Investment Team Voices Home Page

Investment Team Voices Home Page

Calamos Investment Team Outlooks, January 2022

Outlooks from our Investment Team

- Calamos Phineus Long/Short Fund (CPLIX): Slowing—But Not Slow—Growth Calls for More Balanced Risk Positioning

- Calamos Global and International Funds: Rebalancing for Evolving Leadership in 2022: Calamos Global and International Funds

- Calamos Convertible Fund (CICVX): Mid-Cycle Growth Phase: A Supportive Backdrop for Convertible Securities

- Calamos Timpani Small Cap Growth Fund (CTSIX), Calamos Timpani SMID Growth Fund (CTIGX): Fundamentals and Valuations Set the Stage for Small Cap Strength in 2022

- Calamos Market Neutral Income Fund (CMNIX), Calamos Hedged Equity Fund (CIHEX): Alternatives Update: Enhancing Risk/Reward with SPAC Arbitrage and Put Spreads

- Calamos Global Sustainable Equities Fund (CGSIX): Strong ESG Characteristics: A Tailwind as Expansion Moderates in 2022

- Calamos Global Convertible Fund (CXGCX): Global Convertible Outlook: Neither the Fed nor Inflation Should Derail the Markets in 2022

- Calamos Fixed Income Funds: Fixed Income Outlook: Decelerating Inflation, Stable Spreads and Moderately Higher Rates in 2022

Introduction from John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer

During the fourth quarter, the global economy extended its impressive but complicated recovery. By and large, corporations shared encouraging earnings growth announcements and guidance. US consumers remained a force with which to be reckoned, supported by solid household balance sheets and a strong labor market. From a regional perspective, US economic data was the most upbeat with more mixed trends in Europe and China.

The persistence of the Covid-19 delta variant and the emergence of the omicron variant triggered new restrictions around the world and rekindled fears about the road forward for the US and global economies. Inflation worries deepened amid growing indications that rising prices would not be as transitory as many—including the Federal Reserve—had anticipated. Investors also grappled with the potential for a Fed policy misstep as the central bank communicated its intentions for tapering and tightening.

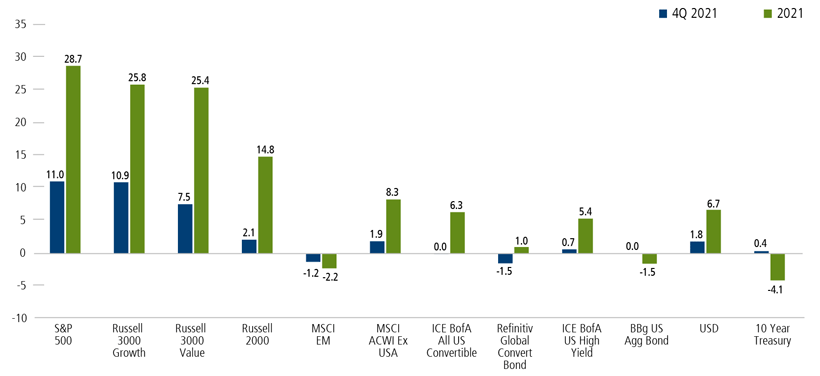

In this complex macro environment, markets were volatile and rotational. When the dust settled, US equity markets led the way for both the quarter and year. Large cap stocks outperformed small caps as investors sought the perceived stability offered by more established companies.

Total Return %

Past performance is no guarantee of future results. Source: Morningstar.

In 2021, conditions in the convertible market proved quite unusual. Over the long term, convertibles’ hybrid stock-bond characteristics have provided an attractive level of upside equity participation and downside risk mitigation, as well as resilience during rising interest rate environments versus traditional bonds. Although the convertible market advanced and outperformed traditional fixed income securities in 2021, we did not see the same level of upside equity capture as we would anticipate in a rising equity market. In large measure, this is attributable to the nature of the equity market rally and the composition of the convertible market. As noted, in the uncertain environment of 2021, investors favored large-cap stocks over smaller companies, particularly smaller growth companies. Meanwhile, the convertible market included a larger representation of these smaller names.

In no way does the relative underperformance of the convertible market in 2021 change our view of the long-term opportunities that convertibles offer. For example, through 2020’s unprecedented volatility and during the 2020-2021 pandemic period, convertibles have provided powerful tools for our active approach—as they have through other full market cycles.

| 2020-2021 | 2020 | 2021 | |

|---|---|---|---|

| Convertible Fund (CICVX) | 25.25% | 48.77% | 5.46% |

| Equity Market (S&P 500 Index) | 23.44% | 18.40% | 28.71% |

Past performance is no guarantee of future results. Source: Morningstar. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

Outlook

In 2022, we expect the US economy will continue to grow, benefiting from robust consumer activity and a healthy corporate sector. Globally, we expect growth to continue as Covid vaccinations and emerging treatments pave the way for sustained reopening. However, the pace of expansion may moderate further as the economy settles in to a mid-cycle phase.

We encourage investors to be prepared for volatility. As economic activity continues to normalize, we are likely to see additional and potentially dramatic rotations. Markets hate uncertainty, and there is plenty of it on the horizon. The Federal Reserve will remain a focal point of investor apprehension as it threads the needle of tapering and tightening while keeping the economy on a sustainable path for growth. With a tightening cycle set to begin this year, it’s worth noting that a Fed rate hike does not typically trigger the end of economic expansion or a bull market. In fact, the stock market most typically has continued its upward trend through initial interest rate hikes, albeit often with additional short-term volatility when a shift in policy is announced.

It’s also important to remember that the direction of the economy and markets depends on more than monetary policy. Fiscal and government policies provide powerful headwinds—or powerful tailwinds—for hiring, capital investment, entrepreneurship, and business innovation. Therefore, sensible policies (e.g., reasonable levels of regulation and taxes) are a cornerstone for individual prosperity and the overall economy. Markets recognize this, which means the results of US midterm elections could be highly consequential. Moreover, the run-up to the elections is likely to bring added uncertainty, rotation and volatility.

