When Rates Rose, CICVX Outperformed Both Stocks And Bonds

The digital ink had barely dried on Tuesday’s blog post Rising Rates Don’t Intimidate Fixed Income Alt CMNIX when an investment professional asked a follow-up question: So, how did Calamos Convertible Fund (CICVX) perform as rates climbed more than 100 basis points from August to last week?

Great question, glad you asked. The interactive chart below shows CICVX’s outperformance vs. the S&P 500, the Bloomberg Barclays U.S. Aggregate Bond Index, and the Morningstar Bank Loan category during the period.

Source: Morningstar Direct.

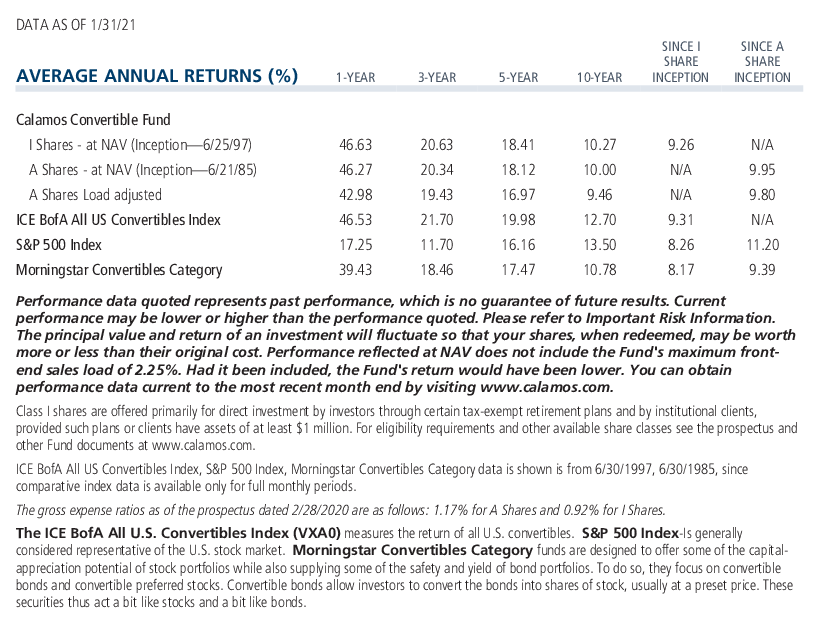

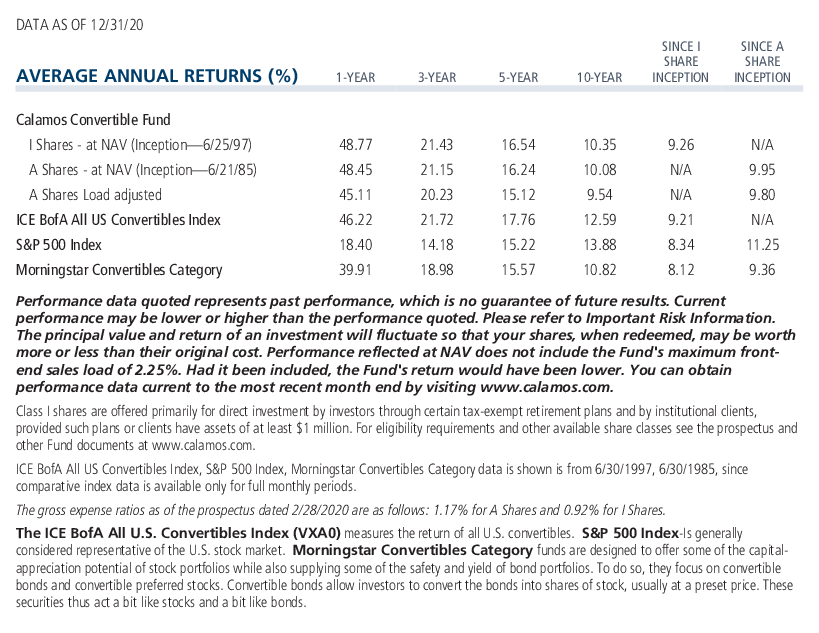

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. Please refer to Important Risk Information. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund's maximum front-end sales load of 2.25%. Had it been included, the Fund's return would have been lower. You can obtain performance data current to the most recent month-end by visiting www.calamos.com.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund's prospectus.

Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government related and corporate securities, MBS (agency fixed-rate and hybrid ARM pass-throughs), ABS and CMBS (agency and non-agency).

S&P 500 Index is generally considered representative of the U.S. stock market.

Bank Loan: Bank-loan portfolios primarily invest in floating-rate bank loans and floating-rate below investment-grade securities instead of bonds. In exchange for their credit risk, these loans offer high interest payments that typically float above a common short-term benchmark such as the London Interbank Offered Rate, or LIBOR.

Remember that convertible securities are hybrids, with characteristics of both bonds and stocks. While fixed income tends to lose value in an environment of rising interest rates, equities in many cases have historically headed the opposite direction.

Convertibles can take on equity qualities because of the option to convert them into a predetermined number of issuer shares. In general, the more a convertible’s price is determined by the value of its underlying equities, the greater its tendency not to be influenced by changing interest rates.

For the period in question, CICVX’s outperformance vs. the S&P 500 had to do with several factors, as outlined by Joe Wysocki, Senior Vice President and Senior Co-Portfolio Manager.

The fund was well positioned in investment themes that strongly benefited from COVID-19 (e.g., the “at home” paradigm). Also, the team’s actively repositioning the fund to take advantage of attractively priced cyclical opportunities added value as many appreciated materially when vaccines were rolled out and progress toward ending the pandemic began to materialize.

What’s more, Wysocki notes, smaller and mid-sized capitalization stocks began to strongly outperform large capitalization stocks starting late summer 2020. These are often the sweet spot for convertible issuers and the portfolio benefited as it had a significantly larger allocation to the small and mid-capitalization areas of the market than the S&P 500.

The bottomline: CICVX in this most recent period extended its historical record of offering an attractive return profile versus traditional bonds in a rising interest rate environment.

Investment professionals, for more about CICVX, contact your Calamos Investment Consultant at 888-571-2567 or caminfo@calamos.com.

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

Opinions and estimates offered constitute our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

The principal risks of investing in the Calamos Convertible Fund include: convertible securities risk consisting of the potential for a decline in value during periods of rising interest rates and the risk of the borrower to miss payments, synthetic convertible instruments risk consisting of fluctuations inconsistent with a convertible security and the risk of components expiring worthless, foreign securities risk, equity securities risk, interest rate risk, credit risk, high yield risk, portfolio selection risk and liquidity risk. As a result of political or economic instability in foreign countries, there can be special risks associated with investing in foreign securities, including fluctuations in currency exchange rates, increased price volatility and difficulty obtaining information. In addition, emerging markets may present additional risk due to potential for greater economic and political instability in less developed countries.

802324 321

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived material may contain dated performance, risk and other information. Current performance may be lower or higher than the performance quoted in the archived material. For the most recent month-end fund performance information visit www.calamos.com. Archived material may contain dated opinions and estimates based on our judgment and are subject to change without notice, as are statements of financial market trends, which are based on current market conditions at the time of publishing. We believed the information provided here was reliable, but do not warrant its accuracy or completeness. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Any forecasts contained herein are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation.

Performance data quoted represents past performance, which is no guarantee of future results. Current performance may be lower or higher than the performance quoted. The principal value and return of an investment will fluctuate so that your shares, when redeemed, may be worth more or less than their original cost. Performance reflected at NAV does not include the Fund’s maximum front-end sales load. Had it been included, the Fund’s return would have been lower.

Archived on March 05, 2022Cookies

This website uses cookies. By continuing to use this website, you consent to the use of cookies. Learn more about our cookie usage.