fund versus 37% three months ago. We will continue to look to add to convertible arbitrage at the margin. We anticipate funding any such growth through the runoff in the SPAC book or a reduction in hedged equity.

Our intentions to increase convertible arbitrage reflect heightened return expectations on the back of the rise in overnight interest rates. Historically, convertible arbitrage returns have been correlated with overnight rates. This is partly because the rebate the fund receives on its short stock positions is directly tied to the fed funds rate. Although returns don’t necessarily go up tick-for-tick with rates, we expect a meaningful tailwind in 2023 and beyond. Additionally, we are getting excited about the potential for a meaningful uptick in new convertible issuance (see sidebar, “The Bull Case for Convertible Issuance”).

The hedged equity side of the fund has been the source of substantially all of the fund’s losses in 2022—mainly because of its beta to the equity market—but we did see some improvement in the relative performance of that sleeve as 2022 progressed. We continue to find attractive opportunities for that portion of the fund and maintain conviction in our approach. However, we believe that convertible arbitrage offers better risk-adjusted expected returns.

Calamos Hedged Equity Fund (CIHEX) is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. As our team has discussed throughout 2022 (including in our post “Navigating Option Skew: When the Smile Turns Into a Smirk”), 2022 has presented some challenges for option-based strategies. Even with these unusual headwinds, we believe the value of using the fund as an alternative to a traditional 60% equity/40% fixed income asset allocation remains intact, particularly in light of the significant declines traditional bonds experienced. Furthermore, we are encouraged that the relative performance of CIHEX has improved over the past couple of quarters.

We have been able to construct trades that give us more income from call writing. We have been taking advantage of this while still maintaining a lighter-than-usual use of call writing. We also continue to layer in put spreads over and above our typical minimum level of notional long puts.

The Case for an Especially Upbeat Outlook for Small Caps

Brandon Nelson, CFA

- Small caps have tended to perform well in a disinflationary environment.

- 2023 is likely to be a better year for the markets than for the economy.

- Our positioning favors secular growth with visible revenue streams.

Although there were many macro moving parts to monitor during the fourth quarter, slowing inflation (i.e., disinflation) was the star of the show and triggered a sizable—and surprising to many—stock market rally. For much of the year, the market has been struggling with many macro concerns, the biggest being stubbornly high inflation and its implications on monetary policy. Thus, the disinflation data points were a welcomed sign for the bulls. While there continues to be uncertainty relating to inflation and monetary policy, the shock to the system appears to be largely behind us as evidenced by a flattish S&P 500 Index over the past six months despite several significant rate increases by the Federal Reserve during that period.

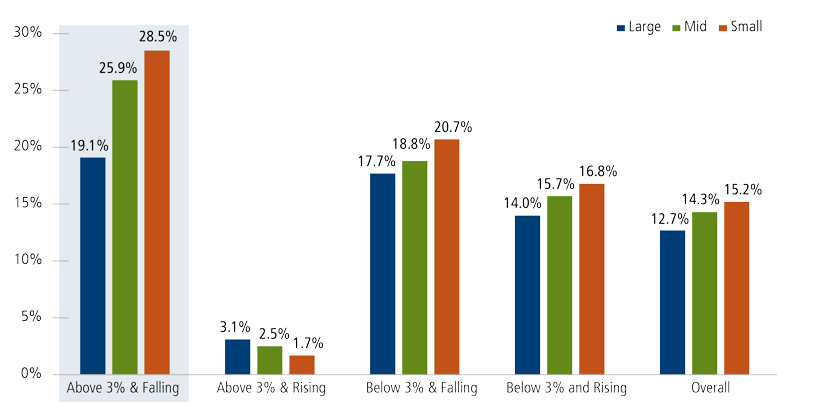

In our October 2022 commentary, we highlighted that stocks tend to perform well after inflation peaks, with or without a recession. We also would note that small cap stocks have tended to perform especially well in a disinflationary environment. More specifically, history shows that when inflation has been above 3% and falling, as it is now, small cap performance has been at its best in terms of absolute performance and performance relative to mid and large caps.