Given the many forces shaping the economy and markets, 2022 will be a stock picker’s—and a bond picker’s—market. Prices are indeed stretched in pockets of the market, but many areas offer attractive potential supported by compelling fundamentals and exposure to growth themes. Below, our teams share their insights and discuss where they are finding opportunities across asset classes. We’ll add posts over the coming days.

Slowing—But Not Slow—Growth Calls for More Balanced Risk Positioning

2021 is unrepeatable. Yet 2022 should be another year of above-trend demand underpinned by the fading pandemic and robust employment conditions. Nominal measures of activity will be strong but decelerate through the year as base comparisons become more challenging. The pandemic has cast a longer shadow than anticipated and its ramifications loom large for all of the key debates.

2022 Key Debates

- Is the pandemic behind us? Can the world return to normality?

- How long can today’s elevated, ubiquitous demand be sustained?

- Is there a hangover in the “Covid winners” including technology?

- Will economic activity in the 2020s exceed the post-2008 era?

- Can the Fed normalize interest rates? Is inflation transitory?

Many of the factors that have supported the economy and markets will carry momentum into the year ahead. This starts with the extraordinary health of the US private sector, both consumers and corporates alike. The tailwind of monetary and fiscal support is starting to fade but only slowly, and the reversal of globalization implies a domestic investment impulse that was absent post-2008.

2022 will be the year that ends the global pandemic, a year of broad global recovery, and a continuation of the early stages of a new inflation paradigm. Concurrent with this, 2022 will witness some dramatic ebbs and flows in the character of economic growth. We anticipate a shift in consumer wallet share as the private sector engages in less online activity and more travel and in-person services. This is a complex transition for durable goods, particularly if input prices ease as supply chains normalize. The early winners of this cycle could confront some payback in demand. Investors will grapple to discern the new level of normalized growth.

Inventories are another swing factor. Inventory rebuilds will add to aggregate demand in 2022, but inventories may grow faster than demand through H2, leading investors to discount an eventual slowdown. We see supply chain bottlenecks easing after the Chinese New Year, yet China’s zero-tolerance policy for Covid points to sporadic shutdowns. Supply chains may not fully normalize until late 2022.

There is legitimate debate over the hangover for many “Covid winners,” including technology. Some material portion of technology spending through the pandemic has been a pull forward of demand. Investors must sort through the haze of normalized growth in a post-Covid world. Equally momentous is how the shift in monetary policy will change the narrative for “unprofitable technology,” including how weakness here eventually feeds into the demand ecosystem.

The leading role of monetary policy in determining the future path of the economy is one reason to remain optimistic. The Fed’s balance sheet was still growing by 20% year-over-year in Q4. Over the past two years, M2 has increased by an unprecedented 42%. Policy typically works with a 12- to 18-month lag, which implies the US economy is unlikely to deteriorate materially until 2023 at the earliest.

Fundamentals appear well established for the year ahead, yet the liquidity and interest rate outlook is transitioning. The “do whatever it takes” policy wave across the Western world is cresting now. This is a decisive development versus the past 22 months when we argued for leaning into equity risk. The outlook for 2022 requires more balanced risk positioning.

Rebalancing for Evolving Leadership in 2022: Calamos Global and International Funds

Nick Niziolek, CFA, Dennis Cogan, CFA, Paul Ryndak, CFA, and Kyle Ruge, CFA

Our outlook for global equity markets for 2022 remains positive, although we expect we will see more volatility and evolving leadership as the market adjusts to tighter monetary conditions and reduced fiscal support. Covid-19 remains a concern for global growth, with the risk of a more deadly variant a persistent threat, but we are encouraged by initial data for the severity of omicron and individuals’ and governments’ willingness to adapt and live with Covid.

We are optimistic that any further disruption will be manageable and believe a significant upside tailwind for 2022 could be the confirmation that Covid, via its omicron variant, is becoming endemic and more manageable, like other coronaviruses. Assuming Covid’s threat to global growth has diminished in 2022, we would anticipate less monetary and fiscal support globally than we have seen in recent years. In an environment of improving global growth, we would anticipate more cyclically oriented industries should outperform, which should benefit many overseas markets whose indices tend to have a higher concentration of these types of companies.

In particular, we believe equities in emerging markets, Europe and Japan exhibit attractive valuations and improving fundamentals that could provide superior returns in 2022. We are also seeing opportunities in international small caps. In a number of countries, the small-cap market includes many companies that provide greater exposure to improving domestic conditions as Covid restrictions are removed and economies reopen.

Positioning. For most of 2021, we positioned our portfolios with a “barbell” approach. We overweighted secular growth and cyclical growth companies, and funded those overweights with an underweight to defensive growth companies. Our view has been that the reopening would be uneven globally with starts and stops, and a barbell approach would allow the cyclicals to benefit as growth prospects improved while the secular growers provided some stability during times of growth concerns. Given our constructive outlook, defensives were less attractive.

This proved to be the right exposure in the US equity market, where the removal of Covid restrictions and the release of pent-up demand supported growth within the cyclical cohort, but concerns about new variants also supported demand for secular growers less dependent on this reopening. Outside the United States, we’ve only recently started to see economies reopen to the same degree, and even these reopenings have been delayed or paused because of the threat of omicron. As a result, defensives outperformed in the emerging markets, and our positioning has been a headwind.

As 2022 unfolds, we have reduced our secular growth overweight at the margin because we see further risk from tighter monetary conditions and improving global growth. We are seeking opportunities to increase our exposure to more cyclically oriented industries that will benefit from an improving global capex cycle and the resumption of global travel. As our conviction builds that peak Covid disruption is behind us, we’d anticipate adding to this cyclical exposure further, particularly within emerging markets, Japan, and Europe.

