Barron’s Q&A Features John Calamos on Convertibles’ Appeal

We have to agree with Barron’s article Saturday on the convertible bond market: “There’s no one better to opine on the outlook for these bond/equity hybrids than John Calamos, the 80-year-old founder of $35 billion Calamos Investments, whose flagship Calamos Convertible Fund (ticker: CICVX) is up 87% over the past 12 months.”

Headlined “The Sun Is Shining on Convertible Bonds, Built for Good or Bad Weather,” the Q&A covers the Calamos outlook on convertibles, issuance and the value of active management.

“The big debate,” John says, “is: Is inflation coming back? Are interest rates going up? There’s a risk of inflation. Monetary supply has been expanding. We’re seeing commodity prices go up here. I don’t have a [specific forecast], but the Federal Reserve would like to see about 2%. It’s something to be concerned about. We’re also concerned about fiscal policies that might put us in stagflation. We’re in the camp that says when interest rates may be going up, we should be invested in equities. The pandemic is, hopefully, going away, so we’re going to see more growth globally. We think there’s opportunity globally and in emerging markets.”

Such market ambiguity can be a good set-up for convertibles.

“With the pandemic behind us, a lot of the cyclical companies will want to raise capital to get going again…Some [issuers] are new, and some are refinancing converts that are running off. These deals come together quickly. They get announced in the morning and priced in the afternoon…The chatter is that there are still a lot of issuers looking hard at the market,” says John.

Barron’s acknowledges the “soaring” convertible market of 2020 and its strong start to this year. But John provides some context that argues for a core allocation to convertibles to provide diversification in all markets.

“The underlying philosophy I’ve had for nearly 50 years is about trying to manage risk without market timing. I got into convertibles early in the ’70s; markets were strong, and then corrected, and people bailed out and went into the bond market. Then, interest rates went up, so they lost money there [because bond prices fall when rates go up]. Then, inflation took off. We had stagflation. Bonds did poorly.

“The stock market went up and down for about 10 years," John continues. "But convertibles did very, very well during that period."

Investment professionals, to learn more about CICVX or any of our convertible-using funds, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Top 10 Holdings

| Company | Security Type | Industry | % |

|---|---|---|---|

| Tesla, Inc. | Convertible Bonds | Automobile Manufacturers | 3.6% |

| Microchip Technology, Inc. | Convertible Bonds | Semiconductors | 2.2% |

| RingCentral, Inc. | Convertible Bonds | Application Software | 2.2% |

| Uber Technologies, Inc. | Convertible Bonds | Trucking | 2.0% |

| Royal Caribbean Cruises, Ltd. | Convertible Bonds | Hotels, Resorts & Cruise Lines | 2.0% |

| Tesla, Inc. | Convertible Bonds | Automobile Manufacturers | 1.9% |

| Coupa Software, Inc. | Convertible Bonds | Application Software | 1.8% |

| Southwest Airlines Company | Convertible Bonds | Airlines | 1.8% |

| Broadcom, Inc. | DECS,ACES,PRIDES | Semiconductors | 1.7% |

| Shift4 Payments, Inc. | Convertible Bonds | Data Processing & Outsourced Services | 1.6% |

| Total | 20.8% |

802236C 321

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

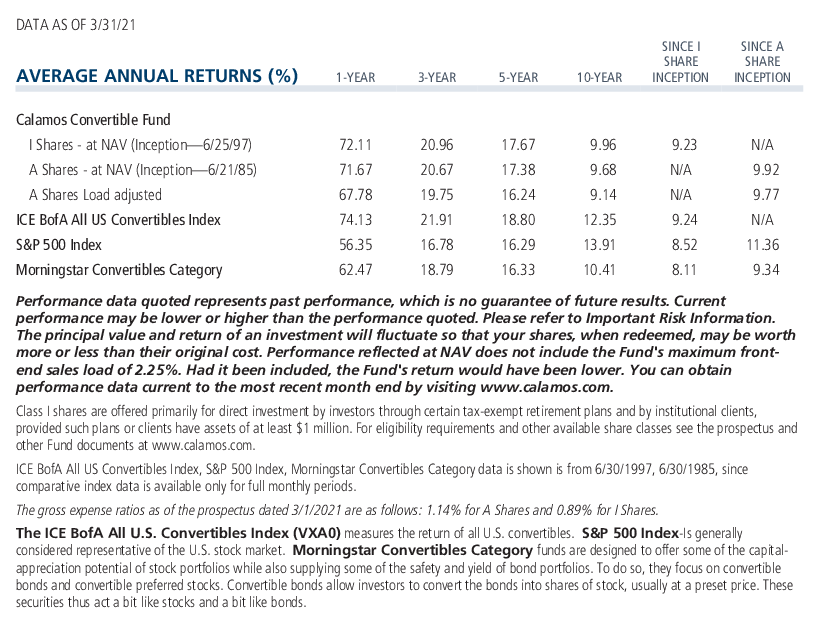

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 19, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.