Absolute annual returns, 1948 to 2021

Source: Center for Research in Security Prices (CRSP®), The University of Chicago Booth School of Business; Jefferies. Past performance is no guarantee of future results.

As mentioned, the inflation picture is improving, however, the markets are increasingly concerned with recession risk and the outlook for corporate earnings. These concerns are legitimate. Data points suggest recession risk is elevated and broadly speaking, earnings estimates for 2023 are likely too high. That sounds bad, but it’s important to know that, typically, new bull markets begin several months before near-term earnings estimates are done falling. Also, soon, the market will likely look through a softer 2023 picture and begin to put heavier weight on a recovering 2024 earnings outlook. Finally, it’s important to note, our small cap growth and SMID cap growth portfolios, Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX), respectively, are heavily exposed to companies with secular growth that have more visible revenue streams, making their fundamentals less vulnerable to broad economic slowdowns. In fact, during economic slowdowns when growth is scarce, our growth-rich portfolios have often performed well.

In sum, we suspect 2023 will be a better year for the stock market than for the overall economy. It’s murky out there now, but the macro will likely settle down, enabling companies with superior fundamentals to be properly rewarded with strong stock price performance. We believe the portfolios we manage are heavily tilted toward those superior performers and, thus, are well positioned for the current environment. We’re especially upbeat about the outlook for small caps. Historically, they have typically won over the long term and during periods of disinflation, have had seasonal tailwinds post-midterm elections, and have entered the year with de-risked valuation.

2023: A Brighter Horizon for Emerging Markets

Nick Niziolek, CFA, Dennis Cogan, CFA

- Monetary policy, US dollar strength, Covid variants and war in Ukraine created significant headwinds for markets in 2022; we see signs these could change course and become tailwinds for the markets in 2023.

- The Calamos global and international portfolios are positioned to reflect our increased optimism.

- We believe 2023 could begin a multiyear cycle of non-US market outperformance, led by emerging markets.

The following is an excerpt of our recent commentary, “Calamos Global and International Update: Reasons for Optimism in 2023.” (Read the commentary in its entirety here.)

Several challenges confronted global markets in 2022. We will likely continue to deal with the real economic impact of these for much of 2023, but markets look forward and we believe resolution on multiple fronts may provide for a positive inflection in equity performance.

Monetary policy. Global monetary policy was the most significant factor driving performance in 2022 and will be paramount next year as well. Inflation may remain elevated during the first half of the year in developed economies, but as the effects of monetary and fiscal stimulus to address Covid-19 disruptions fade, we expect inflation to return to levels that allow central banks to pause and potentially reverse monetary tightening. Emerging market central banks began tightening policy earlier than their developed market counterparts during this cycle, which has been a contributing factor to currency and equity market resilience in many cases despite conditions that have been more disruptive in previous cycles. If we do see developed market central banks pause, this could present a more favorable backdrop for capital flows to return to many emerging economies.

US dollar strength. The extended period of strength of the US dollar, driven in large part by Federal Reserve monetary policy tightening along with the relative strength of the US economy, was a significant headwind for non-US returns in 2022. As is often the case, the dollar’s appreciation exceeded most measures of fair value. We believe this headwind will cease in 2023 as it becomes clear that monetary policy tightening has largely run its course, though this may take a few quarters to play out. Given the sharp reversal we’ve already seen in the dollar, our expectation is that the next few quarters will see consolidation before a resumption of a weaker trend versus most currencies later in the year. This weakening should be a significant tailwind for non-US risk assets because stronger home currencies will provide local central banks with more flexibility to support growth.

Covid variants. Covid variants and their impact on reopening in Asia proved to be a stiff headwind in 2022. We strongly believe this will become a tailwind in 2023. We are very confident that Asian countries, including China, will maintain their reopening trajectories, fueled by pent-up demand in the form of “revenge spending” and “revenge travel.”

War in Ukraine. Global pressure to end the Russia-Ukraine war is increasing, which could lead to resolution during the next few quarters. With China reopening its economy and its economic growth already challenged, we believe there are added incentives for China to advocate for a resolution, joining the US and Europe. That said, the resolution of the conflict is not a major pillar in our more optimistic view for 2023; equity markets are likely to advance either way.