United States. What a difference a year makes. We have gone from expectations of massive monetary and fiscal accommodation to an accelerating timetable for tightening monetary policy and significantly lower fiscal spending. On the monetary policy front, although the Federal Reserve had communicated a willingness to let inflation run hot to address years of undershooting targets, ongoing supply-chain headwinds and political dynamics clearly have driven a more hawkish turn. Quantitative easing tapering is now expected to be completed by March, with the first of at least three expected rate hikes also possible in March. Further, FOMC members discussed the beginning of balance sheet reduction (also known as quantitative tightening or QT) at their most recent meeting. Interest rates across the curve have responded by moving sharply higher over the past month, and there have been volatile sector and factor rotations as well.

We have maintained a balance of cyclical growth and secular growth from a top-down level for nearly two years. The secular growth cohort is likely to face headwinds as its relative advantage in revenue and earnings growth becomes less attractive, given the strength of the overall economy. In some cases, we believe the relative valuation opportunity has become less attractive as well. At the same time, the outlook for cyclical growers remains attractive, and there is likely upside to earnings estimates and room for valuations to rerate higher. Additionally, although we believe the economy will remain on a strong footing for several quarters, having a greater degree of high-quality defensive exposure makes more sense now than it has over the past several quarters, given the degree to which monetary policy is reversing course and the potential for financial conditions to become too tight.

Europe. As has been the case for some time, Europe’s equity market remains more reasonably valued overall compared to the US equity market. Many European countries struggled to reopen their economies to the extent that the US has, and omicron has again delayed a broader normalization. As a result, growth has continued to trail the pace of expansion in the United States. Despite this, European equities have been outperforming their US counterparts since news of omicron and rising case counts emerged. It appears the markets are looking past the near-term disruption from the rise in cases and focusing instead on omicron’s much lower severity and death rates and the possibility its rapid spread may ultimately contribute to higher immunity levels—moving Covid from pandemic to endemic and leading the world to find a way to return to normal life and work. Europe has significant pent-up demand, attractive relative valuations and earnings potential, and a less-threatening inflation dynamic and degree of central bank hawkishness. As a result, we expect that European equities could benefit from investor reallocations away from the United States, where the relative valuation, earnings, and macroeconomic dynamics appear less favorable.

Japan. The Japanese equity market is concentrated heavily in cyclical industries that historically have benefited from improving global growth. As the delta variant drove a resurgence of Covid in 2021, global growth improvements remained subdued and uneven, and the Japanese equity market unsurprisingly underperformed global equities (as measured by a 2.0% return for the MSCI Japan Index). As we enter 2022, we remain optimistic that the backdrop for global growth has improved because of a combination of increased global Covid immunity, both natural and vaccinated, and increased monetary and fiscal stimulus in China. The Japanese economy should benefit from the government’s continued willingness to deploy fiscal stimulus, including the recent approval of budget of over 10% of GDP, which was greater than the amount allocated in 2021. Meanwhile, listed Japanese corporations have seen their cash balances increase from 15% of equity value to over 20% during the pandemic, which leaves significant capacity for stock buybacks and investment. We are adding exposure to Japanese equities selectively across our global and international funds, both via additions within more cyclical sectors that we believe can benefit from an improvement in global growth as well as in select domestic opportunities that should benefit from fiscal stimulus and the reopening of the Japanese economy.

Emerging Markets. As we enter 2022, we see many of the headwinds that contributed to the underperformance of emerging market equities abating, with some of these headwinds becoming powerful tailwinds for the asset class. We believe that 2021 will be ultimately recognized as a year of rebalance, when the Chinese Communist Party leveraged the economy’s strength heading into 2021 to address excesses in China’s property market and deficiencies in its regulatory system, resulting in a disappointing year for investors in the Chinese equity market. As 2022 continues, we expect China to continue the pivot that began during the fourth quarter of 2021 toward easier monetary policy, followed by targeted fiscal easing and less regulatory uncertainty.

Although export demand strength will likely abate as global supply chains normalize, we believe the Chinese consumer can provide an upside surprise to economic growth that offsets impending export weakness as a new investment cycle begins. China is shifting slowly from a “zero-Covid” policy in which regions quickly shutdown at the first signs of new infections to a “Covid-containment" strategy with a higher tolerance for overall cases, where contact tracing and testing have increased, resulting in smaller shutdowns. Although travel is still highly restricted in China, we expect an eventual loosening—perhaps post-Olympics or during the less-infectious warmer season—could result in a release of pent-up demand magnitudes greater than what we’ve seen in the developed world during “reopenings.” This burst would be a boon to China’s economy and to neighboring ASEAN countries that have historically benefited from outbound China travel and trade.

As vaccination rollouts in developing markets lagged developed markets, the impact of the delta variant on reopening plans was another major factor in 2021’s disappointing emerging market returns. Although Covid remains a risk to global growth, we are optimistic that the increase in vaccination rates, natural immunities and treatment options available in the emerging markets will leave these countries better positioned to navigate future outbreaks and more fully reopen their economies, as we have seen in many developed economies. During the fourth quarter, we saw several emerging market countries open to foreign travel, which should boost their economies. As other neighboring countries follow suit, we should see further tailwinds to economic growth in these regions.

India is an example of an equity market that realized strong equity performance in the quarters following the reopening of its economy after an extremely difficult delta outbreak. During 2021, our portfolios benefited from their exposure to Indian consumer activity, which quickly recovered following the April‒May delta surge. As 2022 unfolds, we see additional opportunity in cyclical sectors in India that will benefit from a multi-year capex cycle driven by fiscal stimulus, a pickup in real estate demand and “Make in India” initiatives as global supply chains reorient.

