In an iconic Seinfeld episode, George Costanza seizes on a brilliant idea: What he’s been doing hasn’t been working, maybe he should do the opposite.

We’re invoking the memory of George at this point, deep into the eighth year of a bull market.

If he were an investor with exposure to U.S. equities, George’s instinct may be to head for the exits, expecting a pullback.

Or perhaps he would have been on the sidelines because the market had been “too high”—if so, today’s levels might further convince him that he’s better off waiting for a buying opportunity.

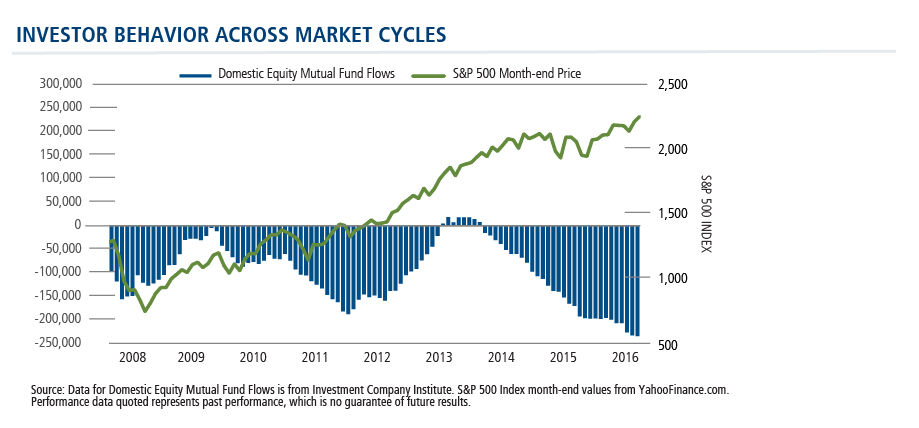

If this was his position, he hasn’t been alone, as shown by the chart below. Many investors have been absent from the post-2008 rally. See the negative domestic equity mutual fund flows as the Standard & Poor’s 500 continued to climb.

Opposite George

What if George (nudged no doubt by his patient financial advisor) decided to adopt an opposite tack? What could happen if he countered what comes naturally to him and decided to remain in the market, if he was invested? Or, instead of avoiding it, bought in at these levels?

We don’t know whether George would be headed to a happy ending as opposed to the tortured existence he mastered in TV Land.