Positioning Implications of our Outlook. We have positioned our portfolios to reflect our expectation that skies will look clearer three to six months from now, but the interim is likely to be volatile with many head fakes along the way.

- We are emphasizing companies with earnings momentum, pricing power, attractive valuations, and strong ROIC and free cash flow.

- We favor balance across macro regimes: secular growth, cyclicals, commodities exposure, Covid reopening, and select defensives.

- We are maintaining thematic exposures across key cyclical and secular trends including cybersecurity, defense, energy transition, digitization, automation and AI, biotech advances, global demographics and consumption.

We are favoring countries positioned to benefit from a reduction in Covid restrictions throughout Asia, increased commodity prices, and a global trend to reorient supply chains (“nearshoring”). Finally, the valuation backdrop for non-US markets remains quite attractive on both relative and absolute levels, providing additional support for our constructive view on non-US markets.

For Growth Stocks, Quality will be Paramount in 2023

Matt Freund, CFA, Michael Kassab, CFA

- We believe the economy will be better than most fear, interest rates will stay higher for longer, and earnings growth will have to be proven, not promised.

- In 2023, stock selection will dominate most other factors.

- We believe companies in noncyclical industries with proven earnings growth should continue to do well.

Past performance is not a guarantee of future results. Most years, this is a warning designed to keep jubilant investors from extrapolating recent gains far into the future. This year, it’s a reminder that disruptions often create bargains and that long-term investors should not lose sight of their goals and the opportunities now available in the marketplace.

As the new year gets underway, many forecasters expect the economy to soften significantly and even fall into recession in the second half of 2023 or early 2024. This level of pessimism is highly unusual, reflecting, we believe, continuing distortions caused by the Covid echo and continuing efforts by central banks around the world to fight unwanted inflation. Our view is that the Fed will take overnight rates to between 5.0%–5.5% before pausing and leaving them there for most of the year. At the same time, the Fed will continue to shrink its bloated balance sheet as officials assess the impact of prior policy moves.

In this environment, we would expect the economy to muddle through, better than feared but weaker than the recent Covid recovery. Investors should remember that the economy and the market are two different things. A better-than-feared economy should be beneficial for stocks broadly, but the market must confront three major issues before a new bull market rally can be sustained for growth stocks: interest rates, valuations, and earnings growth.

Interest Rates. While the Fed closely controls shorter-term rates, long-term rates are more important to stocks, which are often described as long-duration assets. Unfortunately, the outlook for long rates is more challenging. The market is not currently reflecting the Fed’s higher-for-longer rhetoric (in fact, rate cuts are currently priced in for the second half of the year). Higher long-term interest rates could provide a challenge to the market, especially for nonprofitable companies.

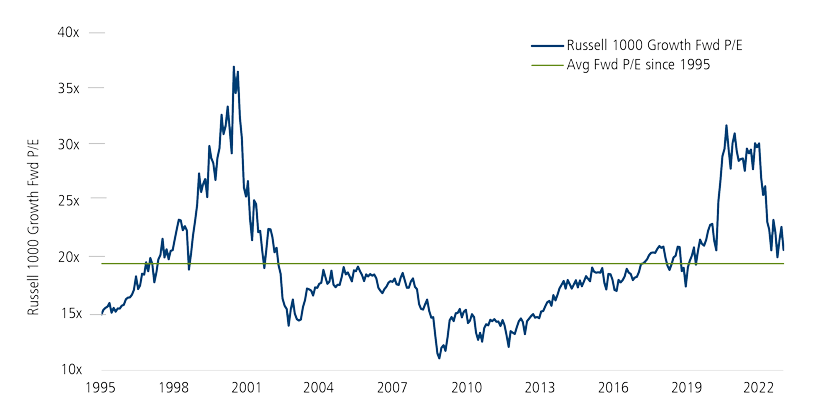

Valuations. Starting points matter. Cheap valuations are generally supportive of long-term returns. Today, the market is cheaper than earlier in the year. But lower prices aren’t automatically bargains. As the chart below shows, growth stocks are currently trading at multiples seen during moderate growth periods and do not yet reflect recessionary bottoms.