Mid-Cycle Growth Phase: A Supportive Backdrop for Convertible Securities

Jon Vacko, CFA and Joe Wysocki, CFA

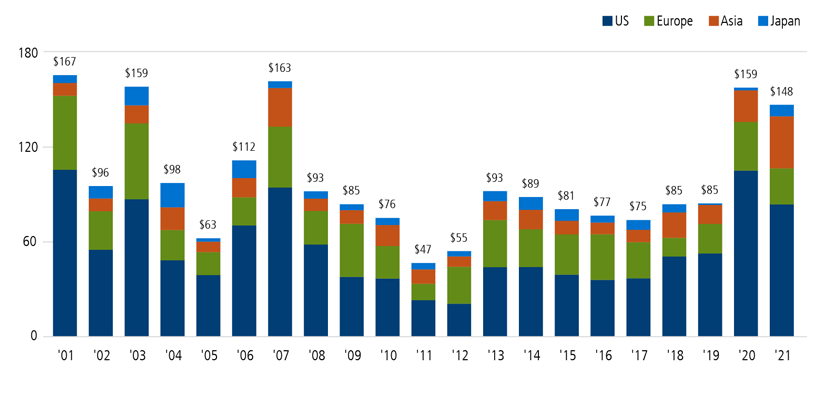

We enter 2022 with a positive outlook on the convertible market based on our view of a broad economic recovery combined with a fundamentally attractive issuer base. In 2021, $148 billion in convertible securities came to market globally on the heels of $159 billion in 2020, which marks the first time there have been back-to-back years of such strong volume.

We are excited by the continued broadening of the convertible market and the access it provides to innovative companies, including many that have the potential to be tomorrow’s leaders. Many companies are issuing convertibles for the first time and can provide bottom-up opportunities for portfolio positioning for years to come. Although we anticipate a deceleration in the pace of new issuance in 2022, we expect it to remain above long-term historical levels as companies seek capital to take advantage of opportunities for growth, expansion, mergers, and increased research and development.

On the economic front, the debate continues to be dominated by the speed at which the economy will expand, the sustainability of inflationary pressures, and the impacts of Covid variants. We anticipate that as 2022 progresses, the market will shift its focus toward the mid-term elections and their potential ramifications for fiscal policies. Combine those variables with a Federal Reserve that is still historically accommodative but removing stimulus, and 2022 could be a year full of uncertainty and financial market volatility. With that backdrop, major asset class returns could be more muted going forward, particularity for traditional fixed-income securities that face the prospect of rising interest rates from such historically low levels.

However, we believe the demand side of the economy is still very strong as consumer and corporate spending should remain at above-trend levels; demand for services improves; and companies rebuild inventories, expand capacity, and improve productivity. This leads us to maintain our view that the economy is expanding but not overheating as it transitions from early expansion to a mid-cycle growth phase An environment of real growth with moderate inflation can be a very attractive backdrop for risk assets.

Our focus in Calamos Convertible Fund (CICVX) is on actively managing the risk/reward trade-off by providing more exposure to upside in the equity markets than to potential downside. Although macro factors and headlines can create volatility, we believe the flipside can be opportunity, especially for businesses that are capitalizing on cyclical and secular growth trends.

Our security selection process seeks to identify companies that are growing their intrinsic value across all market environments. We favor businesses that have products and services that are in high consumer demand and can overcome supply chain issues to meet that demand. From a thematic standpoint, we believe companies involved in productivity enhancement should enjoy a strong tailwind as corporations across all sectors look to offset the impact of rising costs within their business models. Although these opportunities span multiple sectors, they are particularly well represented in the information technology and consumer discretionary sectors, the fund’s two largest exposures. Our largest underweight is to the financial sector where we view convertible structures as being most bond-like and vulnerable to rising interest rate risk.

In closing, we believe the fundamentals of the convertible market remain strong. Continued volatility and rotations within the financial markets may occur but are not uncommon as the economy transitions toward the next phase of expansion. We believe the strategic case for convertibles to help navigate this volatility without sacrificing upside participation remains intact.

Fundamentals and Valuations Set the Stage for Small Cap Strength in 2022

Brandon Nelson, CFA

Small caps (as measured by the Russell 2000 Index) rose in absolute terms by 2.14% during the fourth quarter but lagged large caps (as measured by the Russell 1000 Index) by a surprising 764 basis points. This relative sluggishness intensified during the three weeks after Thanksgiving, when macro concerns surfaced about the new Covid-19 variant and Federal Reserve Chairman Jerome Powell’s hawkish comments. Typically, when investors get nervous about macro conditions, they are less willing to embrace small caps.

Overall, 2021 was a strong year for the stock market. Small caps lagged large caps but were still up 14.82%, and large caps rallied 26.45%. While many stock market indexes hit new highs, many investors may not realize that valuations actually dropped in 2021. That’s right—price-to-earnings (P/E) ratios fell, driven by positive earnings revisions. In other words, the “E” rose more than the “P,” bringing down this ratio. Investors are extremely worried about the Federal Reserve beginning a new monetary tightening cycle. We believe this is quietly getting baked into stock market prices. Could there be more valuation multiple compression ahead? Perhaps, but based on our analysis of past early-tightening-cycle stock market performance, we are not nervous.

Not only are we not nervous, but we are also increasingly excited about the relative outlook for small caps versus large caps. The setup for the short, intermediate, and long term is truly staggering. Here are some small cap highlights: high relative earnings growth, positive earnings and sales revisions, extremely low relative valuations, and seasonal tailwinds for the next two months. Disparities between large caps and small caps are stretched. Small caps have lagged large caps substantially for the past five years, yet they tend to outperform large caps over the long term. Historically, when things have been this stretched, they have tended to revert to equilibrium. Although past performance can’t predict the future, if historic performance patterns were to continue over the next five years, then small caps would have an 83.9% chance of outperforming large caps and by an average magnitude of 7.6% per year. Again, staggering. Keep in mind that we are not necessarily bearish on large caps—we simply see higher relative returns for small caps going forward.