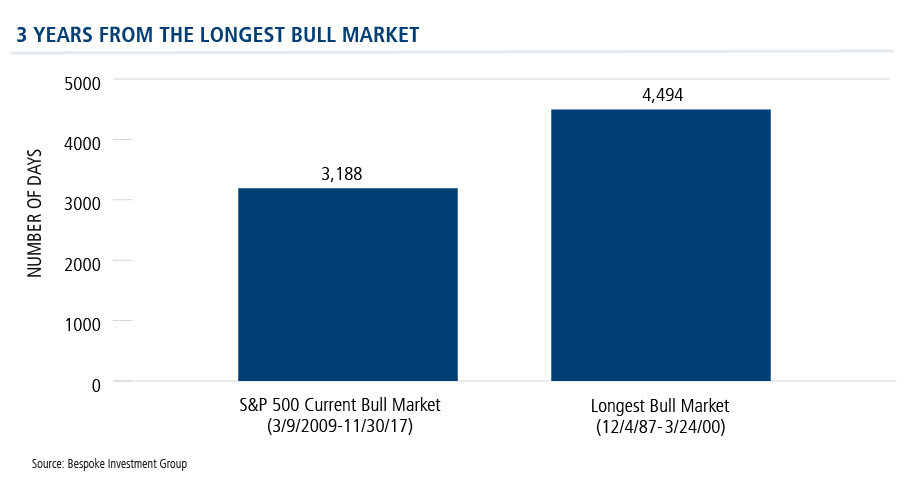

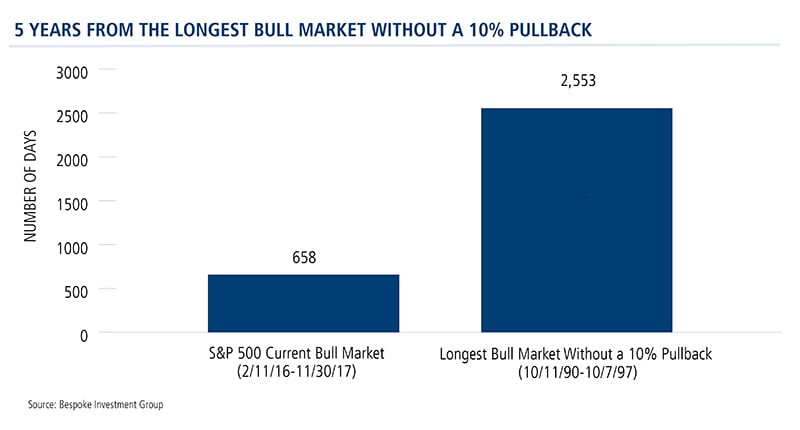

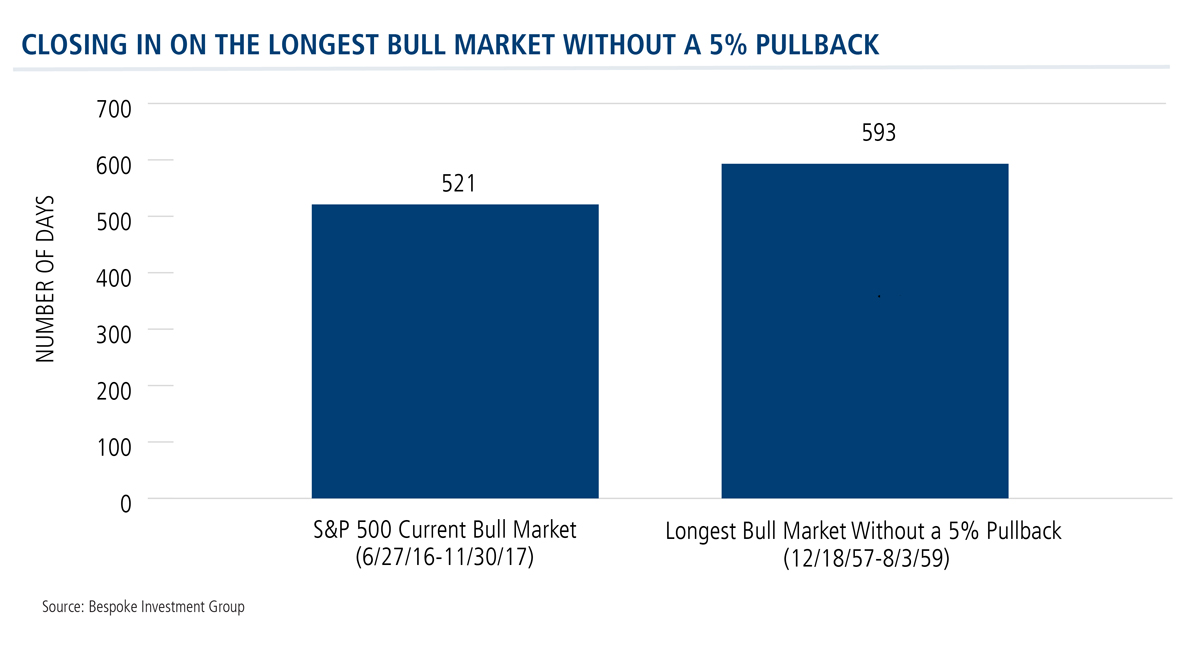

But with the help of S&P data compiled by Bespoke Investment Group, we can take stock of where this market is in relation to other bull markets:

- It’s a special rally, no doubt. But while it’s the second longest, it’s three years from being the longest bull market.

- No U.S. bull market has gone this long without a 3% correction—this market has established a new record.

- However, many other markets have lasted much longer before correcting further.

If George could be persuaded to suspend his disbelief, he could see that there could be more to come in this bull market. This is what Calamos believes, even as we allow for the possibility of a pause or even correction.

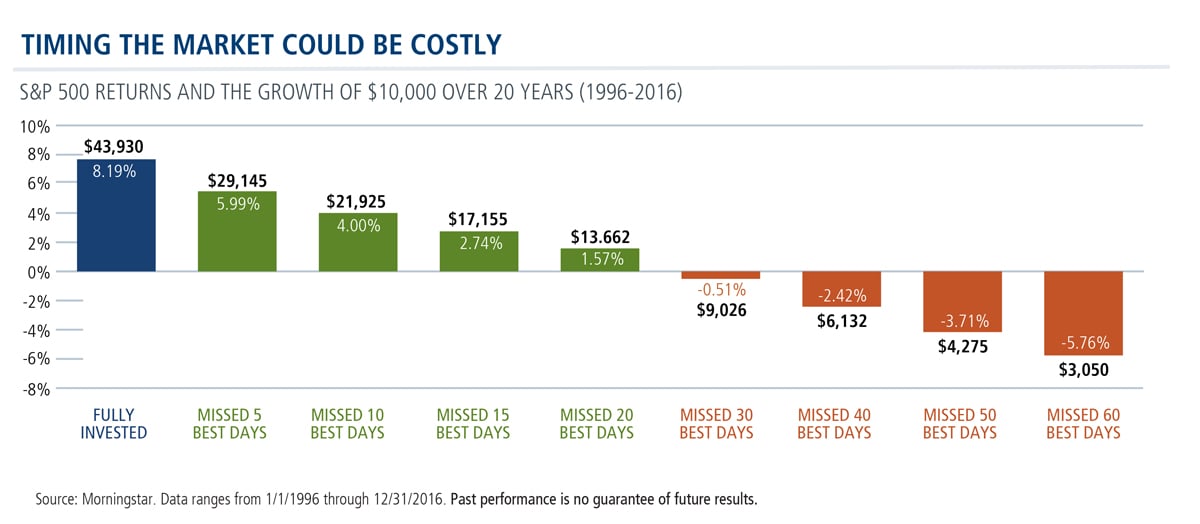

An opposite-leaning George also might see that there’s a risk of being out of the market and that it can be quantified, as John P. Calamos, Sr., Founder, Chairman and Global Chief Investment Officer has blogged about previously.

Pursue the Upside While Protecting Against the Downside

Equities are a favored asset class for pursuing long-term wealth. Most investors understand that investment returns are predicated on taking risk, of course. The irony is that the risk can seem to be magnified in an ever-climbing market such as we’ve experienced.

World markets have enjoyed a strong 2017, with global economies demonstrating fundamentals that suggest the good times could continue well into 2018. Few markets go straight up, however.

Our actively managed funds, providing exposure to U.S., international and emerging markets, are risk-managed to enable your clients to remain invested across full market cycles.

Financial advisors, whether you recognize George among your clients or whether even you too have reservations about the market at this level, talk to a Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com about our solutions for pursuing the upside while protecting against the downside.