More on Convertibles and Rising Interest Rates

We’ve covered the topic of rising rates and convertible bond performance a few times this year (related to Calamos Convertible Fund and related to Calamos Market Neutral Income Fund). Now our recently updated Convertible Securities: Structures, Valuation, Market Environment and Asset Allocation guide provides additional insights on the relationship of the asset class and interest rates. The guide was written by Calamos Founder, Chairman and Global CIO John P. Calamos, Sr. and Eli Pars, CFA, Co-CIO and Senior Co-Portfolio Manager. John is widely recognized as a pioneer in convertibles.

Rising Rates and Issuance

Rising rates can provide a catalyst to issuance.

“Because convertible securities provide the opportunity for upside equity participation, they can offer lower coupons than non-convertible debt. Consequently, convertibles may be an especially attractive way for a company to access the capital markets when interest rates are high.”

Convertibles’ Performance

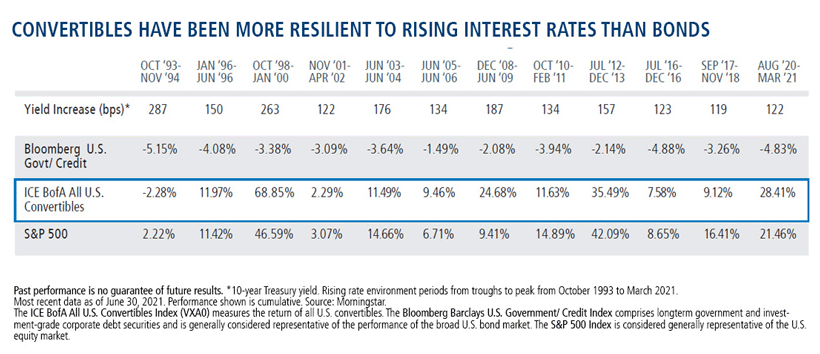

The guide explains the dynamic that results in a convertible security to be driven more by its equity component than its fixed income component as rates are rising.

“…Interest rates affect the investment value of convertibles like they affect the value of straight bonds. As interest rates increase, the investment value will decline; as interest rates decrease, the investment value will rise. The investment value fluctuates in tandem with the price of straight corporate bonds of similar quality.

However, due to the unique nature of convertibles, a change in the investment value of the convertible bond may not necessarily mean a change in the market price. The investment value may fluctuate, but the market price of the convertible bond remains relatively stable because changes in interest rates are just one of many factors that may be affecting the market price at any given moment. A bond that is trading close to its investment value will be relatively more affected by changes in interest rates than one that is trading close to its conversion value and well above its investment value. If the underlying stock is increasing in value as interest rates are rising, the convertible bond will be driven by its equity component rather than by its fixed-income component and will increase in value.”

How Convertibles Can Be Used to Proactively Address Rising Rates, Building Inflation

Convertibles’ hybrid characteristics make them a compelling choice for strategic allocations that pursue lower-volatility equity exposure over full and multiple market cycles. But they can also be used as shorter-term tactical overweights at key times.

“Convertible strategies may provide a good alternative to traditional bonds within the fixed-income segment of an allocation. Tactical allocations to convertibles may be especially attractive during periods of rising interest rates and increased inflation. Bonds tend to lose value in an environment of rising interest rates. However, convertible returns have tended to more closely reflect equity returns than bond returns when the 10-year Treasury yield rose more than 100 basis points. Additionally, convertible securities tend to be issued with maturities in the five-year range, reducing their duration risk versus longer-dated non-convertible and government debt.”

“While convertibles are influenced to a degree by interest-rate fluctuations, they also are affected by the price movements of their underlying stocks, a factor that historically has helped soften the negative effect of rising interest rates. In general, the more a convertible’s price is determined by the value of its underlying equity, the greater its tendency not to be influenced by changing interest rates.”

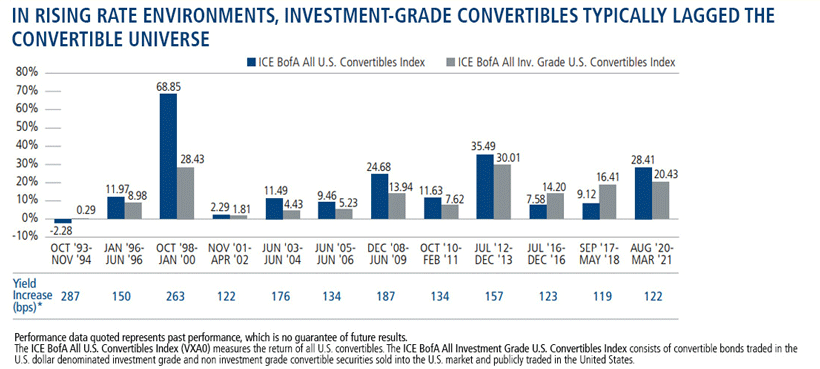

The Potential Limitations of Investment-grade Convertibles

Finally, the guide comments on the exclusive use of investment-grade convertibles, whose equity sensitivity can be higher than the broader convertible universe—thereby lacking the intended level of risk mitigation. Performance can suffer when rates rise, as shown below.

Investment professionals, Calamos Investment Consultants can expand on these points and more. Reach out to your Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions, estimates, forecasts, and statements of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. The views and strategies described may not be appropriate for all investors. References to specific securities, asset classes and financial markets are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations.

As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to the potential for greater economic and political instability.

The principal risks of investing in Calamos Market Neutral Income Fund include: equity securities risk consisting of market prices declining in general, convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk, convertible hedging risk, covered call writing risk, options risk, short sale risk, interest rate risk, credit risk, high yield risk, liquidity risk, portfolio selection risk, and portfolio turnover risk.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

808549 1021

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on October 21, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.