Given their disproportionate exposure to small caps, we believe the aforementioned set-up is especially favorable for Calamos Timpani Small Cap Growth Fund (CTSIX) and Calamos Timpani SMID Growth Fund (CTIGX). Additionally, we believe our fundamental security selection positions us advantageously to add further value beyond the stand-alone asset class performance.

Both funds continue to have exposure to long-term secular growers and certain cyclical growth stocks that we believe should benefit meaningfully from a continued economic uptick. A noteworthy portfolio change we made during the fourth quarter was to decrease the funds’ weightings in health care stocks, partially due to the increased murkiness tied to Covid-19. We also increased exposure to consumer discretionary stocks, especially those related to housing, an area of continued economic strength.

Alternatives Update: Enhancing Risk/Reward with SPAC Arbitrage and Put Spreads

Eli Pars, CFA

As we have discussed in our past commentaries, Calamos Market Neutral Income Fund (CMNIX) is designed to enhance a traditional fixed income allocation. Combining two complementary strategies—arbitrage and hedged equity—the fund pursues absolute returns and income that is not dependent on interest rates. We actively manage the allocations based on our view of market conditions and relative opportunities. At the end of the fourth quarter, the fund’s allocation to each strategy was roughly even, as it was at the start of the quarter and in line with recent years.

Calamos Market Neutral Income Fund’s hedged equity strategy remains positioned with a higher-than-typical hedge ratio, but one that is broadly in line with the hedge ratio at the start of the quarter. The higher the hedge ratio, the less exposure the fund has to equity market downside. We continue to see cheapness in put spreads and are using them in the fund’s hedged equity book in addition to the outright long put allocation we always maintain in the fund.

The fund’s arbitrage strategy includes convertible arbitrage, special purpose acquisition company (SPAC) arbitrage and merger arbitrage. At the end of the quarter, the allocation to convertible arbitrage was roughly 41%, SPAC arbitrage represented approximately 9%, and merger arbitrage was roughly 1%. The weighted average delta of the convertible arbitrage strategy is up modestly since the start of the quarter.

The increase to the SPAC book represents the most notable change over the quarter. SPACs are shell companies that raise money, which they use to acquire companies seeking to go public. The closing of the acquisition is called a de-SPAC process, at which point the SPAC is usually a small-cap equity. SPACs offer different risk/reward profiles. We’re using SPAC arbitrage as a way to support the fund’s historically lower risk profile and steady returns. We’re creating cheap options—similar to convertible arbitrage. We’re not seeking to add a lot of equity sensitivity to our arbitrage book, and we’re not interested in the more volatile segments of the market.

During the fourth quarter, many excellent opportunities emerged in the SPAC market—in fact, far more than we had forecasted. We saw strong issuance with even more favorable terms than earlier in the year. A typical new deal in the first quarter was issued with a $10 unit and $10 in trust. It included a third of a warrant and had a two-year term before the sponsor had to return the cash in trust to shareholders. We believe these structures have good value because the downside exposure is backstopped by the $10 in trust. They also provide upside optionality in the stock and a fractional warrant for free.

In the fourth quarter, the typical new SPAC offered even more attractive characteristics: a $10 issue price with $10.20 in trust (overfunded by the sponsor), half of a warrant versus a third, and a term shortened to 15 months. The fact that issuance was strong despite the new terms illustrates how attractive sponsors find the SPAC market. Time will tell if sponsors’ appetites remain this high.

Calamos Hedged Equity Fund (CIHEX). Calamos Hedged Equity Fund is an equity alternative designed to help investors dampen the impact of equity market volatility and drawdowns. The fund’s hedge is right in the middle of its targeted range, versus starting the quarter slightly below the middle of its targeted range.

Similar to Calamos Market Neutral Income Fund’s hedged equity sleeve, we continue to layer in more put spreads than we have in several years in addition to the outright long put allocation we consistently employ in the fund. This has allowed us to run a lighter call hedge. Pairing this lighter call hedge with long calls has allowed us to enhance the portfolio’s skew.

Strong ESG Characteristics: A Tailwind as Expansion Moderates in 2022

Jim Madden, CFA, Tony Tursich, CFA, and Beth Williamson

We are heading into the new year with strong momentum, despite omicron and supply chain headwinds. We have massive monetary and fiscal stimulus, strong employment and consumer spending, and healthy corporate earnings growth. Consumer and capital expenditures will continue to drive the economy next year, albeit at a more conventional rate of growth as the recovery from the pandemic moderates. Strong household balance sheets and a tight labor market are likely to keep consumer demand high. Revenue growth and corporate profitability can support continued business investment. Inflation has accelerated but should be characterized as reflation not stagflation. Reflation is actually good for earnings growth and the stock market. Global monetary and fiscal support are the wild cards in 2022.

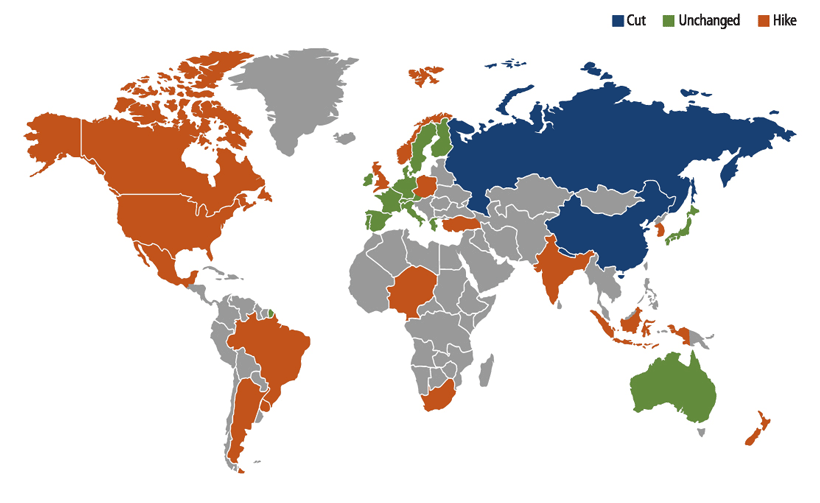

The pace of central bank tightening will be telling. The Fed’s hawkish turn paves the way for an increase in interest rates in the US for the first time since 2018. Other central banks have already begun to raise rates. The extent of tightening matters. It’s the last hikes—not the first—that can lead to recession and peak earnings. Still, central banks may be able to help tackle elevated inflation without derailing economic growth.

