Send This Baby to College, With Help from CGIIX

Here’s a suggestion for your clients with children or grandchildren headed for the college graduating class of 2042: it’s time to start saving!

The cost of a college education has become a national focus over the last few years, and it’s conceivable that structural improvements to reduce expenses may be made in the next 18 or so years. But are your clients willing to take a chance on Junior’s future?

Below let’s take a look at how to help your clients focus on the challenge ahead of them. This idea:

- Makes the most of limited funds available early on for investment

- Assumes consistent investment for the first 10 years of the child’s life

- Seeks to take advantage of the growth potential of U.S. equities…

- …While keeping drawdowns to a minimum to enable the invested balance to continue to grow.

Would you like to be able to tell your clients that their newborn baby could have their college funding secured by the time their child turns 10? Use this example to demonstrate how funding an investment account earmarked as a college fund would have helped a student graduating from college this year.

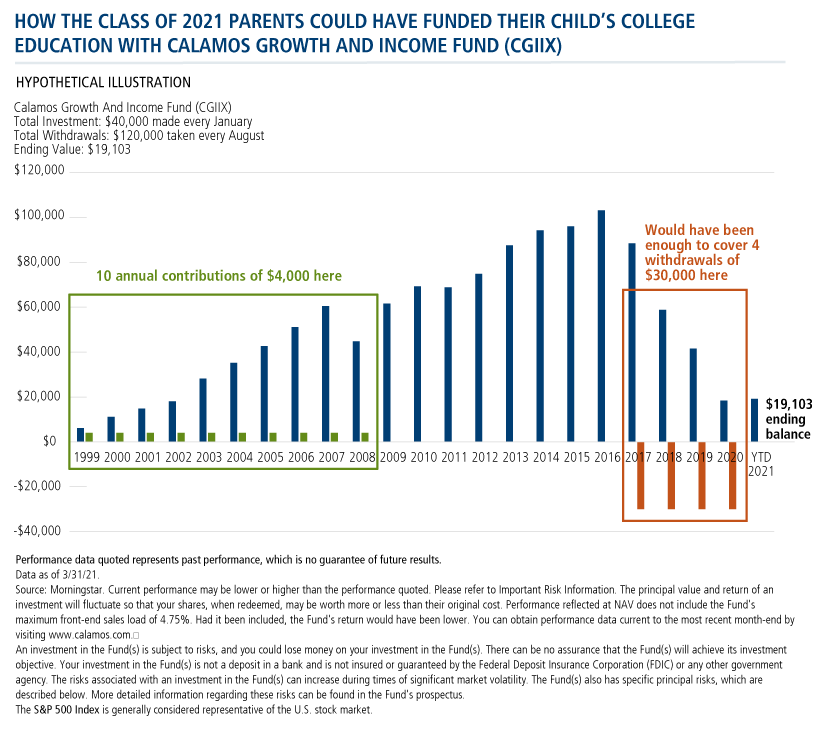

The hypothetical illustration below demonstrates the plan:

- 10 annual contributions of $4,000 each in Calamos Growth and Income Fund (CGIIX) in the baby’s year 1 through year 10.

- Four withdrawals of $30,000 each, starting in August of year 18 (2017).

The $40,000 investment early on provided for a total of $120,000 in four annual withdrawals. After paying for four years of college, $19,103 remained as of 3/31/21. That’s enough for a used car for the graduate or maybe a nice vacation for your clients!

CGIIX Can Keep Parents from Cashing Out Early

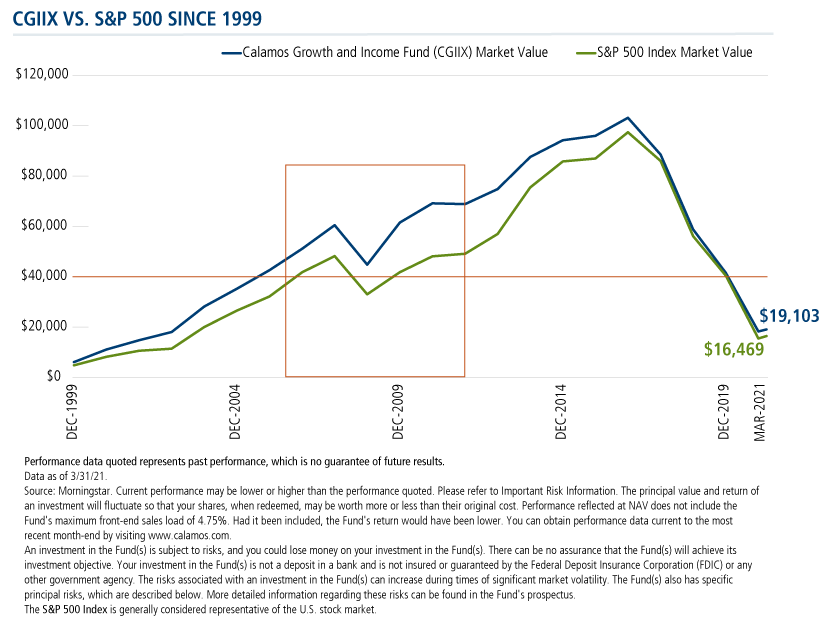

This plan succeeded even as it traversed three crises that rocked equities, as tracked by the S&P 500.

An additional point to make when discussing CGIIX with parents or grandparents: The next 20 years are likely to present their own share of financial tests for the student’s parents, and there may be times when they will be tempted to cash in a long-term investment to meet near-term needs.