Past performance is no guarantee of future results. Source: Bloomberg

Earnings Growth. The market has become much more demanding of companies. Investors have become much less willing to pay for uncertain operating results many years in the future. Management teams, who were once applauded for their long-term outlook and strategic vision, are now being reevaluated based on their short-term results. There is little patience for disappointments; companies that miss earnings are quickly punished before any explanation can be given.

Positioning Implications. We believe the economy will be better than most fear, interest rates will stay higher for longer, and earnings growth will have to be proven, not promised. In such a market, stock selection will dominate most other factors. We believe the stocks of companies with unproven business plans and little to no near-term earnings will continue to struggle. This is not to say the companies won’t eventually succeed. Rather, they won’t be rewarded in the market until performance catches up with their promises. Even so, companies in noncyclical industries with proven earnings growth should continue to do well.

We know this year has been challenging. We believe investors should focus on the risks of something going wrong but also on the possibility of things going right. The proverbial wall of worry is high. Even so, we believe many of these fears will prove manageable for equity investors. We firmly believe that our research-driven process, with its focus on corporate fundamentals and risk management, will prove itself over time.

Calamos Growth and Income Fund: Time to Selectively Add Risk

John Hillenbrand, CPA

- Our premise to add risk reflects our conviction in the long-term US economic growth trajectory, positive policy changes, as well as improvement in certain parts of the economy and corporate returns on capital.

- We see attractive long-term upside in the US equity market from current market levels.

- Over the short and intermediate term, improved real returns on capital should drive higher equity prices.

Since mid-2021, our expectation has been for a lower growth environment in 2022 and 2023. This slower growth outlook has been exacerbated by the war in Ukraine and China’s Covid shutdowns. These two factors have also worsened the inflation environment and caused most central banks around the world to raise interest rates, which has further slowed growth. Given this macro environment, our investment thesis has been a defensive posture with a focus on lower-risk areas including lower-beta, high-quality balance sheets and higher return-on-capital businesses.

As we have monitored the macro and investment landscapes over the past several months, we now believe it is time to selectively add risk to the portfolio focused on areas of improving economic growth in H2 2023 and companies with improving returns of capital. Our premise to add risk is based on several factors, including our conviction in the long-term US economic growth trajectory, positive policy changes, as well as improvement in certain parts of the economy and corporate returns on capital.

We remain confident the positive long-term growth trajectory of the US economy and the cash flow generation capabilities of US companies are intact. The ability of management teams to identify emerging short- and long-term trends and the adaptability of business models and cost structures are central to our long-term favorable view. We see attractive long-term upside in the US equity market from current market levels, which we believe are at fair value or below fair value for a majority of US companies.

Policy changes are often a catalyst for economic improvement, even though that improvement may require time to appear. Positive policy changes that occur toward the end of an economic slowdown have historically caused equity markets to rally even though the economy continues to deteriorate during that time. We believe several recent policy changes will be catalysts for future growth in certain parts of the economy. These policies include recently passed US legislation, such as the IIJA, IRA and CHIPS; student loan forgiveness (if enacted); and increased US fiscal discipline with a divided government. Global policy shifts will also have an impact, most notably, China’s decision to lift Covid restrictions and reopen its economy, and the slowing of global central bank interest rate increases. Although these policies will take time to have a direct positive impact, we believe equities will reflect these positives in the short term.

Finally, we continue to identify a divergence in growth in different parts of the economy as well as in corporate returns on capital. Some parts of the economy have been slowing for quarters and may be nearing their individual cyclic bottom, while other parts of the economy are still showing improvement from pre-Covid levels. Many companies are focused on improving their returns on capital through improved efficiencies, normalized supply chains, clarity on the interest rate environment, and in the case of multinationals, an improved currency environment. Over the short and intermediate term, improved real returns on capital should drive higher equity prices.