Bloomberg Central Bank Outlook

Source: Bloomberg, “New Economy Daily, Central Banks in 2022,” Simon Kenny, January 4, 2022 using Bloomberg Economics forecasts, surveys of economists for Czech Republic, Norway, Poland, Sweden and Switzerland. Mapped data shows rate decision forecasts for distinct central banks.

Equity investors will need to focus on quality companies that can manage their own destiny irrespective of the macroeconomic environment and level of interest rates. Furthermore, current valuation multiples make stock picking all the more important. Resilient profit margins and pricing power amid wage inflation and commodity price volatility will be key. Investors will also need to consider risk and opportunity from an environmental, social and governance (ESG) perspective as well as each company’s environmental footprint.

If companies don’t manage their ESG risks and opportunities well, they won’t keep up with their competitors and are more likely to underperform. Firms that don’t adapt to rising environmental constraints, changing consumer preferences and societal shifts will face significant challenges. Raising capital, attracting talent and maintaining a positive brand image will be more difficult for such companies. Companies with strong ESG management and oversight are less likely to experience disruptions to their growth trajectory, cash flows and earnings visibility. Management of these factors will influence valuation and long-term shareholder returns.

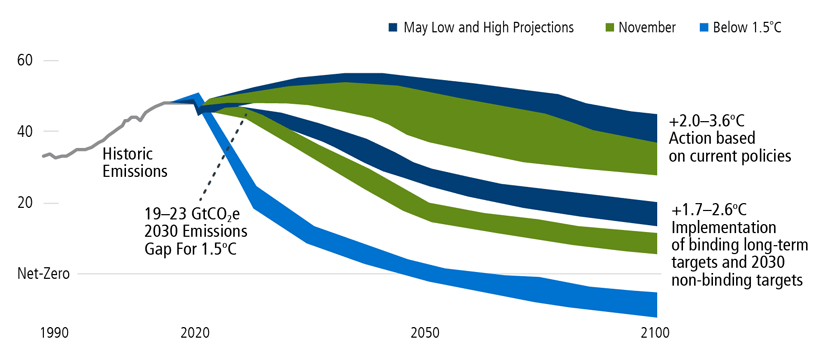

After years of negotiations, the 26th UN Climate Change Conference of the Parties (COP26) in Glasgow finally gave way to a Paris Agreement rulebook for international cooperation through carbon markets. The carbon market rules allow countries to focus their efforts on ambitious implementation of their emission-cutting targets. With carbon pricing directly raising production costs, extreme weather events hitting supply chains and higher temperatures curbing potential growth, the impact of climate change on the economy and corporate profitability is significant. The increase in carbon prices needed to reach zero emissions has begun. Companies that have a head start in recognizing and managing their environmental impact will have advantages.

Impact of COP26 on Emissions Pathways

Source: Bloomberg, Climate Action Tracker, November 2021 update

We continue to believe high-quality global leaders with high returns on capital and strong ESG characteristics will outperform in the long run. We will continue to search the globe for companies that exhibit such attributes for Calamos Global Sustainable Equities Fund (CGSIX).

Global Convertible Outlook: Neither the Fed nor Inflation Should Derail the Markets in 2022

Eli Pars, CFA

We didn’t think we still would be talking about the Covid-19 pandemic going into a third year, but here we are. Despite the disruptions the virus continues to cause, the economy and the markets keep moving past the pandemic. The outlook for growth in 2022 is solid, although more normal than some of the big GDP numbers we saw in the first half of 2021. Investors will be focused on inflation and the Federal Reserve in 2022, but we don’t expect either to derail the markets. The likely combination of strong nominal GDP growth and interest rates that are still near all-time lows (even after a few short-term interest rate hikes by the Fed) should provide tailwinds for equities, and in turn, global convertible securities.

Global convertible issuance during the fourth quarter was strong at $24 billion, led by the US and Asia. For the full year, issuance totaled $148 billion—the fifth highest on record—with $84 billion coming from US companies. Although matching 2020’s and 2021’s levels will be a challenge, issuance is expected to remain strong in 2022 as companies seek capital in a growing economy. Furthermore, even a modest rise in interest rates can further boost issuance. (In exchange for the opportunity for upside equity participation, convertibles are typically issued with lower coupons than non-convertible debt, which makes convertibles an attractive choice for issuers. Additionally, convertibles have tended to outperform traditional bonds in rising rate environments, which makes them an attractive choice for investors as well.)

($ billion)

Source: BofA Global Research. Data as of 12/31/2021.

Convertible securities vary in their levels of equity sensitivity. Those with the highest equity sensitivity behave more like their underlying stocks, with more exposure to equity market downside. Those with the lowest levels of equity sensitivity may not offer enough participation in equity upside. Because we focus on pursuing lower volatility global equity market participation over a full market cycle, we are mindful of taking on outsized equity market risk. At present, Calamos Global Convertible Fund is slightly less equity sensitive than the global convertible market, as measured by the Refinitiv Global Convertible Bond Index. We believe this sets up the fund for a better risk/reward profile. From a geographic standpoint, the fund remains underweight to European convertibles. This positioning continues to reflect our view of the relative bottom-up opportunity set rather than a macro call. The technology sector is the fund’s largest absolute weighting and largest overweighting versus the index.