CGIIX’s shallower drawdowns would have helped keep investors invested. In this hypothetical illustration, by 2009, investors in a S&P 500-based systematic accumulation plan would have completed their 10 annual payments of $40,000. They would have watched their investment balance grow to a high of $50,680 in November 2007, months before the onset of the Great Financial Crisis. That balance then was almost halved, and fell to a low of $27,052 by March 2009. Such a decline can be discouraging for investors, prompting some to liquidate the remaining balance in favor of using the proceeds for the here and now.

CGIIX also lost ground during the GFC but not as much—and that’s the point. This same systematic investment hit its highwater mark of $63,461 also in November 2007 and then declined 35%, to a low of $41,321 in March 2009 until it began to climb back up. It never dipped below the total amount the parents had saved, never giving them a strong reason to be discouraged or lose faith in the sacrifice they made early on in their child’s life. This makes a difference.

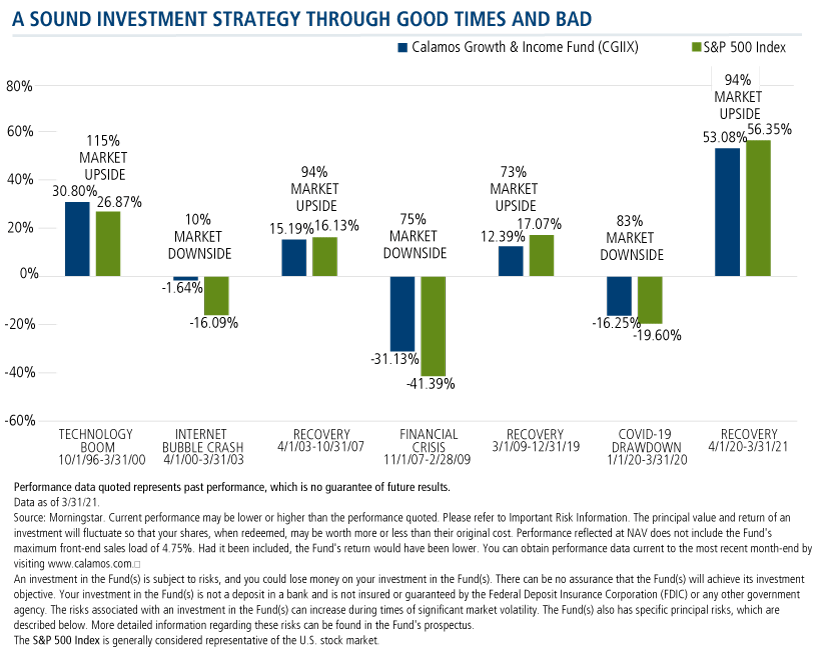

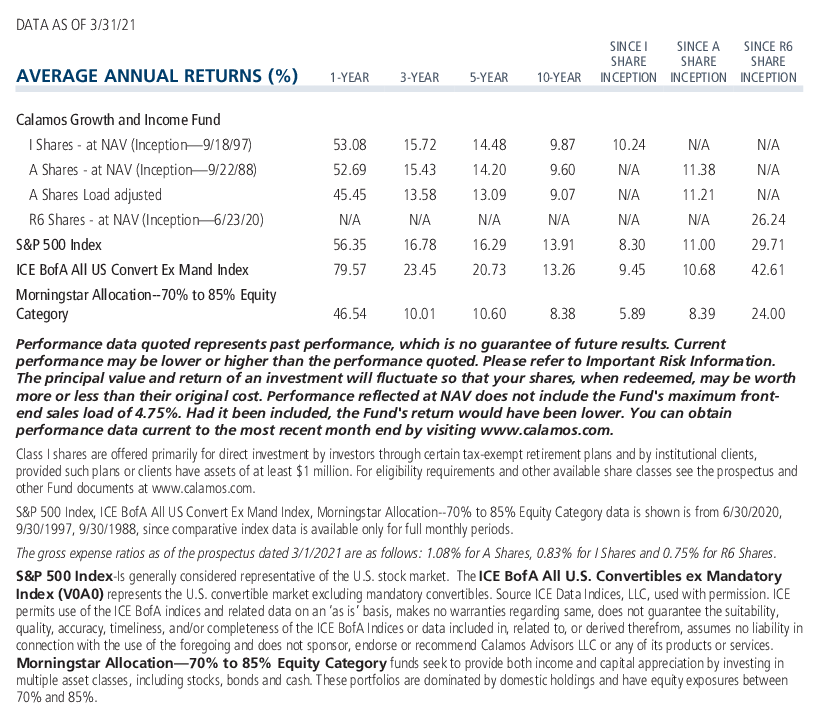

And, this was true for the length of the investment period. When compared to an index-based investment, actively managed lower-equity alternative CGIIX was an appropriate selection for the college savings plan for its superior performance. The fund captured a significant amount of upside during bull markets and limited losses when markets plunged.

The market's ups and downs notwithstanding, the child's college education was provided for, thanks both to the 10 consistent investments made and the capital appreciation and income generation of the fund.

Our team is proud to have played a role in helping the Class of 2021 parents fund their child’s academic dreams, and they (and their investment professionals) have our hearty congratulations.

For thoughts on building a lower volatility plan for your clients’ up-and-coming scholars, talk to your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The S&P 500 Index is generally considered representative of the U.S. stock market.

802378 0521

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on May 11, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.