CGIIX Earns Refinitiv Lipper Award as Best Flexible Portfolio Fund Over 5 Years

Calamos Growth and Income Fund (CGIIX) has been recognized by Refinitiv Lipper as the Best Flexible Portfolio Fund for risk-adjusted performance among 148 funds in its classification in the U.S. as of 12/31/20. The Refinitiv Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers.

“It is an honor to have Calamos Growth and Income Fund recognized for its strong risk-adjusted performance," said John Hillenbrand, CPA, Co-CIO, Head of Multi-Asset Strategies and Co-Head of Convertible Strategies, Senior Co-Portfolio Manager.

Calamos Growth and Income Fund (CGIIX)

Morningstar Overall RatingTM Among 302 Moderately Aggressive Allocation funds. The Fund's risk-adjusted returns based on load-waived Class I Shares had 4 stars for 3 years, 5 stars for 5 years and 5 stars for 10 years out of 302, 274 and 225 Moderately Aggressive Allocation Funds, respectively, for the period ended 3/31/2024.

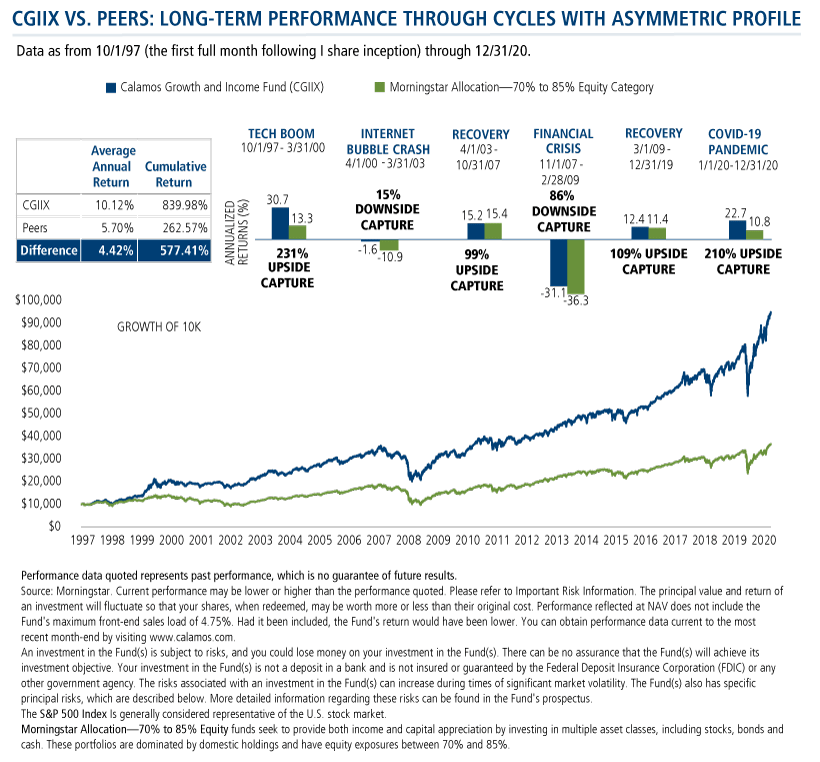

“We are dedicated to providing strong absolute returns and an asymmetrical return profile that captures more upside than downside over full market cycles. Over time—including in volatile markets—the fund has benefited from our active risk management, investments across a broad asset class universe including convertible securities and comprehensive capital structure analysis provided by our dedicated research team. We believe our tested approach will continue to give us an advantage in serving our clients,” Hillenbrand said.

CGIIX is a multi-asset strategy that leverages Calamos’ capital structure research by investing in equities, fixed income and convertible securities seeking to generate equity-like returns while managing downside volatility, as compared to the S&P 500 over a full market cycle.

Since inception, as shown below, CGIIX has posted strong gains and outperformed the equity market, while adhering to its risk-conscious approach. In addition, the fund has consistently provided a competitive distribution throughout its history. The result is a track record of top-tier performance since its inception in 1997.

Investment professionals, for more information on CGIIX, please contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be suitable for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

The principal risks of investing in the Calamos Growth and Income Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, equity securities risk, growth stock risk, small and mid-sized company risk, interest rate risk, credit risk, liquidity risk, high yield risk, forward foreign currency contract risk and portfolio selection risk.

The Refinitiv Lipper Fund Awards are based on Lipper Leader® risk-adjusted performance measures calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader Rating for Consistent Return (Effective Return) in each eligible classification wins the Refinitiv Lipper Fund Award over three, five or ten years. For more information, see lipperfundawards.com. Although Refinitiv Lipper makes reasonable efforts to ensure the accuracy and reliability of the data herein, the accuracy is not guaranteed by Refinitiv Lipper. Refinitiv Lipper Fund Awards, ©2021 Refinitiv. All rights reserved. Used under license.

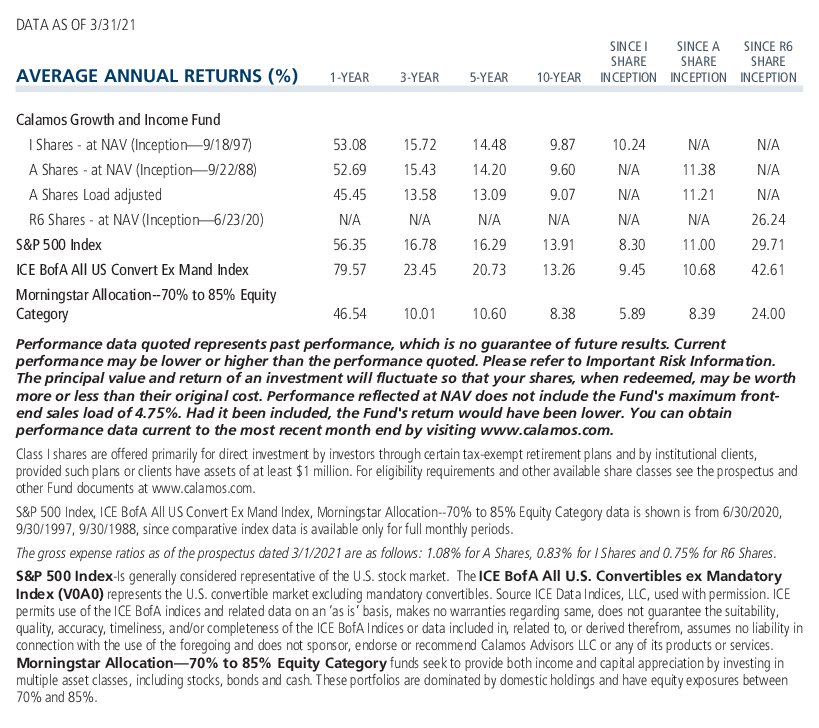

Morningstar Allocation—70% to 85% Equity funds seek to provide both income and capital appreciation by investing in multiple asset classes, including stocks, bonds and cash. These portfolios are dominated by domestic holdings and have equity exposures between 70% and 85%.

Morningstar RatingsTM are based on risk-adjusted returns and are through 2/28/21 for Class I shares and will differ for other share classes. Morningstar ratings are based on a risk-adjusted return measure that accounts for variation in a fund’s monthly historical performance (reflecting sales charges), placing more emphasis on downward variations and rewarding consistent performance. Within each asset class, the top 10%, the next 22.5%, 35%, 22.5%, and the bottom 10% receive 5, 4, 3, 2 or 1 star, respectively. Each fund is rated exclusively against U.S. domiciled funds. The information contained herein is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Source: ©2021 Morningstar, Inc.

The S&P 500 Index is generally considered representative of the U.S. stock market.

802348 321

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 31, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.