Fixed Income Outlook: Decelerating Inflation, Stable Spreads and Moderately Higher Rates in 2022

Matt Freund, CFA, Christian Brobst, and Chuck Carmody, CFA

Day-to-day volatility has increased across all markets. In addition to the Covid-related concerns that continue to drive the market, there are numerous wildcards that have the potential to upend markets, including the possibility of a Fed policy mistake (past or future), fiscal stimulus, midterm elections and geopolitical fragility. Despite the considerable murkiness around these issues, our outlook reflects our confidence in several themes.

Inflation: Aggregate demand continues to run well above trend and beyond manufacturing and distribution capacity. At the same time, supply bottlenecks continue to pinch off the flow of goods across the country. We expect both conditions to slowly improve over several quarters. Inflation has shifted from transitory factors related to reopening sectors (airfare, rental car and used car prices) to stickier forms (wages and shelter). We expect inflation to decelerate from here but remain above the Fed’s symmetric target not only through 2022 but also into 2023.

Fed Policy: Considering the high level of uncertainty, President Biden gave financial markets at least one form of consistency by nominating Jerome Powell to serve a second term as chair of the Federal Reserve. In response to higher price pressure, the Fed has pivoted dramatically over the past few months, announcing an acceleration of its purchase taper to allow it to initiate a tightening cycle of the Federal Funds Rate earlier in 2022 if it deems it necessary. We expect the impact of the quicker taper pace will be minimal. Even so, financial conditions will tighten in the coming year, with the Fed raising interest rates at least twice in our view (currently the market expects three hikes). This is likely to soften growth from its current explosive pace to one much closer to trend growth of 3%.

Fiscal Policy: The failure of Build Back Better introduces fiscal gridlock much earlier than we were anticipating. Our belief was that President Biden’s legislation would pass, albeit with a reduced price tag. This development increases the potential for political gridlock to persist as the midterm elections approach. Should Republicans gain control of the House or Senate, the advancement of a progressive agenda would likely stall for the balance of President Biden’s term. We believe markets would welcome this development because federal spending has expanded to its highest level (measured as a percent of GDP) since WWII, and the highest level ever in a non-war economy.

Credit Markets: All things considered, credit conditions remain robust. Companies with high levels of sensitivity to a fully reopened economy took advantage of easy conditions to raise liquidity over the past 12 to 18 months. We anticipate the historically benign default environment to continue with moderate increases in the second half of the year. Several of the large capital structures that were downgraded into the high-yield universe in early 2020 are likely to be “rising stars” in 2022, reentering the investment-grade market. This is a net negative for high-yield supply (but a positive for prices), and the technicals will help support our expectations for a tight trading range in credit spreads in the first half of 2022. Regardless of the next catalyst, we believe there is a higher likelihood that spreads eventually move wider.

Positioning Implications: Our base case anticipates stable spreads with moderately higher interest rates in 2022. Given its short duration, the high-yield market should deliver attractive risk-adjusted returns if the Fed delivers as expected. In investment-grade markets, three rate hikes are priced into the curve as of year-end 2021. Tighter-than-expected monetary policy would likely have to unfold to dislocate interest-rate markets.

As a result of these conditions, we have migrated our fixed-income strategies—Calamos High Income Opportunities Fund (CIHYX), Calamos Total Return Bond Fund (CTRIX), and Calamos Short-Term Bond Fund (CSTIX)—toward higher-quality credits. We are also emphasizing our focus on being well compensated for the idiosyncratic risks in the portfolios. We do not expect the above-trend inflation environment to lead to drastically higher interest rates in long-dated maturities; however, we are maintaining cautious duration implementation across strategies.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

| 1-Year | 3-Year | 5-Year | 10-Year | Total Expense Ratio | |

|---|---|---|---|---|---|

| CICVX | 5.46% | 23.31% | 16.70% | 11.37% | 0.89% |

| S&P 500 Index | 28.71 | 26.07 | 18.47 | 16.55 |

Total expense ratio is as of prospectus dated 3/1/21.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load of 2.25%. Had it been included, the Fund’s return would have been lower. You can obtain performance data current to the most recent month end by visiting www.calamos.com.

Class I shares are offered primarily for direct investment by investors through certain tax-exempt retirement plans (including 401(k) plans, 457 plans, employer-sponsored 403(b) plans, profit sharing and money purchase pension plans, defined benefit plans and nonqualified deferred compensation plans) and by institutional clients, provided such plans or clients have assets of at least $1 million. Class I shares may also be offered to certain other entities or programs, including, but not limited to, investment companies, under certain circumstances.

Diversification and asset allocation do not guarantee a profit or protect against a loss. Alternative strategies entail added risks and may not be appropriate for all investors. Indexes are unmanaged, not available for direct investment and do not include fees and expenses.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

Duration is a measure of interest rate risk.Hawkish refers to a Federal Reserve stance favoring the raising of interest rates. In financial terminology, delta is a gauge of a convertible security’s sensitivity to changes in the price of its underlying stock. It expresses the change in the convertible price per unit of change in the underlying stock price.

Option implied volatility is the expected volatility of a stock over the life of the option.

Source for issuance and market size data (high yield and convertible): Bank of America.

Environmental, Social and Governance (ESG) represent the three pillars of sustainability. In a business context, sustainability refers to how well a company’s business model contributes to enduring development.

Important Risk Information. An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Foreign security risk (all funds excluding Calamos Hedged Equity Fund, Calamos Total Return Bond Fund, and Calamos Growth and Income Fund): As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

The principal risks of investing in the Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing the Calamos Hedged Equity Fund include: covered call writing risk, options risk (see definition below), equity securities risk, correlation risk, mid-sized company risk, interest rate risk, credit risk, liquidity risk, portfolio turnover risk, portfolio selection risk, foreign securities risk, American depository receipts, and REITs risks.

