Views on current equity market opportunities and the health of the economy, background on the scope of the Calamos Phineus Long/Short Fund (CPLIX) as well as background on the team’s senior portfolio manager Michael Grant all are available in nine videos just published on our Ask the Portfolio Manager series on Calamos.com.

The following are highlights of the comments made. Of course, we recommend you watch the videos in their entirety, they’re an average of two to three minutes long.

2017 was the bull year for equities and 2019 is likely to be the broad topping year for equities, Grant says. The risks for equities include the end of the expansion and competition from other asset classes.

“I don’t see competition for equities as a financial class until interest rates here in the U.S. get much closer to 3%. I don’t see that happening until at least spring of 2018,” he says.

“If there's one undervalued idea today, it's the idea that the global economy can grow in a sustained prosperous fashion,” says Grant. “It's been so long since the world economy was working on all cylinders, that there's still a deep distrust in the viability of the major economies.”

Equities are what investors would want to have exposure to “if the world economy gets at least five-plus years of economic growth. It’s unlikely that another asset class could compete with equities,” he says.

Industries whose stocks traded like bond proxies—“investors were buying them for the safety of their business model and their yields rather than their earnings potential”—are overvalued, according to Grant. On the other hand, he says, selective cyclicals including financials are attractive and he believes that the market is underestimating them.

Grant doesn’t think a recession is imminent. When there is a cyclical downtown, though, it could be corporate borrowers who are in trouble.

“The corporate side has re-levered and it has put on debt levels on the assumption that interest rates stay at these levels for a very long time. So, sometime in the 2019, 2020 period, I think higher interest rates will ultimately impact the corporate sector. And you'll have some high-profile failures. Particularly in industries where the industry dynamics are also changing, such as telecom services, cable and so forth,” says Grant. For more, see More Upside for Equities? CPLIX’s Grant Makes the Case.

The expansion can continue and Grant believes the Fed intends for this expansion to be the longest on record. “Most expansions end because the Fed wants them to end,” he says.

Grant attributes this “late burst of energy” in part to the fact that 80% of American households began to participate—by buying homes, buying cars, etc.—in just the last 2.5 years, despite the expansion being nine years old.

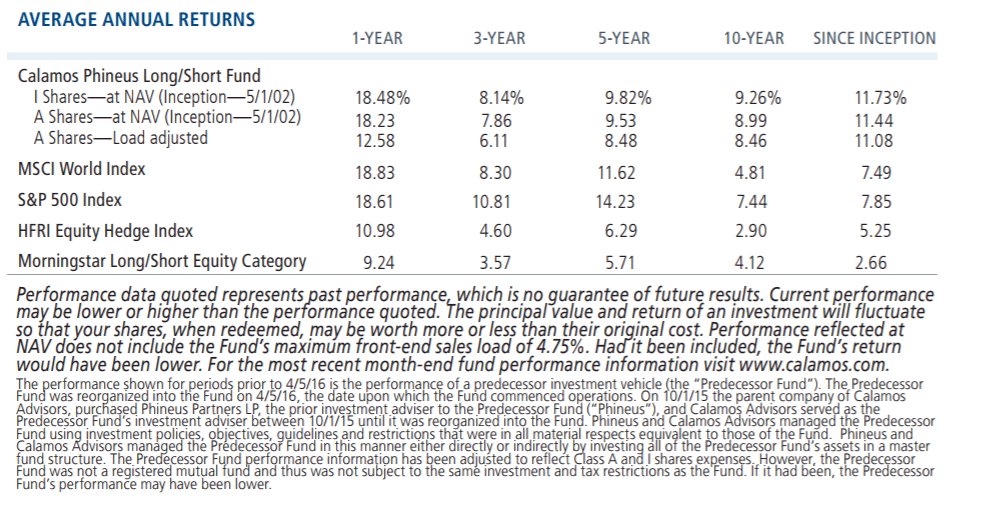

Grant explains the influences that led him to establish his hedge fund in 2002, which was converted in April 2016 into the Calamos mutual fund (and see CPLIX’s Rich 15-year History).

“I was struck by how few clients actually achieved superior returns even if they also understood the rationale for [equities]. Much of the problem in the long-only world, of course, is that clients inevitably buy up here and I could rarely get them to buy down here. One of the real attractions to long/short was taking that risk on/risk off decision to my side of the table,” says Grant.

The team is conventional in its work as fundamental, bottom-up investors. But here’s how Grant explains where his team parts ways with its long/short equity fund peers: “What we're trying to do is to be able to play whatever hand the market deals us. So, many fundamental investors really want to play one kind of hand. They want to be a growth investor or a value investor or a European small cap investor and so forth.

“That can work for a period of time—two, three or four years. But our objective is to be able to perform in different market cycles through an extended period of time and that requires this breadth of approach and the ability to make different kinds of decisions.”

Because of the flexibility of CPLIX’s mandate, Grant says, “We think in terms of company decisions, industry, style, country and market decisions.”

Information is not the investor’s edge in the way it was before Reg FD, Grant says, adding “that game is over.” Today, good investment outcomes result from good decision making.

Describing another difference between CPLIX and other funds, Grant says, “The traditional fundamental investor is heavily focused on benchmarks and relative returns and that leads to how they put the portfolio together. I think a more opportunistic approach to portfolio construction is key.”

Having the flexibility to allocate across geographic, company size or style decisions enables the team to be opportunistic, he says.

Financial advisors, for more information about CPLIX or Grant, talk to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.