We believe the best positioning for this environment still begins with a defensive posture with additional risk in specific areas that have real growth tailwinds, in companies with improving returns on capital in 2023 and 2024, and in equities and fixed income with valuations at favorable expected risk-adjusted return. We see compelling prospects for companies that have exposure to new products and geographic growth opportunities, specific infrastructure spending areas and policy change areas (including companies with exposure to China), and the normalization of supply chains and parts of the service economy. We are still favoring higher credit quality companies with improving free cash flow. We are selectively using options to gain exposure to some higher risk areas. From an asset class perspective, cash and short-term Treasuries remain a useful tool to lower volatility in a multi-asset class portfolio given their yields.

It’s Good to Be Global

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

- An economic downturn is not likely to be a nosedive.

- The prospect for equity market and currency appreciation varies by geography.

- Positioning reflects our view that the next few decades will likely be less about new apps, brands, and fads and more focused on energy infrastructure, manufacturing capacity and modernizing electricity grids.

Markets around the world are recalibrating to higher interest rates and slower economic growth. Although the Fed’s next policy move is largely priced in, uncertainty remains regarding how high the key policy rate will go, how long the economy can weather a higher interest rate environment, and whether it will trigger a recession. Still, an economic downturn is not likely to be a nosedive. Most global business leaders expect an impending recession to be mild and short. In other words, this is not 2008.

These conditions will not affect economies equally. The prospects for equity market and currency appreciation vary by geography, which benefits active global investment strategies. Some economies are farther along in the monetary tightening process, such as Mexico and Brazil. Others are better positioned to fund future growth from a fiscal perspective, such as Indonesia and the Netherlands.

Exposure to select emerging and developing markets is likely to provide a meaningful boost to returns, with currency movement adding fuel to this fire. After years of losses, foreign currencies may see a reversal of fortunes in 2023 as the dollar’s peak allows fundamentals to reassert themselves.

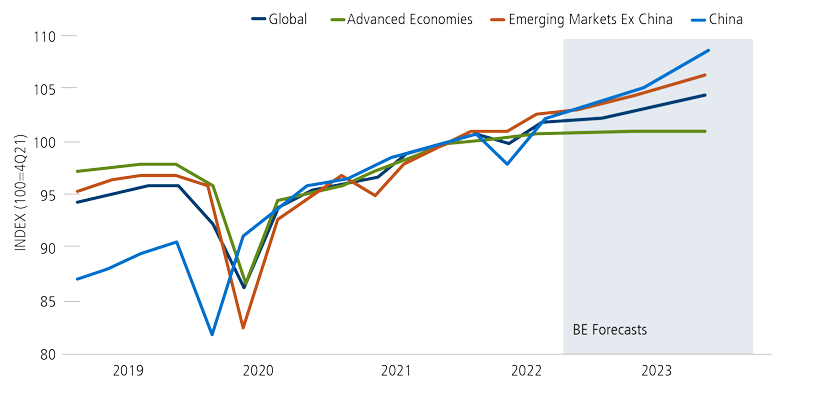

Global Growth Forecasts, Real GDP (Purchasing Power Parity Weighted)

Source: Bloomberg Economics.

The next few decades will likely be less about new apps, brands, and fads, and more focused on energy infrastructure, manufacturing capacity and modernizing electricity grids. Achieving net-zero emissions by 2050 will require significant investment to transform power generation. The International Energy Agency’s (IEA’s) 2022 World Energy Outlook report explores global energy supply and demand scenarios to 2050 and associated implications for energy security, climate targets, and economic development. The IEA is optimistic that the existing energy crisis will not slow down the energy transition, but rather accelerate it because current government policy has prioritized clean energy deployment for energy security and gaining share in the manufacturing supply chain. Furthermore, research forecasts a potential $20 trillion worth of stranded assets, which will increase the longer the transition to clean energy is delayed. This presents clear opportunities and risks for global investors. We are positioned accordingly, resulting in an overweight to select industrials and utilities sectors.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk. Hawkish refers to a Federal Reserve stance favoring the raising of interest rates. In financial terminology, Delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Environmental, Social and Governance (ESG) represent the three pillars of sustainability. In a business context, sustainability refers to how well a company’s business model contributes to enduring development.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing in the Calamos International Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The US Dollar Index measures the value of the US dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex USA Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA US High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market Oil is represented by current pipeline export quality Brent blend. The Bloomberg US Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 1000 Index is a measure of US large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.