Options Risk—the Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the options market. There are significant differences between the securities and options markets that could result in an imperfect correlation among these markets, causing a given transaction not to achieve its objectives. The Fund’s ability to utilize options successfully will depend on the ability of the Fund’s investment advisor to predict pertinent market movements, which cannot be assured.

The principal risks of investing in the Calamos Phineus Long/Short Fund include: equity securities risk consisting of market prices declining in general, short sale risk consisting of potential for unlimited losses, foreign securities risk, currency risk, geographic concentration risk, other investment companies (including ETFs) risk, derivatives risk, Alternative investments may not be suitable for all investors. The fund takes long positions in companies that are expected to outperform the equity markets, while taking short positions in companies that are expected to underperform the equity markets and for hedging purposes. The fund may lose money should the securities the fund is long decline in value or if the securities the fund has shorted increase in value, but the ultimate goal is to realize returns in both rising and falling equity markets while providing a degree of insulation from increased market volatility.

The principal risks of investing in the Calamos Convertible Fund include a potential decline in the value of convertible securities during periods of rising interest rates and the possibility of the borrower missing payments. The credit standing of the issuer and other factors may also affect a convertible security’s investment value. Synthetic convertible instruments may fluctuate and perform inconsistently with an actual convertible security, and components of a synthetic convertible can expire worthless. The Fund may also be subject to foreign securities risk, equity securities risk, credit risk, high yield risk, portfolio selection risk and liquidity risk.

The principal risks of investing in the Calamos Global Convertible Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, currency risk, geographic concentration risk, American depository receipts, midsize company risk, small company risk, portfolio turnover risk and portfolio selection risk.

The principal risks of investing in the Calamos Timpani Small Cap Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Timpani SMID Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, and portfolio selection risk. The Fund invests in small and mid capitalization companies, which are often more volatile and less liquid than investments in larger companies.

The principal risks of investing in the Calamos Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, mid-sized company risk, foreign securities risk and portfolio selection risk.

The principal risks of investing in the Calamos Growth and Income Fund include the potential for convertible securities to decline in value during periods of rising interest rates and the possibility of the borrower missing payments; synthetic convertible instruments risks include fluctuations inconsistent with a convertible security and components expiring worthless. Others include equity securities risk, growth stock risk, small and midsize company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk, and portfolio selection risk.

The principal risks of investing in the Calamos International Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Evolving World Growth Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, foreign securities risk, emerging markets risk, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, and portfolio selection risk.

The principal risks of investing in the Calamos Global Equity Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Opportunities Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, emerging markets risk, equity securities risk, growth stock risk, interest rate risk, credit risk, high yield risk, forward foreign currency contract risk, portfolio selection risk, and liquidity risk.

The principal risks of investing the Calamos Total Return Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower missing payments, high yield risk, liquidity risk, mortgage-related and other asset-backed securities risk, including extension risk and portfolio selection risk.

The principal risks of investing in the Calamos High Income Opportunities Fund include: high yield risk consisting of increased credit and liquidity risks, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, interest rate risk, credit risk, liquidity risk, portfolio selection risk and foreign securities risk. The Fund’s fixed income securities are subject to interest rate risk. If rates increase, the value of the Fund’s investments generally declines. Owning a bond fund is not the same as directly owning fixed income securities. If the market moves, losses will occur instantaneously, and there will be no ability to hold a bond to maturity.

The principal risks of investing in the Calamos Short-Term Bond Fund include: interest rate risk consisting of loss of value for income securities as interest rates rise, credit risk consisting of the risk of the borrower to miss payments, high yield risk, liquidity risk, mortgage-related and other asset-back securities risk, including extension risk and prepayment risk, US Government security risk, foreign securities risk, non-US Government obligation risk and portfolio selection risk.

The principal risks of investing in the Calamos Global Sustainable Equities Fund include: equity securities risk consisting of market prices declining in general, growth stock risk consisting of potential increased volatility due to securities trading at higher multiples, value stock risk, foreign securities risk, forward foreign currency contract risk, emerging markets risk, small and mid-sized company risk and portfolio selection risk.

Indexes are unmanaged, do not include fees or expenses and are not available for direct investment. The US Dollar Index measures the value of the US dollar relative to a basket of foreign currencies, including Euro Area, Canada, Japan, United Kingdom, Switzerland, Australia, and Sweden. The S&P 500 Index is considered generally representative of the US equity market and is market cap weighted. The MSCI All Country World Index represents the performance of global equities. The MSCI All Country World ex US Index represents the performance of global equities, excluding the US. The MSCI Emerging Markets Index is a measure of the performance of emerging market equities. The ICE BofA U.S. High Yield Index is an unmanaged index of US high yield debt securities. The ICE BofA All US Convertible Index (VXA0) is a measure of the US convertible market. The Refinitiv Global Convertible Bond Index measures the performance of the global convertible market. Oil is represented by current pipeline export quality Brent blend. The Bloomberg Barclays U.S. Aggregate Bond Index is a broad based benchmarks of the U.S. investment grade and global investment grade bond market, respectively. They include Treasury, government related, corporate and securitized fixed-rate bonds. The Russell 2000 Index is a measure of US small cap performance. The Russell 1000 Index is a measure of US large cap performance. The Russell 3000 Index measures the performance of 3,000 publicly held US companies based on total market capitalization, which represents approximately 98% of the investable US equity market. The Russell 3000 Growth Index is representative of those Russell 3000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 3000 Value Index is representative of those Russell 3000 Index companies with lower price-to-book ratios and lower forecasted growth values. The MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

ICE Data: Source ICE Data Indices, LLC, used with permission. ICE permits use of the ICE BofA indices and related data on an `as is’ basis, makes no warranties regarding same, does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA Indices or data included in, related to, or derived therefrom, assumes no liability in connection with the use of the foregoing and does not sponsor, endorse or recommend Calamos Advisors LLC or any of its products or services.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

18933 0122O C

Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.